Key Insights

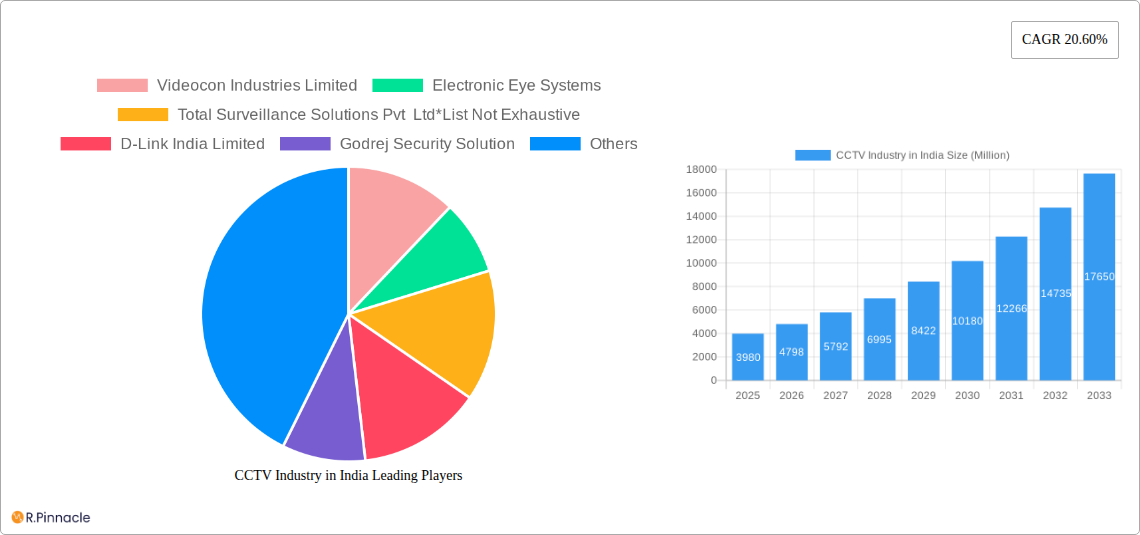

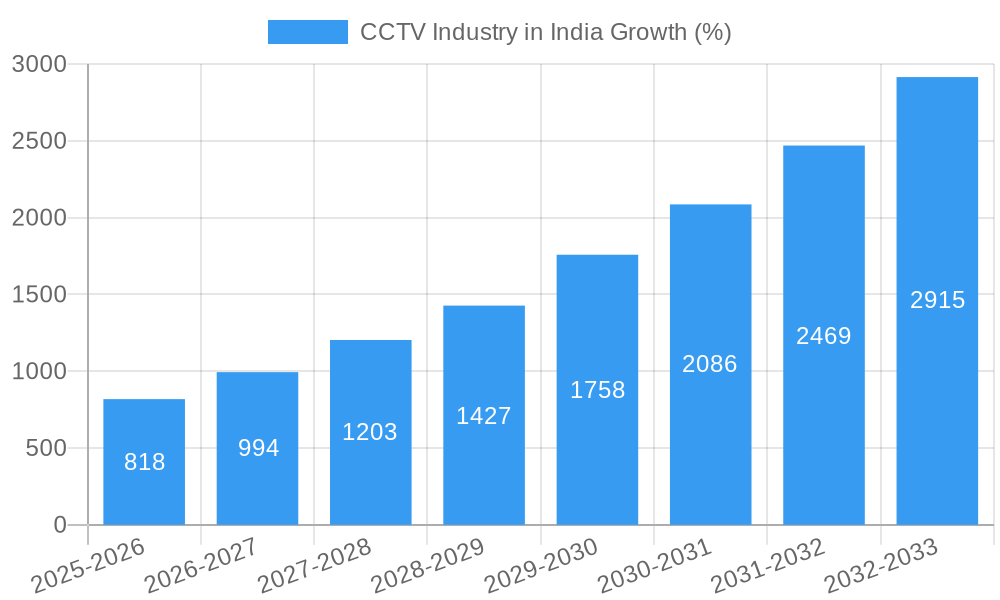

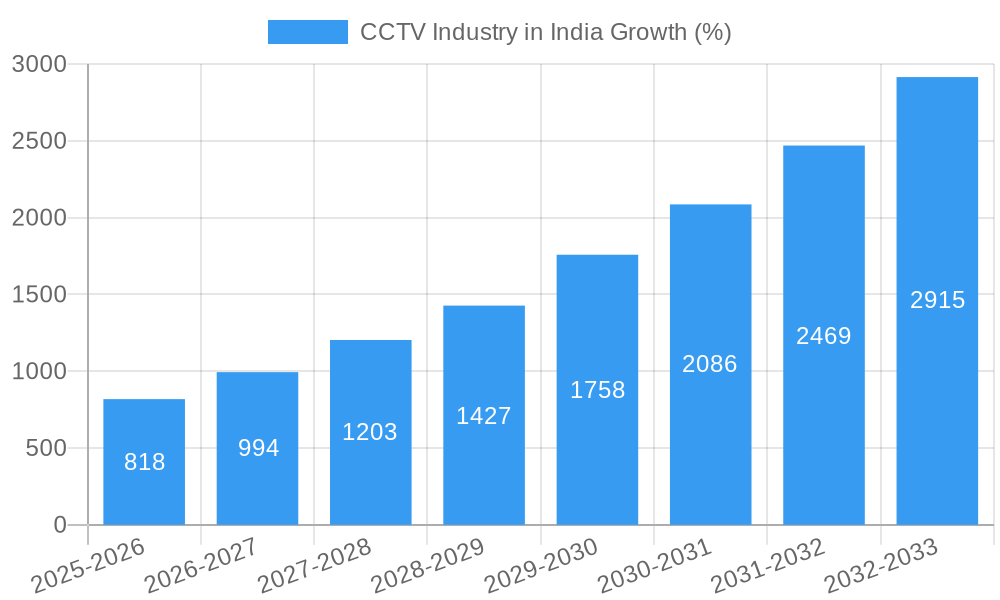

The Indian CCTV market, valued at ₹3.98 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 20.60% from 2025 to 2033. This surge is driven by increasing security concerns across various sectors, including government initiatives promoting smart cities and enhanced surveillance infrastructure. The rising adoption of IP cameras, particularly PTZ (Pan-Tilt-Zoom) cameras offering advanced features like remote monitoring and intelligent analytics, fuels market expansion. Furthermore, the burgeoning BFSI (Banking, Financial Services, and Insurance) sector, coupled with the growth of e-commerce and the need for robust retail security, contributes significantly to market demand. Government regulations mandating CCTV installation in public spaces and critical infrastructure also act as a key driver.

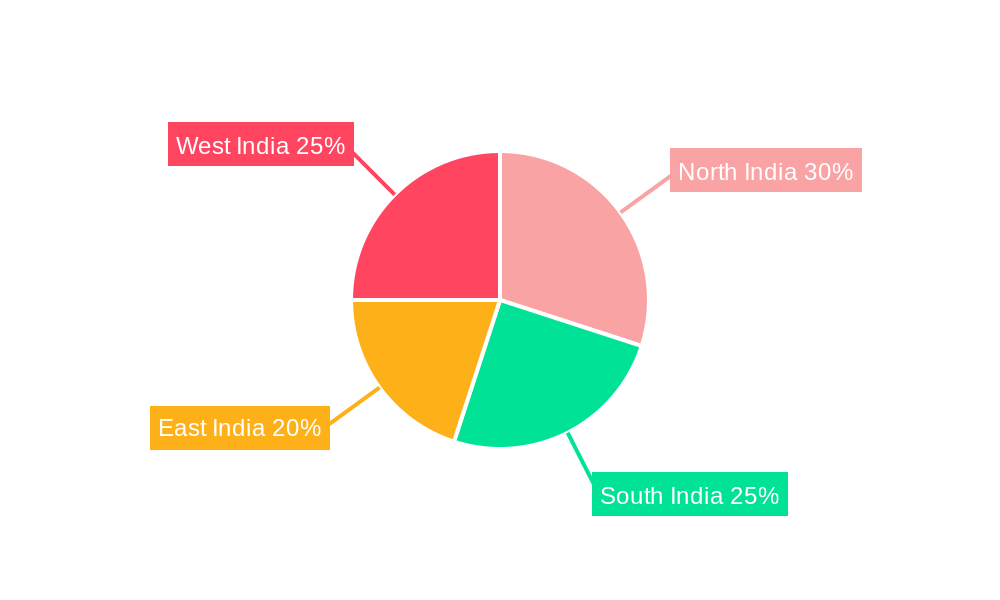

However, the market faces certain challenges. High initial investment costs associated with advanced CCTV systems and the need for skilled professionals for installation and maintenance could potentially restrain growth, particularly in smaller businesses. Competition among numerous domestic and international players, leading to price wars, also presents a challenge. Despite these hurdles, the overall positive trajectory is expected to continue, driven by technological advancements in areas like AI-powered video analytics and cloud-based storage solutions. The market segmentation reveals a significant preference for IP cameras over analog counterparts, indicating a clear shift towards technologically advanced solutions. Regional variations in market penetration exist, with urban centers and economically developed regions like North and West India showing higher adoption rates compared to others.

CCTV Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the CCTV industry in India, covering market structure, dynamics, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report leverages extensive market research and data analysis to provide actionable intelligence on this rapidly evolving sector.

CCTV Industry in India Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian CCTV market, encompassing market concentration, innovation drivers, regulatory frameworks, and merger & acquisition (M&A) activities. The Indian CCTV market is characterized by a mix of both domestic and international players. While precise market share data for each player is proprietary and varies based on the segment and year, we can observe a fragmented yet increasingly competitive environment. Several large multinational companies hold significant market shares, but numerous smaller, regional players also contribute significantly.

Market Concentration: The market exhibits moderate concentration, with a few dominant players alongside numerous smaller companies. Exact market share figures for individual companies are unavailable publicly, and we estimate that top 5 players account for approximately xx% of the overall market.

Innovation Drivers: Key innovation drivers include advancements in Artificial Intelligence (AI), improved image quality (4K and beyond), integration with cloud-based solutions, and increasing demand for intelligent video analytics.

Regulatory Frameworks: Government initiatives focused on enhancing public safety and security significantly influence the market. For instance, the Smart Cities Mission and increasing focus on law enforcement technologies boost demand. However, data privacy regulations are also emerging and shaping the market's trajectory.

Product Substitutes: While traditional CCTV systems remain dominant, competition is increasing from alternative security technologies like thermal imaging and advanced sensor networks.

End-User Demographics: The market is diverse, catering to government agencies, BFSI (Banking, Financial Services, and Insurance), industrial facilities, transportation sectors (including smart traffic management), and other end-user verticals like hospitality, healthcare, retail, and educational institutions.

M&A Activities: The Indian CCTV market has witnessed several M&A activities in recent years, although precise deal values remain largely undisclosed. These activities have primarily focused on expanding market reach, acquiring specialized technologies, and consolidating market share.

CCTV Industry in India Market Dynamics & Trends

The Indian CCTV market is experiencing robust growth, driven by increasing security concerns, rapid urbanization, and technological advancements. The market is characterized by significant growth, with a compound annual growth rate (CAGR) estimated at xx% during the forecast period (2025-2033). Market penetration for CCTV systems remains relatively low compared to other developed nations, suggesting substantial future growth potential.

Market growth is fueled by factors like rising disposable incomes, increased awareness of security threats, government investments in smart city initiatives, and the expanding adoption of cloud-based video surveillance solutions. The ongoing digital transformation across various sectors is further accelerating the demand for advanced CCTV systems. Competitive dynamics are characterized by intense price competition, particularly in the analog camera segment, and innovation-driven competition amongst players offering advanced IP-based and AI-powered solutions. Consumer preferences are shifting toward high-resolution, intelligent cameras with advanced analytics capabilities and user-friendly interfaces.

Dominant Regions & Segments in CCTV Industry in India

The Indian CCTV market exhibits regional variations in growth and adoption rates. While data on specific region dominance is unavailable publicly, metropolitan areas and economically developed states typically exhibit higher demand and market penetration. The strongest segments within the market are currently:

By Type:

- IP Cameras (excluding PTZ): This segment dominates due to its cost-effectiveness, ease of integration, and flexibility in network deployment.

- PTZ Cameras: This niche segment is growing steadily, driven by demand for high-level surveillance with pan, tilt, and zoom capabilities. The government and transportation sectors are particularly strong contributors to this segment.

- Analog Cameras: Although exhibiting slower growth, analog cameras remain present, particularly in price-sensitive segments and legacy systems.

By End-user Verticals:

- Government: This segment is a significant driver of market growth, owing to government initiatives focused on improving public safety and infrastructure projects.

- BFSI: Banks and financial institutions are deploying advanced CCTV systems with robust security features and analytics to secure facilities and transactions.

- Industrial: Industrial sectors require extensive monitoring for security and process optimization, generating strong demand for robust CCTV solutions.

- Transportation: Smart city initiatives are driving significant investment in CCTV systems for transportation management and security.

Key drivers for these dominant segments include government policy (e.g., smart city programs), strong economic growth in key states, and investments by corporations in security infrastructures.

CCTV Industry in India Product Innovations

Recent product developments focus on enhancing video analytics capabilities, improved image quality, seamless cloud integration, and integration with other security systems. AI-powered features like facial recognition, object detection, and behavioral analysis are increasingly prevalent. The market emphasizes system flexibility and scalability to cater to the unique needs of diverse end-users. Competitive advantages are achieved by offering enhanced features, user-friendly interfaces, and reliable customer support.

Report Scope & Segmentation Analysis

This report segments the Indian CCTV market by camera type (Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras) and end-user verticals (Government, Industrial, BFSI, Transportation Vertical, Other End-user verticals (Hospitality and Healthcare, Enterprises, Retail, Educational Institutions)). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics.

- By Type: The report forecasts significant growth for IP cameras and PTZ cameras with analog cameras maintaining a smaller but steady market share.

- By End-user Verticals: Government, BFSI, and Industrial sectors are expected to dominate, showcasing strong growth potential. The "Other End-user verticals" segment is also projected to experience robust expansion as security awareness grows in these sectors.

Key Drivers of CCTV Industry in India Growth

Several factors drive the growth of the Indian CCTV industry: government initiatives promoting smart city infrastructure and public safety (e.g., the Smart Cities Mission); increasing concerns about crime and security; rising disposable incomes leading to greater investment in security solutions; and technological innovations, like AI and improved image quality, improving the efficiency and value of CCTV systems.

Challenges in the CCTV Industry in India Sector

The CCTV industry in India faces challenges, including supply chain disruptions impacting the availability of critical components and price fluctuations; stringent regulatory requirements and data privacy concerns; and intense competition among both domestic and international companies leading to pricing pressures and reduced profit margins. The xx Million INR worth of annual losses from supply chain issues is a considerable impediment to market growth.

Emerging Opportunities in CCTV Industry in India

Emerging opportunities include the expansion of smart city initiatives creating substantial demand for advanced CCTV systems; the rising adoption of cloud-based video management systems offering scalability and enhanced analytics capabilities; and increased focus on cybersecurity features within the design and implementation of these systems. The demand for AI-powered video analytics is also expanding opportunities in areas like predictive policing and loss prevention.

Leading Players in the CCTV Industry in India Market

- Videocon Industries Limited

- Electronic Eye Systems

- Total Surveillance Solutions Pvt Ltd

- D-Link India Limited

- Godrej Security Solution

- Dahua Technology India Pvt Ltd

- Honeywell Commercial Security (Honeywell International Inc)

- Axis Video Systems India Pvt Ltd

- Vantage Security Ltd

- Vintron informatics Ltd

- Aditya Infotech Ltd (CP Plus GmbH & Co KG)

- Zicom Electronic Security Systems

- HIKVISION Digital Technology Co Ltd (Hikvision India)

- Digitals India Security Products Pvt Ltd

- Bosch Security Systems India

Key Developments in CCTV Industry in India Industry

- April 2022: The Telangana State Police Department formed the Telangana Public Safety Society to fund CCTV camera installation and maintenance across the state. This significantly boosted demand in Telangana.

- August 2022: Hanwha Techwin launched WisenetWAVE VMS 5.0, enhancing cybersecurity and usability, which positively impacted market demand for advanced VMS solutions.

Future Outlook for CCTV Industry in India Market

The Indian CCTV market is poised for significant growth over the forecast period, driven by continued government initiatives, technological advancements, and increasing security concerns across various sectors. Strategic opportunities exist for companies focusing on AI-powered analytics, cloud-based solutions, and enhanced cybersecurity features. The market's future is bright, with an expected xx Million USD market value by 2033.

CCTV Industry in India Segmentation

-

1. Type

- 1.1. Analog Cameras

- 1.2. IP Cameras (excluding PTZ)

- 1.3. PTZ Cameras

-

2. End-user Verticals

- 2.1. Government

- 2.2. Industrial

- 2.3. BFSI

- 2.4. Transportation Vertical

- 2.5. Other En

CCTV Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

CCTV Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Concern about Privacy Across Various Enterprises

- 3.2.2 Public Sectors and Residential Associations; Traffic Surveillance

- 3.2.3 and Security in Educational Institutes

- 3.2.4 Railways and Hospital to Augment the Demand of CCTV Cameras; Growth of Smart Cities and Airport Security; Government Regulations Enforcing the Setup of Surveillance Infrastructure Across Various Cities

- 3.3. Market Restrains

- 3.3.1. Limited Customer Awareness Pertaining to Specific Usage of Surveillance Cameras; High Cost of Video Surveillance Camera

- 3.4. Market Trends

- 3.4.1. IP Cameras are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog Cameras

- 5.1.2. IP Cameras (excluding PTZ)

- 5.1.3. PTZ Cameras

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Government

- 5.2.2. Industrial

- 5.2.3. BFSI

- 5.2.4. Transportation Vertical

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog Cameras

- 6.1.2. IP Cameras (excluding PTZ)

- 6.1.3. PTZ Cameras

- 6.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.2.1. Government

- 6.2.2. Industrial

- 6.2.3. BFSI

- 6.2.4. Transportation Vertical

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog Cameras

- 7.1.2. IP Cameras (excluding PTZ)

- 7.1.3. PTZ Cameras

- 7.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.2.1. Government

- 7.2.2. Industrial

- 7.2.3. BFSI

- 7.2.4. Transportation Vertical

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog Cameras

- 8.1.2. IP Cameras (excluding PTZ)

- 8.1.3. PTZ Cameras

- 8.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.2.1. Government

- 8.2.2. Industrial

- 8.2.3. BFSI

- 8.2.4. Transportation Vertical

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog Cameras

- 9.1.2. IP Cameras (excluding PTZ)

- 9.1.3. PTZ Cameras

- 9.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.2.1. Government

- 9.2.2. Industrial

- 9.2.3. BFSI

- 9.2.4. Transportation Vertical

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analog Cameras

- 10.1.2. IP Cameras (excluding PTZ)

- 10.1.3. PTZ Cameras

- 10.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.2.1. Government

- 10.2.2. Industrial

- 10.2.3. BFSI

- 10.2.4. Transportation Vertical

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North India CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India CCTV Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Videocon Industries Limited

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Electronic Eye Systems

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Total Surveillance Solutions Pvt Ltd*List Not Exhaustive

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 D-Link India Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Godrej Security Solution

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Dahua Technology India Pvt Ltd

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Honeywell Commercial Security (Honeywell International Inc)

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Axis Video Systems India Pvt Ltd

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Vantage Security Ltd

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Vintron informatics Ltd

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Aditya Infotech Ltd (CP Plus GmbH & Co KG)

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Zicom Electronic Security Systems

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 HIKVISION Digital Technology Co Ltd (Hikvision India)

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Digitals India Security Products Pvt Ltd

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Bosch Security Systems India

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.1 Videocon Industries Limited

List of Figures

- Figure 1: Global CCTV Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America CCTV Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 5: North America CCTV Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America CCTV Industry in India Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 7: North America CCTV Industry in India Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 8: North America CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 9: North America CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America CCTV Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 11: South America CCTV Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America CCTV Industry in India Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 13: South America CCTV Industry in India Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 14: South America CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 15: South America CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe CCTV Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe CCTV Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe CCTV Industry in India Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 19: Europe CCTV Industry in India Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 20: Europe CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa CCTV Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa CCTV Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa CCTV Industry in India Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 25: Middle East & Africa CCTV Industry in India Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 26: Middle East & Africa CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific CCTV Industry in India Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific CCTV Industry in India Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific CCTV Industry in India Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 31: Asia Pacific CCTV Industry in India Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 32: Asia Pacific CCTV Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific CCTV Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CCTV Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 4: Global CCTV Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 12: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 18: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 24: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 36: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global CCTV Industry in India Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global CCTV Industry in India Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 45: Global CCTV Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific CCTV Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CCTV Industry in India?

The projected CAGR is approximately 20.60%.

2. Which companies are prominent players in the CCTV Industry in India?

Key companies in the market include Videocon Industries Limited, Electronic Eye Systems, Total Surveillance Solutions Pvt Ltd*List Not Exhaustive, D-Link India Limited, Godrej Security Solution, Dahua Technology India Pvt Ltd, Honeywell Commercial Security (Honeywell International Inc), Axis Video Systems India Pvt Ltd, Vantage Security Ltd, Vintron informatics Ltd, Aditya Infotech Ltd (CP Plus GmbH & Co KG), Zicom Electronic Security Systems, HIKVISION Digital Technology Co Ltd (Hikvision India), Digitals India Security Products Pvt Ltd, Bosch Security Systems India.

3. What are the main segments of the CCTV Industry in India?

The market segments include Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concern about Privacy Across Various Enterprises. Public Sectors and Residential Associations; Traffic Surveillance. and Security in Educational Institutes. Railways and Hospital to Augment the Demand of CCTV Cameras; Growth of Smart Cities and Airport Security; Government Regulations Enforcing the Setup of Surveillance Infrastructure Across Various Cities.

6. What are the notable trends driving market growth?

IP Cameras are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Limited Customer Awareness Pertaining to Specific Usage of Surveillance Cameras; High Cost of Video Surveillance Camera.

8. Can you provide examples of recent developments in the market?

August 2022: Hanwha Techwin, a global supplier of intelligent video surveillance solutions, launched a significantly updated version of its WisenetWAVE Video Management Software (VMS) in response to the changing needs of security professionals and system integrators. Version 5.0 expands the platform's focus on cybersecurity, system usability, convenience, and interactivity. It features advanced object search, metadata-driven active backup, webpage proxy via servers, two-factor authentication (2FA), resource grouping, audio mapping, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CCTV Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CCTV Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CCTV Industry in India?

To stay informed about further developments, trends, and reports in the CCTV Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence