Key Insights

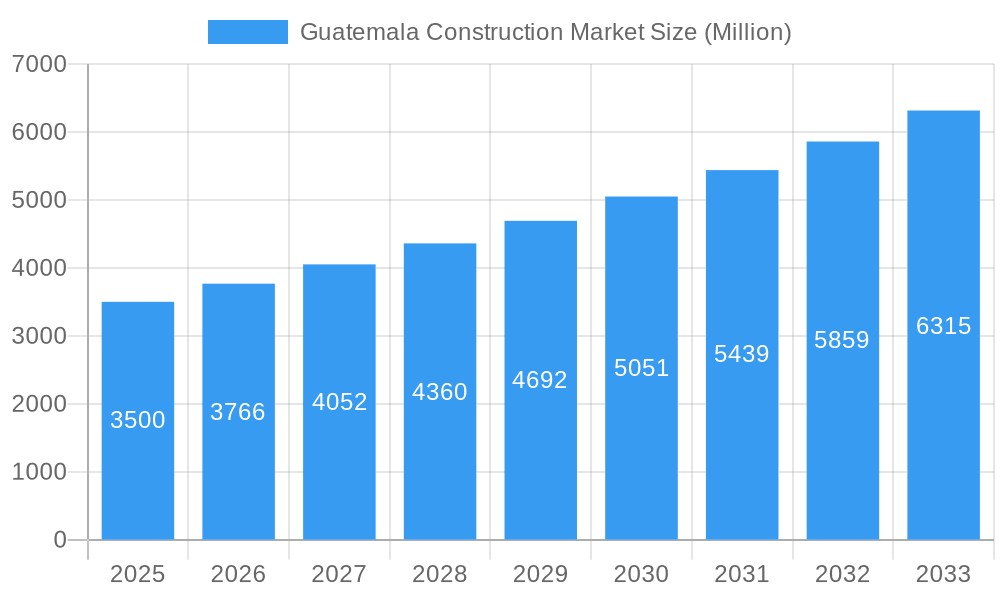

The Guatemala construction market, valued at $3.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.87% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing urbanization and population growth within Guatemala are fueling demand for residential, commercial, and infrastructure projects. Government initiatives focused on improving infrastructure, such as road networks, energy grids, and public transportation systems, are further stimulating market activity. The tourism sector’s continued growth is also contributing, with investments in hotels, resorts, and related infrastructure adding to the construction boom. Furthermore, a growing middle class with increased disposable income is driving demand for better housing and commercial spaces. However, challenges remain. Economic volatility and potential fluctuations in material costs could pose constraints on project development. Furthermore, bureaucratic hurdles and regulatory complexities may impact project timelines and overall market growth. The market is segmented by construction type, including residential, commercial, industrial, institutional, infrastructure, and energy & utility projects, with residential and infrastructure construction likely to be the largest segments.

Guatemala Construction Market Market Size (In Billion)

The competitive landscape comprises both domestic and international players. Local construction companies like Corporacion San Francisco S.A., Construcciones de Guatemala, and Constructora Aicsa S.A. hold significant market share, competing with international companies for larger projects. The market's future trajectory will hinge on sustained economic growth, effective government policies, and efficient management of potential risks associated with material costs and regulatory environments. Focusing on sustainable construction practices and incorporating technological advancements within the industry will also influence the market's long-term prospects. The projected growth rate suggests a considerable expansion, offering opportunities for both established players and new entrants to the Guatemalan construction market.

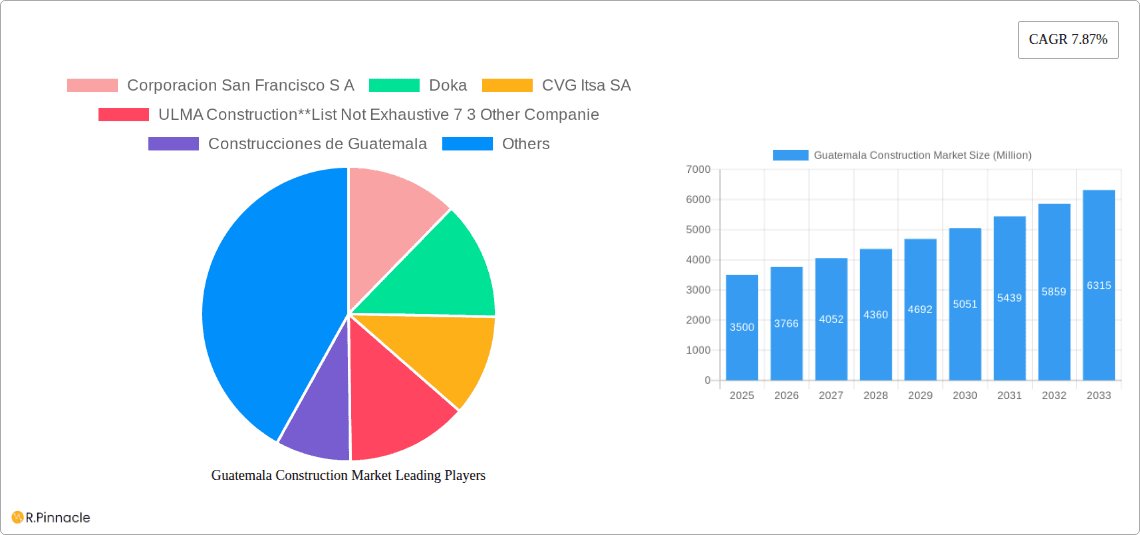

Guatemala Construction Market Company Market Share

Guatemala Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Guatemala construction market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a detailed understanding of market dynamics, growth drivers, and future trends. The report's findings are based on rigorous research and analysis, providing actionable intelligence for strategic decision-making. The market size is estimated at XX Million in 2025, with a projected CAGR of XX% during the forecast period.

Guatemala Construction Market Structure & Innovation Trends

This section analyzes the structure of the Guatemalan construction market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational companies and smaller local players. Key players include Corporacion San Francisco S A, Doka, CVG Itsa SA, and ULMA Construction, alongside 73 other companies such as Construcciones de Guatemala, Constructora Aicsa SA, Metro Proyectos SA, Nabla Group, Guatemala Constructions, Futuros Constructivos Sobre la Roca S A, and LGB Guatemala Sociedad Anonima.

Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share, while a large number of smaller companies compete in niche segments. Precise market share data is unavailable for public disclosure, but based on available data, Doka and ULMA likely hold significant shares in their respective segments.

Innovation Drivers: Government initiatives promoting sustainable construction practices and technological advancements drive innovation. Adoption of Building Information Modeling (BIM) and prefabrication techniques are gaining traction.

Regulatory Frameworks: The regulatory environment significantly influences the market's growth trajectory. Stringent building codes and environmental regulations necessitate compliance and investment in sustainable technologies.

M&A Activities: The acquisition of AT-PAC by Doka in February 2023 illustrates the ongoing consolidation within the industry. While precise M&A deal values for the Guatemalan market are not publicly available, such activities are expected to continue, driven by the pursuit of economies of scale and diversification.

Guatemala Construction Market Dynamics & Trends

This section delves into the market dynamics, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The Guatemalan construction market's growth is influenced by several factors. Robust economic growth, an expanding population, and rising urbanization fuels demand for residential, commercial, and infrastructure projects. However, economic volatility and political stability remain key considerations.

Technological advancements, particularly in prefabrication and sustainable building materials, are transforming the market landscape. The rising preference for eco-friendly construction methods is also impacting market dynamics. Competition is intense, with both local and international players vying for market share. Pricing pressures and project delays are common challenges faced by companies.

Dominant Regions & Segments in Guatemala Construction Market

The Guatemalan construction market is geographically diverse, with various regions exhibiting different levels of activity. However, data on regional breakdown is unavailable for public reporting and therefore precise regional dominance cannot be determined.

Dominant Segment: The residential construction segment is likely the largest and fastest-growing sector, driven by the expanding population and increasing urbanization. This is further supported by the demand for affordable housing. The infrastructure sector also holds significant potential, with investments in transportation and utilities infrastructure creating substantial opportunities.

Key Drivers: Economic policies promoting infrastructure development and government investment in public projects are major drivers of market growth. Additionally, population growth and urbanization are major factors influencing demand across all segments.

Guatemala Construction Market Product Innovations

Technological advancements are driving product innovation. The adoption of BIM software is enhancing project management, while the use of sustainable building materials, such as recycled products, reduces environmental impact. Prefabricated construction methods are gaining popularity, improving efficiency and reducing construction timelines. These innovations provide competitive advantages through improved efficiency, cost savings, and enhanced sustainability.

Report Scope & Segmentation Analysis

This report segments the Guatemalan construction market by type: Residential Construction, Commercial Construction, Industrial Construction, Institutional Construction, Infrastructure Construction, and Energy & Utility Construction. Each segment exhibits different growth rates and competitive dynamics. Market sizes for each segment in 2025 are projected at XX Million (with projections for other years and future growth predictions for each segment being unavailable for public disclosure). Data on competitive dynamics in each segment is similarly unavailable.

Key Drivers of Guatemala Construction Market Growth

Several factors drive the growth of the Guatemalan construction market. Government initiatives supporting infrastructure development, a growing middle class fueling demand for housing, and increasing urbanization provide strong momentum. Technological advancements leading to increased efficiency and sustainability further contribute to market expansion.

Challenges in the Guatemala Construction Market Sector

The Guatemalan construction market faces several challenges. Regulatory complexities, supply chain disruptions, and infrastructure limitations create hurdles for businesses. Labor shortages and skills gaps further restrict the market's potential.

Emerging Opportunities in Guatemala Construction Market

Emerging opportunities exist in sustainable construction, particularly in the adoption of green building technologies. Growth in the tourism sector creates opportunities for hospitality projects. Investment in renewable energy infrastructure also presents promising prospects for the sector.

Leading Players in the Guatemala Construction Market Market

- Corporacion San Francisco S A

- Doka

- CVG Itsa SA

- ULMA Construction

- Construcciones de Guatemala

- Constructora Aicsa SA

- Metro Proyectos SA

- Nabla Group

- Guatemala Constructions

- Futuros Constructivos Sobre la Roca S A

- LGB Guatemala Sociedad Anonima

- 73 Other Companies

Key Developments in Guatemala Construction Market Industry

May 2023: The Vicuña Mackenna 20 project in Chile (while not directly in Guatemala, it serves as an example of large-scale projects that could influence Guatemalan construction trends) demonstrates the potential for large-scale, complex projects. The project's scale and features reflect advancements in design and construction techniques, which could be adopted in Guatemala.

February 2023: Doka's acquisition of AT-PAC signals a trend toward consolidation in the construction equipment and supplies market. This could impact the Guatemalan market through increased competition and potentially a wider range of services offered by key players.

Future Outlook for Guatemala Construction Market Market

The Guatemalan construction market is poised for continued growth, driven by long-term economic expansion and increasing urbanization. Strategic investments in infrastructure and sustainable construction practices will be key drivers of future market potential. The ongoing need for affordable housing and improvements to existing infrastructure creates significant opportunities for both local and international companies.

Guatemala Construction Market Segmentation

-

1. Type

- 1.1. Residential Construction

- 1.2. Commercial Construction

- 1.3. Industrial Construction

- 1.4. Institutional Construction

- 1.5. Infrastructure Construction

- 1.6. Energy & Utility Construction

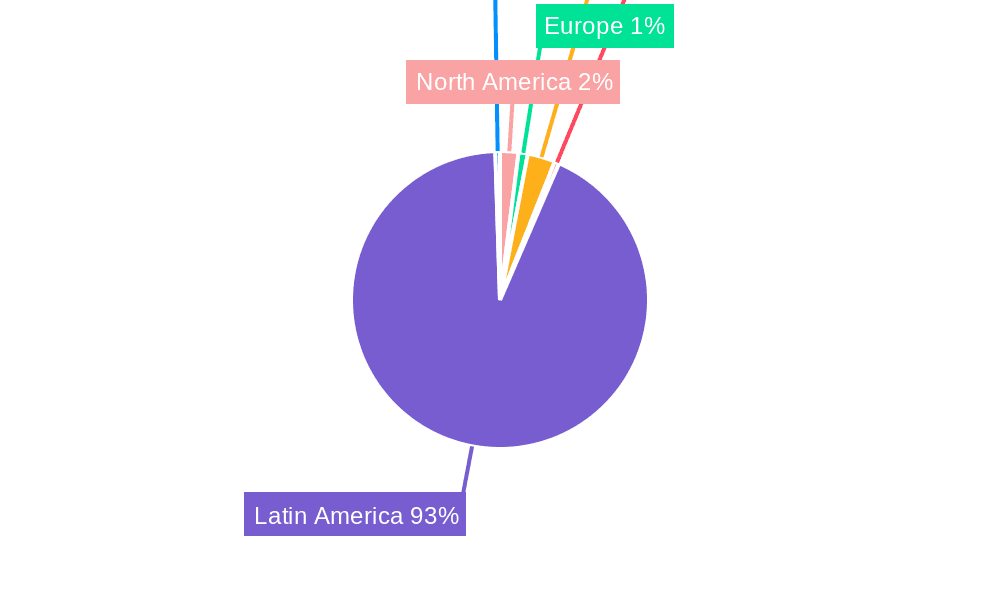

Guatemala Construction Market Segmentation By Geography

- 1. Guatemala

Guatemala Construction Market Regional Market Share

Geographic Coverage of Guatemala Construction Market

Guatemala Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increasing residential construction in the country is driving the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Guatemala Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential Construction

- 5.1.2. Commercial Construction

- 5.1.3. Industrial Construction

- 5.1.4. Institutional Construction

- 5.1.5. Infrastructure Construction

- 5.1.6. Energy & Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Guatemala

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Corporacion San Francisco S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Doka

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CVG Itsa SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ULMA Construction**List Not Exhaustive 7 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Construcciones de Guatemala

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constructora Aicsa SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Metro Proyectos SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nabla Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Guatemala Constructions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Futuros Constructivos Sobre la Roca S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lgb Guatemala Sociedad Anonima

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Corporacion San Francisco S A

List of Figures

- Figure 1: Guatemala Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Guatemala Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Guatemala Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Guatemala Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Guatemala Construction Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Guatemala Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Guatemala Construction Market?

The projected CAGR is approximately 7.87%.

2. Which companies are prominent players in the Guatemala Construction Market?

Key companies in the market include Corporacion San Francisco S A, Doka, CVG Itsa SA, ULMA Construction**List Not Exhaustive 7 3 Other Companie, Construcciones de Guatemala, Constructora Aicsa SA, Metro Proyectos SA, Nabla Group, Guatemala Constructions, Futuros Constructivos Sobre la Roca S A, Lgb Guatemala Sociedad Anonima.

3. What are the main segments of the Guatemala Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Increasing residential construction in the country is driving the market growth.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

May 2023: The Vicuña Mackenna 20 project represented a significant undertaking led by the University of Chile. Situated adjacent to Plaza Italia, this large-scale initiative is set to host the Faculty of Government, the Institute of International Studies, and the Centre for Artistic and Cultural Extension in the future. The Vicuña Mackenna 20 building, spanning over 32,000 m², boasts eight floors and five underground levels. Additionally, it features more than 1,500 meters of interior courtyards, concert halls, a dance hall, and rehearsal rooms dedicated to the Chilean Symphony Orchestra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Guatemala Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Guatemala Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Guatemala Construction Market?

To stay informed about further developments, trends, and reports in the Guatemala Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence