Key Insights

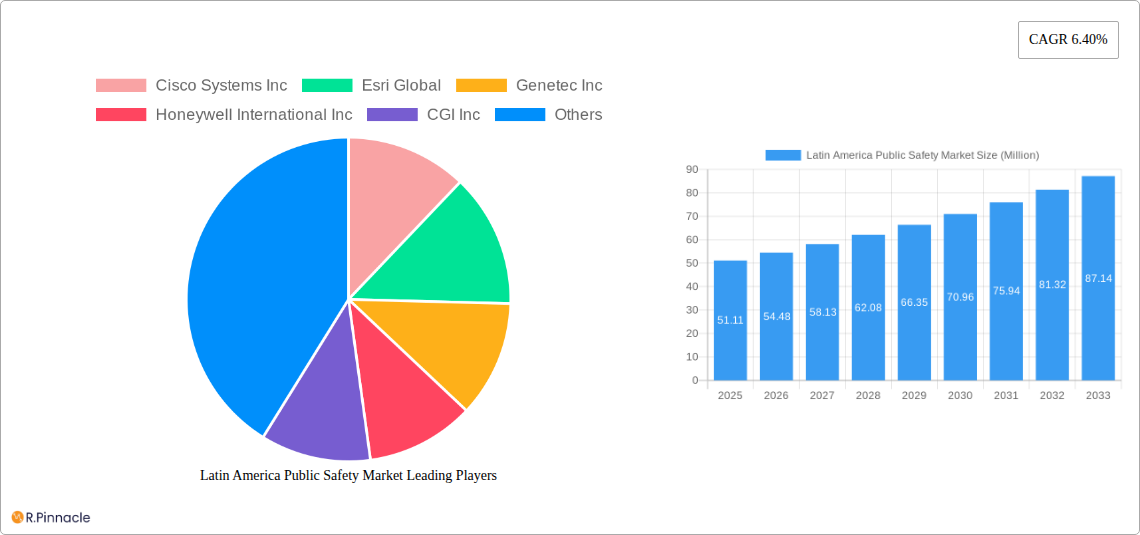

The Latin American Public Safety market, valued at $51.11 million in 2025, is projected to experience robust growth, driven by increasing crime rates, rising demand for advanced security technologies, and government initiatives to enhance public safety infrastructure. A compound annual growth rate (CAGR) of 6.40% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key drivers include the adoption of smart city technologies, increasing investments in surveillance systems (CCTV, facial recognition), and the growing need for integrated security solutions that combine physical security with cybersecurity measures. Furthermore, the rising adoption of cloud-based solutions for data management and analytics is contributing to market growth. While data limitations prevent precise segmentation details, we can infer that significant market segments likely include video surveillance, access control, command and control centers, and cybersecurity solutions, each with its own growth trajectory based on specific regional needs and priorities. Major players like Cisco, Esri, and Honeywell are well-positioned to capitalize on these trends. However, market growth may be constrained by factors such as budget limitations in some regions, a lack of digital infrastructure in certain areas, and the need for robust cybersecurity measures to protect sensitive data.

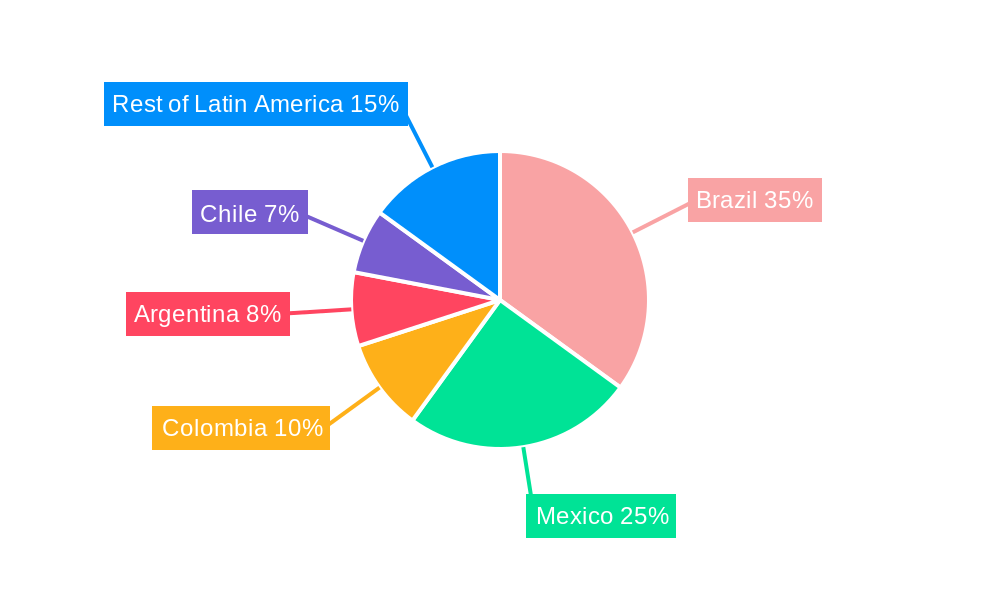

The market's growth is not uniform across all Latin American countries. Brazil, Mexico, and Colombia are likely to be the largest contributors due to their larger populations and higher investments in public safety. However, other countries are also experiencing growth, driven by both internal security needs and international collaboration focused on cross-border crime prevention and regional security initiatives. The increasing adoption of AI and machine learning in public safety applications, such as predictive policing and crime analysis, will further stimulate market expansion. The market's evolution also depends on the successful integration of various technologies into a comprehensive and interoperable public safety ecosystem. Ongoing political stability and economic development within the region will also play a crucial role in shaping the market's future trajectory.

This comprehensive report provides an in-depth analysis of the Latin America Public Safety Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report unveils the market's structure, dynamics, key players, and future outlook. Expect detailed analysis of market size (in Millions), CAGR, and segment-specific growth projections.

Latin America Public Safety Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin America Public Safety Market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. Cisco Systems Inc., Motorola Solutions Inc., and Honeywell International Inc. are among the leading players, collectively controlling an estimated xx% of the market in 2025. Smaller companies and specialized providers occupy the remaining market share, with intense competition emerging around niche technologies.

Innovation Drivers: Technological advancements such as AI-powered video analytics, improved sensor technologies, and the increasing adoption of cloud-based solutions are major drivers of innovation. Government initiatives promoting smart city development and increased cybersecurity concerns also fuel market growth.

Regulatory Frameworks: Varying regulatory landscapes across Latin American countries influence market dynamics. Harmonization efforts, data privacy regulations, and interoperability standards present both opportunities and challenges.

Product Substitutes: Limited direct substitutes exist for many specialized public safety solutions. However, the market faces indirect competition from solutions that offer overlapping functionalities, such as private security services and general-purpose surveillance systems.

End-User Demographics: The key end-users are government agencies (national and local), law enforcement bodies, emergency services, and transportation authorities. The report analyzes market penetration within each sector.

M&A Activities: The market has witnessed a moderate level of M&A activity in recent years. Deal values have ranged from xx Million to xx Million, primarily driven by companies aiming to expand their product portfolios and geographical reach. Key deals included [Insert Details of Specific M&A deals if available. If not, mention "Further research is required to provide specific examples"].

Latin America Public Safety Market Market Dynamics & Trends

This section explores the market's dynamic characteristics, including growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The Latin American Public Safety market is expected to witness significant growth, driven by factors such as rising crime rates, increasing government investments in public safety infrastructure, and the growing adoption of advanced technologies to improve efficiency and effectiveness in law enforcement and emergency response.

The market experienced a CAGR of xx% during the historical period (2019-2024), and it is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033). This growth is influenced by increasing urbanization, leading to a greater need for enhanced security measures. The market penetration of advanced technologies like AI and IoT in the public safety sector is growing steadily, which further adds to market growth. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups.

Dominant Regions & Segments in Latin America Public Safety Market

This section identifies the leading regions and segments within the Latin America Public Safety Market.

Dominant Region: [Name of Dominant Region, e.g., Brazil] holds the largest market share due to [Reasons, e.g., its large population, higher crime rates, and greater government spending on public safety].

Key Drivers for Dominant Region:

- High crime rates and security concerns

- Significant government investments in public safety infrastructure.

- Growing adoption of advanced technologies.

- Increased urbanization.

Dominant Segment: [Name of Dominant Segment, e.g., Video Surveillance Systems] accounts for the largest share of the market, driven by increasing demand for enhanced situational awareness and crime prevention measures.

Key Drivers for Dominant Segment:

- Increasing need for enhanced situational awareness.

- Rising crime rates.

- Growing popularity of smart city initiatives.

Detailed dominance analysis of the region and segment will be explored within the full report, including a detailed breakdown of market size and CAGR for each key segment.

Latin America Public Safety Market Product Innovations

The Latin America Public Safety Market is witnessing significant product innovations, driven by the convergence of technologies like AI, IoT, and cloud computing. New products are emphasizing improved situational awareness, predictive policing capabilities, and enhanced data analytics. For example, the integration of AI-powered video analytics for real-time threat detection and improved response times represents a key advancement. These solutions provide competitive advantages by improving efficiency, accuracy, and overall effectiveness of public safety operations, aligning with the increasing demand for smarter and more responsive security systems.

Report Scope & Segmentation Analysis

This report segments the Latin America Public Safety Market based on several criteria:

By Technology: Video surveillance, access control, command and control centers, communication systems, and other technologies. Each segment's growth trajectory and market dynamics are analyzed. Specific growth projections and market sizes are detailed in the complete report.

By Application: Law enforcement, emergency response, transportation security, and other applications. Detailed analysis of each application’s growth projection and competitive landscape is provided.

By Country: [List Major Countries] - Each country's market size, growth rate, and key market drivers are examined.

Key Drivers of Latin America Public Safety Market Growth

The growth of the Latin America Public Safety Market is fueled by several factors:

Technological Advancements: The integration of AI, IoT, and cloud computing into public safety solutions is driving efficiency and effectiveness gains.

Rising Crime Rates: Increased crime rates across several Latin American countries fuel demand for advanced security technologies.

Government Initiatives: Investments in public safety infrastructure and smart city projects boost market growth.

Urbanization: Growing urbanization necessitates improved security measures in densely populated areas.

Challenges in the Latin America Public Safety Market Sector

The Latin America Public Safety Market faces several challenges:

Budgetary Constraints: Limited public sector budgets restrict investment in advanced technologies in certain regions.

Cybersecurity Threats: Increased reliance on connected devices and systems heightens vulnerability to cyberattacks.

Infrastructure Limitations: Inadequate infrastructure in some areas hinders the deployment and effectiveness of advanced technologies.

Data Privacy Concerns: Stricter data protection regulations create challenges for data collection and sharing.

Emerging Opportunities in Latin America Public Safety Market

The Latin America Public Safety Market presents several emerging opportunities:

Smart City Initiatives: Increased government investment in smart city projects creates a demand for innovative security solutions.

Cybersecurity Solutions: Growing concerns about cyber threats drive demand for robust cybersecurity solutions for public safety systems.

AI-powered Analytics: Adoption of AI-powered analytics for improved crime prediction and response is expected to increase.

Biometric Technologies: Implementation of biometric technologies for improved identity management and access control offers significant potential.

Leading Players in the Latin America Public Safety Market Market

- Cisco Systems Inc.

- Esri Global

- Genetec Inc.

- Honeywell International Inc.

- CGI Inc.

- Thales Group

- ALE International

- Motorola Solutions Inc.

- NEC Corporation

- Atos SE

- Idemia

- Kroll LLC

- Hexagon AB

- SAAB

- Central Square

Key Developments in Latin America Public Safety Market Industry

June 2023: Hexagon AB launched a new Citizen Reporting portal for its HxGN OnCall Records suite, streamlining citizen-law enforcement interaction.

February 2024: Irisity increased investments in Latin America, focusing on public security and collaborating with Grupo Securitas in Uruguay.

Future Outlook for Latin America Public Safety Market Market

The Latin America Public Safety Market is poised for continued growth, driven by ongoing technological advancements, increasing government investments, and the rising need for enhanced security measures in a rapidly urbanizing region. Strategic partnerships, innovative product development, and expansion into new markets will shape the future landscape, creating significant opportunities for growth and innovation within the sector.

Latin America Public Safety Market Segmentation

-

1. Component

-

1.1. Software

- 1.1.1. Location Management

- 1.1.2. Record Management

- 1.1.3. Investigation Management

- 1.1.4. Crime Analysis

- 1.1.5. Criminal Intelligence

- 1.1.6. Other Software

- 1.2. Services

-

1.1. Software

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. Medical

- 3.2. Transportation

- 3.3. Law Enforcement

- 3.4. Firefighting

- 3.5. Other End-user Industries

Latin America Public Safety Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Public Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.2.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.3. Market Restrains

- 3.3.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.3.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.4. Market Trends

- 3.4.1. Software Component to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Public Safety Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.1.1. Location Management

- 5.1.1.2. Record Management

- 5.1.1.3. Investigation Management

- 5.1.1.4. Crime Analysis

- 5.1.1.5. Criminal Intelligence

- 5.1.1.6. Other Software

- 5.1.2. Services

- 5.1.1. Software

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Medical

- 5.3.2. Transportation

- 5.3.3. Law Enforcement

- 5.3.4. Firefighting

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esri Global

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genetec Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CGI Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALE International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Motorola Solutions Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEC Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atos SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Idemia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kroll LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hexagon AB

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SAAB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Central Squar

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Latin America Public Safety Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Public Safety Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 6: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 7: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 13: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 14: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 15: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Latin America Public Safety Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Public Safety Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Brazil Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Argentina Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Colombia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Colombia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Mexico Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Peru Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Peru Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Venezuela Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Venezuela Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Ecuador Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ecuador Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Bolivia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Bolivia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Paraguay Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Paraguay Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Public Safety Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Latin America Public Safety Market?

Key companies in the market include Cisco Systems Inc, Esri Global, Genetec Inc, Honeywell International Inc, CGI Inc, Thales Group, ALE International, Motorola Solutions Inc, NEC Corporation, Atos SE, Idemia, Kroll LLC, Hexagon AB, SAAB, Central Squar.

3. What are the main segments of the Latin America Public Safety Market?

The market segments include Component, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

6. What are the notable trends driving market growth?

Software Component to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

8. Can you provide examples of recent developments in the market?

February 2024: Irisity, a Swedish AI and video analytics software provider, increased investments in Latin America, focusing on public security, transportation, and mission-critical infrastructure. The company supplies technology in countries like Mexico and Argentina and supports emergency services in Ecuador and the Dominican Republic. Additionally, Irisity collaborates with the Uruguayan security firm Grupo Securitas. The regional strategy includes bolstering brand recognition, expanding the team, and fostering partnerships with integrators, resellers, and camera manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Public Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Public Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Public Safety Market?

To stay informed about further developments, trends, and reports in the Latin America Public Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence