Key Insights

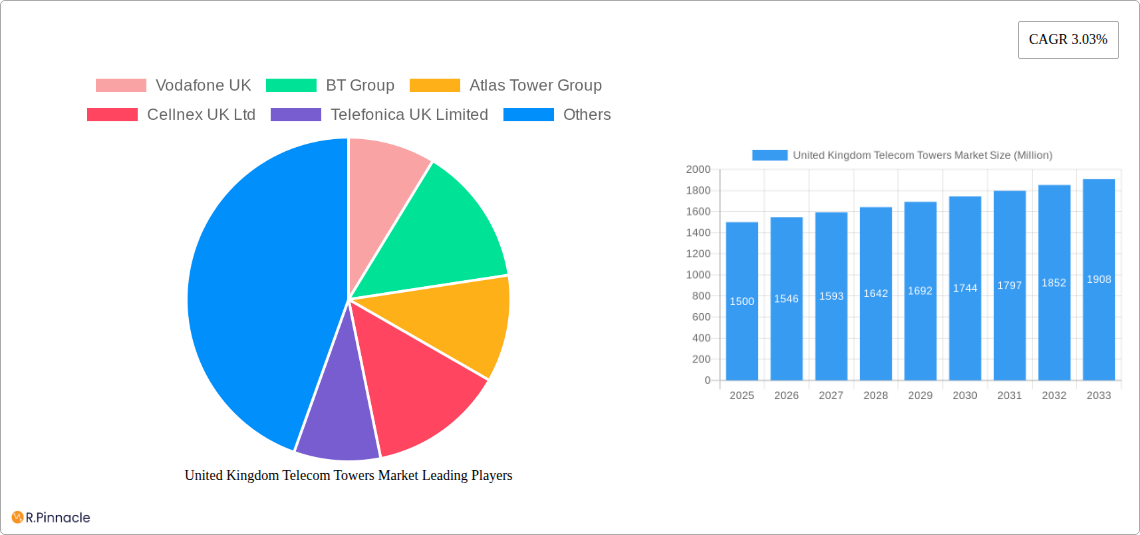

The United Kingdom Telecom Towers market, currently experiencing robust growth, is projected to reach a substantial size driven by increasing demand for enhanced mobile broadband services, 5G network rollout, and the rising adoption of IoT devices. The 3.03% CAGR from 2019-2033 indicates a steady, albeit moderate, expansion. This growth is fueled by the ongoing infrastructure upgrades necessary to support the burgeoning data consumption rates. Major players like Vodafone UK, BT Group, and Cellnex UK Ltd are key contributors, competing intensely for market share through strategic partnerships, acquisitions, and investments in new tower infrastructure. The market is segmented by tower type (macro, micro, small cells), ownership (independent, operator-owned), and geographic location. While regulatory hurdles and land acquisition challenges may pose some restraints, the overall market outlook remains positive, propelled by the continuous need for improved network coverage and capacity.

Further analysis suggests that the significant investments in 5G infrastructure are a primary driver of market expansion. The transition to 5G requires a denser network of towers, leading to increased demand for new tower construction and upgrades. The growing adoption of IoT technologies further intensifies this need, as a larger number of connected devices requires improved network capacity and wider coverage. Furthermore, the ongoing consolidation within the telecom industry through mergers and acquisitions has led to an increased focus on shared infrastructure and tower co-location, optimizing operational efficiency and reducing capital expenditure. This trend is likely to continue, further influencing market dynamics in the coming years. Competition among tower companies is expected to remain fierce, pushing them to innovate and offer attractive pricing and service packages to telecom operators.

United Kingdom Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom telecom towers market, offering actionable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, leading players, and future growth opportunities.

United Kingdom Telecom Towers Market Structure & Innovation Trends

This section analyzes the competitive landscape of the UK telecom towers market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report assesses market share held by key players such as Vodafone UK, BT Group, Atlas Tower Group, Cellnex UK Ltd, Telefonica UK Limited, Crown Castle UK Limited, Virgin Media O2, Wireless Infrastructure Group, Helios Towers, and Freshwav. We delve into the impact of mergers and acquisitions, quantifying deal values where possible (e.g., xx Million in 2023 M&A activity). The analysis incorporates details on regulatory frameworks influencing market growth and innovation, including the impact of spectrum allocation policies and infrastructure development initiatives. Product substitution trends and their effect on market dynamics are also discussed. Finally, we examine end-user demographics, including the increasing demand for 5G infrastructure and its influence on the market.

- Market Concentration: Analysis of market share distribution amongst key players.

- Innovation Drivers: Examination of technological advancements driving market growth (e.g., 5G, small cells).

- Regulatory Landscape: Evaluation of the impact of government regulations on market expansion.

- M&A Activity: Analysis of significant mergers and acquisitions, including deal values (xx Million).

- Product Substitutes: Discussion of alternative technologies and their impact on market share.

United Kingdom Telecom Towers Market Dynamics & Trends

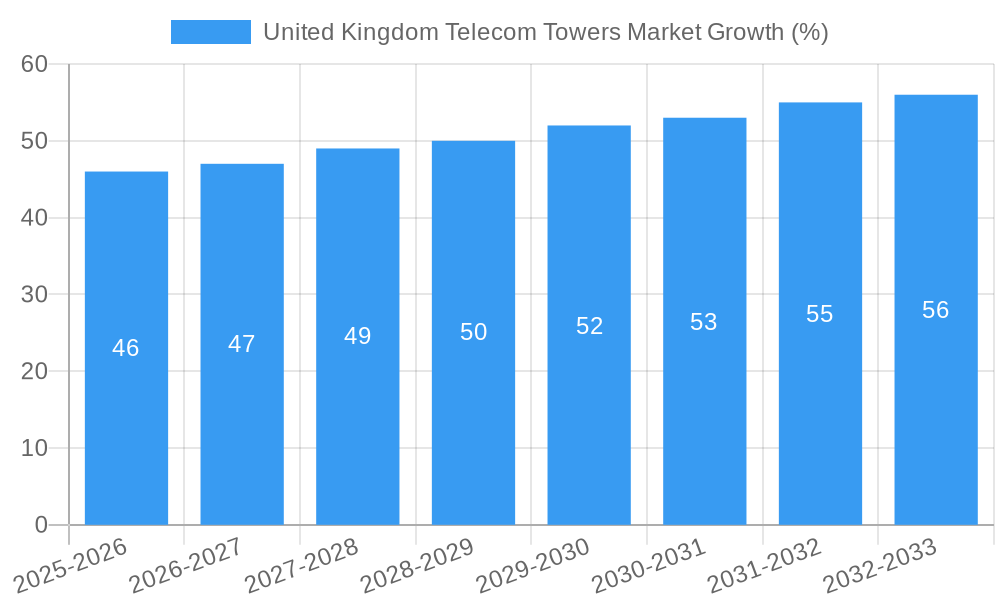

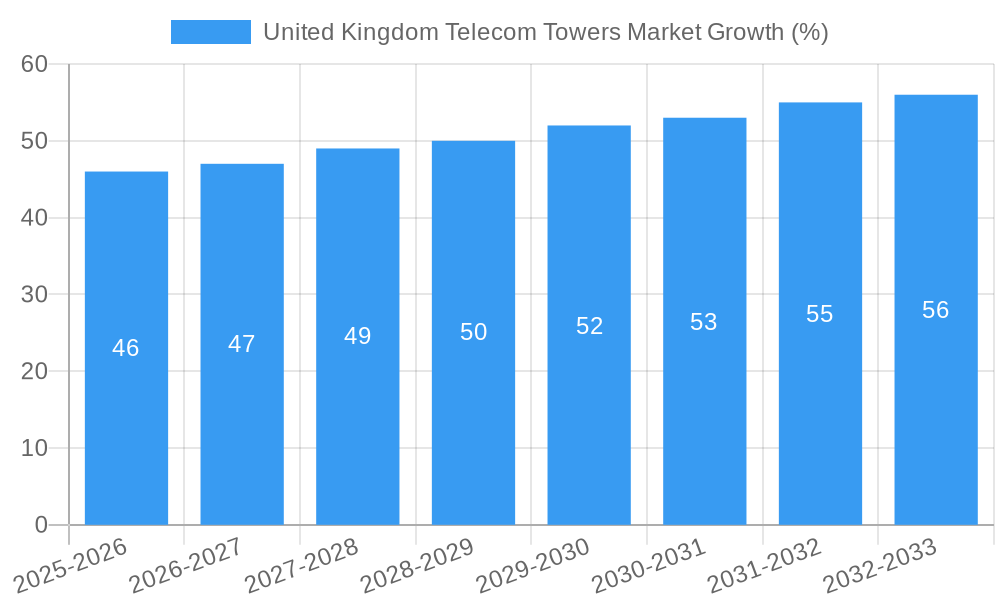

This section examines the market's growth trajectory, identifying key drivers and disruptive forces. We analyze the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) and assess market penetration rates for various technologies. We explore consumer preferences influencing market demand, and analyze the competitive dynamics between established players and emerging entrants. The interplay between technological advancements (e.g., 5G rollout, densification of networks) and consumer behavior is meticulously examined, along with their impact on market expansion. Specific market size values (in Million) for key segments are provided for the study period (2019-2024) and forecast period (2025-2033).

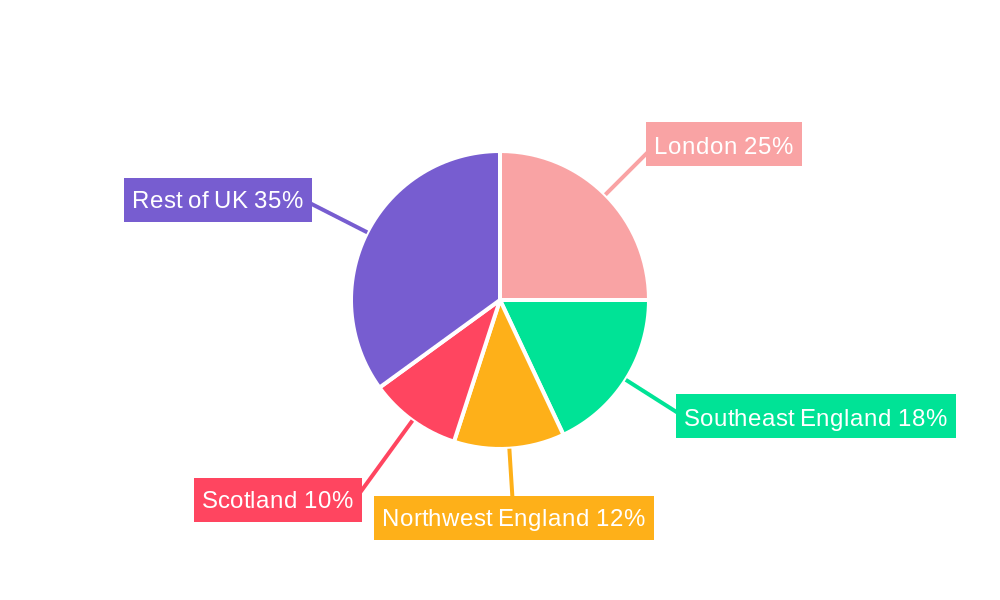

Dominant Regions & Segments in United Kingdom Telecom Towers Market

This section identifies the leading regions and segments within the UK telecom towers market. We present a detailed analysis of the factors driving dominance in these areas using both bullet points highlighting key drivers and paragraphs providing deeper insights. The analysis considers factors such as population density, economic development, existing infrastructure, and government policies influencing telecom infrastructure development.

- Key Drivers for Dominant Region/Segment:

- Economic Growth

- Infrastructure Development

- Government Policies

- Population Density

United Kingdom Telecom Towers Market Product Innovations

This section summarizes recent product developments, focusing on technological advancements and their market fit. We discuss the competitive advantages offered by these innovations and their impact on market dynamics. Examples may include new tower designs, improved materials, or smart tower technologies.

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report, including projected growth, market sizes (in Million), and competitive dynamics for each segment. This may include segments based on tower type, technology, location, or ownership model. Each segment receives a dedicated paragraph outlining its characteristics and market outlook.

Key Drivers of United Kingdom Telecom Towers Market Growth

This section outlines the key factors driving growth in the UK telecom towers market. This includes the rollout of 5G networks, increasing mobile data consumption, government initiatives promoting digital infrastructure, and the growth of the Internet of Things (IoT). Specific examples illustrating the impact of these drivers on market expansion are provided.

Challenges in the United Kingdom Telecom Towers Market Sector

This section discusses the challenges hindering market growth, including regulatory hurdles (e.g., planning permissions), supply chain disruptions, and intense competition. We quantify the impact of these challenges wherever possible, using metrics such as projected delays or cost increases.

Emerging Opportunities in United Kingdom Telecom Towers Market

This section highlights emerging opportunities in the UK telecom towers market, including the expansion of private 5G networks, the growth of IoT applications, and the potential for new partnerships and collaborations.

Leading Players in the United Kingdom Telecom Towers Market Market

- Vodafone UK

- BT Group

- Atlas Tower Group

- Cellnex UK Ltd

- Telefonica UK Limited

- Crown Castle UK Limited

- Virgin Media O2

- Wireless Infrastructure Group

- Helios Towers

- Freshwav

Key Developments in United Kingdom Telecom Towers Market Industry

- July 2024: Cellnex UK signed a long-term agreement with Vodafone and Virgin Media O2, strengthening their existing partnership and securing tower infrastructure supply. This significantly impacts market stability and resource allocation.

- May 2024: Virgin Media O2 and Accenture partnered to target the growing UK mobile private network market (projected to reach USD 673.41 Million by 2030), enhancing Virgin Media O2's 5G private network capabilities. This development signifies significant growth potential in a specific market niche.

Future Outlook for United Kingdom Telecom Towers Market Market

The UK telecom towers market is poised for continued growth, driven by the ongoing rollout of 5G, increasing demand for mobile data, and the expansion of IoT applications. Strategic partnerships and investments in infrastructure development will play a crucial role in shaping the market's future. The report concludes with a forecast of market size (in Million) for the coming years, highlighting key opportunities for investors and industry participants.

United Kingdom Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive Sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

United Kingdom Telecom Towers Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 3.4. Market Trends

- 3.4.1. 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive Sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vodafone UK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BT Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atlas Tower Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cellnex UK Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telefonica UK Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Castle UK Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virgin Media O2

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wireless Infrastructure Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Helios Towers

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Freshwav

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vodafone UK

List of Figures

- Figure 1: United Kingdom Telecom Towers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Telecom Towers Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: United Kingdom Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: United Kingdom Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: United Kingdom Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: United Kingdom Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: United Kingdom Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: United Kingdom Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Telecom Towers Market?

The projected CAGR is approximately 3.03%.

2. Which companies are prominent players in the United Kingdom Telecom Towers Market?

Key companies in the market include Vodafone UK, BT Group, Atlas Tower Group, Cellnex UK Ltd, Telefonica UK Limited, Crown Castle UK Limited, Virgin Media O2, Wireless Infrastructure Group, Helios Towers, Freshwav.

3. What are the main segments of the United Kingdom Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

6. What are the notable trends driving market growth?

5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G Deployment Acts as a Major Catalyst for Growth in the Cell-tower Leasing Environment.

8. Can you provide examples of recent developments in the market?

July 2024: Cellnex UK signed a long-term agreement with Vodafone and Virgin Media O2, supplying the two MNOs with tower infrastructure and related services. This agreement fortifies and expands the existing partnership, ensuring stability for all parties involved.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Telecom Towers Market?

To stay informed about further developments, trends, and reports in the United Kingdom Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence