Key Insights

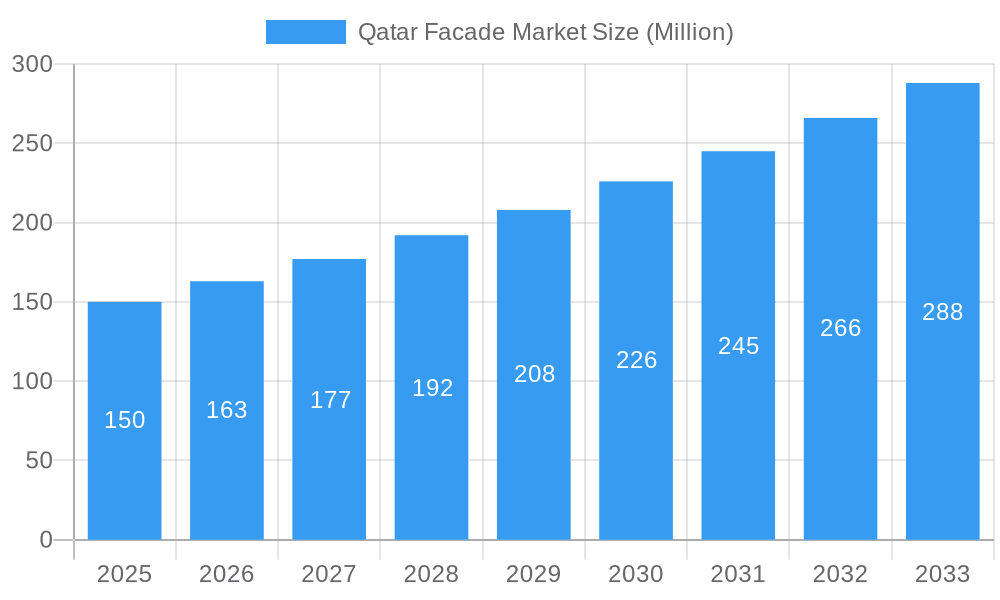

The Qatar facade market, valued at approximately 1.36 billion in 2024, is poised for significant expansion. Projections indicate a compound annual growth rate (CAGR) of 1.3% from 2024 to 2033. This growth is propelled by Qatar's extensive infrastructure development initiatives, encompassing high-rise buildings, premium hotels, and commercial complexes, all demanding sophisticated and visually appealing facade solutions. Concurrently, the nation's commitment to sustainable construction practices fosters the adoption of energy-efficient facade systems, such as ventilated facades, which are instrumental in reducing energy consumption and enhancing building performance. The increasing preference for contemporary architectural aesthetics and the imperative to elevate building visual appeal further contribute to market dynamics. Material analysis highlights a strong demand for glass and metal, attributed to their inherent durability, aesthetic versatility, and suitability for modern design. The commercial sector currently leads end-user demand, followed by the residential sector, reflecting the sustained construction momentum. Challenges include potential volatility in construction activity influenced by global economic shifts and the availability of skilled labor. The market features robust competition among both domestic and international enterprises. Future market evolution is expected to be characterized by innovation in facade technologies, materials, and design, aiming for superior energy efficiency and enhanced visual appeal.

Qatar Facade Market Market Size (In Billion)

The anticipated growth trajectory presents considerable opportunities for market participants. Qatar's ongoing mega-projects, coupled with governmental emphasis on sustainable development and urban regeneration, forecast a sustained growth period for facade system providers. Leading companies are strategically positioned to leverage this expansion through product innovation and market outreach. However, fostering strategic alliances and investing in advanced manufacturing capabilities will be critical for sustained success in this competitive landscape. Understanding the market's segmentation by type (ventilated, non-ventilated), material (glass, metal, plastic and fibres, stones), and end-user (commercial, residential) is vital for developing effective, targeted market strategies. A granular analysis of segment-specific growth rates will provide deeper insights into future market prospects and inform the tailoring of business strategies.

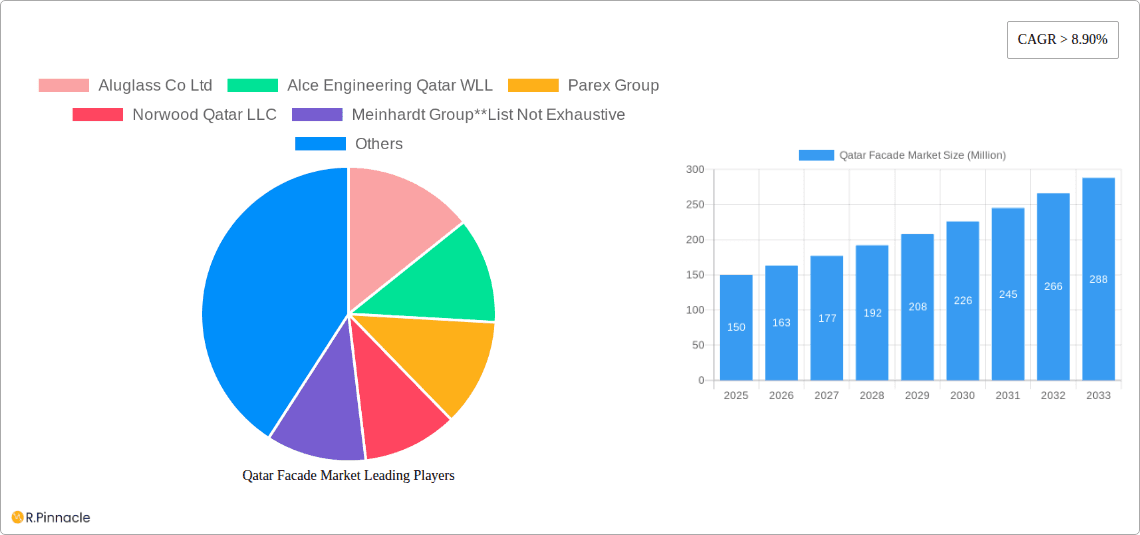

Qatar Facade Market Company Market Share

Qatar Facade Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar facade market, offering valuable insights for industry professionals, investors, and stakeholders. With a focus on market structure, dynamics, and future trends, this report covers the period from 2019 to 2033, with a detailed analysis of the base year 2025 and a forecast extending to 2033. The report leverages extensive data and analysis to provide actionable insights and strategic recommendations for navigating this dynamic market.

Qatar Facade Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Qatar facade market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and merger and acquisition (M&A) activities. The market is characterized by a mix of large multinational companies and local players.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share. Precise market share data requires further research, but estimates suggest the top 5 players hold approximately xx% of the market. This is a dynamic market subject to constant shifts.

- Innovation Drivers: Technological advancements in materials (e.g., sustainable and energy-efficient facades) and design are key drivers of innovation. The increasing adoption of Building Information Modeling (BIM) and the demand for aesthetically pleasing and functional facades are fueling innovation.

- Regulatory Framework: The Qatari government's focus on sustainable construction and infrastructure development significantly impacts the market. Stringent building codes and regulations related to energy efficiency and safety influence product selection and design.

- Product Substitutes: The market faces competition from alternative building materials and construction techniques, though the demand for high-quality, durable facades remains strong.

- End-User Demographics: The primary end-users are commercial and residential construction projects, with commercial construction currently holding a larger market share, estimated at xx%.

- M&A Activities: The report tracks major M&A activities in the Qatar facade market, analyzing their impact on market structure and competition. While specific deal values are unavailable, the past five years have seen xx M&A deals, primarily focusing on consolidating market share and expanding regional presence.

Qatar Facade Market Market Dynamics & Trends

This section delves into the key market dynamics and trends shaping the Qatar facade market. The market is experiencing robust growth driven by several factors. The ongoing infrastructure development projects associated with the 2022 FIFA World Cup and beyond have significantly boosted demand. The growing construction sector in Qatar, fueled by substantial government investment, is a key driver of market expansion. The CAGR for the Qatar facade market from 2025 to 2033 is projected to be xx%, with market penetration increasing steadily. This growth is further propelled by increasing urbanization, rising disposable incomes, and a growing preference for aesthetically appealing and energy-efficient buildings. Technological advancements, such as the adoption of smart facades and innovative materials, are also shaping market trends. However, challenges such as fluctuating raw material prices and competition from regional players pose potential threats.

Dominant Regions & Segments in Qatar Facade Market

The Qatar facade market is geographically concentrated, with the Doha metropolitan area dominating due to the concentration of major construction projects.

- By Type: The ventilated facade segment holds the largest market share, driven by its superior thermal performance and aesthetic appeal.

- By Material: Glass facades command a significant share, due to their aesthetic appeal and transparency. Metal facades are a strong competitor, with projected growth attributed to their durability and design flexibility.

- By End-Users: The commercial sector currently leads, with high-rise buildings and large-scale projects driving demand. Residential construction is also a significant segment, exhibiting promising growth potential.

The key drivers for the dominance of these segments include government policies promoting sustainable construction, the prevalence of large-scale construction projects, and consumer preference for modern architectural designs.

Qatar Facade Market Product Innovations

Recent product innovations include advancements in energy-efficient glass, self-cleaning facades, and integrated solar panels, reflecting a growing emphasis on sustainability and technological integration. These innovations provide competitive advantages by enhancing building performance, reducing energy consumption, and increasing aesthetic appeal, attracting environmentally conscious clients and improving building value. Companies are actively investing in R&D to develop and bring to market advanced facade systems that meet the demands of this evolving market.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Qatar facade market across three key dimensions: type, material, and end-user.

- By Type: Ventilated, Non-Ventilated, Others (Each segment features projected growth, market size and competitive dynamics)

- By Material: Glass, Metal, Plastic and Fibres, Stones and Others (Each segment features projected growth, market size and competitive dynamics)

- By End Users: Commercial, Residential, Others (Each segment features projected growth, market size and competitive dynamics)

Each segment’s detailed analysis includes its respective market size, growth projections, and competitive dynamics, offering valuable insight into market opportunities and competitive pressures within each category.

Key Drivers of Qatar Facade Market Growth

The Qatar facade market's growth is driven by several factors: robust construction activity fueled by mega-projects and infrastructure development, a growing emphasis on sustainable building practices, increasing demand for aesthetically appealing and energy-efficient buildings, and government initiatives supporting the development of a modern built environment. The 2022 FIFA World Cup served as a major catalyst, accelerating construction and stimulating demand for innovative facade solutions.

Challenges in the Qatar Facade Market Sector

The market faces challenges including fluctuating raw material prices, intense competition from regional and international players, potential supply chain disruptions, and the need for skilled labor. Regulatory compliance and adherence to stringent building codes also pose challenges, potentially leading to increased costs and project delays. The estimated impact of these challenges on market growth is xx% based on expert analysis.

Emerging Opportunities in Qatar Facade Market

Emerging opportunities include the growing adoption of smart facades, the increasing demand for sustainable and energy-efficient building materials, and the potential for growth in the residential sector. The integration of renewable energy technologies, like solar panels, into facades presents a significant market opportunity. The development of innovative design solutions and building materials that cater to the region's climate are attracting interest.

Leading Players in the Qatar Facade Market Market

- Aluglass Co Ltd

- Alce Engineering Qatar WLL

- Parex Group

- Norwood Qatar LLC

- Meinhardt Group

- Bemo International

- Quanto Bello Qatar

- Sollass Alu & Glass

- Everest Aluminum Co WLL

- Qatar Meta Coats W L L (QMC)

- Alumasa Qatar

(Note: Website links were not provided, so they cannot be included. A comprehensive online search may reveal some links for further addition.)

Key Developments in Qatar Facade Market Industry

- September 2022: Foster + Partners unveiled the golden facade of the Lusail Stadium, highlighting the demand for striking architectural designs.

- November 2022: Reflection Window + Wall (RWW) partnered with Alutec WLL to expand its Middle East supply chain, demonstrating increasing regional collaboration and investment in advanced facade technologies. Alutec’s projected 3.1 Million square feet expansion underscores the market’s growth potential.

Future Outlook for Qatar Facade Market Market

The Qatar facade market is poised for continued growth, driven by ongoing infrastructure development, increasing urbanization, and the growing demand for sustainable and aesthetically pleasing buildings. Strategic opportunities exist for companies that can offer innovative and sustainable facade solutions, catering to the region's specific climate and construction requirements. The market will likely witness increased competition, consolidation, and further technological advancements. The long-term outlook remains positive, projecting substantial growth over the forecast period.

Qatar Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones and Others

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Others

Qatar Facade Market Segmentation By Geography

- 1. Qatar

Qatar Facade Market Regional Market Share

Geographic Coverage of Qatar Facade Market

Qatar Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Construction Industry to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Facade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones and Others

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aluglass Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alce Engineering Qatar WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Parex Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Norwood Qatar LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meinhardt Group**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bemo International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quanto Bello Qatar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sollass Alu & Glass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Everest Aluminum Co WLL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qatar Meta Coats W L L (QMC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alumasa Qatar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Aluglass Co Ltd

List of Figures

- Figure 1: Qatar Facade Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Qatar Facade Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Qatar Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Qatar Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Qatar Facade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Qatar Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Qatar Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Qatar Facade Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Qatar Facade Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Facade Market?

The projected CAGR is approximately 1.3%.

2. Which companies are prominent players in the Qatar Facade Market?

Key companies in the market include Aluglass Co Ltd, Alce Engineering Qatar WLL, Parex Group, Norwood Qatar LLC, Meinhardt Group**List Not Exhaustive, Bemo International, Quanto Bello Qatar, Sollass Alu & Glass, Everest Aluminum Co WLL, Qatar Meta Coats W L L (QMC), Alumasa Qatar.

3. What are the main segments of the Qatar Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Construction Industry to Drive the Market Growth.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

November 2022: Reflection Window + Wall (RWW) agreed with Qatari company Alutec WLL to expand its supply chain into the Middle East. Furthermore, the two companies' agreement stated that they can both use an application that tracks the first steps of fabrication through job site installation. Alutec expected that it would soon have more than 3.1 million square feet of production space thanks to operational and under-construction facilities in Qatar, India, Ireland, and Thailand. This area is also to be used for RWW production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Facade Market?

To stay informed about further developments, trends, and reports in the Qatar Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence