Key Insights

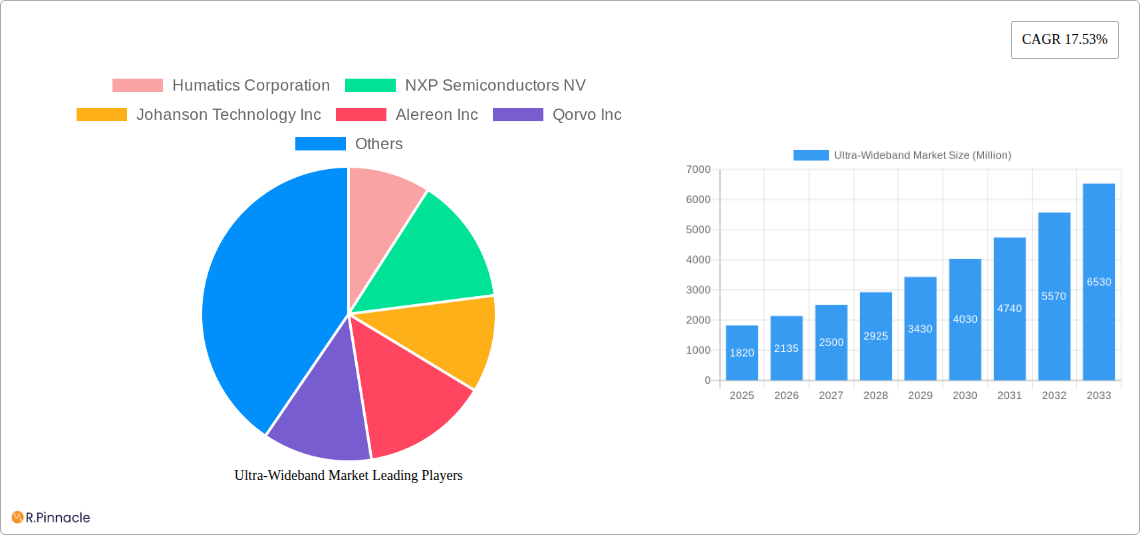

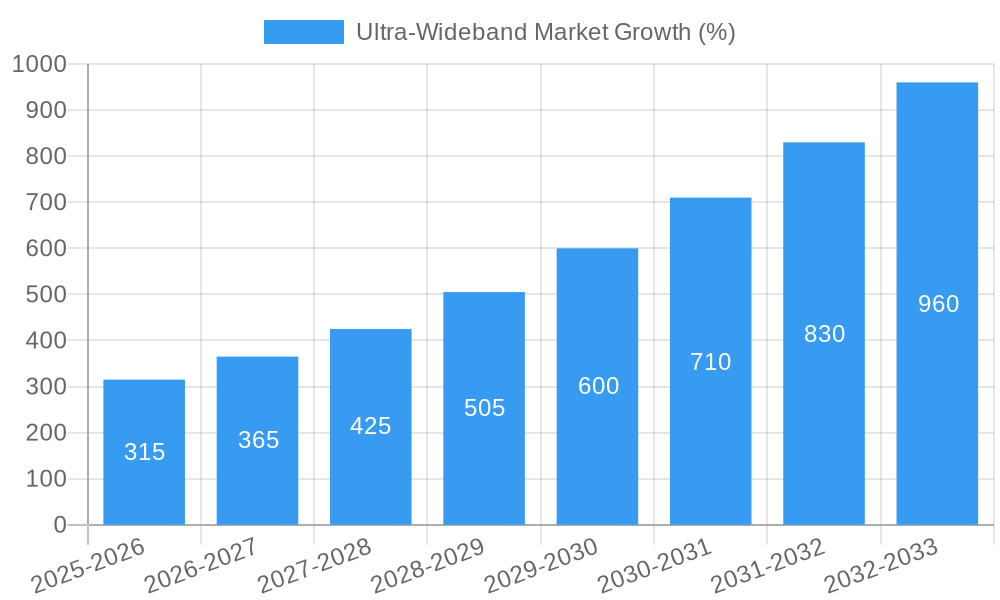

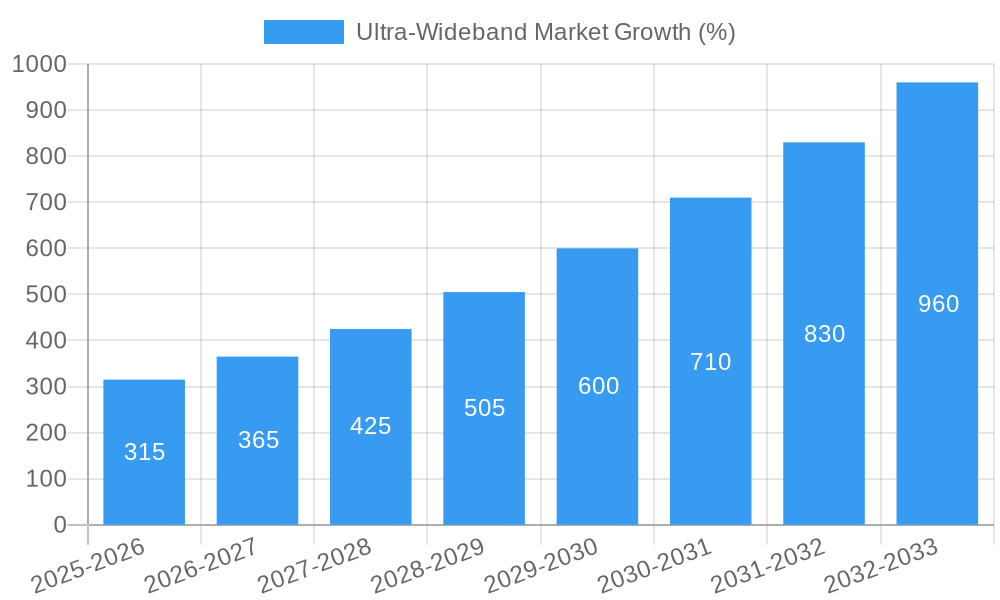

The Ultra-Wideband (UWB) market is experiencing robust growth, projected to reach $1.82 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.53% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of UWB technology in smartphones for precise location tracking and secure access control is a significant driver. Furthermore, the burgeoning demand for high-accuracy positioning systems in diverse sectors like healthcare (patient tracking, asset management), automotive (advanced driver-assistance systems, autonomous driving), and manufacturing (inventory management, industrial automation) fuels market growth. The rise of the Internet of Things (IoT) and the need for seamless connectivity further contribute to the UWB market's expansion. While technological complexities and relatively higher costs compared to other short-range technologies may pose some challenges, ongoing innovation and the pursuit of enhanced performance are mitigating these restraints. The segmentation of the market by application (RTLS, imaging, communication) and end-user vertical (healthcare, automotive, manufacturing, consumer electronics) highlights the versatile nature of UWB technology and its applicability across various industries. Leading companies like NXP Semiconductors, Texas Instruments, and Qorvo are actively contributing to the market's growth through continuous product development and strategic partnerships.

The future of the UWB market appears promising, particularly with the growing integration of UWB in next-generation smart devices and the expanding adoption in industrial automation and location-based services. The continuous refinement of UWB technology, aiming for improved accuracy, lower power consumption, and cost-effectiveness, will unlock new avenues for application and market penetration. The ongoing research and development efforts in UWB technology will further expand its functionality, driving increased demand across various sectors. This trend is expected to propel the market to even greater heights in the coming years, surpassing current projections. The strategic focus of key players on innovation and expanding into new applications will help to realize the full potential of this technology and solidify its position in the global market.

Ultra-Wideband (UWB) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Ultra-Wideband (UWB) market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers crucial data on market size, segmentation, growth drivers, challenges, and future opportunities. The report leverages extensive research and incorporates recent key developments to provide a complete and up-to-date understanding of this dynamic market.

Ultra-Wideband Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UWB market, exploring market concentration, innovation drivers, regulatory influences, and key industry activities. The analysis includes an assessment of market share distribution amongst leading players and a review of significant mergers and acquisitions (M&A) within the industry. The total market size is estimated at xx Million in 2025, with a projected xx% CAGR from 2025-2033.

- Market Concentration: The UWB market exhibits a moderately concentrated structure, with a few major players holding significant market share. Further granular data on specific market share percentages is available within the full report.

- Innovation Drivers: Ongoing advancements in semiconductor technology, miniaturization, and power efficiency are major drivers of innovation within the UWB market. The development of higher-bandwidth, lower-power UWB chips fuels adoption across diverse applications.

- Regulatory Frameworks: Regulatory bodies play a crucial role in shaping the UWB market, influencing spectrum allocation and standardization efforts. Compliance with international standards is essential for market entry and widespread adoption.

- Product Substitutes: Competing technologies such as Bluetooth and Wi-Fi offer some level of overlapping functionality, but UWB's superior precision and security capabilities create a distinct market niche.

- End-User Demographics: The report provides detailed analysis of end-user demographics across different segments, identifying key trends in adoption patterns.

- M&A Activities: Recent M&A activities have involved significant investments, with deal values exceeding xx Million in recent years. This activity points towards consolidation and strategic expansion within the sector.

Ultra-Wideband Market Dynamics & Trends

This section delves into the market's dynamic forces, examining growth drivers, technological disruptions, consumer preferences, and competitive pressures. The analysis incorporates key metrics such as CAGR and market penetration rates to provide a comprehensive picture of market evolution. The report forecasts a significant market expansion driven by increasing demand across diverse sectors. Specific details on technological trends such as the increasing integration of UWB with other technologies like AR/VR, and the growing adoption of UWB in various applications will be discussed in the full report. The forecast period is from 2025 to 2033, with 2025 serving as the base year.

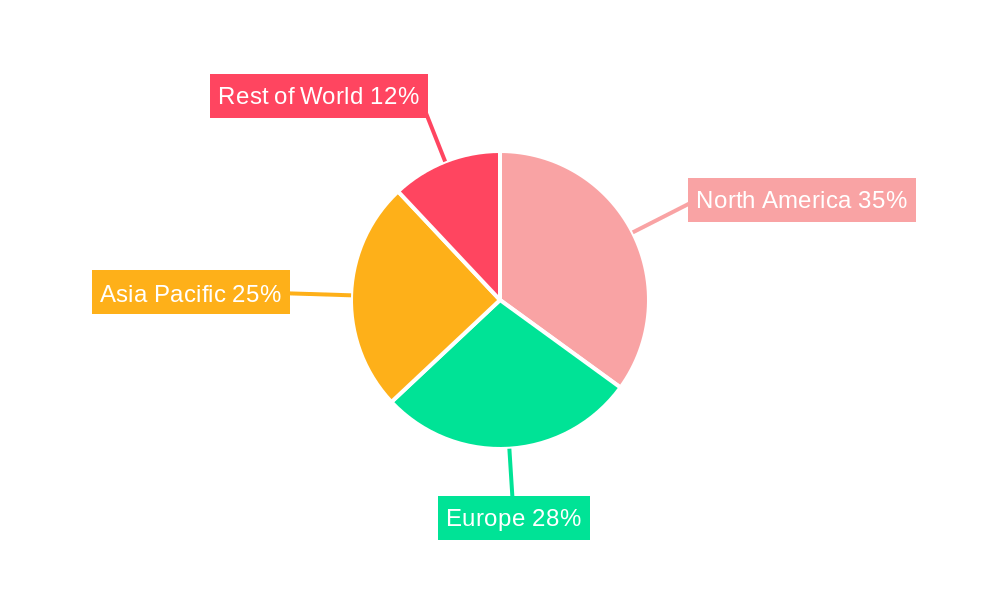

Dominant Regions & Segments in Ultra-Wideband Market

This section identifies the leading regions, countries, and market segments within the UWB market, offering a detailed analysis of their dominance. Key drivers for growth in each segment are highlighted.

- By Application:

- RTLS (Real-Time Location Services): This segment is experiencing rapid growth due to increasing demand for precise location tracking in various applications, such as asset tracking and industrial automation.

- Imaging: UWB technology's capabilities in high-resolution imaging are driving its adoption in specialized applications, offering unique advantages.

- Communication: This segment is growing due to the advantages of UWB for high-bandwidth, short-range communication, particularly for secure data transfer.

- By End-user Vertical:

- Automotive and Transportation: This is a rapidly expanding segment, fueled by the increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- Healthcare: UWB finds application in patient tracking, asset management, and other healthcare-related applications, resulting in steady growth.

- Manufacturing: The need for improved efficiency and productivity in manufacturing is driving the adoption of UWB in real-time location and tracking systems.

- Consumer Electronics: The integration of UWB in smartphones and other consumer devices is accelerating market growth in this segment.

- Retail: UWB is finding its way into in-store navigation, inventory management and other applications.

- Other End-user Verticals: This segment encompasses numerous niche applications where UWB provides unique advantages.

- Major UWB Suppliers for Smartphone Companies: The report will detail the key suppliers to major smartphone brands.

Ultra-Wideband Market Product Innovations

The UWB market is characterized by continuous product innovation, with manufacturers focusing on improving performance, reducing power consumption, and enhancing integration capabilities. Recent developments include the introduction of smaller, more energy-efficient UWB chips, enabling their seamless integration into a wider range of devices and applications. This trend is further fueled by advancements in antenna designs and signal processing algorithms, leading to improved accuracy and range. Such innovations are enhancing the market fit of UWB across diverse sectors.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the UWB market, segmented by application (RTLS, Imaging, Communication), end-user vertical (Healthcare, Automotive and Transportation, Manufacturing, Consumer Electronics, Retail, Other End-user Verticals), and geographic region. The report includes market size estimations, growth projections, and competitive analysis for each segment. Growth projections for each segment are detailed within the complete report.

Key Drivers of Ultra-Wideband Market Growth

Several factors are driving the growth of the UWB market. Technological advancements, such as miniaturization and improved power efficiency, are enabling wider adoption across various applications. Strong demand from the automotive and consumer electronics industries further propels market expansion. Moreover, supportive government policies and regulations are fostering the development and deployment of UWB technologies.

Challenges in the Ultra-Wideband Market Sector

The UWB market faces certain challenges, including the relatively high cost of UWB chips compared to other short-range wireless technologies, and the need for further standardization and interoperability across different UWB systems. Competition from alternative technologies, such as Bluetooth and Wi-Fi, also presents a challenge. These factors could potentially impact adoption rates in some segments.

Emerging Opportunities in Ultra-Wideband Market

The UWB market presents significant opportunities, particularly in emerging applications such as advanced driver-assistance systems (ADAS), augmented reality (AR) and virtual reality (VR) applications, and the Internet of Things (IoT). Expanding into new geographic markets and exploring untapped applications holds great potential for growth.

Leading Players in the Ultra-Wideband Market Market

- Humatics Corporation

- NXP Semiconductors NV

- Johanson Technology Inc

- Alereon Inc

- Qorvo Inc

- Texas Instruments Incorporated

- Pulse~Link Inc

- Zebra Technologies Corporation

- Fractus S

- Apple Inc

Key Developments in Ultra-Wideband Market Industry

- June 2024: Google enhanced its Find My Device network with ultra-wideband (UWB) and augmented reality (AR) support, improving location tracking for Android users.

- May 2024: Easelink and NXP Semiconductors launched a UWB-based positioning system for automated inductive charging, optimizing parking and charging efficiency.

Future Outlook for Ultra-Wideband Market Market

The future of the UWB market appears bright, with strong growth potential driven by technological advancements, increasing demand across various sectors, and supportive regulatory frameworks. Strategic partnerships and collaborations are expected to further accelerate market expansion, opening new avenues for innovation and adoption across a broader spectrum of applications. The market is poised for significant expansion in the coming years, with potential for substantial revenue generation.

Ultra-Wideband Market Segmentation

-

1. Application

- 1.1. RTLS

- 1.2. Imaging

- 1.3. Communication

Ultra-Wideband Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

Ultra-Wideband Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for RTLS applications; Increased Adoption of the Industrial Internet of Things (IIoT)

- 3.3. Market Restrains

- 3.3.1. Competition from the Substitute Products

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. RTLS

- 5.1.2. Imaging

- 5.1.3. Communication

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. RTLS

- 6.1.2. Imaging

- 6.1.3. Communication

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. RTLS

- 7.1.2. Imaging

- 7.1.3. Communication

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. RTLS

- 8.1.2. Imaging

- 8.1.3. Communication

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. RTLS

- 9.1.2. Imaging

- 9.1.3. Communication

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. RTLS

- 10.1.2. Imaging

- 10.1.3. Communication

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. RTLS

- 11.1.2. Imaging

- 11.1.3. Communication

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Humatics Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 NXP Semiconductors NV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johanson Technology Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Alereon Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Qorvo Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Texas Instruments Incorporated

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pulse~Link Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Zebra Technologies Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fractus S

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Apple Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Humatics Corporation

List of Figures

- Figure 1: Global Ultra-Wideband Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 3: North America Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Europe Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Europe Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Asia Pacific Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 11: Asia Pacific Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: Asia Pacific Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Asia Pacific Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Australia and New Zealand Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Australia and New Zealand Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Australia and New Zealand Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Australia and New Zealand Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Latin America Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Latin America Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Latin America Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Latin America Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Middle East Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra-Wideband Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Ultra-Wideband Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-Wideband Market?

The projected CAGR is approximately 17.53%.

2. Which companies are prominent players in the Ultra-Wideband Market?

Key companies in the market include Humatics Corporation, NXP Semiconductors NV, Johanson Technology Inc, Alereon Inc, Qorvo Inc, Texas Instruments Incorporated, Pulse~Link Inc, Zebra Technologies Corporation, Fractus S, Apple Inc.

3. What are the main segments of the Ultra-Wideband Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for RTLS applications; Increased Adoption of the Industrial Internet of Things (IIoT).

6. What are the notable trends driving market growth?

Consumer Electronics to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Competition from the Substitute Products.

8. Can you provide examples of recent developments in the market?

June 2024: Google enhanced its Find My Device network with ultra-wideband (UWB) and augmented reality (AR) support. These features, available in version 3.1.078-1, aim to provide precise location tracking for Android users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra-Wideband Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra-Wideband Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra-Wideband Market?

To stay informed about further developments, trends, and reports in the Ultra-Wideband Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence