Key Insights

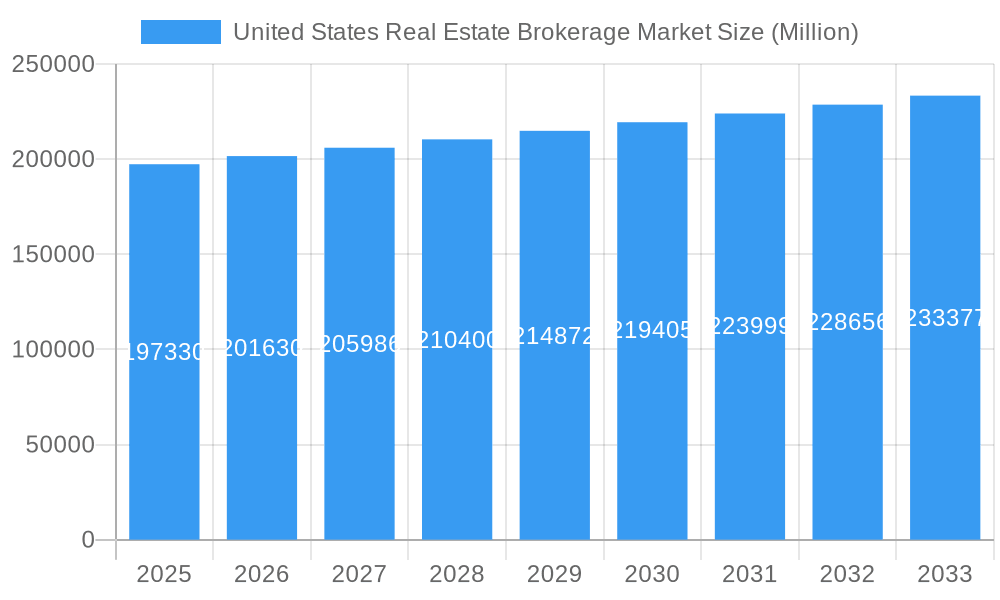

The United States real estate brokerage market, valued at $197.33 billion in 2025, is projected to experience steady growth, driven primarily by a robust housing market, increasing demand for luxury properties, and the expanding adoption of technological innovations within the industry. The 2.10% Compound Annual Growth Rate (CAGR) from 2025 to 2033 suggests a consistent, albeit moderate, expansion. Key drivers include a growing population, rising disposable incomes fueling homeownership aspirations, and a continued preference for personalized real estate services. Emerging trends such as the increasing use of online platforms, virtual tours, and data analytics are streamlining the buying and selling process, enhancing efficiency and customer experience. However, challenges remain, including potential interest rate fluctuations impacting affordability, economic uncertainties influencing buyer confidence, and increasing competition among established and emerging brokerage firms. The market is highly fragmented, with major players like Keller Williams, RE/MAX, Coldwell Banker, and Berkshire Hathaway Home Services commanding significant market share, but also leaving room for smaller, specialized firms to flourish. Geographic variations in market performance are expected, reflecting differences in local economic conditions, population density, and housing inventory levels.

United States Real Estate Brokerage Market Market Size (In Billion)

The forecast period of 2025-2033 will see a continued focus on technological advancements, with virtual reality and augmented reality technologies further revolutionizing the property viewing experience. The industry's regulatory environment will also play a significant role, influencing market dynamics and the operational strategies of brokerage firms. Further consolidation within the industry is likely, with larger players potentially acquiring smaller firms to gain a competitive advantage. The overall growth trajectory remains positive, indicating sustained demand for professional real estate brokerage services across diverse market segments within the United States. Successful firms will demonstrate adaptability, embrace technological innovation, and provide specialized services catering to the evolving needs of a dynamic customer base.

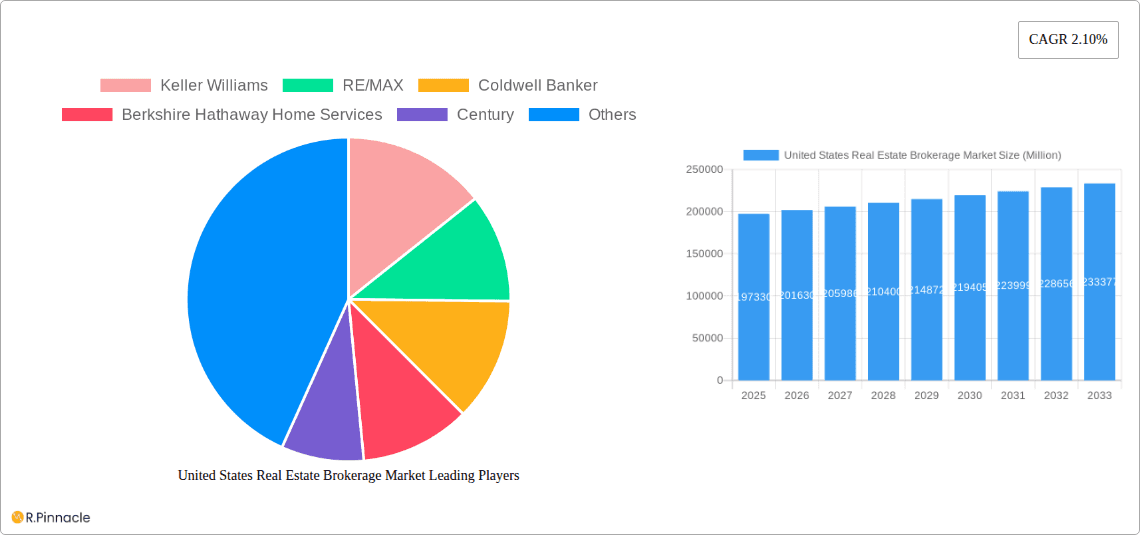

United States Real Estate Brokerage Market Company Market Share

United States Real Estate Brokerage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States real estate brokerage market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategic planners seeking to navigate this dynamic sector. The report analyzes market trends, key players, and future growth opportunities, leveraging data from the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

United States Real Estate Brokerage Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US real estate brokerage market, focusing on market concentration, innovation, regulation, and mergers and acquisitions (M&A) activity. The market is characterized by a mix of large national players and smaller regional firms. Key players include Keller Williams, RE/MAX, Coldwell Banker, Berkshire Hathaway Home Services, Century 21, Sotheby's International Realty, Compass, eXp Realty, Realogy Holdings Corp, and Redfin, along with numerous other smaller companies.

Market Concentration: The top 10 players account for approximately xx% of the market share in 2025. The market exhibits moderate concentration, with significant opportunities for both expansion and consolidation.

Innovation Drivers: Technological advancements, such as AI-powered property valuation tools and virtual tours, are driving innovation. The increasing adoption of PropTech solutions is changing the way real estate is bought and sold.

Regulatory Frameworks: Federal and state regulations influence brokerage practices, licensing requirements, and consumer protection measures. Changes in these frameworks can significantly affect market dynamics.

Product Substitutes: Direct-to-consumer platforms and online marketplaces are emerging as substitutes, presenting both opportunities and threats to traditional brokerages.

End-User Demographics: Millennials and Gen Z are increasingly influencing market trends, driving demand for digital services and personalized experiences.

M&A Activities: The market has witnessed significant M&A activity in recent years, with deals valued at xx Million. Compass's recent acquisitions of Parks Real Estate and Latter & Blum are prime examples of this trend, indicating a push for consolidation and expansion.

United States Real Estate Brokerage Market Market Dynamics & Trends

This section explores the key factors driving market growth, including technological disruptions, evolving consumer preferences, and competitive dynamics. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is driven by factors such as increasing urbanization, rising disposable incomes, and favorable government policies.

Technological disruptions, such as the rise of iBuyers and the increasing adoption of virtual and augmented reality, are reshaping the market. Consumer preferences are shifting towards personalized services, streamlined processes, and seamless digital experiences. Intense competition amongst established players and new entrants is shaping market strategies and pricing models. Market penetration of PropTech solutions is expected to reach xx% by 2033.

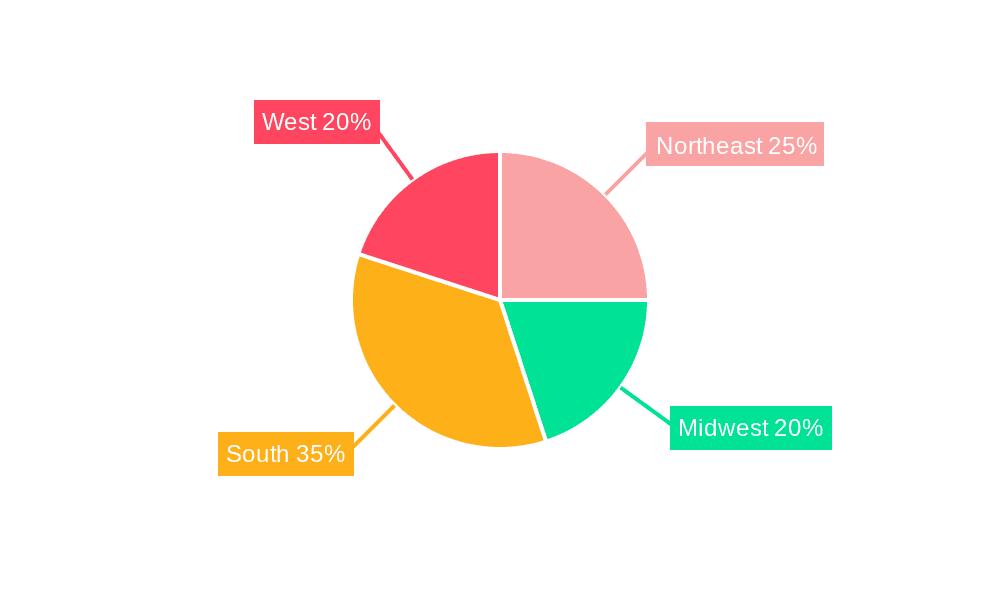

Dominant Regions & Segments in United States Real Estate Brokerage Market

The US real estate brokerage market is geographically diverse. However, certain regions and segments consistently show higher performance. For instance, the major metropolitan areas on the coasts continue to dominate due to higher population density, job growth, and significant real estate activity.

- Key Drivers in Dominant Regions:

- Strong economic growth and job creation.

- High population density and urbanization.

- Favorable government policies and tax incentives.

- Robust infrastructure and transportation networks.

The analysis reveals that the residential segment holds the largest market share and is expected to continue its dominance throughout the forecast period. Commercial real estate is also expected to show considerable growth fueled by increased investment.

United States Real Estate Brokerage Market Product Innovations

The US real estate brokerage market is witnessing significant product innovations, primarily driven by technology. New applications include AI-powered property valuation tools, virtual staging software, and advanced search functionalities. These innovations improve efficiency, enhance customer experiences, and provide competitive advantages. The integration of blockchain technology offers potential for improved transparency and security in real estate transactions.

Report Scope & Segmentation Analysis

This report segments the US real estate brokerage market based on several key factors: type of property (residential, commercial, industrial), service type (sales, leasing, property management), and geographic location. Each segment's growth projection, market size, and competitive dynamics are analyzed. The residential segment is projected to grow at a faster rate compared to the commercial and industrial segments over the forecast period. Within residential, luxury properties are expected to experience higher growth rates.

Key Drivers of United States Real Estate Brokerage Market Growth

Several factors contribute to the growth of the US real estate brokerage market. These include increasing urbanization, economic growth leading to higher disposable incomes, and favorable government policies such as low-interest rates. Technological advancements, such as AI-powered tools and virtual reality, are enhancing efficiency and customer experience, boosting market growth further.

Challenges in the United States Real Estate Brokerage Market Sector

The US real estate brokerage market faces several challenges, including increasing regulatory scrutiny, rising operating costs, and competition from online platforms. Supply chain disruptions (material shortages for new constructions) are also impacting the market. These factors can lead to reduced profitability and affect market growth.

Emerging Opportunities in United States Real Estate Brokerage Market

Emerging opportunities include the adoption of new technologies like blockchain for secure transactions, the expansion into new markets (e.g., vacation rentals), and the increasing demand for personalized and customized real estate services. Meeting the evolving needs of younger generations presents a significant growth opportunity.

Leading Players in the United States Real Estate Brokerage Market Market

Key Developments in United States Real Estate Brokerage Market Industry

- May 2024: Compass Inc. acquired Parks Real Estate, significantly expanding its agent network and technological reach.

- April 2024: Compass finalized its acquisition of Latter & Blum, strengthening its position in the Gulf Coast region.

Future Outlook for United States Real Estate Brokerage Market Market

The US real estate brokerage market is poised for continued growth, driven by technological advancements, changing consumer preferences, and economic factors. Strategic acquisitions, expansion into new market segments, and the adoption of innovative business models will play a crucial role in shaping the future of the industry. The market is expected to see a continued trend of consolidation and the emergence of new, technology-driven players.

United States Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

United States Real Estate Brokerage Market Segmentation By Geography

- 1. United States

United States Real Estate Brokerage Market Regional Market Share

Geographic Coverage of United States Real Estate Brokerage Market

United States Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.4. Market Trends

- 3.4.1 Industrial Sector Leads Real Estate Absorption

- 3.4.2 Retail Tightens Vacancy Rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Keller Williams

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RE/MAX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coldwell Banker

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berkshire Hathaway Home Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Century

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sotheby's International Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compass

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eXp Realty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Realogy Holdings Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Redfin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Keller Williams

List of Figures

- Figure 1: United States Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: United States Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: United States Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Real Estate Brokerage Market?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the United States Real Estate Brokerage Market?

Key companies in the market include Keller Williams, RE/MAX, Coldwell Banker, Berkshire Hathaway Home Services, Century, Sotheby's International Realty, Compass, eXp Realty, Realogy Holdings Corp, Redfin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Real Estate Brokerage Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

6. What are the notable trends driving market growth?

Industrial Sector Leads Real Estate Absorption. Retail Tightens Vacancy Rates.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

8. Can you provide examples of recent developments in the market?

May 2024: Compass Inc., the leading residential real estate brokerage by sales volume in the United States, acquired Parks Real Estate, Tennessee's top residential real estate firm that boasts over 1,500 agents. Known for its strategic acquisitions and organic growth, Compass's collaboration with Parks Real Estate not only enriches its agent pool but also grants these agents access to Compass's cutting-edge technology and a vast national referral network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence