Key Insights

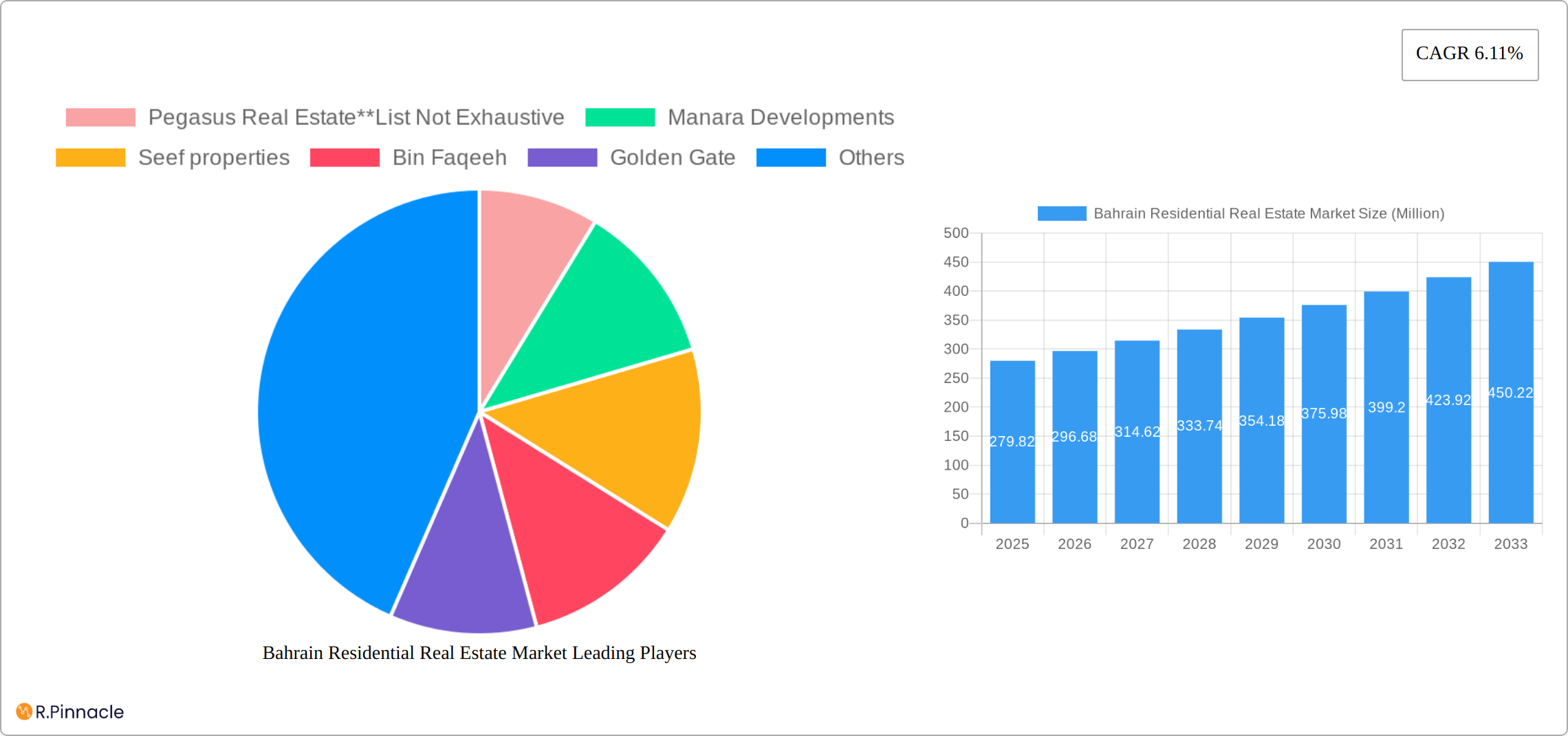

The Bahrain residential real estate market, valued at $279.82 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.11% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization and a growing population necessitate more housing units, driving demand. Government initiatives promoting affordable housing and infrastructure development further stimulate the market. The tourism sector's expansion also contributes to the demand for residential properties, particularly in prime locations like Manama, Juffair, and Muharraq. Furthermore, a favorable investment climate and the influx of expatriates working in various sectors contribute to market buoyancy. The market is segmented into condominiums and apartments, villas and landed houses, catering to diverse preferences and budgets. While challenges such as fluctuating property prices and potential economic downturns exist, the long-term outlook for the Bahraini residential real estate sector remains positive, supported by strong underlying economic fundamentals and continued government support.

The market's segmentation reveals a significant preference for certain property types and locations. Condominiums and apartments in urban centers like Manama and Juffair command higher prices due to their convenience and proximity to amenities. Villas and landed houses, particularly in areas like Muharraq and suburban developments, cater to families seeking more space and privacy. Prominent developers such as Pegasus Real Estate, Manara Developments, Seef Properties, and Bin Faqeeh play a crucial role in shaping the market dynamics, offering diverse projects that cater to varying income levels and lifestyle preferences. Competition among these developers enhances the market's vibrancy and provides buyers with a wider array of choices. Continuous monitoring of government policies, economic indicators, and evolving consumer preferences will be key to accurately forecasting future market trends and assessing investment opportunities within this dynamic sector.

Bahrain Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Bahrain residential real estate market, offering valuable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, growth drivers, challenges, and future opportunities. The analysis incorporates data on market size, CAGR, segmentation by type (condominiums/apartments, villas/landed houses) and key cities (Manama, Muharraq, Juffair, Rest of Bahrain), and profiles leading players such as Pegasus Real Estate, Manara Developments, and more.

Bahrain Residential Real Estate Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting market concentration, innovation drivers, regulatory frameworks, and M&A activities. We examine the influence of product substitutes, end-user demographics, and the overall market share held by key players. The analysis includes:

- Market Concentration: The report assesses the degree of market concentration, identifying dominant players and their respective market shares. For instance, we estimate that the top 5 developers collectively hold approximately xx% of the market in 2025.

- Innovation Drivers: Key drivers of innovation are analyzed, including technological advancements in construction, sustainable building practices, and evolving consumer preferences.

- Regulatory Framework: The impact of government regulations and policies on market growth is explored, including building codes, zoning laws, and incentives for sustainable development.

- M&A Activities: The report examines recent mergers and acquisitions (M&A) in the sector, analyzing deal values and their implications for market consolidation. For example, a significant M&A deal worth approximately $xx Million in 2023 resulted in a xx% increase in market share for the acquiring company.

- Product Substitutes: Analysis includes the potential impact of alternative housing solutions on market growth.

- End-User Demographics: The report examines the changing demographics of homebuyers and their impact on market demand.

Bahrain Residential Real Estate Market Dynamics & Trends

This section delves into the market's dynamic forces, including growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The analysis encompasses:

- Market Growth Drivers: Factors driving market expansion, such as population growth, economic development, and government initiatives to boost housing supply, are meticulously examined. The projected CAGR for the forecast period (2025-2033) is estimated at xx%.

- Technological Disruptions: The influence of technology on the real estate sector, including PropTech solutions, digital marketing strategies, and the use of Building Information Modeling (BIM), is discussed. Market penetration of PropTech solutions is estimated to reach xx% by 2033.

- Consumer Preferences: Shifting consumer demands, such as preferences for sustainable housing, smart home technology, and specific property types are assessed.

- Competitive Dynamics: The analysis explores the competitive landscape, including strategies adopted by key players to gain market share and maintain competitiveness.

Dominant Regions & Segments in Bahrain Residential Real Estate Market

This section identifies the leading regions and segments within the Bahrain residential real estate market.

By Type:

- Condominiums and Apartments: Manama is expected to be the leading location for condominiums and apartments due to its strong rental market and central location. Drivers include high population density and strong demand for rental properties.

- Villas and Landed Houses: Areas outside of Manama, such as the northern governorates, are expected to show stronger growth in villa and landed house sales. Drivers include an increase in family sizes and the preference for larger living spaces.

By Key Cities:

- Manama: Manama's dominance is driven by its established infrastructure, employment opportunities, and proximity to key amenities.

- Muharraq: Muharraq benefits from its historical significance and relatively affordable housing options.

- Juffair: Juffair's appeal is primarily its affluent population and high-end residential offerings.

- Rest of Bahrain: This segment encompasses areas experiencing growth due to government-led infrastructure projects and real estate developments.

Bahrain Residential Real Estate Market Product Innovations

The Bahrain residential real estate market is experiencing a wave of product innovations driven by technological advancements, sustainability concerns, and heightened competition. Smart home technology integration is becoming increasingly prevalent, offering buyers enhanced convenience, security, and energy efficiency. This includes features like automated lighting, climate control, and security systems, all controlled through user-friendly interfaces. Furthermore, the adoption of sustainable building materials, such as recycled content and locally sourced products, is gaining traction, reducing the environmental footprint of new constructions and appealing to environmentally conscious buyers. Innovative construction techniques, such as prefabricated modular building, are streamlining the development process, potentially leading to faster completion times and reduced costs. Developers are vying to offer unique selling propositions, incorporating these innovations to attract discerning buyers and stand out in a competitive market. This focus on innovation is not only enhancing the quality of living but also contributing to a more sustainable and resilient real estate sector.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Bahrain residential real estate market, segmented by property type (Condominiums and Apartments, Villas and Landed Houses) and key geographic locations (Manama, Muharraq, Juffair, and Rest of Bahrain). Each segment is meticulously examined, considering market size, growth trajectory, and competitive landscape. Detailed projections are offered, illustrating the expected market value for each segment. For instance, the condominium and apartment market in Manama is forecast to reach a substantial value by [Insert Year], driven by [Insert Key Factors]. Conversely, the villas and landed houses sector in the Rest of Bahrain region is anticipated to experience robust growth, with a projected Compound Annual Growth Rate (CAGR) of [Insert CAGR]% throughout the forecast period, fueled by [Insert Key Factors]. This granular segmentation allows for a nuanced understanding of market dynamics and opportunities within each specific area.

Key Drivers of Bahrain Residential Real Estate Market Growth

Key growth drivers include sustained economic growth, government initiatives to improve housing affordability, and increasing urbanization. Infrastructure development and the continuous inflow of foreign investment also contribute significantly. Population growth is another major factor fueling demand.

Challenges in the Bahrain Residential Real Estate Market Sector

Challenges include fluctuating oil prices, competition from other regional markets, and the availability of skilled labor. Regulatory hurdles and financing constraints pose additional obstacles to market expansion. The current supply chain challenges result in an estimated xx% increase in construction costs.

Emerging Opportunities in Bahrain Residential Real Estate Market

The Bahrain residential real estate market presents numerous exciting opportunities for investors and developers. The growing demand for sustainable and affordable housing creates a significant niche, requiring innovative solutions that balance environmental responsibility with economic viability. The increasing popularity of smart homes presents another promising avenue, allowing developers to integrate cutting-edge technology to enhance the living experience. Exploring niche segments, such as eco-friendly housing options incorporating green building practices and renewable energy technologies, can attract environmentally conscious buyers willing to pay a premium for sustainable living. The government's continued investment in infrastructure development projects provides further opportunities, as improved connectivity and amenities attract residents and investors to new developments. By capitalizing on these emerging trends and adapting to the evolving needs of the market, stakeholders can position themselves for success within the dynamic Bahrain residential real estate sector.

Leading Players in the Bahrain Residential Real Estate Market Market

- Pegasus Real Estate

- Manara Developments

- Seef properties

- Bin Faqeeh

- Golden Gate

- Durrat Khaleej Al Bahrain

- Diyar Al Muharraq

- Naseej B S C

- Arabian Homes Properties

- Carlton Real Estate

Key Developments in Bahrain Residential Real Estate Market Industry

- 2022 Q4: Launch of a new luxury villa development in Juffair by Manara Developments.

- 2023 Q1: Completion of a major infrastructure project in the Northern Governorate, boosting property values in the surrounding areas.

- 2023 Q3: Announcement of a new partnership between two major developers, leading to increased market consolidation. (Further details on specific projects and partnerships will be included in the full report).

Future Outlook for Bahrain Residential Real Estate Market Market

The Bahrain residential real estate market is expected to experience continued growth driven by economic diversification, population growth, and government initiatives. Strategic partnerships, innovative building techniques, and the adoption of sustainable practices are key factors influencing future market potential. The market is poised for significant expansion, presenting attractive opportunities for investors and developers alike.

Bahrain Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Manama

- 2.2. Muharraq

- 2.3. Juffair

- 2.4. Rest of Bahrain

Bahrain Residential Real Estate Market Segmentation By Geography

- 1. Bahrain

Bahrain Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector

- 3.3. Market Restrains

- 3.3.1. The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain

- 3.4. Market Trends

- 3.4.1. Increase in demand for rental villas driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Manama

- 5.2.2. Muharraq

- 5.2.3. Juffair

- 5.2.4. Rest of Bahrain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pegasus Real Estate**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Manara Developments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seef properties

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bin Faqeeh

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Golden Gate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durrat Khaleej Al Bahrain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Diyar Al Muharraq

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Naseej B S C

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arabian Homes Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carlton Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pegasus Real Estate**List Not Exhaustive

List of Figures

- Figure 1: Bahrain Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Bahrain Residential Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Bahrain Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bahrain Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bahrain Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Bahrain Residential Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Bahrain Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Residential Real Estate Market?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the Bahrain Residential Real Estate Market?

Key companies in the market include Pegasus Real Estate**List Not Exhaustive, Manara Developments, Seef properties, Bin Faqeeh, Golden Gate, Durrat Khaleej Al Bahrain, Diyar Al Muharraq, Naseej B S C, Arabian Homes Properties, Carlton Real Estate.

3. What are the main segments of the Bahrain Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 279.82 Million as of 2022.

5. What are some drivers contributing to market growth?

High demand with signs of increased residential project developments and buyers in the market; The growing population in Bahrain is driving the luxury residential real estate sector.

6. What are the notable trends driving market growth?

Increase in demand for rental villas driving the market.

7. Are there any restraints impacting market growth?

The Bahrain real estate sector has been growing at a slower pace in recent years; The increased cost of credit due to higher interest rates is starting to dent demand for luxury real estate in Bahrain.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Bahrain Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence