Key Insights

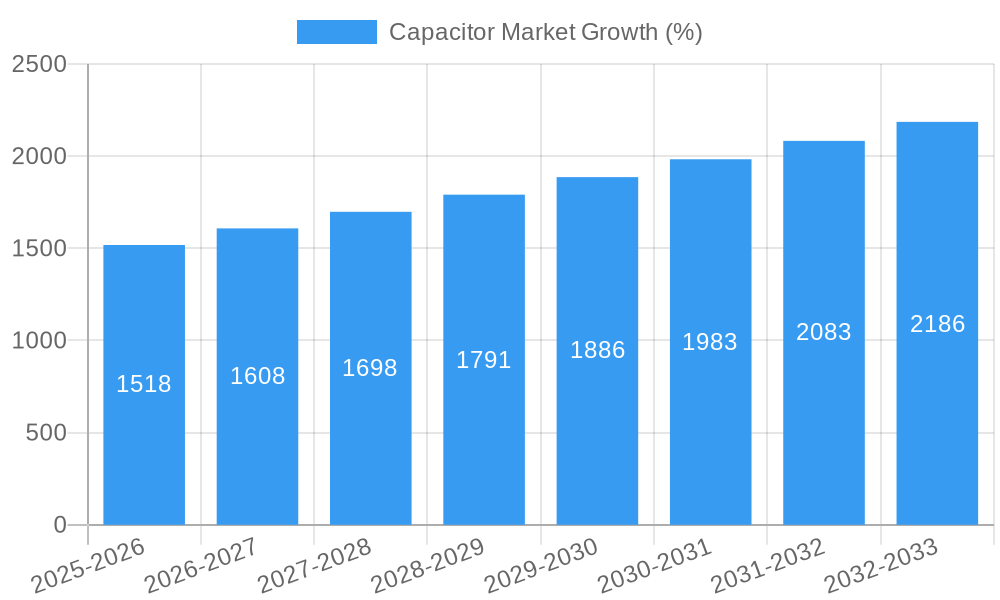

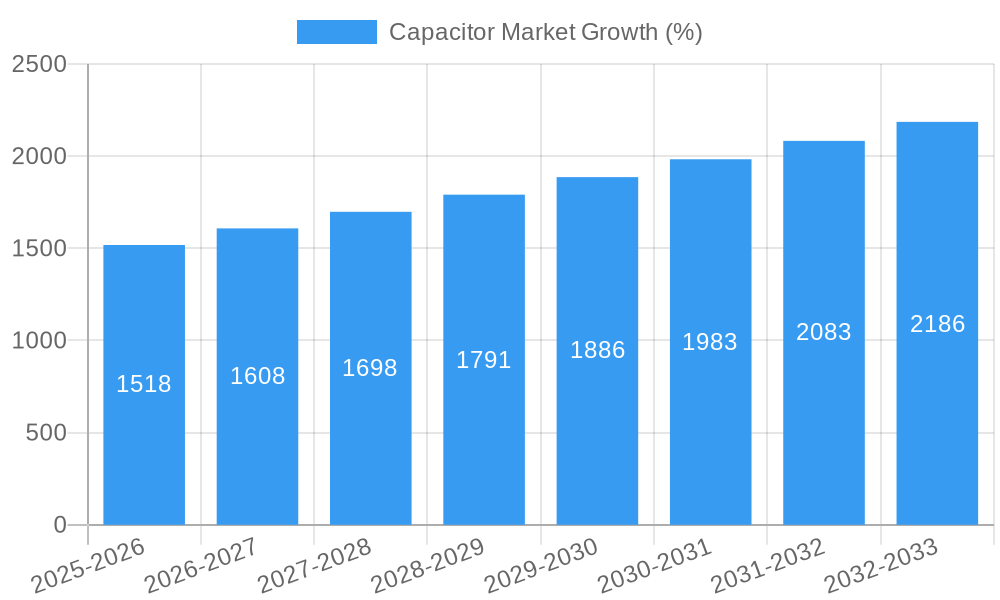

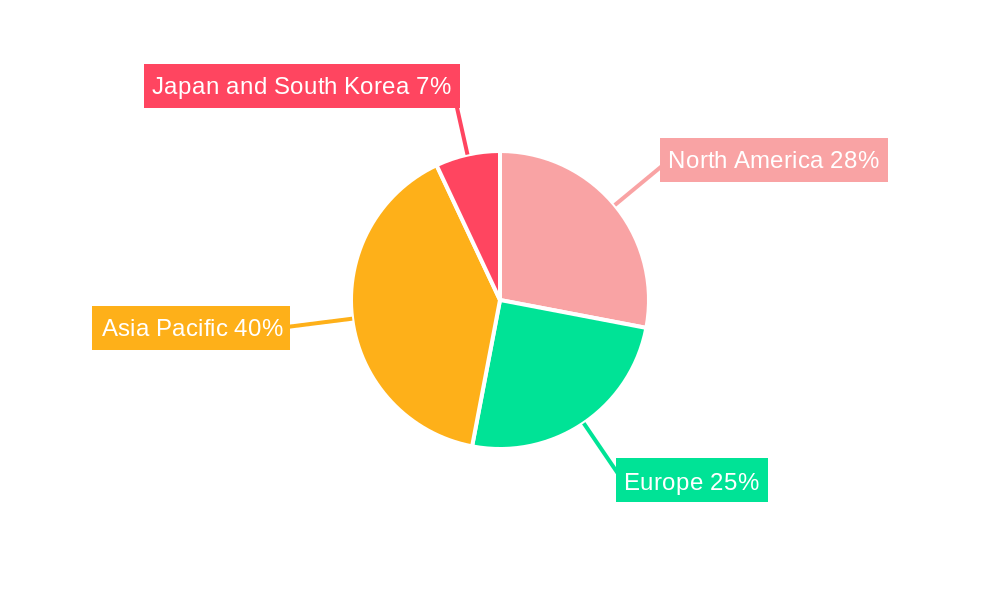

The global capacitor market, valued at $25.21 billion in 2025, is projected to experience robust growth, driven by the increasing demand for electronic components across diverse sectors. A compound annual growth rate (CAGR) of 5.90% from 2025 to 2033 indicates a significant expansion, reaching an estimated market value exceeding $40 billion by 2033. Key drivers include the proliferation of electric vehicles (EVs), the expansion of renewable energy infrastructure (solar, wind), and the surging adoption of advanced technologies in consumer electronics, 5G communication networks, and industrial automation. The automotive sector is a major contributor, fueled by the rising demand for advanced driver-assistance systems (ADAS) and the electrification of vehicles. Growth is also propelled by miniaturization trends in electronics, requiring higher-density and more efficient capacitor solutions. Market segmentation reveals strong performance across various capacitor types, with ceramic, tantalum, and aluminum electrolytic capacitors maintaining significant market share, while supercapacitors are witnessing impressive growth due to their high energy density and long lifespan. Regional analysis suggests that the Asia Pacific region, driven by strong manufacturing bases and growing electronics consumption in countries like China and India, will likely dominate the market, followed by North America and Europe. However, the market faces some restraints, primarily including fluctuating raw material prices and supply chain complexities.

Despite these challenges, the long-term outlook for the capacitor market remains optimistic. Continued technological advancements, such as the development of advanced materials and improved manufacturing processes, are expected to enhance capacitor performance, leading to wider adoption across diverse applications. Furthermore, increasing investments in research and development to enhance energy storage capabilities will drive demand for higher-capacity capacitors, further bolstering market growth. The competitive landscape features a mix of established players and emerging companies, fostering innovation and competition, ultimately benefiting consumers and driving down costs. Strategic partnerships, mergers, and acquisitions are also likely to reshape the market dynamics in the coming years. This growth will be further augmented by expanding applications in Internet of Things (IoT) devices, smart grids, and medical devices, all requiring reliable and efficient energy storage solutions.

Capacitor Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global capacitor market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. This report forecasts market growth from 2025 to 2033 and analyzes historical data from 2019-2024. The market is segmented by type (Ceramic Capacitors, Tantalum Capacitors, Aluminum Electrolytic Capacitors, Paper and Plastic Film Capacitors, Supercapacitors/EDLCs) and end-user industry (Automotive, Industrial, Aerospace and Defense, Energy, Communications/Servers/Data Storage, Consumer Electronics, Medical). The report values are in Millions.

Capacitor Market Structure & Innovation Trends

The global capacitor market is characterized by a moderately concentrated structure, with key players such as Vishay Intertechnology Inc, KEMET Corporation, Murata Manufacturing Co Ltd, and TDK Corporation holding significant market share. Precise market share figures are xx% for each company in 2025. Innovation in the capacitor market is driven by the increasing demand for miniaturization, higher energy density, improved performance, and enhanced safety features in electronic devices across various sectors. Regulatory frameworks, particularly concerning safety and environmental compliance, significantly influence product development and market entry. The market sees continuous innovation with new materials, designs, and manufacturing processes. Product substitutes, such as alternative energy storage solutions, present a challenge, though their market penetration remains relatively low at xx% in 2025. M&A activity within the capacitor sector is moderate; recent deals totaled an estimated xx Million in 2024.

Capacitor Market Dynamics & Trends

The capacitor market is experiencing robust growth, driven primarily by the escalating demand from the electronics industry. The CAGR for the forecast period (2025-2033) is estimated at xx%. Technological advancements, such as the development of high-performance capacitors for electric vehicles and renewable energy applications, are key drivers. Consumer preferences for smaller, lighter, and more energy-efficient electronic devices are fueling the demand for advanced capacitor technologies. Competitive dynamics are intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to gain a competitive edge. Market penetration of new capacitor technologies varies significantly, with xx% market share for advanced ceramic capacitors in 2025.

Dominant Regions & Segments in Capacitor Market

- Leading Region: Asia-Pacific continues its reign as the dominant force in the global capacitor market. This leadership is largely propelled by the robust expansion of the consumer electronics and automotive sectors within the region, with China, Japan, and South Korea spearheading this growth.

- Leading Segment (Type): Ceramic capacitors maintain their leading position, boasting the largest market share. Their ubiquity in a vast array of electronic devices, coupled with their inherent cost-effectiveness and versatility, underpins their continued dominance.

- Leading Segment (End-user Industry): The automotive industry stands out as a primary consumer of capacitors. This surge is directly attributable to the accelerating adoption of electric and hybrid vehicles, the proliferation of advanced driver-assistance systems (ADAS), and the increasing integration of connected car technologies.

Key Drivers for Dominant Regions/Segments:

- Asia-Pacific: The region benefits from sustained rapid economic development, a burgeoning electronics manufacturing ecosystem, and proactive government initiatives aimed at fostering technological advancement.

- Automotive: Stringent government mandates and incentives driving the transition towards electric vehicles, alongside the escalating complexity and sophistication of automotive electronic systems, are significant drivers.

- Ceramic Capacitors: Their competitive edge lies in their exceptional cost-efficiency, high performance capabilities, and remarkable suitability for the miniaturization trend prevalent across electronic devices.

Capacitor Market Product Innovations

The capacitor market is witnessing a dynamic wave of product innovation. Key advancements include the development of high-temperature capacitors specifically engineered for the demanding automotive environment, ultra-miniaturized capacitors catering to the ever-shrinking form factors of portable electronics, and sophisticated energy storage solutions designed for the burgeoning renewable energy sector. These innovations underscore a concerted effort to elevate energy density, dramatically reduce physical dimensions, and substantially enhance performance parameters to align with the relentless evolution of technological landscapes. The ultimate success and widespread adoption of these innovations will be contingent upon their ability to meet stringent performance benchmarks and economic constraints, while simultaneously offering discernible competitive advantages to manufacturers and end-users.

Report Scope & Segmentation Analysis

By Type:

- Ceramic Capacitors: This segment is expected to witness xx% CAGR during the forecast period, driven by its wide range of applications. The market is highly competitive.

- Tantalum Capacitors: The growth of this segment is projected at xx% CAGR. It is facing challenges from the increasing adoption of ceramic capacitors.

- Aluminum Electrolytic Capacitors: The market size for aluminum electrolytic capacitors is xx Million in 2025, and projected to grow at a CAGR of xx%.

- Paper and Plastic Film Capacitors: This segment holds a significant market share, with a projected growth of xx%.

- Supercapacitors/EDLCs: This segment is expected to exhibit rapid growth due to increasing demand in electric vehicles and energy storage applications, growing at xx% CAGR.

By End-user Industry: Each segment experiences a unique growth rate driven by its respective industry trends. The Automotive sector, with an estimated market size of xx Million in 2025, exhibits the highest growth potential.

Key Drivers of Capacitor Market Growth

The capacitor market's growth trajectory is primarily steered by the escalating demand for electronic components that are both compact and high-performing, serving an increasingly diverse range of industries. The continued expansion of pivotal sectors such as automotive, consumer electronics, and renewable energy serves as a powerful catalyst for capacitor consumption. Furthermore, government-led initiatives focused on promoting energy efficiency and environmental sustainability are playing a crucial role in accelerating market growth. Concurrently, breakthroughs in materials science and continuous improvements in manufacturing technologies are consistently pushing the boundaries of capacitor performance and driving down production costs.

Challenges in the Capacitor Market Sector

The capacitor market faces challenges such as fluctuating raw material prices, supply chain disruptions, and intense competition from Asian manufacturers. Stringent environmental regulations and the emergence of substitute technologies pose additional hurdles. These factors can affect production costs and market profitability, resulting in reduced profit margins. Specific quantifiable impacts are xx% increase in raw material costs in 2024.

Emerging Opportunities in Capacitor Market

The capacitor market is ripe with significant opportunities, particularly in the development of high-energy-density capacitors tailored for the burgeoning electric vehicle market, robust grid-scale energy storage systems, and advanced electronics applications requiring exceptional power management. The proliferation of Internet of Things (IoT) devices and the rapid rollout of 5G technology present further avenues for substantial market expansion. Moreover, pioneering innovations in materials science hold the potential to unlock the development of novel capacitor technologies offering unprecedented performance characteristics and efficiency gains.

Leading Players in the Capacitor Market Market

- Vishay Intertechnology Inc

- KEMET Corporation

- Lelon Electronics Corp

- WIMA GmbH & Co KG

- Cornell Dubilier Electronics Inc

- Eaton Corporation PLC

- Würth Elektronik eiSos GmbH & Co KG

- United Chemi-Con (Nippon Chemi-Con Corporation)

- Yageo Corporation

- TDK Corporation

- Murata Manufacturing Co Ltd

- KYOCERA AVX Components Corporation

- Panasonic Corporation

- Honeywell International Inc

Key Developments in Capacitor Market Industry

- November 2023: KYOCERA AVX launched safety-certified MLCCs (KGK and KGH series), enhancing its product portfolio and targeting safety-critical applications.

- March 2023: Murata Manufacturing expanded its silicon capacitor production line in France, boosting capacity for telecommunication, medical, and mobile applications.

Future Outlook for Capacitor Market Market

The future of the capacitor market appears bright, driven by technological advancements, increasing demand from diverse sectors, and the emergence of new applications. Strategic partnerships, mergers and acquisitions, and continuous product innovation will be crucial for success in this dynamic and competitive landscape. The market is poised for substantial growth in the coming years, with opportunities for both established players and new entrants.

Capacitor Market Segmentation

-

1. Type

- 1.1. Ceramic Capacitors

- 1.2. Tantalum Capacitors

- 1.3. Aluminum Electrolytic Capacitors

- 1.4. Paper and Plastic Film Capacitors

- 1.5. Supercapacitors/EDLCs

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Aerospace and Defense

- 2.4. Energy

- 2.5. Communications/Servers/Data Storage

- 2.6. Consumer Electronics

- 2.7. Medical

Capacitor Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia Pacific

- 4. Japan and South Korea

Capacitor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of EVs to Boost the Demand for Capacitors; Increasing Adoption of Capacitors in the Telecom and Electronics Industry

- 3.3. Market Restrains

- 3.3.1. Requirement of Technical Competence for Developing Advanced Capacitors

- 3.4. Market Trends

- 3.4.1. Ceramic Capacitors to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ceramic Capacitors

- 5.1.2. Tantalum Capacitors

- 5.1.3. Aluminum Electrolytic Capacitors

- 5.1.4. Paper and Plastic Film Capacitors

- 5.1.5. Supercapacitors/EDLCs

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy

- 5.2.5. Communications/Servers/Data Storage

- 5.2.6. Consumer Electronics

- 5.2.7. Medical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Japan and South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Americas Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ceramic Capacitors

- 6.1.2. Tantalum Capacitors

- 6.1.3. Aluminum Electrolytic Capacitors

- 6.1.4. Paper and Plastic Film Capacitors

- 6.1.5. Supercapacitors/EDLCs

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Aerospace and Defense

- 6.2.4. Energy

- 6.2.5. Communications/Servers/Data Storage

- 6.2.6. Consumer Electronics

- 6.2.7. Medical

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ceramic Capacitors

- 7.1.2. Tantalum Capacitors

- 7.1.3. Aluminum Electrolytic Capacitors

- 7.1.4. Paper and Plastic Film Capacitors

- 7.1.5. Supercapacitors/EDLCs

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Aerospace and Defense

- 7.2.4. Energy

- 7.2.5. Communications/Servers/Data Storage

- 7.2.6. Consumer Electronics

- 7.2.7. Medical

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ceramic Capacitors

- 8.1.2. Tantalum Capacitors

- 8.1.3. Aluminum Electrolytic Capacitors

- 8.1.4. Paper and Plastic Film Capacitors

- 8.1.5. Supercapacitors/EDLCs

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Aerospace and Defense

- 8.2.4. Energy

- 8.2.5. Communications/Servers/Data Storage

- 8.2.6. Consumer Electronics

- 8.2.7. Medical

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan and South Korea Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ceramic Capacitors

- 9.1.2. Tantalum Capacitors

- 9.1.3. Aluminum Electrolytic Capacitors

- 9.1.4. Paper and Plastic Film Capacitors

- 9.1.5. Supercapacitors/EDLCs

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Aerospace and Defense

- 9.2.4. Energy

- 9.2.5. Communications/Servers/Data Storage

- 9.2.6. Consumer Electronics

- 9.2.7. Medical

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Americas Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Japan and South Korea Capacitor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Vishay Intertechnology Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 KEMET Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Lelon Electronics Corp

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 WIMA GmbH & Co KG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Cornell Dubilier Electronics Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Eaton Corporation PLC

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Würth Elektronik eiSos GmbH & Co KG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 United Chemi-Con (Nippon Chemi-Con Corporation)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Yageo Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 TDK Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Murata Manufacturing Co Ltd

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 KYOCERA AVX Components Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Panasonic Corporation

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Honeywell International Inc *List Not Exhaustive

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Capacitor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Americas Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Americas Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Japan and South Korea Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Japan and South Korea Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Americas Capacitor Market Revenue (Million), by Type 2024 & 2032

- Figure 11: Americas Capacitor Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: Americas Capacitor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: Americas Capacitor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: Americas Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Americas Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Capacitor Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Capacitor Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Capacitor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Capacitor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Capacitor Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Capacitor Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Capacitor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Capacitor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Capacitor Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Japan and South Korea Capacitor Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Japan and South Korea Capacitor Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Japan and South Korea Capacitor Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Japan and South Korea Capacitor Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Japan and South Korea Capacitor Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Japan and South Korea Capacitor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Capacitor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Capacitor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Capacitor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Capacitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Capacitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Capacitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Capacitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Capacitor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Capacitor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Capacitor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Capacitor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Capacitor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capacitor Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Capacitor Market?

Key companies in the market include Vishay Intertechnology Inc, KEMET Corporation, Lelon Electronics Corp, WIMA GmbH & Co KG, Cornell Dubilier Electronics Inc, Eaton Corporation PLC, Würth Elektronik eiSos GmbH & Co KG, United Chemi-Con (Nippon Chemi-Con Corporation), Yageo Corporation, TDK Corporation, Murata Manufacturing Co Ltd, KYOCERA AVX Components Corporation, Panasonic Corporation, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Capacitor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of EVs to Boost the Demand for Capacitors; Increasing Adoption of Capacitors in the Telecom and Electronics Industry.

6. What are the notable trends driving market growth?

Ceramic Capacitors to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Requirement of Technical Competence for Developing Advanced Capacitors.

8. Can you provide examples of recent developments in the market?

November 2023: KYOCERA AVX, a respected global manufacturer of advanced electronic components, has enhanced its wide range of commercial surface-mount MLCCs by introducing its inaugural safety-certified MLCCs. These new additions include the KGK Series, which possesses the Class X1/Y2 safety certification, and the KGH Series, which boasts the Class X2 safety certification. These Class-X and Class-Y certified capacitors have been specifically engineered to safeguard against surges and transients while also delivering effective EMI filtering in AC line filtering applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capacitor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capacitor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capacitor Market?

To stay informed about further developments, trends, and reports in the Capacitor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence