Key Insights

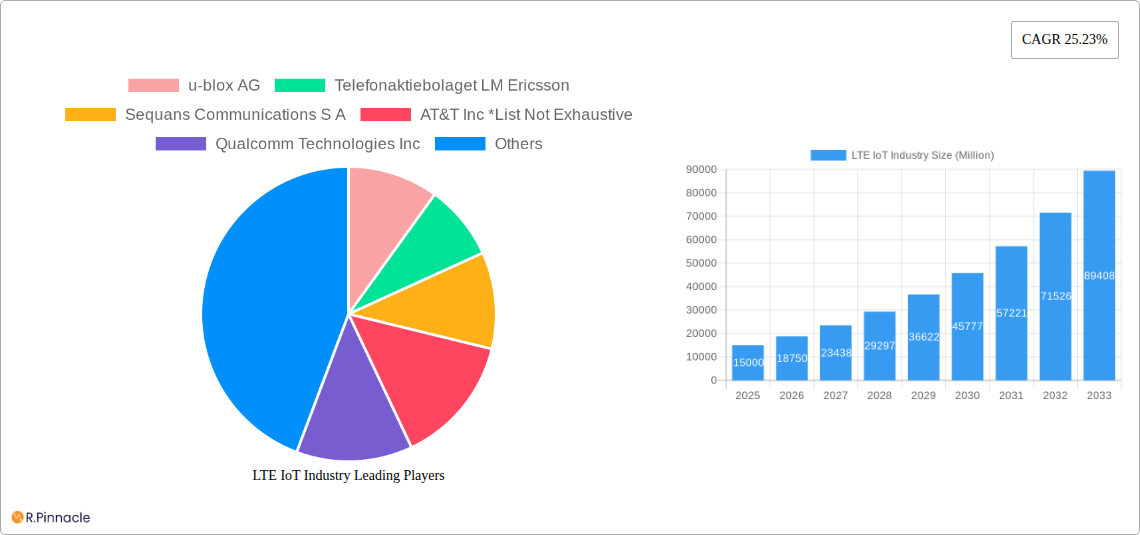

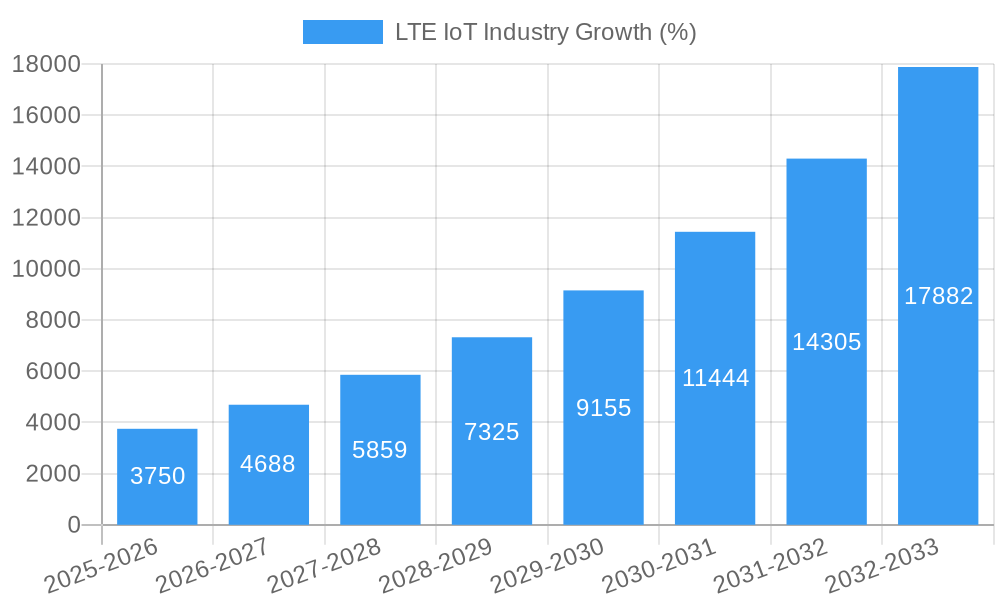

The LTE-IoT market is experiencing robust growth, driven by the increasing adoption of connected devices across diverse sectors. The 25.23% CAGR from 2019 to 2024 indicates a significant upward trajectory, projected to continue through 2033. Key drivers include the expanding need for real-time data monitoring and control in industries like manufacturing, logistics, and healthcare, coupled with the rising demand for improved operational efficiency and reduced costs. The market's segmentation reflects this diversification, with professional services commanding a larger share compared to managed services, reflecting the complexity of deploying and managing large-scale IoT networks. NB-IoT and LTE-M technologies are leading the product type segment, offering a balance of cost-effectiveness, power efficiency, and wide-area coverage ideal for various IoT applications. The IT & telecommunication sector currently holds a significant market share, but growth is also notable in consumer electronics, particularly with smart wearables and home automation devices gaining traction. Retail (digital e-commerce), healthcare (remote patient monitoring), and industrial automation are other fast-growing segments. While challenges exist, such as regulatory hurdles and security concerns, the overall market outlook remains overwhelmingly positive, fueled by continuous technological advancements and expanding applications.

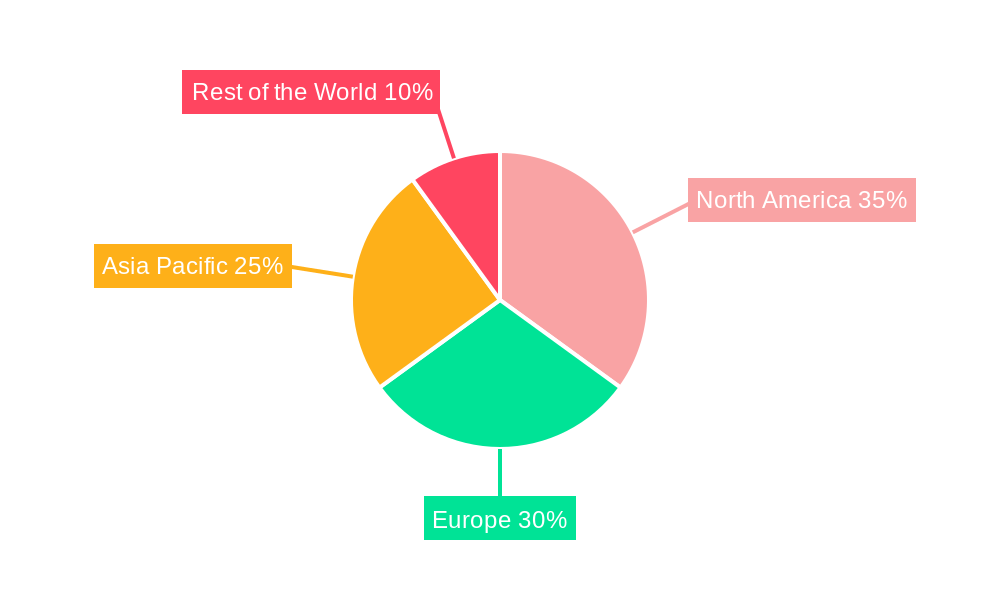

The competitive landscape is populated by a mix of established telecommunication giants, chip manufacturers, and specialized IoT solution providers. Companies like u-blox, Ericsson, Qualcomm, and others are actively developing and marketing LTE-IoT solutions, fostering innovation and driving down costs. The regional distribution shows a substantial presence in North America and Europe, reflecting early adoption and well-developed infrastructure. However, the Asia-Pacific region is projected to witness the most rapid growth in the coming years, fueled by substantial investments in infrastructure development and the massive expansion of the IoT ecosystem in rapidly developing economies. The continued focus on 5G deployment will further accelerate the market's expansion by offering enhanced speed, capacity, and reliability for LTE-IoT networks. Strategic partnerships and mergers and acquisitions will also shape the market landscape, leading to further consolidation and technological advancements in the coming years.

This comprehensive report provides an in-depth analysis of the LTE IoT industry, offering invaluable insights for businesses, investors, and researchers. With a focus on market size, growth drivers, and competitive dynamics, this report covers the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025. The forecast period spans from 2025 to 2033, while the historical period covers 2019 to 2024. The report projects a market exceeding $XX Million by 2033.

LTE IoT Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the LTE IoT market, examining market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The global LTE IoT market is characterized by a moderately concentrated structure with key players like u-blox AG, Telefonaktiebolaget LM Ericsson, and Qualcomm Technologies Inc. holding significant market share. However, the presence of numerous smaller players and continuous innovation contributes to a dynamic competitive environment.

- Market Share: Qualcomm Technologies Inc. holds an estimated xx% market share, followed by Ericsson at xx% and u-blox AG at xx%. (These are estimations pending data verification).

- Innovation Drivers: The primary drivers include advancements in NB-IoT and LTE-M technologies, increasing demand for connected devices across various industries, and supportive government regulations.

- M&A Activities: The past five years have witnessed several notable M&A activities, although the total deal value is currently estimated at $XX Million. Further research is needed to determine precise numbers.

- Regulatory Frameworks: Government initiatives promoting IoT adoption and the development of 5G infrastructure influence market growth. However, varying regulations across different regions can pose challenges.

- Product Substitutes: Other wireless communication technologies (e.g., 5G) offer some level of substitution, but LTE IoT retains a strong position due to its cost-effectiveness and wide coverage.

LTE IoT Industry Market Dynamics & Trends

This section delves into the key market dynamics driving growth, exploring factors such as technological advancements, evolving consumer preferences, and competitive pressures. The LTE IoT market is experiencing robust growth, fueled by the increasing adoption of connected devices across various sectors. This growth is expected to continue, with a projected CAGR of xx% during the forecast period, leading to a market value exceeding $XX Million by 2033. Market penetration is currently estimated at xx% and is expected to increase significantly. The proliferation of smart devices, increasing demand for real-time data, and advancements in connectivity technologies are key factors driving this market expansion.

Dominant Regions & Segments in LTE IoT Industry

This section identifies the leading regions and market segments in the LTE IoT industry.

- By Service: The managed services segment currently dominates, driven by increasing demand for comprehensive solutions, but the professional services segment shows strong growth potential.

- By Product Type: NB-IoT (Cat-NB1) and LTE-M (eMTC Cat-M1) are the primary product types, each catering to specific application needs, with NB-IoT currently holding a larger market share due to its lower power consumption.

- By End-user Industry: The IT & Telecommunication sector is currently the largest end-user segment, followed by the Industrial sector. However, rapid growth is anticipated in the Healthcare and Retail sectors, driven by the increasing demand for remote monitoring and smart retail solutions.

Key Drivers:

- North America: Strong government support for IoT initiatives, well-developed infrastructure, and high consumer adoption rates.

- Europe: Growing focus on smart cities and industrial automation, along with robust regulatory frameworks.

- Asia-Pacific: High population density, rapid urbanization, and increasing government investment in digital infrastructure.

LTE IoT Industry Product Innovations

Recent innovations include improved power efficiency in NB-IoT and LTE-M modules, along with enhanced security features to address growing concerns over data privacy. These advancements are expanding the applicability of LTE IoT across various applications, including smart agriculture, industrial automation, and wearable technology, leading to increased market adoption and improved competitive advantages.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis of the LTE IoT market across service types (professional and managed), product types (NB-IoT, LTE-M), and end-user industries (IT & Telecommunications, Consumer Electronics, Retail, Healthcare, Industrial, and Others). Each segment's growth projections, market size estimations, and competitive dynamics are discussed in detail, providing actionable insights into market opportunities and potential challenges. Each segment is expected to exhibit robust growth over the forecast period.

Key Drivers of LTE IoT Industry Growth

The LTE IoT industry's growth is driven by several key factors:

- Technological Advancements: Enhanced device capabilities, improved network coverage, and reduced power consumption.

- Economic Factors: Increased investments in IoT infrastructure and the growing demand for connected devices in various sectors, creating immense market opportunities.

- Favorable Regulatory Environment: Government initiatives supporting IoT adoption and the development of necessary infrastructure.

Challenges in the LTE IoT Industry Sector

Despite significant growth, the LTE IoT industry faces several challenges:

- Interoperability Issues: Ensuring seamless communication between devices from different manufacturers can be complex.

- Security Concerns: Protecting sensitive data transmitted through IoT networks from cyber threats is critical.

- High Initial Investment Costs: Implementing IoT infrastructure can require significant upfront investment, particularly for smaller businesses.

Emerging Opportunities in LTE IoT Industry

Significant opportunities exist in the LTE IoT industry, including:

- Expansion into New Markets: The growing adoption of IoT in sectors like smart agriculture, smart homes, and smart cities creates significant expansion potential.

- Integration with Emerging Technologies: Combining LTE IoT with AI, big data analytics, and blockchain technology can open up new possibilities.

- Development of Innovative Applications: Creating novel applications tailored to specific industry needs can lead to significant market differentiation and growth.

Leading Players in the LTE IoT Industry Market

- u-blox AG

- Telefonaktiebolaget LM Ericsson

- Sequans Communications S A

- AT&T Inc

- Qualcomm Technologies Inc

- PureSoftware

- Verizon Communications

- TELUS Corporation

- MediaTek Inc

- Cisco Syatem Inc (Jasper)

- Cradlepoint Inc

- Gemalto N V

Key Developments in LTE IoT Industry Industry

- June 2022: System Loco partnered with Aeris to leverage LTE-M, NB-IoT, LTE, and 2G/3G for global smart pallet tracking. This highlights the expanding applications of LTE IoT in supply chain management.

- April 2022: UScellular, Qualcomm, and Inseego launched a 5G mmWave high-speed internet service. This showcases the convergence of 5G and LTE technologies, driving overall market expansion and innovation.

Future Outlook for LTE IoT Industry Market

The LTE IoT market is poised for continued strong growth, driven by technological advancements, increasing adoption across diverse sectors, and supportive government policies. Strategic partnerships and innovations in areas such as edge computing and AI integration will further propel market expansion, presenting significant opportunities for both established players and new entrants. The market is expected to reach $XX Million by 2033, creating immense opportunities for stakeholders.

LTE IoT Industry Segmentation

-

1. Service

- 1.1. Professional

- 1.2. Managed

-

2. Product Type

- 2.1. NB-IoT (Cat-NB1)

- 2.2. LTE-M (eMTC Cat-M1)

-

3. End-user Industry

- 3.1. IT & Telecommunication

- 3.2. Consumer Electronics

- 3.3. Retail (Digital Ecommerce)

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Other End-user Industries

LTE IoT Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

LTE IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for High-speed Broadband Connectivity; Rising Demand for the Industrial IoT among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Reduction in PC Demand

- 3.4. Market Trends

- 3.4.1. Industrial Sector is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Professional

- 5.1.2. Managed

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. NB-IoT (Cat-NB1)

- 5.2.2. LTE-M (eMTC Cat-M1)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT & Telecommunication

- 5.3.2. Consumer Electronics

- 5.3.3. Retail (Digital Ecommerce)

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Professional

- 6.1.2. Managed

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. NB-IoT (Cat-NB1)

- 6.2.2. LTE-M (eMTC Cat-M1)

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT & Telecommunication

- 6.3.2. Consumer Electronics

- 6.3.3. Retail (Digital Ecommerce)

- 6.3.4. Healthcare

- 6.3.5. Industrial

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Professional

- 7.1.2. Managed

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. NB-IoT (Cat-NB1)

- 7.2.2. LTE-M (eMTC Cat-M1)

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT & Telecommunication

- 7.3.2. Consumer Electronics

- 7.3.3. Retail (Digital Ecommerce)

- 7.3.4. Healthcare

- 7.3.5. Industrial

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Professional

- 8.1.2. Managed

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. NB-IoT (Cat-NB1)

- 8.2.2. LTE-M (eMTC Cat-M1)

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT & Telecommunication

- 8.3.2. Consumer Electronics

- 8.3.3. Retail (Digital Ecommerce)

- 8.3.4. Healthcare

- 8.3.5. Industrial

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of the World LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Professional

- 9.1.2. Managed

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. NB-IoT (Cat-NB1)

- 9.2.2. LTE-M (eMTC Cat-M1)

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT & Telecommunication

- 9.3.2. Consumer Electronics

- 9.3.3. Retail (Digital Ecommerce)

- 9.3.4. Healthcare

- 9.3.5. Industrial

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. North America LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World LTE IoT Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 u-blox AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Telefonaktiebolaget LM Ericsson

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Sequans Communications S A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 AT&T Inc *List Not Exhaustive

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Qualcomm Technologies Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 PureSoftware

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Verizon Communications

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 TELUS Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 MediaTek Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Cisco Syatem Inc (Jasper)

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Cradlepoint Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Gemalto N V

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 u-blox AG

List of Figures

- Figure 1: Global LTE IoT Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America LTE IoT Industry Revenue (Million), by Service 2024 & 2032

- Figure 11: North America LTE IoT Industry Revenue Share (%), by Service 2024 & 2032

- Figure 12: North America LTE IoT Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America LTE IoT Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America LTE IoT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America LTE IoT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe LTE IoT Industry Revenue (Million), by Service 2024 & 2032

- Figure 19: Europe LTE IoT Industry Revenue Share (%), by Service 2024 & 2032

- Figure 20: Europe LTE IoT Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe LTE IoT Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe LTE IoT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe LTE IoT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LTE IoT Industry Revenue (Million), by Service 2024 & 2032

- Figure 27: Asia Pacific LTE IoT Industry Revenue Share (%), by Service 2024 & 2032

- Figure 28: Asia Pacific LTE IoT Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific LTE IoT Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific LTE IoT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Asia Pacific LTE IoT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Asia Pacific LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World LTE IoT Industry Revenue (Million), by Service 2024 & 2032

- Figure 35: Rest of the World LTE IoT Industry Revenue Share (%), by Service 2024 & 2032

- Figure 36: Rest of the World LTE IoT Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Rest of the World LTE IoT Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Rest of the World LTE IoT Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Rest of the World LTE IoT Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Rest of the World LTE IoT Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World LTE IoT Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LTE IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global LTE IoT Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global LTE IoT Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global LTE IoT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global LTE IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: LTE IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: LTE IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: LTE IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: LTE IoT Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global LTE IoT Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Global LTE IoT Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global LTE IoT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global LTE IoT Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 19: Global LTE IoT Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global LTE IoT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global LTE IoT Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 23: Global LTE IoT Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global LTE IoT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global LTE IoT Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 27: Global LTE IoT Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global LTE IoT Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global LTE IoT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LTE IoT Industry?

The projected CAGR is approximately 25.23%.

2. Which companies are prominent players in the LTE IoT Industry?

Key companies in the market include u-blox AG, Telefonaktiebolaget LM Ericsson, Sequans Communications S A, AT&T Inc *List Not Exhaustive, Qualcomm Technologies Inc, PureSoftware, Verizon Communications, TELUS Corporation, MediaTek Inc, Cisco Syatem Inc (Jasper), Cradlepoint Inc, Gemalto N V.

3. What are the main segments of the LTE IoT Industry?

The market segments include Service, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for High-speed Broadband Connectivity; Rising Demand for the Industrial IoT among End-user Industries.

6. What are the notable trends driving market growth?

Industrial Sector is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Reduction in PC Demand.

8. Can you provide examples of recent developments in the market?

June 2022 - System Loco selected the Aeris Intelligent IoT network to provide next-generation connectivity that includes LTE-M, NB-IoT, LTE, and 2G/3G coverage from 600 carriers globally to offer a dynamic and flexible connectivity solution that ensures that all demands from current and future networks are met to support and manage the worldwide track and trace of smart pallets employed by System Loco's customers throughout the world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LTE IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LTE IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LTE IoT Industry?

To stay informed about further developments, trends, and reports in the LTE IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence