Key Insights

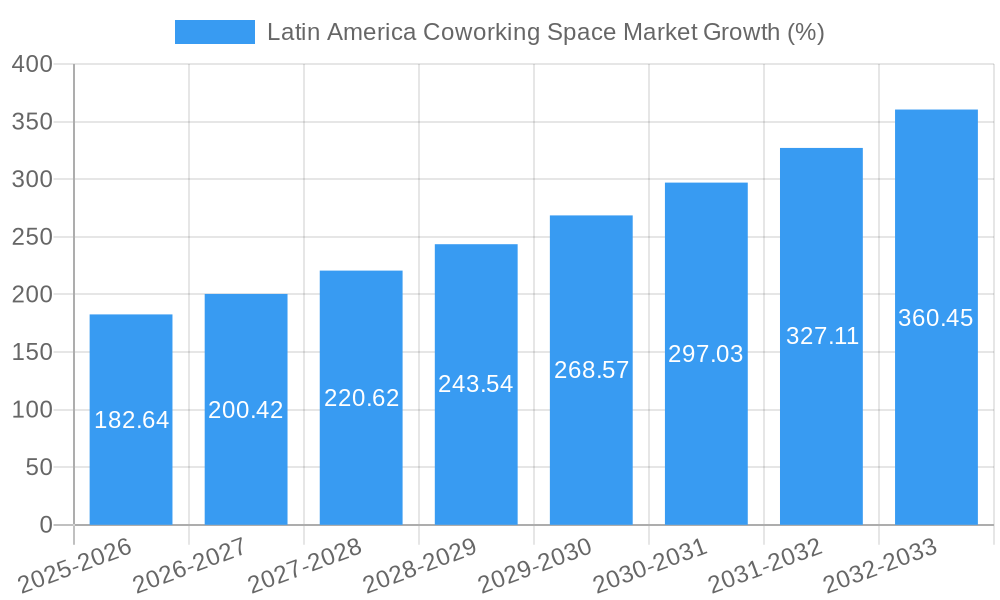

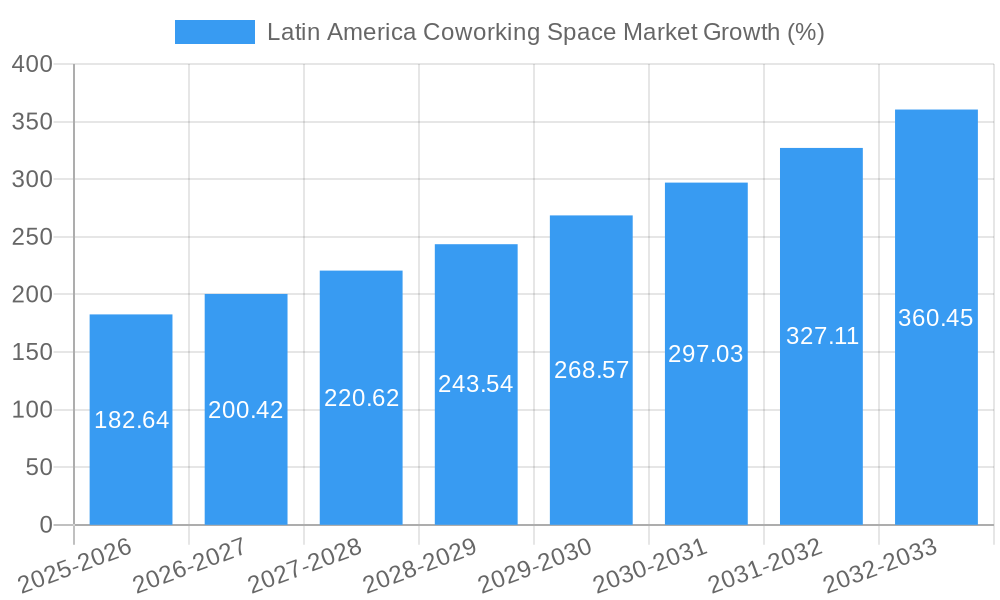

The Latin American coworking space market, valued at $1.66 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 10.64% from 2025 to 2033. This expansion is driven by several key factors. The increasing preference for flexible work arrangements among both freelancers and established businesses, particularly within the burgeoning IT and ITES sectors, fuels demand for coworking spaces. Furthermore, the growing number of small and medium-sized enterprises (SMEs) in Latin America, seeking cost-effective and scalable solutions, contributes significantly to market growth. The appeal of networking opportunities, access to amenities, and professional environments offered by coworking spaces further solidifies their position as a preferred workspace solution. While the market faces potential restraints, such as economic fluctuations and competition from traditional office spaces, the overall positive outlook is reinforced by the rising adoption of hybrid work models and the continued expansion of the digital economy across the region.

Specific growth within the Latin American market is further segmented by type (flexible managed offices, serviced offices), business model (IT & ITES, legal, BFSI, consulting), and end-user (personal, small-scale, large-scale companies). Brazil, Argentina, and Mexico are anticipated to be the leading contributors to overall market growth, given their relatively advanced economies and thriving entrepreneurial ecosystems. However, other countries in the region, such as Peru and Chile, are also projected to show substantial growth, driven by increasing foreign investment and a young, tech-savvy workforce. The competitive landscape is dynamic, featuring established global players like IWG/Regus and WeWork, alongside numerous local and regional providers. The market's success hinges on the continued evolution of flexible workspace offerings, adapted to the specific needs and preferences of the Latin American business environment.

Latin America Coworking Space Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America coworking space market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The report leverages robust data analysis to present a clear picture of market size, segmentation, growth drivers, and challenges, ultimately offering actionable recommendations for navigating this dynamic sector.

Latin America Coworking Space Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Latin America coworking space market. We examine market concentration, identifying key players like IWG/Regus, WeWork, Selina, and others, and assess their market share. The report also explores the impact of M&A activities, quantifying deal values (xx Million) and their influence on market structure. Innovation drivers, such as technological advancements in workspace management and the increasing demand for flexible work arrangements, are examined. The analysis also considers regulatory frameworks and their effect on market growth and the presence of product substitutes impacting market dynamics. End-user demographics, including personal users, small and large-scale companies, are analyzed to provide a comprehensive picture.

- Market Concentration: The market is moderately concentrated, with a few major players holding significant shares, but with room for smaller, specialized providers to flourish.

- M&A Activity: The report details completed and projected M&A deals (xx Million in total value during 2019-2024, projected xx Million in 2025-2033).

- Innovation Drivers: Technological advancements in booking systems, space management, and community-building platforms are significant drivers.

- Regulatory Frameworks: Variations in regulations across Latin American countries are analyzed for their impact on market growth.

- End-User Demographics: The report analyzes the shift in demand from different user segments, highlighting the growth of small to medium sized enterprises (SMEs).

Latin America Coworking Space Market Dynamics & Trends

This section delves into the market's growth trajectory, identifying key drivers and disruptive forces. We analyze the Compound Annual Growth Rate (CAGR) (xx%) for the forecast period (2025-2033) and market penetration rate. The impact of technological disruptions, such as the rise of remote work tools and virtual office solutions, is assessed. We analyze evolving consumer preferences, including the demand for flexible contracts, amenity-rich spaces, and sustainable practices, and explore how competitive dynamics, such as pricing strategies and service offerings, shape market evolution. The influence of economic factors, such as GDP growth and investment trends, on market expansion is also incorporated.

Dominant Regions & Segments in Latin America Coworking Space Market

This section pinpoints the leading regions, countries, and segments within the Latin American coworking space market. The analysis focuses on segmentations by type (Flexible Managed Office, Serviced Office), business model (IT & ITES, Legal Services, BFSI, Consulting, etc.), and end-user (Personal, Small Scale Company, Large Scale Company, Other). Key drivers of dominance are identified using bullet points, offering granular insights into market dynamics. For instance, Mexico and Brazil are analyzed for their dominant position in the overall market, with factors such as robust economic growth, favorable regulatory environments, and well-developed infrastructure highlighted.

- Dominant Region: Mexico and Brazil are projected as the dominant markets due to factors including strong economic growth and a large number of businesses adopting flexible work arrangements.

- Dominant Type: Flexible Managed Offices are projected to dominate, due to their versatility and cost-effectiveness for businesses of all sizes.

- Dominant Business Model: The IT and ITES sector is expected to show significant growth, driven by the increasing demand for tech talent and the adoption of flexible work models by tech companies.

- Dominant End-User: Small to Medium-sized Enterprises (SMEs) constitute a dominant end-user segment, attracted by the affordability and scalability offered by coworking spaces.

Latin America Coworking Space Market Product Innovations

This section provides a concise overview of recent product developments and technological advancements within the Latin American coworking space market. It emphasizes how these innovations address market needs and provide competitive advantages. Examples include the integration of smart building technologies, advancements in workspace design promoting collaboration and wellbeing, and the adoption of booking and management systems.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Latin American coworking space market, categorized by key factors to offer a granular understanding of its current state and future trajectory. The market is segmented by type (Flexible Managed Office, Serviced Office), business model (Information Technology (IT and ITES), Legal Services, BFSI, Consulting, and other services), and end-user (Personal User, Small Scale Company, Large Scale Company, and Other End-users). For each segment, the report delivers a detailed breakdown of market size (in Millions of USD), presents robust growth projections with supporting data and methodologies, and analyzes the competitive landscape, highlighting key players and their market strategies. Specific growth rates and market size predictions are provided for each segment, along with an in-depth assessment of the competitive dynamics, including factors such as market share, pricing strategies, and innovative offerings.

Key Drivers of Latin America Coworking Space Market Growth

Several key factors are driving the growth of the Latin American coworking space market. These include the increasing adoption of flexible work models by businesses of all sizes, the growth of the technology sector, and supportive government policies promoting entrepreneurship and innovation. Improved infrastructure in major cities also plays a key role, along with a younger, more mobile workforce embracing flexible work arrangements.

Challenges in the Latin America Coworking Space Market Sector

The Latin American coworking space market faces several significant challenges. Economic volatility across different regions presents a considerable risk, impacting demand and investment. Intense competition from traditional office spaces and established players necessitates innovative strategies for differentiation and market penetration. Furthermore, infrastructural limitations, particularly in certain areas, can hinder expansion and operational efficiency. Regulatory inconsistencies and hurdles across the diverse Latin American landscape pose another significant challenge, impacting market standardization and ease of operation. Addressing these regulatory complexities and advocating for consistent standards are crucial for sustainable growth.

Emerging Opportunities in Latin America Coworking Space Market

Despite the challenges, the Latin American coworking space market presents substantial untapped potential and promising emerging opportunities. Expansion into secondary and tertiary cities, currently underserved by coworking spaces, offers significant growth prospects. The integration of cutting-edge technologies, such as AI-powered solutions for space management, member services, and community building, can significantly enhance the member experience and attract a wider range of users. Focusing on specialized niche markets catering to specific industries, such as creative industries, healthcare, or technology startups, allows for targeted marketing and the development of tailored services to meet the unique needs of these communities. These strategic moves are crucial for driving future growth and establishing a strong competitive edge in this dynamic market.

Leading Players in the Latin America Coworking Space Market Market

- IWG/Regus

- Alley

- Impact Hub

- Techspace

- WeWork

- Green Desk

- Serendipity Labs

- Industrious Office

- Knotel

- Selina

Key Developments in Latin America Coworking Space Market Industry

- 2022 Q4: WeWork expands its presence in Mexico City with a new flagship location.

- 2023 Q1: IWG/Regus announces a strategic partnership with a local real estate developer in Brazil.

- 2023 Q3: Selina launches a new brand focusing on sustainable coworking spaces in South America.

- (Further developments to be added with specific dates and details).

Future Outlook for Latin America Coworking Space Market Market

The future of the Latin American coworking space market is bright. Continued economic growth, increasing urbanization, and the ongoing adoption of flexible work arrangements will drive market expansion. Strategic partnerships, technological innovation, and a focus on delivering exceptional member experiences will be crucial for success. The market is projected to experience significant growth in the coming years, with opportunities for both established players and new entrants.

Latin America Coworking Space Market Segmentation

-

1. Type

- 1.1. Flexible Managed office

- 1.2. Serviced Office

-

2. Business Model

- 2.1. Information Technology (IT and ITES)

- 2.2. Legal Services

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting and other services

-

3. End-User

- 3.1. Personal User

- 3.2. Small Scale Company

- 3.3. Large Scale Company

- 3.4. Other End-users

Latin America Coworking Space Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Coworking Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The pandemic accelerated the adoption of flexible workspaces

- 3.2.2 including coworking spaces and serviced offices; Landlords and property owners have been offering more flexible lease terms to attract tenants

- 3.3. Market Restrains

- 3.3.1. Economic and political fluctuations in some Latin American countries can create uncertainty for businesses; Bureaucracy and Red Tape

- 3.4. Market Trends

- 3.4.1. Growth of Coworking Spaces Market in Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Managed office

- 5.1.2. Serviced Office

- 5.2. Market Analysis, Insights and Forecast - by Business Model

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Legal Services

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting and other services

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Personal User

- 5.3.2. Small Scale Company

- 5.3.3. Large Scale Company

- 5.3.4. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Coworking Space Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 IWG/Regus

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alley

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Impact Hub

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Techspace

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 WeWork

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Green Desk**List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Serendipity Labs

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Industrious Office

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Knotel

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Selina

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 IWG/Regus

List of Figures

- Figure 1: Latin America Coworking Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Coworking Space Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Coworking Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Coworking Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Coworking Space Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 4: Latin America Coworking Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Latin America Coworking Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Coworking Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Coworking Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Latin America Coworking Space Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 15: Latin America Coworking Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Latin America Coworking Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Coworking Space Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Coworking Space Market?

The projected CAGR is approximately > 10.64%.

2. Which companies are prominent players in the Latin America Coworking Space Market?

Key companies in the market include IWG/Regus, Alley, Impact Hub, Techspace, WeWork, Green Desk**List Not Exhaustive, Serendipity Labs, Industrious Office, Knotel, Selina.

3. What are the main segments of the Latin America Coworking Space Market?

The market segments include Type, Business Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The pandemic accelerated the adoption of flexible workspaces. including coworking spaces and serviced offices; Landlords and property owners have been offering more flexible lease terms to attract tenants.

6. What are the notable trends driving market growth?

Growth of Coworking Spaces Market in Mexico.

7. Are there any restraints impacting market growth?

Economic and political fluctuations in some Latin American countries can create uncertainty for businesses; Bureaucracy and Red Tape.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Coworking Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Coworking Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Coworking Space Market?

To stay informed about further developments, trends, and reports in the Latin America Coworking Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence