Key Insights

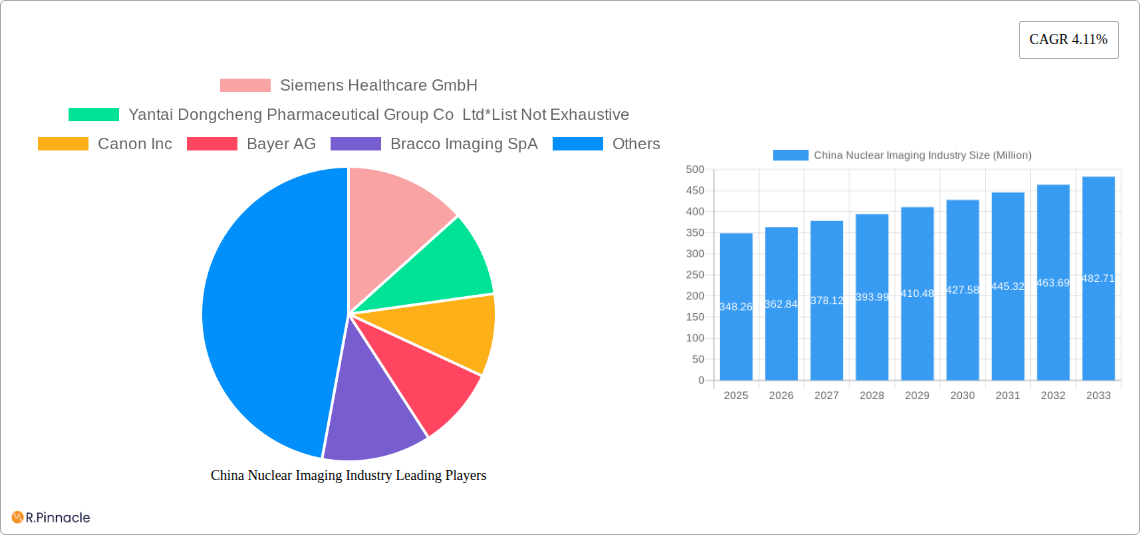

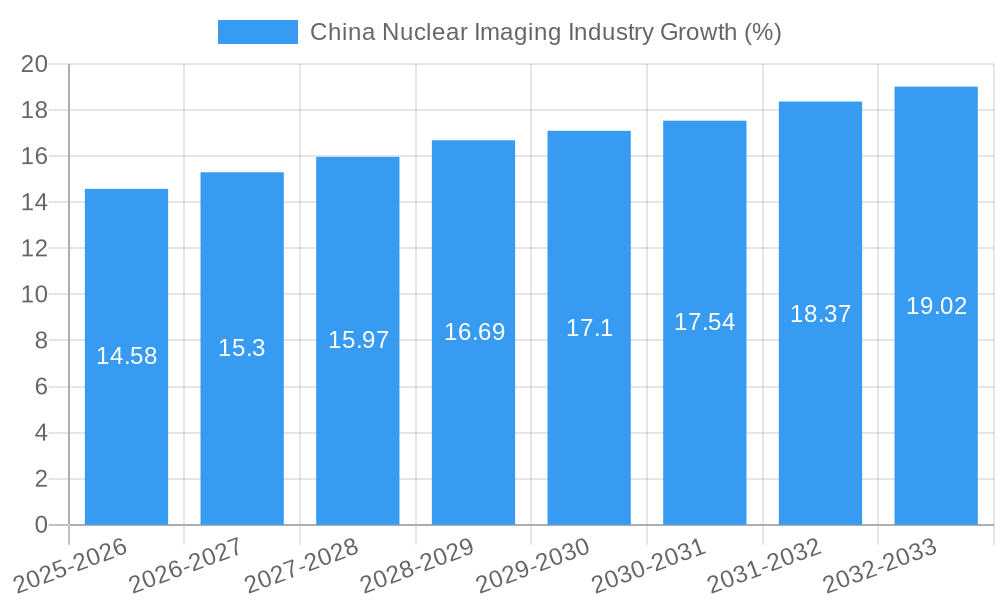

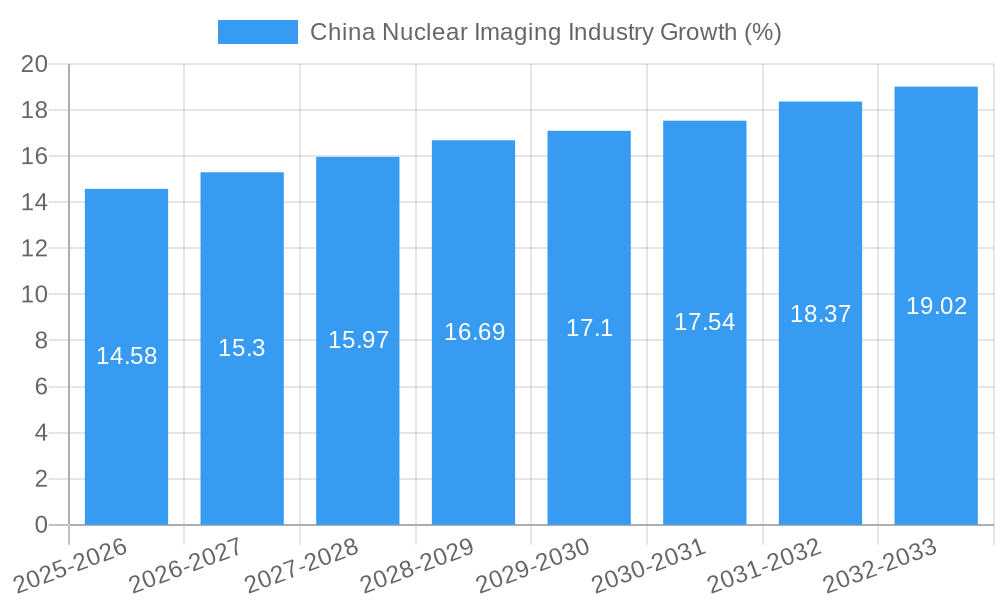

The China nuclear imaging market, valued at $348.26 million in 2025, is projected to experience robust growth, driven by increasing prevalence of chronic diseases like cancer and cardiovascular ailments necessitating advanced diagnostic tools. The market's Compound Annual Growth Rate (CAGR) of 4.11% from 2019 to 2024 indicates a steady expansion, expected to continue through 2033. Key drivers include rising healthcare expenditure, government initiatives promoting advanced medical technologies, and a growing geriatric population susceptible to age-related diseases. Technological advancements in PET and SPECT imaging systems, including improved resolution and faster scan times, are further propelling market expansion. The segment encompassing PET radioisotopes, particularly Fluorine-18 (F-18), is anticipated to witness significant growth due to its wide application in oncology. While data on specific market restraints is limited, potential challenges could include regulatory hurdles, high equipment costs, and the need for skilled professionals to operate and interpret the complex imaging data. The competitive landscape includes both international giants like Siemens and GE Healthcare, and domestic players like Yantai Dongcheng Pharmaceutical Group, highlighting the industry's dynamism.

The market segmentation reveals a significant contribution from SPECT and PET applications, with the former dominating due to wider availability and established clinical practices. However, the PET segment, propelled by the increasing use of F-18 for oncology, is poised for faster growth. Regional focus on China provides a concentrated view of a rapidly developing market with considerable growth potential. The continued rise in disposable incomes, improving healthcare infrastructure, and increasing awareness about early disease detection are expected to sustain the market's upward trajectory in the forecast period (2025-2033). Further research focusing on specific regional trends and the impact of emerging technologies within the Chinese healthcare system would yield a more comprehensive understanding of this dynamic sector.

China Nuclear Imaging Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China nuclear imaging industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The market is segmented by product (equipment, radioisotopes) and application (SPECT, PET), offering granular analysis of market size, growth projections, and competitive dynamics. Expected market value in Millions are provided throughout the report.

China Nuclear Imaging Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive activity within the Chinese nuclear imaging market. We examine the market share of key players, including Siemens Healthcare GmbH, Yantai Dongcheng Pharmaceutical Group Co Ltd, Canon Inc, Bayer AG, Bracco Imaging SpA, Cardinal Health Inc, Global Medical Solutions Ltd, China Isotope & Radiation Corporation (CIRC), Koninklijke Philips NV, Curium Pharma, and General Electric Company (GE HealthCare), and assess the impact of mergers and acquisitions (M&A) on market dynamics. The report also explores the role of technological advancements, regulatory frameworks, and the emergence of substitute products in shaping the competitive landscape.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players and several smaller niche players. The combined market share of the top 5 players is estimated at xx Million.

- Innovation Drivers: Government initiatives promoting healthcare infrastructure development, rising prevalence of chronic diseases, increasing demand for advanced diagnostic tools are key innovation drivers.

- Regulatory Framework: The regulatory landscape, including licensing and approval processes for medical devices and radiopharmaceuticals, significantly influences market growth.

- Product Substitutes: The emergence of advanced imaging technologies might pose challenges to the existing nuclear imaging market but is also driving innovation for better products.

- M&A Activity: The past five years have witnessed several notable M&A deals, with total deal values exceeding xx Million. These transactions have reshaped the competitive landscape and spurred innovation.

- End-User Demographics: The aging population and increasing healthcare expenditure in China are key factors fueling market growth.

China Nuclear Imaging Industry Market Dynamics & Trends

This section delves into the key drivers and trends shaping the Chinese nuclear imaging market. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics. The report will include specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates for different segments. We will also analyze the impact of factors such as increasing healthcare awareness, government investments in healthcare infrastructure, and the adoption of advanced technologies. The forecast period shows a CAGR of xx% for the overall market. Market penetration of PET scans is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions & Segments in China Nuclear Imaging Industry

This section identifies the leading regions and segments within the Chinese nuclear imaging market. Analysis will focus on market size, growth rate, and key drivers. Detailed information about the dominance of specific regions and application areas like SPECT applications, PET applications, and the various radioisotopes (Technetium-99m (TC-99m), Thallium-201 (TI-201), Gallium (Ga-67), Iodine (I-123), Fluorine-18 (F-18), Rubidium-82 (RB-82), etc.) will be provided.

- Key Drivers (by Region):

- Eastern China: Strong healthcare infrastructure, higher healthcare spending, and higher concentration of hospitals.

- Southern China: Growing economic prosperity and rising healthcare awareness.

- Key Drivers (by Segment):

- Equipment: Increasing demand for advanced imaging systems and technological advancements.

- Radioisotopes: Growth driven by the increasing adoption of PET and SPECT imaging. Technetium-99m (TC-99m) remains the dominant radioisotope.

- SPECT Applications: Driven by the widespread use of SPECT in cardiology and oncology.

- PET Applications: Rapid growth due to increased adoption in oncology and neurology.

Dominance Analysis: Eastern China is projected to maintain its dominance in the market, followed by Southern China, driven by factors such as higher healthcare spending, robust infrastructure and a higher concentration of specialized medical centers. The PET application segment is anticipated to show the highest growth rate over the forecast period.

China Nuclear Imaging Industry Product Innovations

This section highlights recent product developments, applications, and competitive advantages in the Chinese nuclear imaging market. We analyze the latest technological trends, the introduction of new products, and their market fit, focusing on improvements in image quality, speed, and safety. Several companies are investing heavily in the development of new radiopharmaceuticals and imaging systems.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the China nuclear imaging industry. The market is segmented by product (equipment, radioisotopes) and application (SPECT, PET). Further segmentation within radioisotopes includes SPECT radioisotopes (Technetium-99m (TC-99m), Thallium-201 (TI-201), Gallium (Ga-67), Iodine (I-123), and others) and PET radioisotopes (Fluorine-18 (F-18), Rubidium-82 (RB-82), and others). The report provides detailed growth projections, market sizes, and competitive dynamics for each segment, offering a granular understanding of market opportunities.

- Equipment: This segment shows steady growth driven by technological advancements and investments in modernizing healthcare infrastructure.

- Radioisotopes: This segment is projected to exhibit strong growth due to increasing applications in various diagnostic procedures.

- SPECT Applications: The cardiac application segment is expected to continue dominating.

- PET Applications: The oncology application segment is the main driver for PET growth.

Key Drivers of China Nuclear Imaging Industry Growth

The growth of the China nuclear imaging industry is fueled by several factors, including increasing prevalence of chronic diseases requiring advanced diagnostics, government initiatives supporting healthcare infrastructure development, and the rising affordability of nuclear imaging procedures due to technological advancements and improved cost-effectiveness of healthcare services. Stringent government regulations ensure safety and quality, while technological advancements constantly improve image quality and diagnostic accuracy.

Challenges in the China Nuclear Imaging Industry Sector

The China nuclear imaging industry faces several challenges, including stringent regulatory hurdles for product approvals, potential supply chain disruptions related to radioisotopes, and intense competition among both domestic and international players. These factors can lead to increased costs and potential delays in product launches and market expansion. The impact of these challenges is estimated to reduce the market growth by approximately xx Million by 2033.

Emerging Opportunities in China Nuclear Imaging Industry

Emerging opportunities include expanding into underserved regions, developing innovative imaging techniques for early disease detection, and incorporating AI and machine learning for improved image analysis and diagnostics. Furthermore, there are opportunities in developing new radiopharmaceuticals targeted at specific diseases and personalized medicine. These advancements may increase the market value by xx Million by 2033.

Leading Players in the China Nuclear Imaging Industry Market

- Siemens Healthcare GmbH

- Yantai Dongcheng Pharmaceutical Group Co Ltd

- Canon Inc

- Bayer AG

- Bracco Imaging SpA

- Cardinal Health Inc

- Global Medical Solutions Ltd

- China Isotope & Radiation Corporation (CIRC)

- Koninklijke Philips NV

- Curium Pharma

- General Electric Company (GE HealthCare)

Key Developments in China Nuclear Imaging Industry

- August 2022: IBA and Chengdu New Radiomedicine Technology Co. Ltd (CNRT) signed a collaboration agreement to install a Cyclone IKON cyclotron in Chengdu, expanding PET and SPECT isotope production capabilities.

- January 2022: ImaginAb and DongCheng Pharmaceutical Group partnered to introduce ImaginAb's CD8 ImmunoPET agent to the Chinese market.

Future Outlook for China Nuclear Imaging Industry Market

The future outlook for the China nuclear imaging industry is positive, driven by sustained growth in healthcare spending, technological advancements, and the increasing prevalence of chronic diseases. The market is poised for significant expansion, with opportunities for both established players and new entrants. The development of advanced imaging technologies, combined with the government's continued support for healthcare infrastructure, is set to drive the industry's growth trajectory over the forecast period.

China Nuclear Imaging Industry Segmentation

-

1. Product

- 1.1. Equipment

-

1.2. Radioisotope

-

1.2.1. SPECT Radioisotopes

- 1.2.1.1. Technetium-99m (TC-99m)

- 1.2.1.2. Thallium-201 (TI-201)

- 1.2.1.3. Gallium (Ga-67)

- 1.2.1.4. Iodine (I-123)

- 1.2.1.5. Other SPECT Radioisotopes

-

1.2.2. PET Radioisotopes

- 1.2.2.1. Fluorine-18 (F-18)

- 1.2.2.2. Rubidium-82 (RB-82)

- 1.2.2.3. Other PET Radioisotopes

-

1.2.1. SPECT Radioisotopes

-

2. Application

-

2.1. SPECT Applications

- 2.1.1. Neurology

- 2.1.2. Cardiology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Applications

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Applications

China Nuclear Imaging Industry Segmentation By Geography

- 1. China

China Nuclear Imaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases; Increasing Technological Advancements with Growth in Applications of Nuclear Imaging

- 3.3. Market Restrains

- 3.3.1. High Cost of the Techniques; Short Half-life of Radiopharmaceuticals

- 3.4. Market Trends

- 3.4.1. Neurology Under SPECT Application Segment is Expected to Grow with a Significant CAGR Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Nuclear Imaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.2. Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.1.1. Technetium-99m (TC-99m)

- 5.1.2.1.2. Thallium-201 (TI-201)

- 5.1.2.1.3. Gallium (Ga-67)

- 5.1.2.1.4. Iodine (I-123)

- 5.1.2.1.5. Other SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.1.2.2.1. Fluorine-18 (F-18)

- 5.1.2.2.2. Rubidium-82 (RB-82)

- 5.1.2.2.3. Other PET Radioisotopes

- 5.1.2.1. SPECT Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Applications

- 5.2.1.1. Neurology

- 5.2.1.2. Cardiology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Applications

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Siemens Healthcare GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yantai Dongcheng Pharmaceutical Group Co Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Canon Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bracco Imaging SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cardinal Health Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Medical Solutions Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Isotope & Radiation Corporation (CIRC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Curium Pharma

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 General Electric Company (GE HealthCare)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: China Nuclear Imaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Nuclear Imaging Industry Share (%) by Company 2024

List of Tables

- Table 1: China Nuclear Imaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Nuclear Imaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: China Nuclear Imaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: China Nuclear Imaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Nuclear Imaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Nuclear Imaging Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 7: China Nuclear Imaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: China Nuclear Imaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Nuclear Imaging Industry?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the China Nuclear Imaging Industry?

Key companies in the market include Siemens Healthcare GmbH, Yantai Dongcheng Pharmaceutical Group Co Ltd*List Not Exhaustive, Canon Inc, Bayer AG, Bracco Imaging SpA, Cardinal Health Inc, Global Medical Solutions Ltd, China Isotope & Radiation Corporation (CIRC), Koninklijke Philips NV, Curium Pharma, General Electric Company (GE HealthCare).

3. What are the main segments of the China Nuclear Imaging Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 348.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases; Increasing Technological Advancements with Growth in Applications of Nuclear Imaging.

6. What are the notable trends driving market growth?

Neurology Under SPECT Application Segment is Expected to Grow with a Significant CAGR Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of the Techniques; Short Half-life of Radiopharmaceuticals.

8. Can you provide examples of recent developments in the market?

August 2022: IBA (Ion Beam Applications S.A), a provider of radiopharmaceutical production solutions, signed a collaboration agreement with Chengdu New Radiomedicine Technology Co. Ltd (CNRT) to install a Cyclone IKON in Chengdu, Sichuan Province, China. The Cyclone IKON is IBA's new high-energy and high-capacity cyclotron which offers the largest energy spectrum for PET and SPECT isotopes from 13 MeV to 30 MeV. CNRT is a Chinese manufacturer and provider of medical isotopes used for oncology diagnosis and therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Nuclear Imaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Nuclear Imaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Nuclear Imaging Industry?

To stay informed about further developments, trends, and reports in the China Nuclear Imaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence