Key Insights

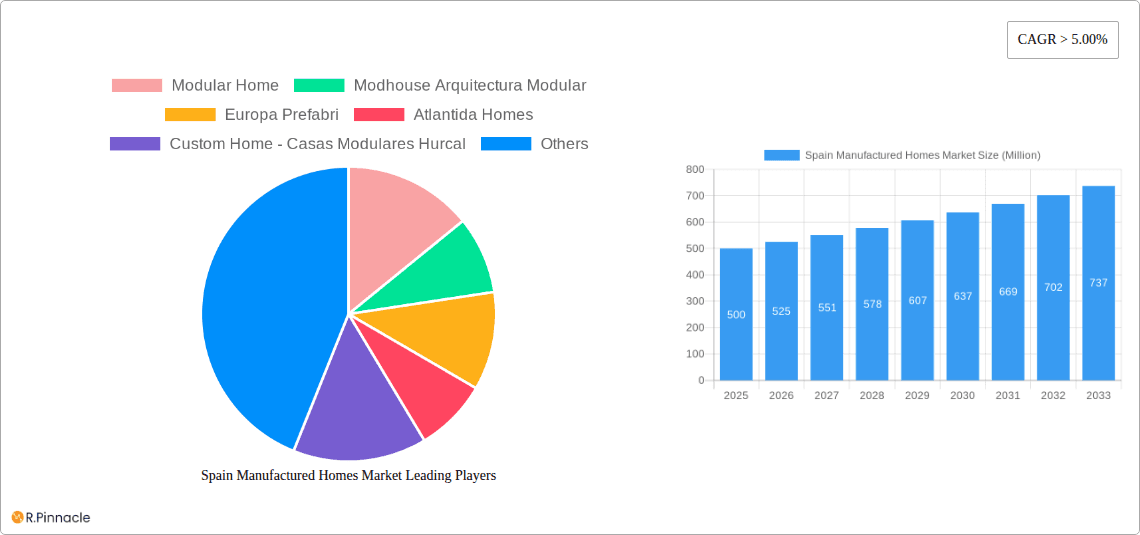

The Spain manufactured homes market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing urbanization and a shortage of affordable housing in Spain are pushing consumers towards cost-effective and quicker-to-build manufactured homes. Furthermore, evolving architectural designs and improved construction technologies are enhancing the aesthetic appeal and overall quality of these homes, blurring the lines between traditional and manufactured housing. Government initiatives promoting sustainable and energy-efficient housing solutions also contribute to market growth. The market is segmented by type, primarily into single-family and multi-family units, with single-family homes currently dominating the market share due to strong individual homeowner demand. However, the multi-family segment is projected to witness significant growth in the coming years, driven by rising rental demand and investor interest in large-scale developments of manufactured housing communities. While potential regulatory hurdles and fluctuations in raw material costs pose some challenges, the overall market outlook remains positive, with continued expansion anticipated throughout the forecast period. The presence of numerous established and emerging players, such as Modular Home, Modhouse Arquitectura Modular, and others, further indicates a competitive and dynamic market landscape.

Spain Manufactured Homes Market Market Size (In Million)

The competitive landscape is characterized by a mix of large-scale manufacturers and smaller, specialized companies. Larger firms often focus on mass production and standardization, while smaller companies cater to more customized designs and bespoke needs. This diversity ensures a wide range of options for consumers, from budget-friendly models to high-end luxury manufactured homes. The market's success will depend on continuous innovation, adapting to evolving consumer preferences, and addressing potential challenges, such as material supply chain disruptions and environmental concerns. Future growth will likely be driven by technological advancements, including the increased integration of smart home technologies and sustainable building materials, further solidifying the manufactured home sector's position within the broader Spanish housing market. Strategic partnerships and collaborations between manufacturers, developers, and financial institutions could also play a crucial role in accelerating market expansion and affordability.

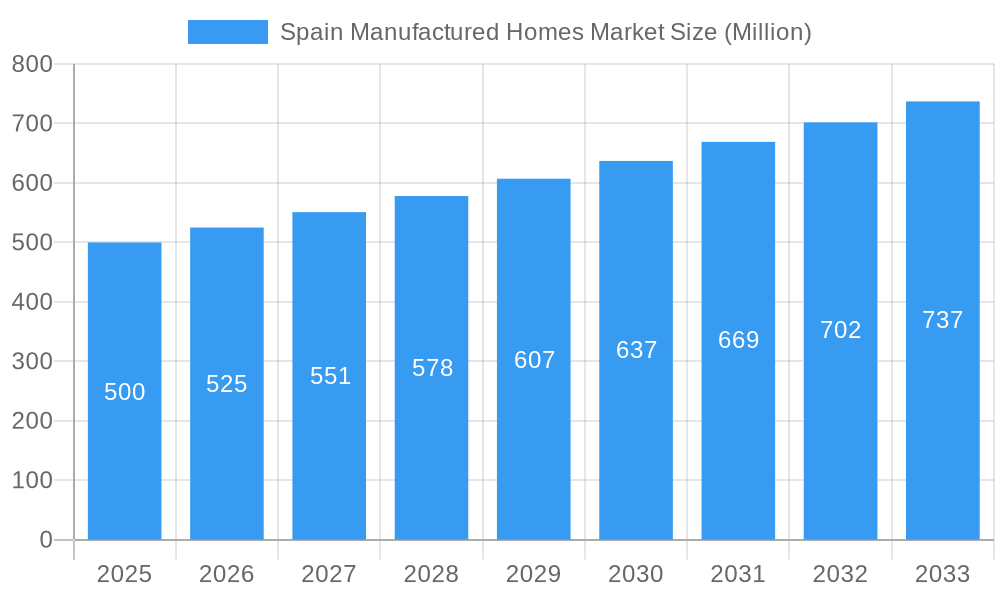

Spain Manufactured Homes Market Company Market Share

Spain Manufactured Homes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Spain manufactured homes market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential.

Spain Manufactured Homes Market Structure & Innovation Trends

The Spanish manufactured homes market exhibits a moderately fragmented structure, with several key players competing alongside smaller, regional businesses. Market share is currently dominated by a few large companies, but the landscape is dynamic, influenced by M&A activities and emerging innovative firms. Innovation is driven by the need for sustainable and affordable housing solutions, leading to the adoption of new materials, construction techniques, and smart home technologies. Regulatory frameworks, while generally supportive of the sector, have a significant impact on materials used, building codes, and energy efficiency requirements. Key product substitutes include traditional brick-and-mortar homes and alternative housing options like apartments. End-user demographics are diverse, ranging from young professionals to families and retirees, with specific preferences influencing market demand. Recent M&A activity shows a growing interest in the sector; however, precise deal values remain undisclosed in many cases, with a projected average deal value of €xx Million for significant transactions in the period 2019-2024.

- Market Concentration: Moderately Fragmented

- Innovation Drivers: Sustainability, Affordability, Smart Home Technology

- Regulatory Impact: Significant influence on materials, codes, and energy efficiency

- M&A Activity: Increasing interest, average deal value ≈ €xx Million (2019-2024)

Spain Manufactured Homes Market Dynamics & Trends

The Spanish manufactured homes market is experiencing robust growth, driven by several factors. Increasing urbanization, rising housing costs in major cities, and a growing preference for sustainable and efficient housing solutions are all contributing to market expansion. Technological disruptions, particularly the adoption of modular construction methods and prefabrication techniques, are boosting efficiency and reducing construction timelines. Consumer preferences are shifting towards modern designs, energy-efficient features, and personalized customization options. Competitive dynamics are intense, with companies focusing on differentiation through innovative product offerings, superior customer service, and strategic partnerships. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Regions & Segments in Spain Manufactured Homes Market

The Madrid and Barcelona metropolitan areas currently represent the most dominant regions within the Spanish manufactured homes market, driven by high population density, strong economic activity, and supportive government policies. While both single-family and multi-family segments are present, the single-family segment commands a larger market share due to increased demand from young families and individuals seeking affordable housing.

- Key Drivers (Madrid & Barcelona): High population density, strong economic growth, supportive local government policies, readily available infrastructure.

- Dominance Analysis: Strong demand fueled by affordability concerns and rising property prices in traditional housing markets. The multi-family segment shows potential for growth, particularly in urban areas.

Spain Manufactured Homes Market Product Innovations

Recent product innovations in the Spanish manufactured homes market focus on improving energy efficiency, incorporating smart home technology, and enhancing design aesthetics. Manufacturers are adopting sustainable materials, improving insulation, and integrating renewable energy sources. The market is witnessing increased adoption of modular and prefabricated construction, leading to faster construction times and cost reductions. These innovations cater to consumer demand for affordable, sustainable, and technologically advanced housing solutions.

Report Scope & Segmentation Analysis

This report segments the Spanish manufactured homes market by type:

Single-Family Homes: This segment dominates the market, driven by individual household demand for affordable and customizable homes. Growth is projected at xx% CAGR (2025-2033), with a market size of €xx Million in 2025. Competition in this area is high.

Multi-Family Homes: This segment represents a growing market opportunity, with potential for increased adoption in urban areas. Growth projections indicate a xx% CAGR (2025-2033), reaching a market size of €xx Million in 2025. Competition is less intense than in the single-family segment but is growing rapidly.

Key Drivers of Spain Manufactured Homes Market Growth

Several factors are driving the growth of the Spanish manufactured homes market:

- Government Initiatives: Policies promoting affordable housing and sustainable construction contribute to market expansion.

- Technological Advancements: Improved construction techniques and materials are making manufactured homes more attractive.

- Rising Housing Costs: Increased property prices in traditional housing markets are fueling demand for cost-effective alternatives.

Challenges in the Spain Manufactured Homes Market Sector

The Spanish manufactured homes market faces several challenges:

- Regulatory Hurdles: Navigating complex building codes and permitting processes can create delays and increase costs.

- Supply Chain Issues: Fluctuations in material prices and availability can disrupt production schedules.

- Consumer Perception: Overcoming negative perceptions associated with manufactured homes remains a key challenge. These factors can contribute to a reduction in market growth by an estimated xx% in certain periods.

Emerging Opportunities in Spain Manufactured Homes Market

Emerging opportunities in the Spanish manufactured homes market include:

- Sustainable Housing: Growing demand for environmentally friendly housing solutions presents significant growth potential.

- Smart Home Integration: Integrating smart technology into manufactured homes enhances their appeal.

- Expansion into Rural Areas: Providing affordable housing options in rural communities can drive market expansion.

Leading Players in the Spain Manufactured Homes Market Market

- Modular Home

- Modhouse Arquitectura Modular

- Europa Prefabri

- Atlantida Homes

- Custom Home - Casas Modulares Hurcal

- Sismo Building Technology

- Modular Buildings Cabisuar SA

- ALUCASA Mobile Homes

- Cofitor Prefabricated Houses

- Prefabricated House Lopez SL

- SteelHous

- Alhambra Mobilhomes - DPC

- Construcciones Modulares CUNI

- (List Not Exhaustive)

Key Developments in Spain Manufactured Homes Market Industry

- December 2022: CBRE Investment Management acquired an affordable housing asset in Madrid (82 homes). This signifies institutional investment interest in the sector.

- August 2022: Harrison Street and DeA Capital launched a joint venture to develop 441 built-to-rent units in Seville, indicating growth in the rental market segment.

Future Outlook for Spain Manufactured Homes Market Market

The future of the Spanish manufactured homes market appears promising, driven by strong growth drivers and emerging opportunities. Continued technological advancements, supportive government policies, and evolving consumer preferences will shape market dynamics. The sector is poised for significant expansion, with a continued focus on innovation, sustainability, and affordability. Strategic partnerships and investments in research and development will be key to success in the coming years.

Spain Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi-family

Spain Manufactured Homes Market Segmentation By Geography

- 1. Spain

Spain Manufactured Homes Market Regional Market Share

Geographic Coverage of Spain Manufactured Homes Market

Spain Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increasing Home Ownership Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Modular Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Modhouse Arquitectura Modular

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Europa Prefabri

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atlantida Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Custom Home - Casas Modulares Hurcal

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sismo Building Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Modular Buildings Cabisuar SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALUCASA Mobile Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cofitor Prefabricated Houses

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prefabricated House Lopez SL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SteelHous

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alhambra Mobilhomes - DPC**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Construcciones Modulares CUNI

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Modular Home

List of Figures

- Figure 1: Spain Manufactured Homes Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Manufactured Homes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Spain Manufactured Homes Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Spain Manufactured Homes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Spain Manufactured Homes Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Manufactured Homes Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Spain Manufactured Homes Market?

Key companies in the market include Modular Home, Modhouse Arquitectura Modular, Europa Prefabri, Atlantida Homes, Custom Home - Casas Modulares Hurcal, Sismo Building Technology, Modular Buildings Cabisuar SA, ALUCASA Mobile Homes, Cofitor Prefabricated Houses, Prefabricated House Lopez SL, SteelHous, Alhambra Mobilhomes - DPC**List Not Exhaustive, Construcciones Modulares CUNI.

3. What are the main segments of the Spain Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increasing Home Ownership Driving the Market.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

December 2022 - CBRE Investment Management ("CBRE IM") acquired a new affordable residential asset in Madrid, Spain, on behalf of a fund it sponsors. The property is in San Sebastian de Los Reyes and has a total gross lettable area of 12,174 square meters. It is fully leased and consists of two adjacent buildings with 82 homes, 123 parking spaces, and 82 storage units. It was completed in 2009.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Spain Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence