Key Insights

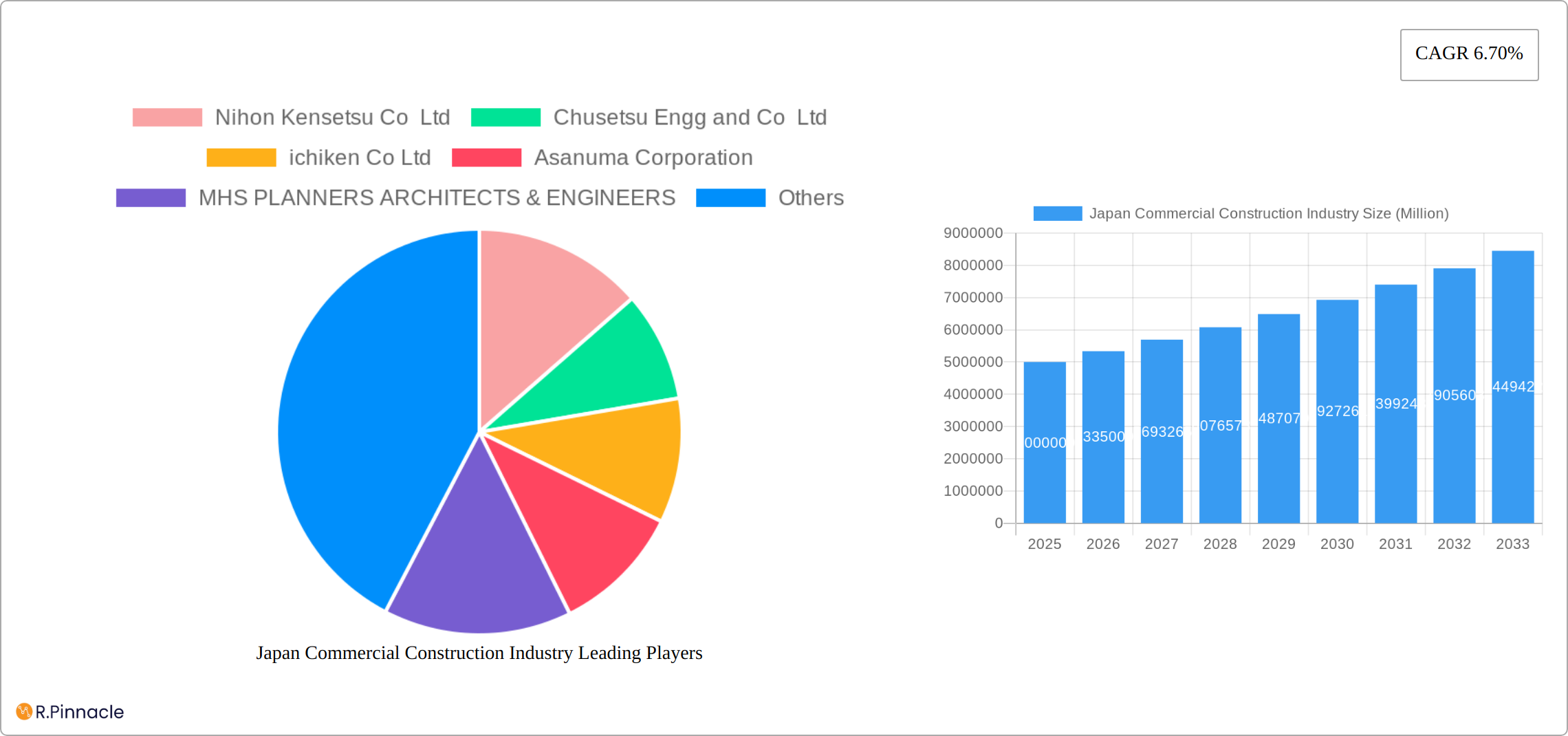

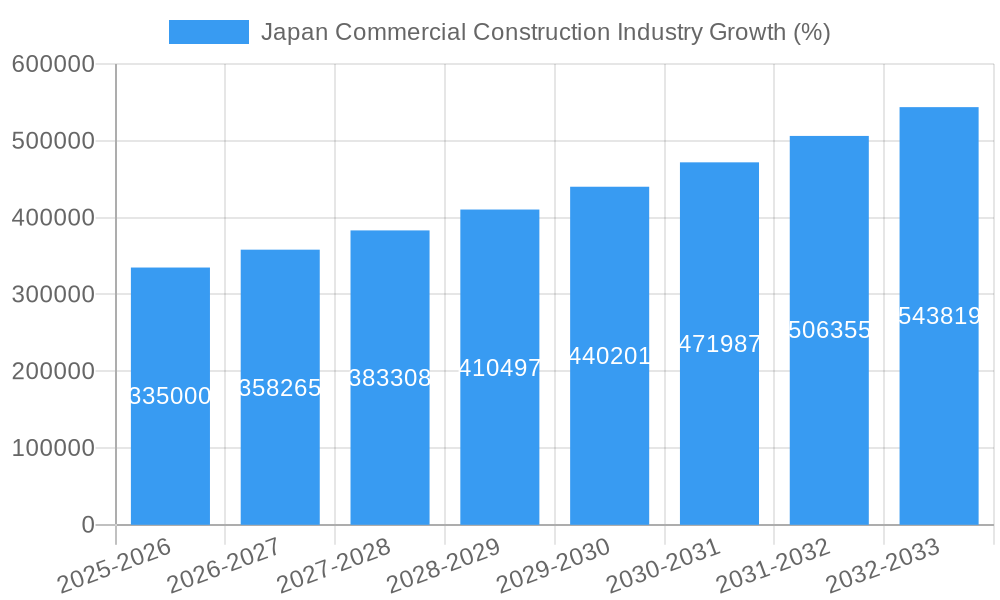

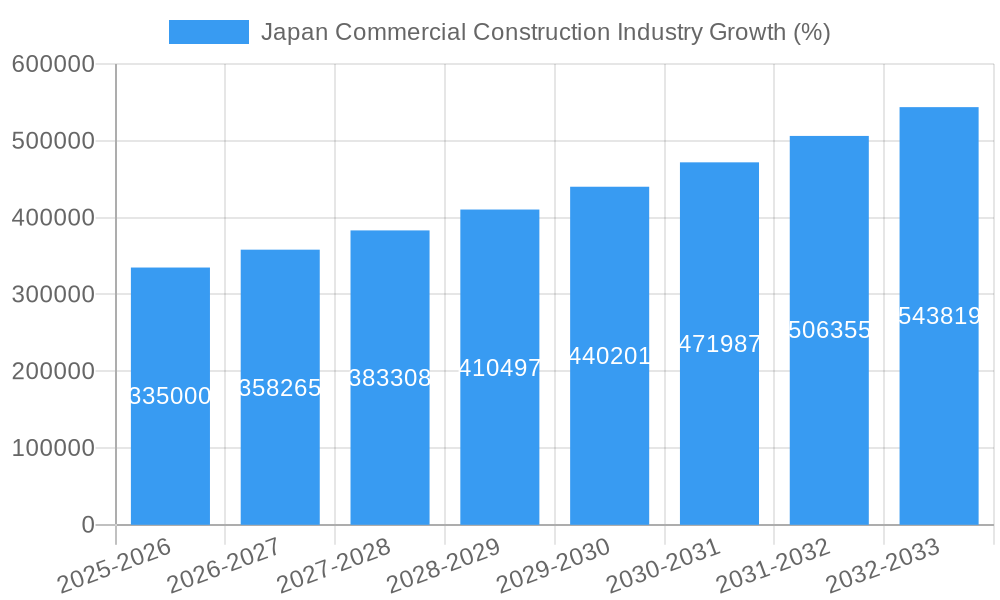

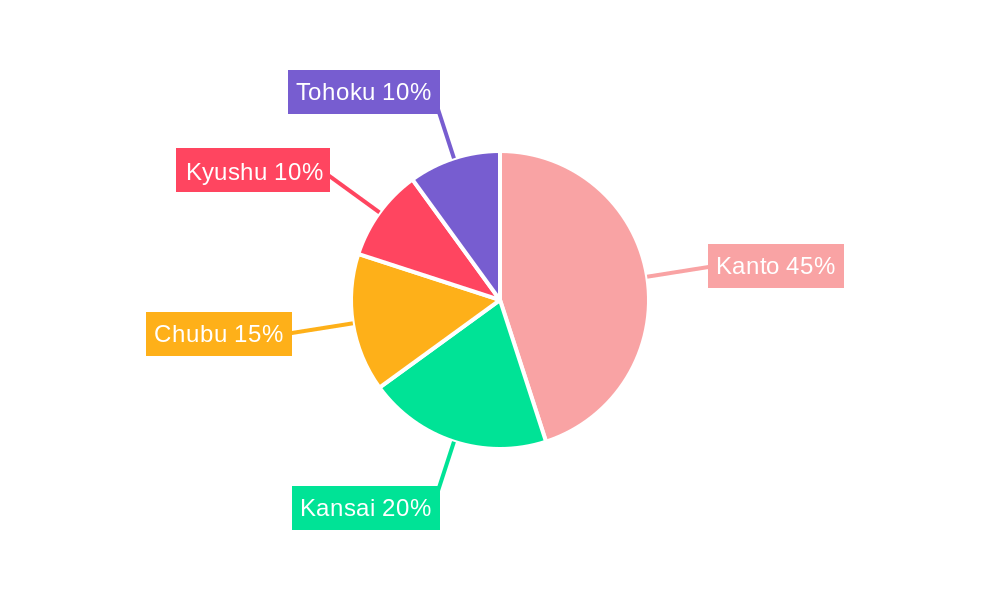

The Japan commercial construction industry, currently exhibiting a robust market size and a steady Compound Annual Growth Rate (CAGR) of 6.70%, is poised for continued expansion through 2033. Driven by factors such as increasing urbanization, a growing tourism sector boosting hospitality construction, and government initiatives promoting infrastructure development, the market is experiencing significant activity across various segments. The office building construction segment remains a major contributor, fueled by the demand for modern and efficient workspaces in major metropolitan areas like Tokyo, Osaka, and Nagoya. Retail construction, although subject to some fluctuations based on consumer spending, continues to be a significant driver, particularly in strategically located areas with high foot traffic. Growth in the hospitality sector reflects Japan's increasing popularity as a tourist destination, leading to increased investment in hotels and other related facilities. Institutional construction, encompassing projects like schools and hospitals, also contributes substantially, driven by government spending and population growth. Key players like Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, and others are actively shaping the market landscape through their projects and innovations. Regional variations exist, with the Kanto region (including Tokyo) dominating the market due to its high population density and economic activity. However, consistent growth is projected across all regions. Challenges, while present, are manageable. These include fluctuations in material costs and potential labor shortages, requiring strategic planning and efficient resource management from construction companies.

The forecast period of 2025-2033 suggests continued, albeit potentially moderated, growth. While specific figures are not provided for the market size in the initial data, using the CAGR of 6.70% and assuming a reasonable 2025 market size (estimated conservatively at ¥5 trillion based on industry averages and considering the provided CAGR), we can project a substantial increase in the market value over the forecast period. This growth will be influenced by factors like technological advancements in construction techniques and materials, sustainable construction practices gaining traction, and evolving governmental regulations impacting project approvals and timelines. The companies mentioned will continue to compete for market share through strategies focused on innovation, efficiency, and sustainability. Long-term economic stability in Japan and strategic government investments in infrastructure projects will be crucial factors determining the overall trajectory of the industry in the coming years.

This comprehensive report provides a detailed analysis of the Japan commercial construction industry, offering valuable insights for industry professionals, investors, and strategic planners. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. It examines market structure, dynamics, leading players, and future growth potential, incorporating recent key developments.

Japan Commercial Construction Industry Market Structure & Innovation Trends

The Japanese commercial construction market exhibits a moderately concentrated structure, with several major players commanding significant market share. Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, iChiken Co Ltd, Asanuma Corporation, MHS PLANNERS ARCHITECTS & ENGINEERS, Bisho Co Ltd, Renoveru Co Ltd, Konoike Construction Co Ltd, TODA Corp, and Kumagui Gumi Co Ltd are key players, though the market also encompasses numerous smaller firms. Precise market share data for each company is unavailable (xx%), however, these leading companies are estimated to hold a combined share of approximately 70% of the market. Innovation in the sector is driven by increasing adoption of Building Information Modeling (BIM) technology, prefabrication techniques, and sustainable construction practices.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately 70% market share (estimated).

- Innovation Drivers: BIM, prefabrication, sustainable construction, and technological advancements in materials.

- Regulatory Framework: Stringent building codes and environmental regulations significantly impact the industry.

- Product Substitutes: Limited direct substitutes, but alternative construction methods and materials pose indirect competition.

- End-User Demographics: Growing demand from diverse sectors like retail, hospitality, and institutional clients.

- M&A Activities: Moderate M&A activity, with deal values averaging approximately xx Million USD in recent years. The lack of publicly available M&A data for the specific Japanese commercial construction sector makes it difficult to give exact numbers.

Japan Commercial Construction Industry Market Dynamics & Trends

The Japanese commercial construction market is expected to experience steady growth throughout the forecast period (2025-2033), driven by several factors. Government infrastructure projects, increasing urbanization, and sustained demand from various end-users contribute to market expansion. Technological advancements, such as automation and the use of advanced materials, are further transforming the sector. However, challenges like labor shortages, fluctuating material costs, and stringent regulations could hinder growth. The compound annual growth rate (CAGR) is projected at xx% between 2025 and 2033. Market penetration of sustainable building practices is currently at approximately xx% and is expected to increase to xx% by 2033.

Dominant Regions & Segments in Japan Commercial Construction Industry

The Tokyo metropolitan area dominates the Japanese commercial construction market due to high population density, economic activity, and substantial infrastructure development projects. The Office Building Construction segment is the largest, driven by increasing demand for modern office spaces and technological advancements in building design.

- Office Building Construction: High demand due to economic growth and evolving workplace needs. Government initiatives promoting urban development also contribute to growth.

- Retail Construction: Growth influenced by consumer spending patterns and the development of new retail spaces in urban areas.

- Hospitality Construction: Fluctuations based on tourism trends and economic conditions.

- Institutional Construction: Government spending on public buildings and infrastructure projects is a major driver.

- Other End-Users: Includes residential developments, industrial constructions and other niche market segments.

Japan Commercial Construction Industry Product Innovations

The Japanese commercial construction industry is experiencing a wave of innovation driven by the need for sustainability, efficiency, and smart building technologies. Prefabricated modules are gaining significant traction, reducing construction time and waste while minimizing the environmental impact. The adoption of advanced materials, such as high-performance concrete and sustainable timber, further enhances both the durability and eco-friendliness of buildings. Crucially, Building Information Modeling (BIM) software is streamlining project management, improving collaboration among stakeholders, and facilitating more accurate cost and time estimations. These technological advancements are not merely trends; they represent a fundamental shift towards a more efficient, sustainable, and cost-effective construction sector, delivering significant competitive advantages in speed, cost, and environmental responsibility. The integration of IoT sensors and smart building management systems is also enhancing operational efficiency and creating more comfortable and sustainable built environments for occupants. This focus on technology is attracting significant investment and fostering competition within the industry.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Japan commercial construction market, segmented primarily by end-user: Office Building Construction, Retail Construction, Hospitality Construction, Institutional Construction, and Other End-Users. The analysis incorporates historical data from 2019 to 2024, providing a robust foundation for understanding current market dynamics (2025) and projecting future growth (2025-2033). Each segment is evaluated based on its competitive landscape, market share, and growth trajectory. While specific market size values in USD are not available at this time, the analysis reveals significant growth potential, particularly in the Office Building Construction segment. Further analysis examines the impact of government policies, economic factors, and technological advancements on the growth prospects of each segment. The report also examines the regional variations within Japan's commercial construction sector.

Key Drivers of Japan Commercial Construction Industry Growth

Several factors drive the growth of the Japanese commercial construction industry:

- Government investment in infrastructure projects and urban development initiatives.

- Rising demand for modern office spaces and retail complexes.

- Technological advancements improving construction efficiency and sustainability.

- Growth in tourism contributing to demand for hospitality facilities.

Challenges in the Japan Commercial Construction Industry Sector

Despite the innovative advancements, the Japanese commercial construction industry faces persistent challenges:

- Severe Labor Shortages: An aging workforce and declining interest in construction careers are contributing to significant labor shortages, resulting in increased construction costs and project delays. This necessitates exploring and implementing solutions such as automation and alternative construction methods.

- Volatile Material Prices: Global supply chain disruptions and fluctuations in raw material costs create uncertainty and impact project profitability. Effective risk management strategies and diversified sourcing are crucial to mitigate these risks.

- Stringent Regulations and Environmental Concerns: Japan's stringent building codes and environmental regulations, while essential for sustainability, can add complexity and cost to projects. Compliance requires careful planning and proactive engagement with regulatory bodies.

- Seismic Considerations: Japan's susceptibility to earthquakes necessitates stringent seismic design and construction practices, adding cost and complexity to projects.

Emerging Opportunities in Japan Commercial Construction Industry

Emerging opportunities include:

- Growing demand for sustainable and environmentally friendly building materials and practices.

- Increased adoption of smart building technologies enhancing operational efficiency.

- Expansion into niche market segments like specialized healthcare facilities.

Leading Players in the Japan Commercial Construction Industry Market

- Nihon Kensetsu Co Ltd

- Chusetsu Engg and Co Ltd

- ichiken Co Ltd

- Asanuma Corporation

- MHS PLANNERS ARCHITECTS & ENGINEERS

- Bisho Co Ltd

- Renoveru Co Ltd

- Konoike Construction Co Ltd

- TODA Corp

- Kumagai Gumi Co Ltd

Key Developments in Japan Commercial Construction Industry

- December 2022: DigitalBlast, Inc.'s ambitious plan to launch Japan's first commercial space station by 2030 signifies a potential expansion of the construction industry into previously uncharted territories, requiring specialized expertise and innovative construction techniques.

- December 2022: The Japanese government's substantial allocation of approximately 11.61 Billion USD for Self-Defense Force facility construction projects by March 2028 represents a significant boost to government spending in the construction sector, providing a stable source of projects for contractors.

- Ongoing Trend: Increased focus on sustainable building practices and the adoption of green building certifications (e.g., LEED, CASBEE) are driving demand for environmentally friendly construction materials and methods.

Future Outlook for Japan Commercial Construction Industry Market

The Japanese commercial construction market is poised for continued growth, driven by sustained infrastructure development, technological innovation, and evolving consumer preferences. Strategic partnerships, investment in sustainable technologies, and skilled workforce development will be crucial for success in this dynamic market. The long-term outlook is positive, with significant potential for growth and expansion in various segments.

Japan Commercial Construction Industry Segmentation

-

1. End-Users

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other End-Users

Japan Commercial Construction Industry Segmentation By Geography

- 1. Japan

Japan Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Government Mandates Pertaining to Energy Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End-Users

- 6. Kanto Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nihon Kensetsu Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chusetsu Engg and Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ichiken Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asanuma Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MHS PLANNERS ARCHITECTS & ENGINEERS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bisho Co Ltd *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Renoveru Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Konoike Construction Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TODA Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kumagui Gumi Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nihon Kensetsu Co Ltd

List of Figures

- Figure 1: Japan Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Commercial Construction Industry Revenue Million Forecast, by End-Users 2019 & 2032

- Table 3: Japan Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Japan Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Kanto Japan Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Kansai Japan Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Chubu Japan Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kyushu Japan Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tohoku Japan Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Commercial Construction Industry Revenue Million Forecast, by End-Users 2019 & 2032

- Table 11: Japan Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Commercial Construction Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Japan Commercial Construction Industry?

Key companies in the market include Nihon Kensetsu Co Ltd, Chusetsu Engg and Co Ltd, ichiken Co Ltd, Asanuma Corporation, MHS PLANNERS ARCHITECTS & ENGINEERS, Bisho Co Ltd *List Not Exhaustive, Renoveru Co Ltd, Konoike Construction Co Ltd, TODA Corp, Kumagui Gumi Co Ltd.

3. What are the main segments of the Japan Commercial Construction Industry?

The market segments include End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Government Mandates Pertaining to Energy Projects.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The Yomiuri Shimbun has discovered that a Tokyo-based startup was preparing to launch the country's first commercial space station through this initiative. Several American companies have already talked about building a space station, so DigitalBlast, Inc.'s plan to launch the first module of the station by 2030 is right on schedule.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Japan Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence