Key Insights

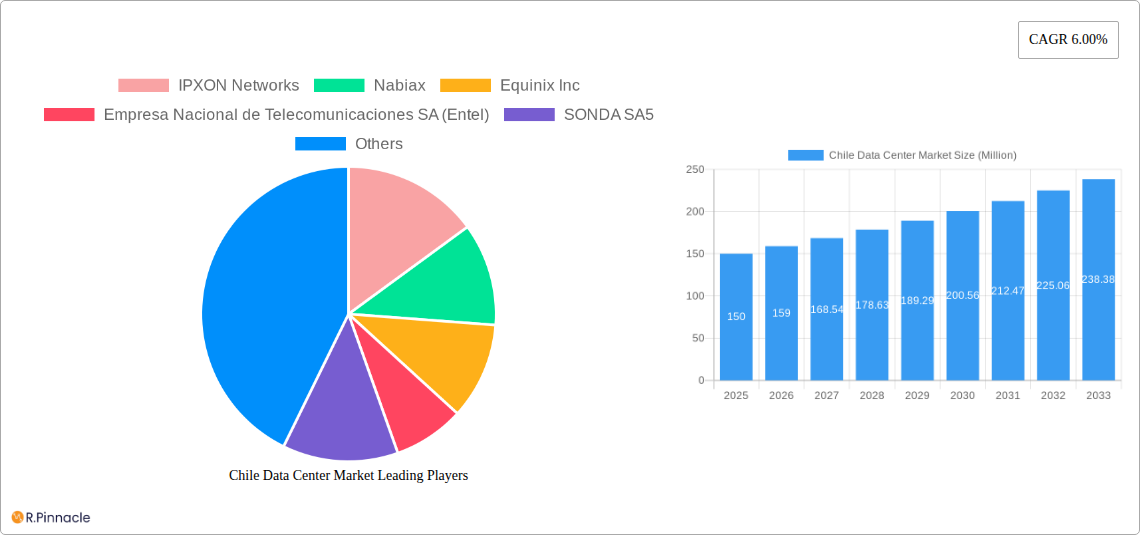

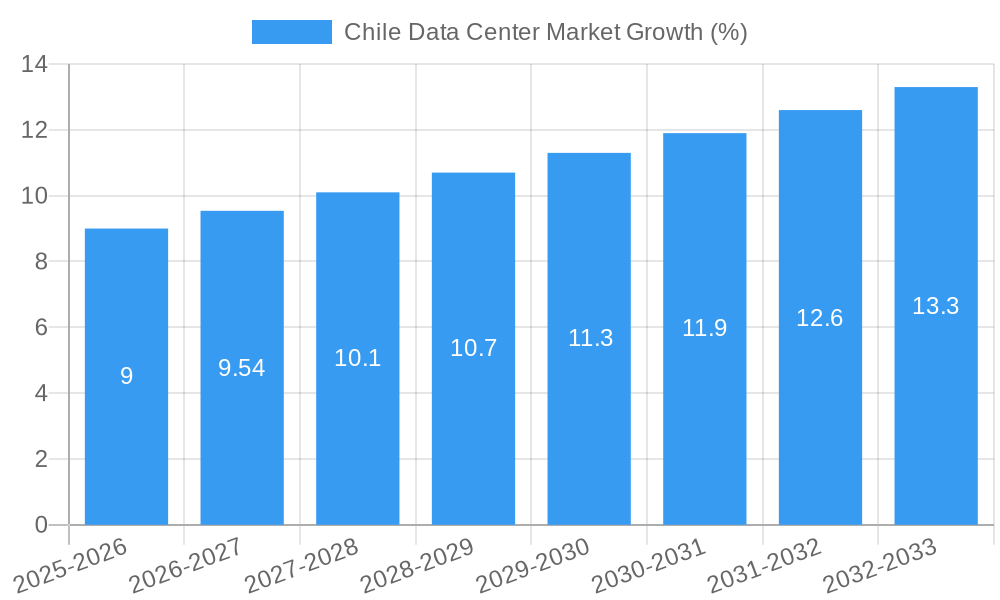

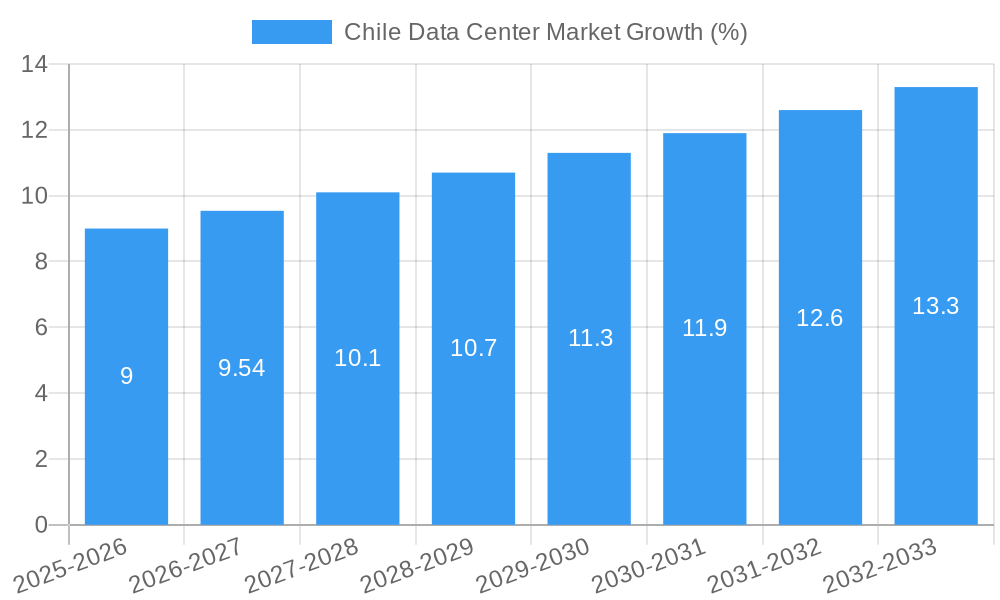

The Chilean data center market, currently experiencing robust growth, is projected to expand significantly over the forecast period (2025-2033). A 6.00% CAGR indicates a steady and sustained increase in market size, driven primarily by the increasing adoption of cloud computing, the burgeoning digital economy, and the government's initiatives to enhance digital infrastructure. Santiago, as a major economic hub, dominates the market as a hotspot, attracting significant investment from both domestic and international players. The demand for larger data center facilities (Mega and Massive) is particularly strong, reflecting the needs of large enterprises and cloud providers. While the market is largely utilized, the potential for growth in the non-utilized segment presents opportunities for new entrants and expansion strategies. Key players like Equinix, Entel, and others are actively competing in this dynamic landscape, vying for market share through strategic expansions and service offerings. The diverse range of data center tiers (Tier 1-4) caters to different needs and budgets, further driving market complexity and dynamism.

The market's growth is, however, subject to certain restraints. These include potential infrastructure limitations, regulatory hurdles, and the overall economic climate of Chile. The availability of skilled labor and energy costs also present ongoing challenges for market participants. Nevertheless, the long-term outlook remains positive, fueled by consistent growth in digital adoption, robust government support for technological advancement, and the increasing demand for reliable data storage and processing capabilities in the region. Segments such as medium-sized data centers are expected to experience healthy growth, driven by small and medium-sized enterprises (SMEs) adopting cloud technologies and digital transformation initiatives. Furthermore, the development of robust network connectivity and improved digital literacy will further catalyze growth within the Chilean data center sector.

Chile Data Center Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Chile data center market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth prospects. The report leverages extensive data analysis and expert insights to provide actionable intelligence on this rapidly evolving market.

Chile Data Center Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Chilean data center market, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The study period covers 2019-2024 (historical) and projects to 2033 (forecast), with 2025 as the base year and estimated year.

- Market Concentration: The Chilean data center market exhibits a moderately concentrated structure, with key players like Equinix Inc., Ascenty (Digital Realty Trust Inc.), and Entel holding significant market share. However, smaller players like IPXON Networks and EdgeUno Inc. are also contributing to the growth and innovation. Precise market share data for each player is unavailable for this report and requires further investigation xx.

- Innovation Drivers: The increasing adoption of cloud computing, the expansion of digital services, and government initiatives promoting digitalization are driving innovation within the Chilean data center market. This includes advancements in data center design, energy efficiency technologies, and security measures.

- Regulatory Framework: The Chilean government's policies related to digital infrastructure and telecommunications play a vital role in shaping the market's growth trajectory. Further analysis of specific regulations is needed for comprehensive understanding.

- Product Substitutes: While traditional colocation services remain dominant, the emergence of edge computing and cloud-based solutions presents alternative options for certain end-users.

- End-User Demographics: The primary end-users include telecommunication companies, financial institutions, government bodies, and large enterprises. Specific demographic details and usage patterns require further investigation for detailed analysis, including sector break downs for better insight into demand.

- M&A Activities: Significant mergers and acquisitions have shaped the market landscape. For instance, Equinix's acquisition of four data centers from Entel in May 2022 demonstrates the consolidation trend. The total value of M&A deals within the studied period is estimated to be xx Million.

Chile Data Center Market Dynamics & Trends

This section delves into the market dynamics, focusing on growth drivers, technological advancements, consumer preferences, and competitive dynamics. The analysis covers the period from 2019 to 2033.

The Chilean data center market is experiencing robust growth, driven by several factors. The increasing adoption of cloud services, the expansion of digital businesses, and the government's support for digital infrastructure development are key drivers. Technological disruptions, such as the rise of edge computing and hyperscale data centers, are reshaping the market. Consumer preferences are shifting towards greater reliability, security, and energy efficiency in data center services. Intense competition among established players and new entrants is stimulating innovation and price optimization. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, with market penetration exceeding xx% by 2033.

Dominant Regions & Segments in Chile Data Center Market

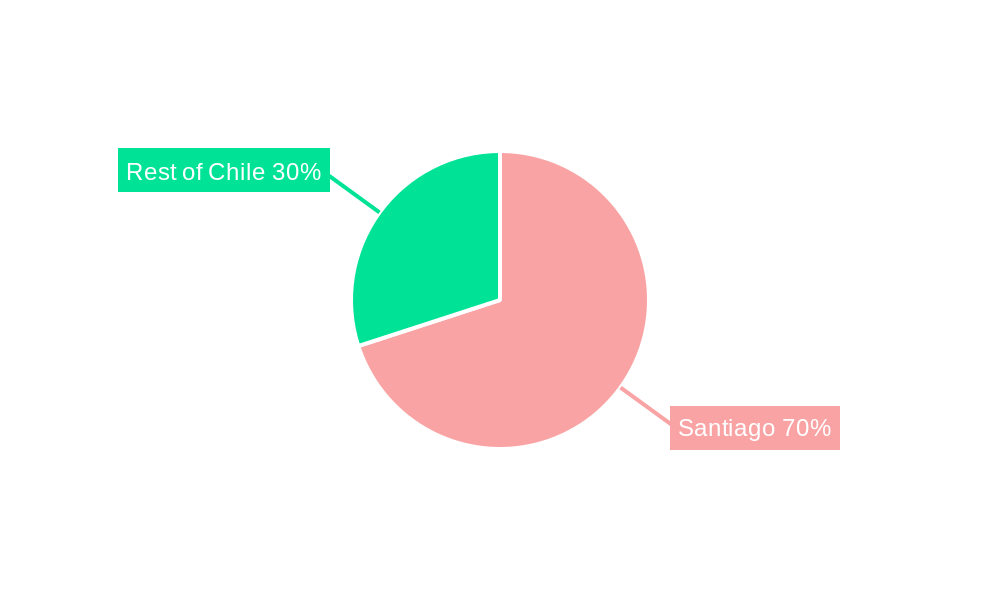

This section identifies the dominant regions and segments within the Chilean data center market based on Hotspot, Data Center Size, and Tier Type.

- Dominant Region: Santiago is the clear leader, due to its concentration of businesses, IT infrastructure, and population density. The "Rest of Chile" region exhibits growth potential but lags behind Santiago due to infrastructure limitations and lower demand.

- Data Center Size: The market is dominated by Medium and Large data centers. However, the share of Mega and Massive data centers is gradually increasing, reflecting the growing need for hyperscale infrastructure. Small data centers cater to specific niche segments. Further details are required for a comprehensive market size analysis of each segment.

- Tier Type: Tier III and Tier IV data centers are gaining popularity, reflecting the increasing demand for high availability and resilience. However, a significant portion of the market still comprises Tier II facilities. A detailed breakdown of Tier type market share is needed.

- Absorption: A majority of the data center capacity is utilized. However, there is some non-utilized capacity available due to several factors, primarily timing mismatches between construction and market demand. The exact figures for both utilized and non-utilized capacity require further investigation.

Key Drivers for Dominance:

- Santiago: Strong economic activity, high population density, advanced telecommunications infrastructure, and government support for digital infrastructure development.

- Medium & Large Data Centers: Cost-effectiveness for scaling operations, suitability for various enterprise needs, and adaptability to diverse business models.

- Tier III & Tier IV Data Centers: Higher reliability, redundancy, and uptime, meeting the stringent requirements of critical applications and large enterprises.

Chile Data Center Market Product Innovations

Recent product innovations in the Chilean data center market focus on enhancing efficiency, security, and scalability. This includes the adoption of advanced cooling technologies, improved power management systems, and enhanced security features. Furthermore, there is a growing emphasis on sustainable data center designs, aligning with global environmental goals. These innovations are driving competitiveness and improving market fit by addressing customer demands for high-performance, energy-efficient, and secure infrastructure.

Report Scope & Segmentation Analysis

This report segments the Chilean data center market by region (Santiago and Rest of Chile), data center size (Small, Medium, Mega, Large, Massive), and tier type (Tier I, Tier II, Tier III, Tier IV). Absorption is classified as utilized or non-utilized, and other end-user sectors are also factored into the analysis. Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined. Further details on exact sizes and growth projections are pending, and will be updated in the final version.

Key Drivers of Chile Data Center Market Growth

Several factors drive the growth of the Chilean data center market. The expansion of the digital economy, a growing demand for cloud services, the government's initiatives to support the growth of the digital economy, and improvements in telecommunications infrastructure are key contributors. Moreover, increased investment in data center infrastructure and technological innovations like edge computing and hyperscale data centers significantly impact the market expansion.

Challenges in the Chile Data Center Market Sector

The Chilean data center market faces some challenges. These include high infrastructure costs, power limitations in certain regions, and competition from regional and international players. Furthermore, regulatory uncertainties and the availability of skilled labor can also impact market growth. Quantifiable impacts of these challenges on market growth need additional research to provide conclusive results.

Emerging Opportunities in Chile Data Center Market

The Chilean data center market presents several emerging opportunities. The growing adoption of 5G technology, the expansion of the IoT ecosystem, and increasing demand for edge computing services are driving new growth avenues. Further exploration of specialized data center services catering to specific industries, such as finance and healthcare, also presents promising opportunities for market expansion.

Leading Players in the Chile Data Center Market Market

- IPXON Networks

- Nabiax

- Equinix Inc

- Empresa Nacional de Telecomunicaciones SA (Entel)

- SONDA SA5

- EdgeConneX Inc

- Century Link (Lumen Technologies Inc)

- General Datatech L P (GDT)

- NetActuate Inc

- ODATA (Patria Investments Ltd)

- EdgeUno Inc

- Ascenty (Digital Realty Trust Inc)

Key Developments in Chile Data Center Market Industry

- November 2022: Ascenty announced a US$290 Million investment to construct five new data centers across South America, including Chile. This significantly boosts capacity and market competition.

- August 2022: Ascenty inaugurated its second data facility in Santiago, Chile (Santiago 2), adding 21,000 sq m of floor area and 31 MW of IT load, expanding capacity and enhancing market offerings.

- May 2022: Equinix expanded its Platform Equinix in Latin America after acquiring four data centers from Entel in Chile, consolidating its position and increasing market share.

Future Outlook for Chile Data Center Market Market

The future of the Chilean data center market appears promising. Continued growth in the digital economy, increasing demand for cloud and edge computing services, and ongoing investments in data center infrastructure point towards sustained market expansion. Strategic partnerships, technological innovations, and government support will further accelerate growth, creating significant opportunities for both existing players and new entrants.

Chile Data Center Market Segmentation

-

1. Hotspot

- 1.1. Santiago

- 1.2. Rest of Chile

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Chile Data Center Market Segmentation By Geography

- 1. Chile

Chile Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Santiago

- 5.1.2. Rest of Chile

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IPXON Networks

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nabiax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equinix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresa Nacional de Telecomunicaciones SA (Entel)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SONDA SA5

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EdgeConneX Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Century Link (Lumen Technologies Inc )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Datatech L P (GDT)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NetActuate Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ODATA (Patria Investments Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 EdgeUno Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ascenty (Digital Realty Trust Inc )

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 IPXON Networks

List of Figures

- Figure 1: Chile Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chile Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Chile Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chile Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Chile Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Chile Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Chile Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Chile Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Chile Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Chile Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Chile Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Chile Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Chile Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Chile Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Chile Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Chile Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Chile Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Chile Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Chile Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Chile Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Chile Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Chile Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Chile Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Chile Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Chile Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Chile Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Chile Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Chile Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Chile Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Chile Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Chile Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Chile Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Chile Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Chile Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Chile Data Center Market?

Key companies in the market include IPXON Networks, Nabiax, Equinix Inc, Empresa Nacional de Telecomunicaciones SA (Entel), SONDA SA5, EdgeConneX Inc, Century Link (Lumen Technologies Inc ), General Datatech L P (GDT), NetActuate Inc, ODATA (Patria Investments Ltd), EdgeUno Inc, Ascenty (Digital Realty Trust Inc ).

3. What are the main segments of the Chile Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

November 2022: Ascenty will invest (US$290 million) in constructing five new data centers in South America. The locations of the data centers will be Brazil, Chile, and Colombia.August 2022: In Santiago, Chile, Ascenty has inaugurated its second data facility. The capital's Quilicura sector is home to the Santiago 2 facility, which has a 21,000 sq m (226,000 sq ft) floor area, 31 MW of IT load, and space for up to 3,550 racks.May 2022: Following the completion of the purchase of four data centers in CHILE from Empresa Nacional De Telecomunicaciones S.A. ("Entel"), a Chilean telecommunications provider, Equinix, Inc., the provider of digital infrastructure, announced it has expanded Platform Equinix deeper into LATIN AMERICA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Data Center Market?

To stay informed about further developments, trends, and reports in the Chile Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence