Key Insights

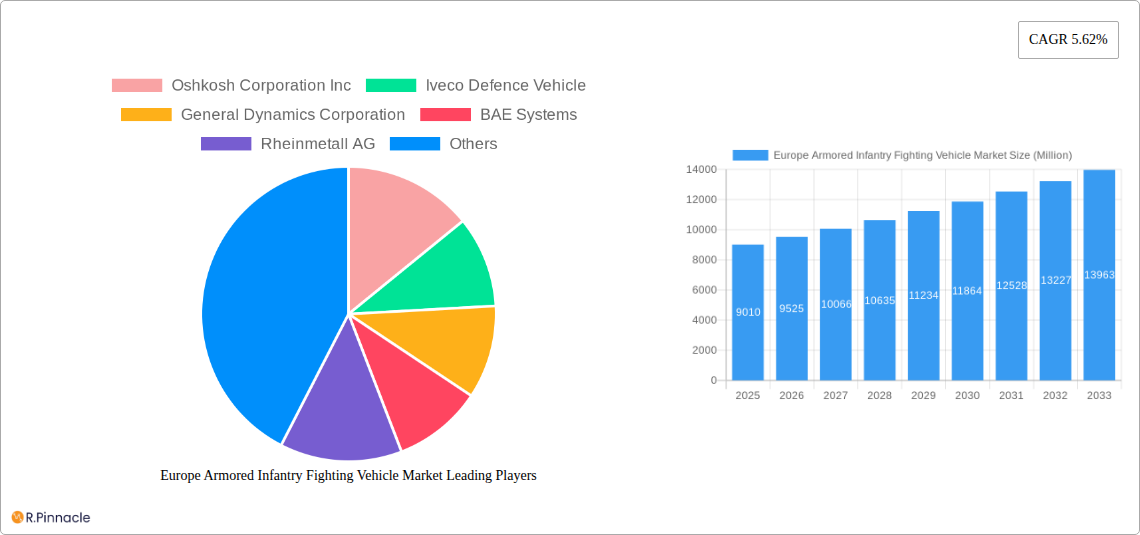

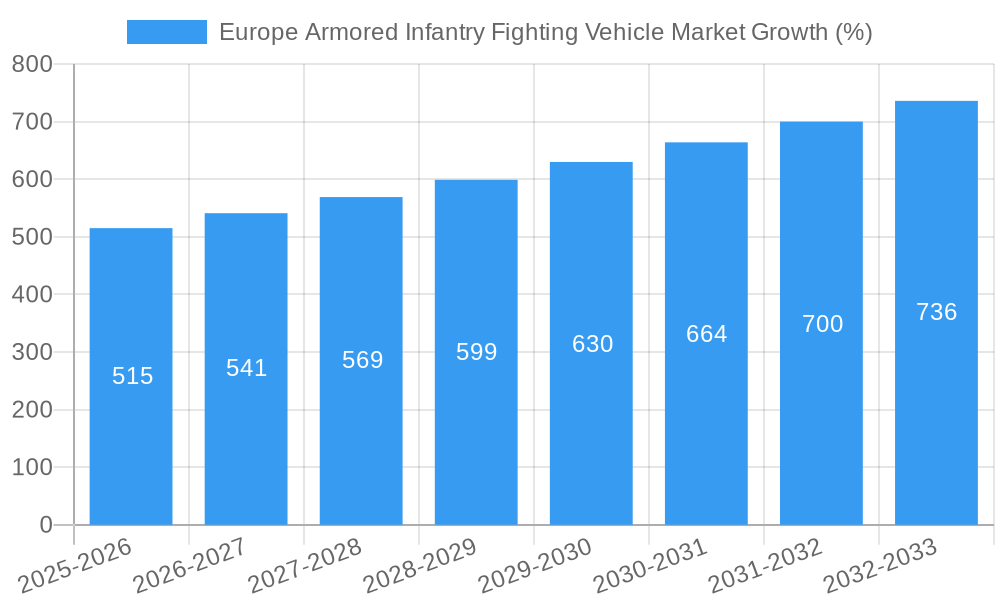

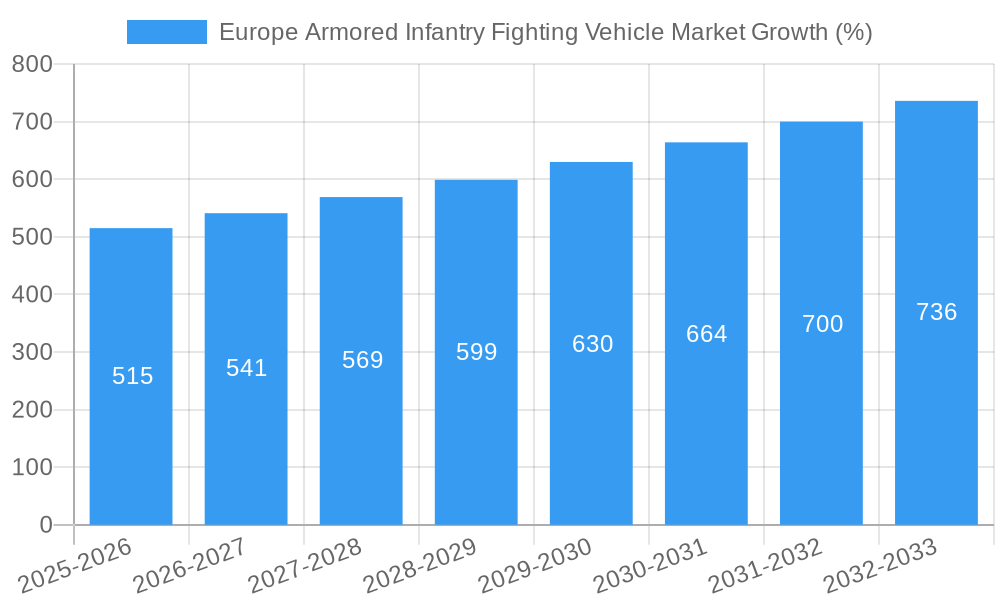

The European Armored Infantry Fighting Vehicle (AIFV) market, valued at €9.01 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization of military fleets across European nations, and increasing demand for advanced technological integration within AIFVs. The market's Compound Annual Growth Rate (CAGR) of 5.62% from 2025 to 2033 reflects a steady expansion, fueled by significant investments in defense budgets across key European countries like Germany, the United Kingdom, and France. These nations are prioritizing the acquisition of new AIFVs to enhance their operational capabilities and address evolving battlefield requirements. Furthermore, the ongoing conflict in Ukraine has underscored the critical need for robust and technologically advanced armored vehicles, thereby accelerating procurement plans across the region. The market segmentation, which includes various AIFV types such as Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), and Main Battle Tanks (MBTs), along with differing national markets, reflects the diverse needs and strategic priorities of individual European nations. The competitive landscape is characterized by a mix of established defense contractors and emerging players, each vying for market share through technological innovation and strategic partnerships.

Continued growth will be influenced by several factors. Technological advancements in areas such as active protection systems, improved mobility, and enhanced lethality are key drivers. Government policies favoring domestic defense manufacturing and collaborative programs between nations could also significantly contribute to market expansion. However, potential restraints include budgetary constraints, especially in countries facing economic challenges, and the ongoing shift towards lighter, more agile platforms. Nevertheless, the long-term outlook for the European AIFV market remains positive, with consistent demand projected throughout the forecast period driven by sustained geopolitical instability and the imperative to maintain a strong defense posture. The involvement of major players like Oshkosh Corporation, Iveco Defence Vehicles, and BAE Systems highlights the intense competition and the high stakes in this crucial sector.

Europe Armored Infantry Fighting Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Armored Infantry Fighting Vehicle (AIFV) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this analysis is 2025. The report reveals market size, growth drivers, challenges, and emerging opportunities within this dynamic sector. Expected market value is estimated at xx Million for the year 2025 and projected to reach xx Million by 2033. Key players analyzed include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), and Military Industrial Company.

Europe Armored Infantry Fighting Vehicle Market Market Structure & Innovation Trends

The European AIFV market exhibits a moderately concentrated structure, with several key players holding significant market share. Market share dynamics are influenced by factors such as technological innovation, government defense budgets, and strategic partnerships. Innovation drivers include the development of advanced armor, improved mobility, enhanced firepower, and the integration of sophisticated electronic warfare systems. Stringent regulatory frameworks governing the development, production, and export of military equipment shape the market landscape. Product substitutes, such as unmanned ground vehicles (UGVs), are gaining traction but haven't yet significantly disrupted the AIFV market. End-user demographics primarily comprise national armed forces and allied international forces. M&A activities have played a significant role in consolidating the market, with notable deals valued at xx Million over the past five years. Further consolidation is anticipated in the coming years. For example, the merger between Company A and Company B in 2022 resulted in a xx% increase in market share for the combined entity.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Advanced armor, enhanced mobility, improved firepower, electronic warfare integration.

- Regulatory Frameworks: Stringent regulations governing production, export, and safety standards.

- M&A Activities: Significant consolidation over the past 5 years, with deals totaling approximately xx Million.

Europe Armored Infantry Fighting Vehicle Market Market Dynamics & Trends

The European AIFV market is experiencing steady growth, driven primarily by increasing geopolitical instability and the need for modernization of defense capabilities across various European nations. Technological disruptions, such as the integration of AI and autonomous capabilities, are transforming the sector. Consumer preferences are shifting towards lighter, more agile, and technologically advanced vehicles with improved survivability. Competitive dynamics are marked by intense rivalry among established players, each vying to differentiate their offerings through technological innovation and strategic partnerships. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration is expected to increase significantly as countries upgrade their existing fleets and invest in next-generation AIFVs. Factors like increasing defense budgets, technological advancements, and geopolitical tensions are fueling market growth, while the high cost of procurement and limited defense spending in some countries pose challenges.

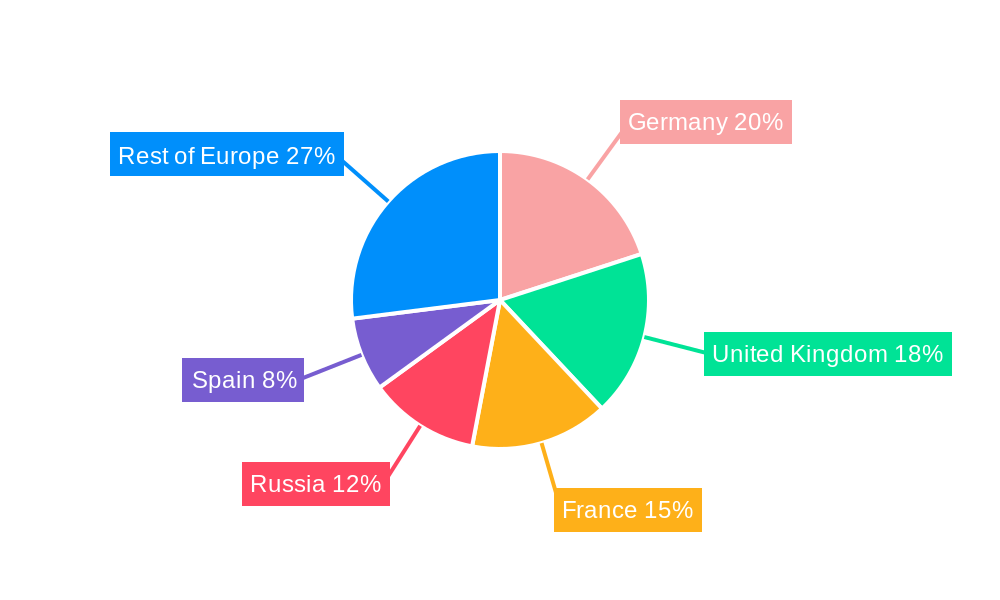

Dominant Regions & Segments in Europe Armored Infantry Fighting Vehicle Market

Germany, the United Kingdom, and France are the dominant markets within Europe for AIFVs, owing to substantial defense budgets, robust indigenous defense industries, and active participation in international military alliances. Russia and Spain also hold notable market positions, with regional variations based on defense priorities and economic factors. The "Rest of Europe" segment shows significant potential for future growth. The Infantry Fighting Vehicle (IFV) segment holds the largest market share due to its versatility and operational effectiveness across diverse terrains and scenarios. Key drivers for each region include:

Germany: Strong domestic defense industry, substantial defense spending, and geopolitical considerations.

United Kingdom: Large defense budget, commitment to NATO, and modernization of armed forces.

France: Significant defense industry, robust military capabilities, and active participation in international operations.

Russia: Large domestic military requirements, focus on domestic production, and technological advancements.

Spain: Moderate defense budget, growing emphasis on military modernization, and participation in international alliances.

Rest of Europe: Emerging demand driven by improving defense budgets and regional stability concerns.

Segment Dominance: The IFV segment commands the largest market share, followed by APC. MBTs represent a smaller but strategically important segment.

Europe Armored Infantry Fighting Vehicle Market Product Innovations

Recent product innovations within the European AIFV market focus on incorporating advanced materials, enhancing protection levels, improving mobility, and integrating advanced sensor and communication systems. Manufacturers are striving to increase the versatility and adaptability of their vehicles to meet the evolving operational needs of modern warfare. The emphasis is on enhancing situational awareness, improving survivability, and integrating autonomous features to optimize battlefield performance. The market sees a trend towards lighter, more fuel-efficient designs without compromising protection and firepower.

Report Scope & Segmentation Analysis

This report segments the European AIFV market by type (Armored Personnel Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), and Other Types) and by country (Germany, United Kingdom, France, Russia, Spain, and Rest of Europe). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the IFV segment is projected to experience a significant CAGR of xx% during the forecast period due to increasing demand for modernized armored vehicles. The APC segment is anticipated to grow steadily, driven by demand for troop transport and reconnaissance vehicles.

Key Drivers of Europe Armored Infantry Fighting Vehicle Market Growth

The European AIFV market is driven by several factors, including rising geopolitical tensions leading to increased defense spending, technological advancements enhancing vehicle capabilities, modernization of existing fleets in several countries, and growing demand for superior armored protection in dynamic environments. Government policies encouraging domestic manufacturing and technological advancements play a vital role.

Challenges in the Europe Armored Infantry Fighting Vehicle Market Sector

Challenges within the European AIFV market include high procurement costs, stringent regulatory approvals and certifications, fluctuations in global defense budgets, and increasing competition among manufacturers. Supply chain disruptions caused by global events can also impact production and delivery timelines. These challenges need to be navigated effectively for sustained growth. These issues may lead to delays in projects and increased overall costs.

Emerging Opportunities in Europe Armored Infantry Fighting Vehicle Market

The European AIFV market presents opportunities in developing lighter, more fuel-efficient vehicles, integrating advanced technologies like AI and autonomous systems, exploring export markets in regions with high defense expenditure, and focusing on sustainable and environmentally friendly vehicle technologies. These innovations can provide significant competitive advantages.

Leading Players in the Europe Armored Infantry Fighting Vehicle Market Market

- Oshkosh Corporation Inc

- Iveco Defence Vehicle

- General Dynamics Corporation

- BAE Systems

- Rheinmetall AG

- ARQUUS Defense

- KNDS N V

- Patria

- Supacat Limited (SC Group)

- Military Industrial Company

Key Developments in Europe Armored Infantry Fighting Vehicle Market Industry

- January 2023: Rheinmetall AG announces a major contract for the supply of IFVs to an undisclosed European nation.

- June 2022: BAE Systems unveils a new generation of APC with enhanced protection features.

- November 2021: General Dynamics Corporation successfully completes trials for its latest IFV prototype. (Further developments can be added here as they become available)

Future Outlook for Europe Armored Infantry Fighting Vehicle Market Market

The future outlook for the European AIFV market remains positive, driven by ongoing modernization efforts, increased defense budgets, and technological advancements. Strategic partnerships and collaborations are expected to play a significant role in shaping the market's future. The market will continue its growth trajectory driven by consistent defense modernization programs across Europe. The demand for sophisticated, versatile, and technologically advanced AIFVs will ensure market stability and continued growth.

Europe Armored Infantry Fighting Vehicle Market Segmentation

-

1. Type

- 1.1. Armored Personal Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

Europe Armored Infantry Fighting Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Armored Infantry Fighting Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personal Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Oshkosh Corporation Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Iveco Defence Vehicle

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Dynamics Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BAE Systems

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Rheinmetall AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ARQUUS Defense

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KNDS N V

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Patria

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Supacat Limited (SC Group)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Military Industrial Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Oshkosh Corporation Inc

List of Figures

- Figure 1: Europe Armored Infantry Fighting Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Armored Infantry Fighting Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Armored Infantry Fighting Vehicle Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Europe Armored Infantry Fighting Vehicle Market?

Key companies in the market include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), Military Industrial Company.

3. What are the main segments of the Europe Armored Infantry Fighting Vehicle Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Armored Infantry Fighting Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Armored Infantry Fighting Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Armored Infantry Fighting Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Armored Infantry Fighting Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence