Key Insights

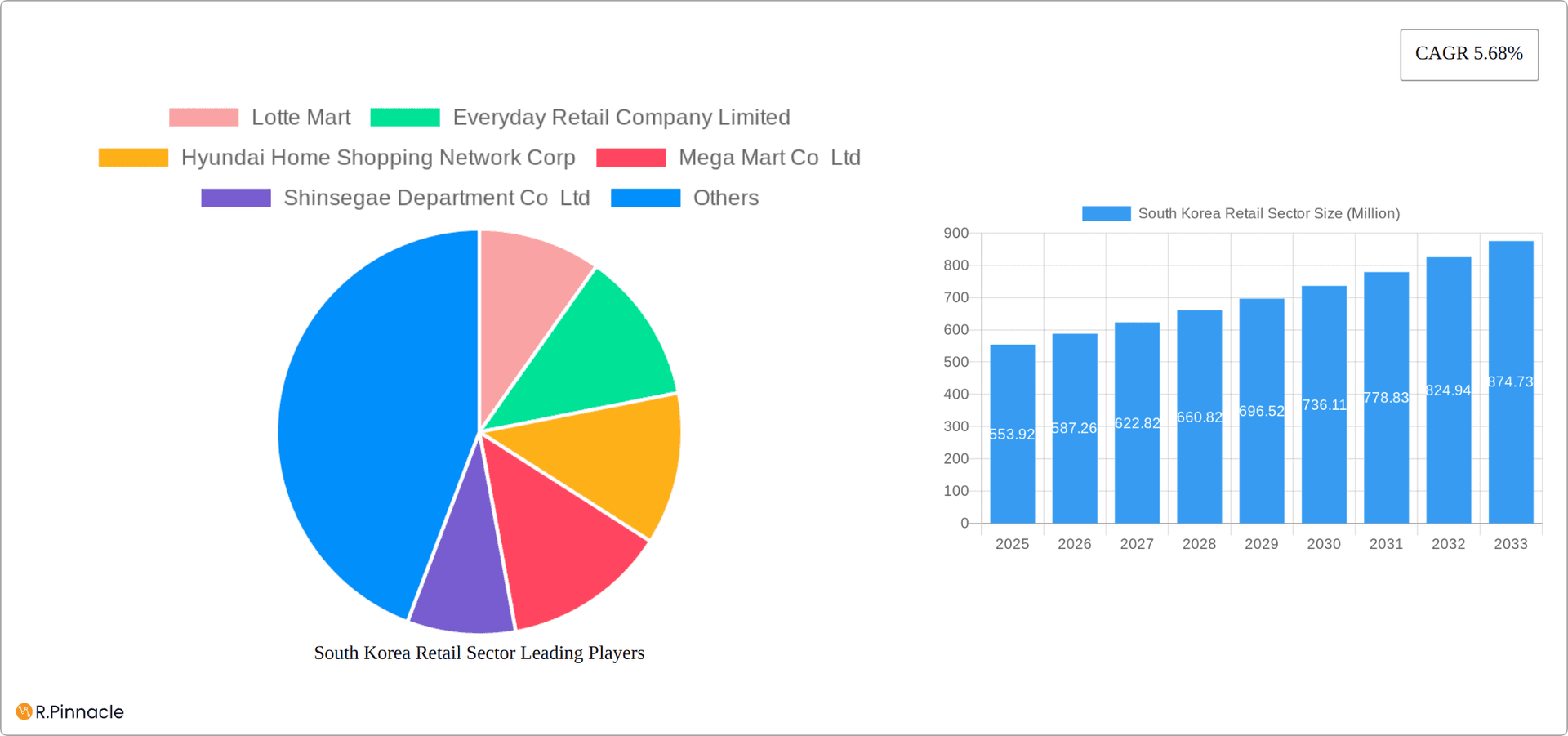

The South Korean retail sector, valued at $553.92 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.68% from 2025 to 2033. This growth is fueled by several key factors. The increasing disposable incomes of South Korean consumers, coupled with a burgeoning middle class, are driving higher spending on retail goods and services. Furthermore, the rapid adoption of e-commerce and omnichannel strategies by major players like Lotte Mart, E-Mart Inc., and Shinsegae Department Co Ltd, is significantly impacting sales growth. The convenience offered by online shopping and the seamless integration of online and offline retail experiences contribute to the overall market expansion. While factors like economic fluctuations and global supply chain disruptions pose potential challenges, the innovative approaches of South Korean retailers, including the strategic use of technology for personalized marketing and enhanced customer experience, are expected to mitigate these risks.

South Korea Retail Sector Market Size (In Million)

The competitive landscape is fiercely dynamic, with established players like Lotte Mart and E-Mart Inc. facing competition from both large international chains (Costco Wholesale Korea Ltd.) and smaller, specialized retailers. The success of individual players depends heavily on their ability to adapt to evolving consumer preferences, embracing technological advancements, and offering compelling value propositions. The continued growth in the convenience store sector (7-Eleven) and the ongoing popularity of department stores (Shinsegae, Grand Department Store) demonstrates the resilience and adaptability of different retail formats within the market. The forecast suggests a continued expansion of the market, driven by ongoing consumer demand and a retail industry adept at leveraging technology to improve the customer experience. Future growth will likely be influenced by factors such as government regulations impacting retail operations and the emergence of new innovative retail models.

South Korea Retail Sector Company Market Share

South Korea Retail Sector: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the South Korea retail sector, covering market structure, dynamics, trends, and future outlook from 2019 to 2033. The report leverages extensive data analysis, identifying key growth drivers, challenges, and opportunities for industry professionals and investors. With a focus on actionable insights and detailed segmentation, this report is an essential resource for understanding the evolving landscape of South Korea's dynamic retail market. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period analyzed covers 2019-2024. Market values are expressed in Millions.

South Korea Retail Sector Market Structure & Innovation Trends

The South Korean retail landscape is a dynamic mix of established giants and emerging players, shaped by rapid technological advancements and evolving consumer preferences. This section provides a detailed analysis of the market's structure, competitive dynamics, and innovation drivers, offering insights into its current state and future trajectory. We examine the market share distribution amongst key players such as Lotte Mart, E-Mart Inc., Shinsegae Department Co. Ltd., and Homeplus Co. Ltd., analyzing mergers and acquisitions (M&A) activity and its impact on market consolidation. The projected total market size for 2025 is [Insert Updated Market Size in Million]. Our analysis also explores the key factors driving innovation, including the rapid expansion of e-commerce, the widespread adoption of omnichannel strategies, the increasing demand for personalized shopping experiences, and the influence of government regulations.

- Market Concentration and Competitive Dynamics: The South Korean retail market demonstrates a moderately concentrated structure, with several dominant players controlling significant market share in specific segments. Lotte Mart and E-Mart, for example, hold substantial positions within the grocery and hypermarket sectors. However, the market also features a vibrant ecosystem of smaller, specialized retailers and rapidly growing e-commerce platforms. The full report provides a detailed breakdown of market share data for 2025, including a comprehensive analysis of competitive intensity and strategic interactions between key players. [Consider adding a brief overview of competitive strategies employed by major players].

- Innovation Drivers: Technological Advancements and Consumer Behavior: E-commerce continues to experience explosive growth, driving the widespread adoption of omnichannel retail strategies that seamlessly integrate online and offline shopping experiences. Consumers increasingly demand personalized shopping experiences, fueled by the rise of mobile payments, contactless technologies, and data-driven marketing techniques. This section will delve into specific examples of innovative technologies and their impact on the market. [Mention specific examples like AI-powered recommendation systems or the use of big data analytics].

- Regulatory Landscape and its Influence: The South Korean government's policies and regulations significantly impact market competition and innovation. This analysis will examine the key regulatory frameworks affecting the retail sector, including those related to e-commerce, data privacy, and consumer protection. [Mention specific regulations and their effects].

- Mergers and Acquisitions (M&A) Activity and its Impact: A detailed analysis of significant M&A activities in the sector will be presented, including deal values and their effects on market consolidation and competitive dynamics. Specific examples of notable mergers and acquisitions and their consequences will be discussed. [Include at least 2-3 examples with a brief explanation of their impact].

- Substitute Products and Market Competition: The report thoroughly analyzes substitute products and services and their impact on market competition within the South Korean retail landscape. This includes an examination of how alternative shopping channels and product categories influence consumer choices and market dynamics. [Give 1-2 examples of substitute products/services].

- End-User Demographics and Spending Patterns: A comprehensive analysis of demographic trends and their influence on consumer spending and retail preferences is included. This analysis considers factors such as age, income, and lifestyle to provide a detailed understanding of the changing consumer base. [Mention key demographic trends and their impact on retail].

South Korea Retail Sector Market Dynamics & Trends

This section explores the market’s growth trajectory, technological disruptions, evolving consumer preferences, and competitive landscape. Key metrics such as CAGR and market penetration are analyzed for the forecast period (2025-2033). Specific emphasis will be placed on the influence of macroeconomic factors, such as economic growth and consumer confidence, on retail sales. The report also details the rise of omnichannel retailing, the growing popularity of mobile commerce, and the implications of these trends for traditional brick-and-mortar stores. Detailed analysis of competitive strategies, including pricing, promotions, and loyalty programs, will be provided. The expected CAGR for the forecast period (2025-2033) is estimated at xx%.

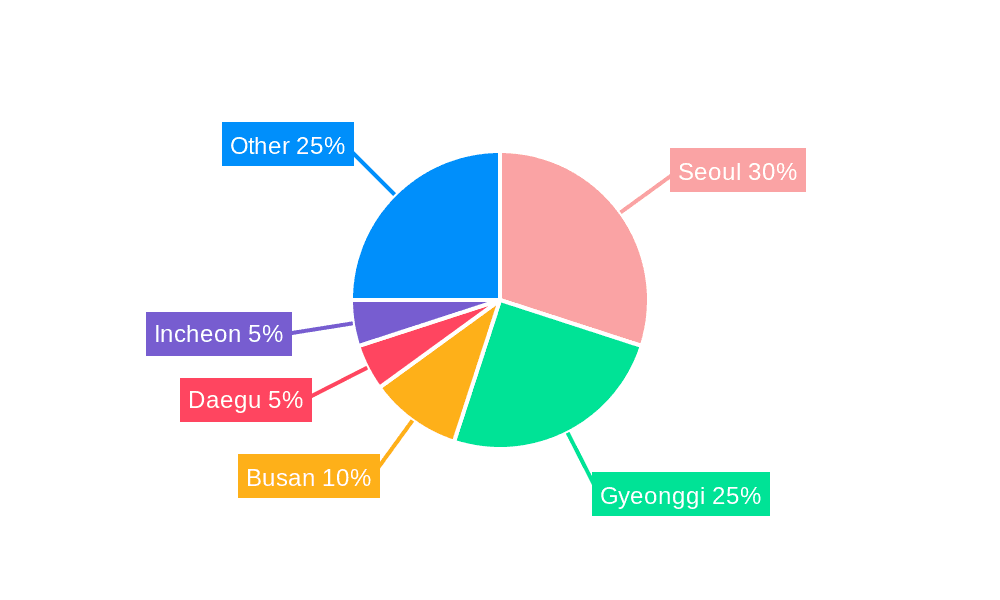

Dominant Regions & Segments in South Korea Retail Sector

This section identifies the leading regions and segments within the South Korean retail sector. The analysis utilizes both quantitative and qualitative data to highlight the underlying factors contributing to the dominance of specific geographical areas and retail categories. We examine the interplay between economic factors, consumer behavior, infrastructure development, and government policies in shaping regional market leadership.

- Key Drivers of Regional Dominance: Seoul's high population density and strong consumer spending power significantly contribute to its dominance as a major retail hub. However, other regions are also experiencing growth, driven by factors such as infrastructure improvements, rising disposable incomes, and targeted government initiatives. This section will pinpoint the specific drivers of regional market leadership, providing detailed insights into the economic and demographic forces at play. [Provide examples beyond Seoul, highlighting at least 2 other regions and their drivers].

- Segment Analysis: Performance and Growth Prospects: This in-depth segment analysis examines the performance of key retail categories, including grocery, apparel, electronics, cosmetics, and others. It explores segment-specific trends, including changing consumer preferences, the emergence of new product categories, and the impact of technological advancements. Growth prospects for each segment are carefully evaluated, providing a comprehensive overview of the sector's dynamic evolution. [Provide a brief overview of at least 3 key segments and their growth outlook].

South Korea Retail Sector Product Innovations

This section showcases recent product innovations, technological trends driving these advancements, and their impact on market competition. The focus is on how these innovations are enhancing the customer experience and creating competitive advantages, leading to a more dynamic and customer-centric retail environment. Examples include the integration of AI-powered recommendation systems, the implementation of personalized marketing campaigns, the development of innovative retail formats (e.g., automated stores, pop-up shops), and the increasing adoption of sustainable and ethical practices.

Report Scope & Segmentation Analysis

This report segments the South Korea retail sector by various parameters, including retail format (e.g., supermarkets, hypermarkets, department stores, convenience stores, online retail), product category (e.g., food & beverages, apparel, electronics, cosmetics), and geographic location. Each segment's market size, growth projections, and competitive dynamics will be analyzed thoroughly.

Key Drivers of South Korea Retail Sector Growth

This section identifies and analyzes the key factors driving growth in the South Korean retail sector. This includes technological advancements (e.g., the expansion of e-commerce platforms, the widespread adoption of mobile payments, the integration of artificial intelligence (AI) and machine learning (ML) technologies), favorable economic conditions (e.g., rising disposable incomes, increased consumer confidence), and supportive government policies (e.g., investment in digital infrastructure, deregulation initiatives). The synergistic effects of these factors are carefully examined to provide a holistic understanding of the sector's growth trajectory.

Challenges in the South Korea Retail Sector

This section explores challenges hindering the growth of the South Korean retail sector, including rising labor costs, intense competition, and supply chain disruptions. Quantifiable impacts of these challenges on market growth will be discussed.

Emerging Opportunities in South Korea Retail Sector

This section highlights promising emerging opportunities, including the growing demand for sustainable and ethically sourced products, the rise of the experience economy (emphasizing customer engagement and experiential retail), and the potential for growth in niche market segments catering to specific consumer needs and preferences. We explore the potential for innovation and expansion in these areas, providing insights into the strategies that retailers can adopt to capitalize on these opportunities.

Leading Players in the South Korea Retail Sector Market

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd*

- Five Guys

- List Not Exhaustive

Key Developments in South Korea Retail Sector Industry

- September 2023: Lotte Mart announced a dedicated shopping zone for non-Korean tourists in key locations. This initiative targets a growing segment of international visitors and aims to boost sales.

- June 2023: Five Guys, a US burger chain, opened its first South Korean location in Seoul, marking an entry into a highly competitive market.

Future Outlook for South Korea Retail Sector Market

The future of the South Korean retail sector appears promising, driven by factors like sustained economic growth, increasing consumer spending, and continued technological advancements. The sector is poised for significant transformation, with omnichannel strategies, personalized shopping experiences, and innovative retail formats gaining traction. The market is expected to witness a period of consolidation and increased competition, with both domestic and international players vying for market share. Strategic opportunities exist for businesses that can adapt to changing consumer demands, leverage technology effectively, and maintain operational efficiency.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence