Key Insights

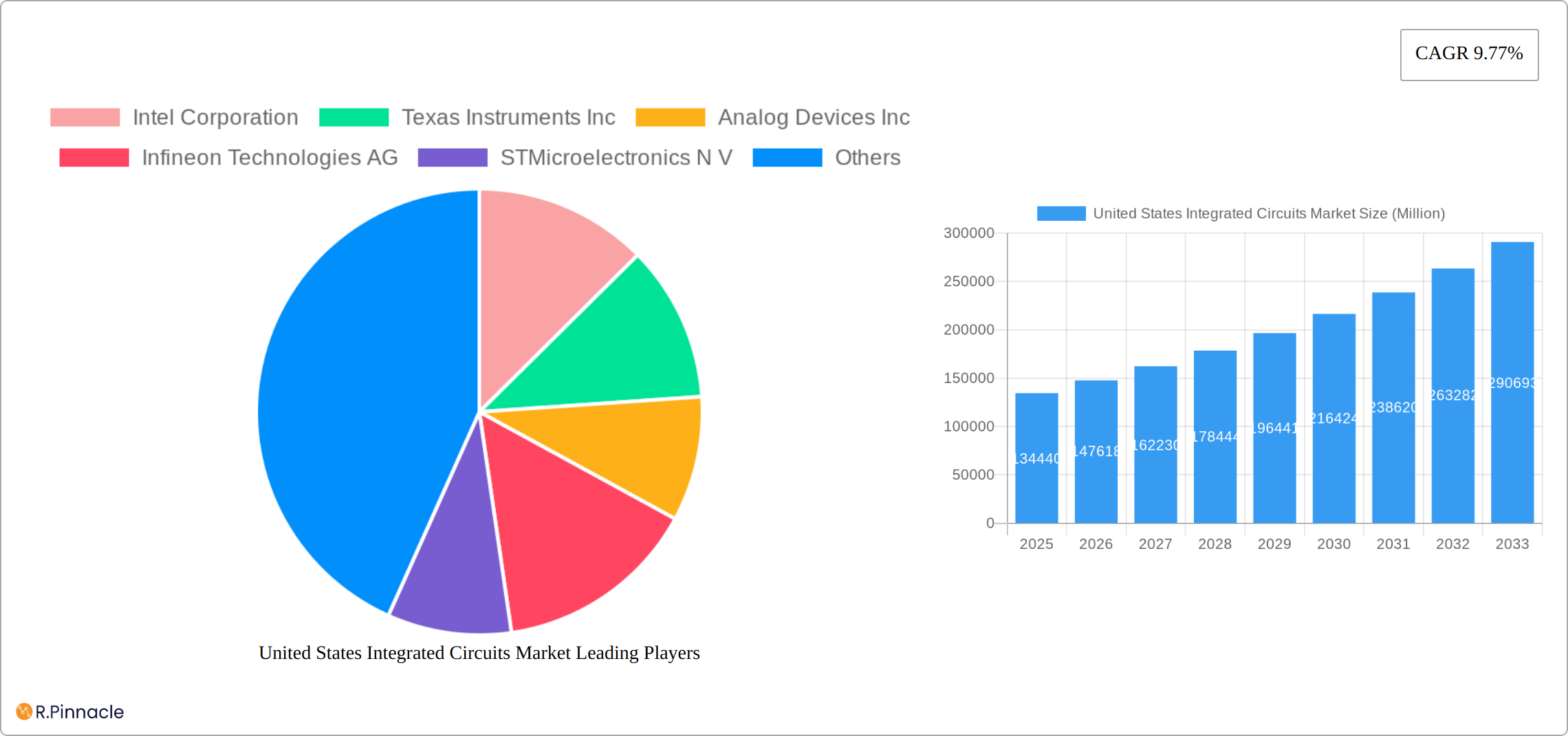

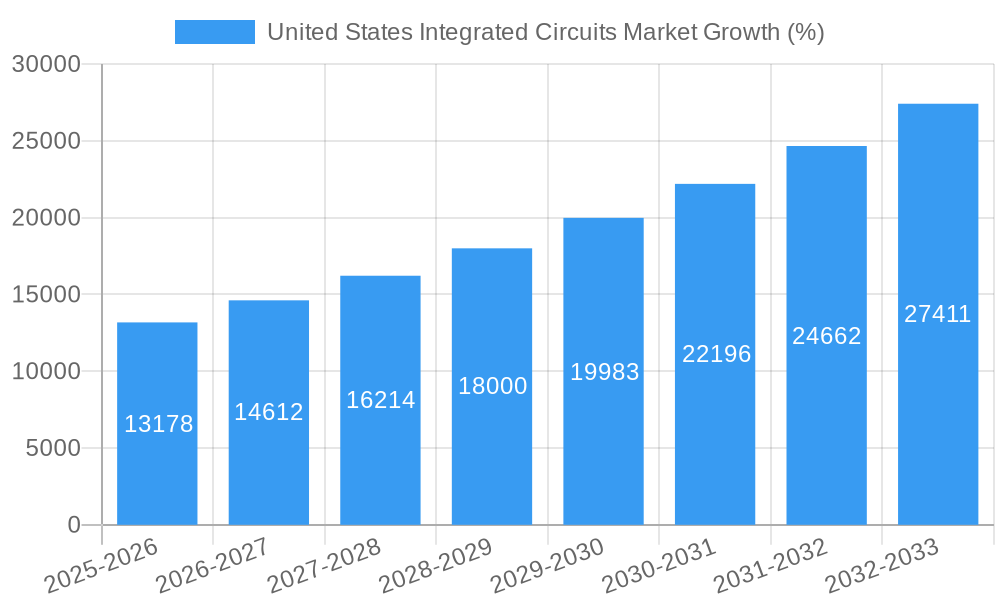

The United States Integrated Circuits (IC) market, valued at $134.44 billion in 2025, is projected to experience robust growth, driven by the increasing demand for electronics across various sectors. A Compound Annual Growth Rate (CAGR) of 9.77% from 2025 to 2033 signifies a significant expansion, fueled by several key factors. The proliferation of IoT devices, the surge in demand for high-performance computing, and the ongoing advancements in automotive electronics are major contributors to this growth. Furthermore, the increasing adoption of AI and machine learning technologies is creating new avenues for IC applications, particularly in data centers and edge computing. The market is segmented by various IC types (e.g., microprocessors, memory chips, analog ICs), each exhibiting unique growth trajectories. Leading players like Intel, Texas Instruments, and Analog Devices are heavily investing in R&D to maintain their market positions and capitalize on emerging opportunities. While supply chain disruptions and potential geopolitical uncertainties could pose challenges, the overall outlook for the US IC market remains positive, indicating substantial growth potential in the coming years.

The competitive landscape is marked by the presence of both established industry giants and emerging players. The ongoing technological advancements and the constant drive for miniaturization and improved performance are creating a dynamic environment. Strategic alliances, mergers, and acquisitions are expected to shape the market structure further. Government initiatives aimed at boosting domestic semiconductor manufacturing and research are also influencing market dynamics. The US market benefits from a strong ecosystem of skilled professionals, research institutions, and supporting infrastructure, which will continue to propel its growth. However, factors such as potential trade restrictions and the need for continuous innovation to remain competitive must be carefully considered. The US IC market is expected to witness a considerable increase in its market value by 2033, driven by these dynamic forces.

United States Integrated Circuits Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Integrated Circuits market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033).

United States Integrated Circuits Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US Integrated Circuits market, examining market concentration, innovation drivers, regulatory frameworks, and key industry trends. We delve into the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their influence on market share.

Market Concentration: The US Integrated Circuits market exhibits a moderately concentrated structure, with a few major players holding significant market share. Intel Corporation, Texas Instruments Inc., and Analog Devices Inc. are among the leading players, collectively accounting for approximately xx% of the market in 2025. Smaller players are actively competing through niche specialization and innovation.

Innovation Drivers: Continuous advancements in semiconductor technology, particularly in areas like 5G, AI, and IoT, are driving market innovation. The increasing demand for high-performance, energy-efficient chips fuels ongoing research and development.

Regulatory Framework: Government regulations and policies aimed at promoting domestic semiconductor manufacturing and addressing supply chain vulnerabilities significantly impact market dynamics.

Product Substitutes: While direct substitutes for integrated circuits are limited, alternative technologies are constantly evolving, posing potential challenges.

End-User Demographics: The demand for integrated circuits is driven by a wide range of end-users, including the automotive, consumer electronics, industrial, and communication sectors. Market growth is directly correlated with the expansion of these industries.

M&A Activities: The US Integrated Circuits market has witnessed significant M&A activity in recent years, with deals valued at approximately xx Million in 2024. These transactions have reshaped the competitive landscape, leading to increased market consolidation and technological integration.

United States Integrated Circuits Market Dynamics & Trends

This section examines the key factors influencing the growth trajectory of the US Integrated Circuits market. We explore market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics that shape industry evolution. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at xx%, reflecting substantial market expansion.

[Insert 600 words exploring market growth drivers (e.g., increasing demand from various sectors, technological advancements), technological disruptions (e.g., the rise of AI, IoT, and 5G impacting chip design and demand), consumer preferences (e.g., demand for smaller, faster, and more energy-efficient chips), and competitive dynamics (e.g., strategic alliances, product differentiation, pricing strategies) with specific metrics like CAGR and market penetration for various segments. Include discussion of market size in Million for key segments.]

Dominant Regions & Segments in United States Integrated Circuits Market

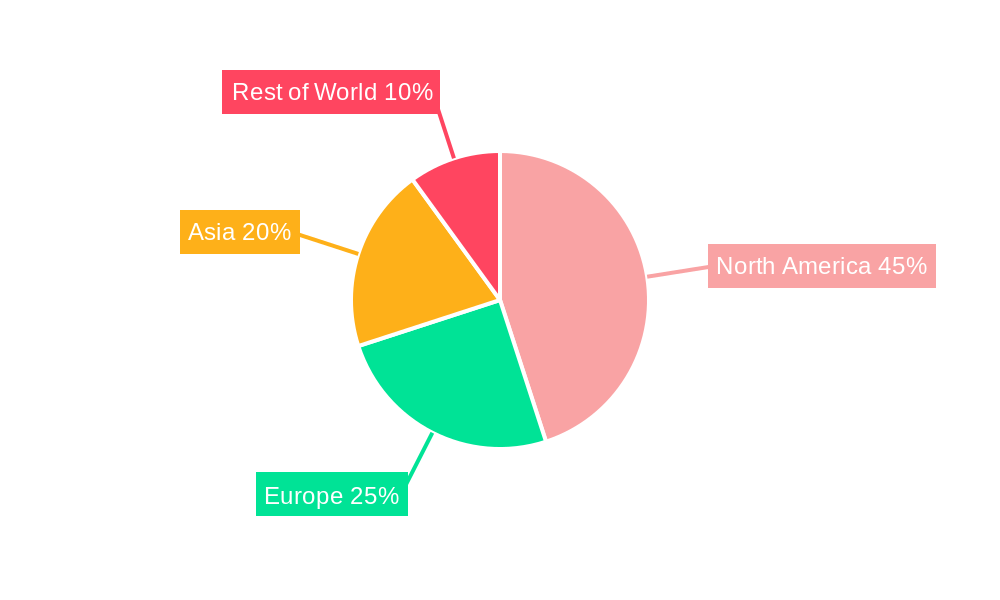

The United States Integrated Circuits (IC) market is characterized by distinct regional strengths and segment leadership, driven by a confluence of technological innovation, robust industrial demand, and strategic government initiatives. Analyzing these dominant forces provides critical insights into the market's current landscape and future trajectory.

Dominant Regions:

-

California: The Silicon Valley Epicenter

California, particularly the Silicon Valley region, remains the undisputed heart of the US IC market. This dominance stems from a legacy of pioneering semiconductor innovation and a vibrant ecosystem of tech giants, venture capital firms, and research institutions. The presence of leading fabless design companies, advanced R&D facilities, and a highly skilled workforce fuels continuous development and adoption of cutting-edge IC technologies. The region's market size is estimated to be in the tens of billions of US dollars annually, driven by its concentration of demand from the consumer electronics, computing, and emerging technology sectors.

- Key Drivers:

- Unparalleled concentration of venture capital and startup funding.

- Proximity to major universities and research centers driving innovation.

- Established infrastructure supporting advanced manufacturing and design.

- Strong demand from leading tech companies for high-performance chips.

- Government initiatives focused on semiconductor research and development.

- Key Drivers:

-

Texas: A Growing Hub for Manufacturing and Design

Texas has emerged as a significant player, rapidly expanding its IC market presence. Driven by a proactive state government, attractive business incentives, and substantial investments from major semiconductor companies, the state is becoming a crucial center for both IC design and advanced manufacturing (fabs). Its growing market size is estimated to be in the billions of US dollars, bolstered by expansions in memory and logic chip production. The burgeoning tech scene in cities like Austin and Dallas further contributes to this growth.

- Key Drivers:

- Supportive state policies and tax incentives for semiconductor investments.

- Availability of land and a growing skilled workforce.

- Strategic investments from leading semiconductor manufacturers.

- Lower operating costs compared to other tech hubs.

- Growing demand from the automotive and industrial sectors within the state.

- Key Drivers:

-

Arizona and the Mountain West: Foundry and Advanced Packaging Growth

Arizona, along with other states in the Mountain West region, is witnessing substantial growth, particularly in the area of semiconductor foundries and advanced packaging technologies. Major investments in new fabrication facilities are transforming the region into a key player in IC manufacturing. The market size in this region is rapidly increasing, driven by government support for onshoring semiconductor production and the strategic importance of these capabilities. The establishment of large-scale manufacturing operations contributes billions in market value.

- Key Drivers:

- Significant federal and state funding for domestic chip manufacturing.

- Development of new, large-scale fabrication plants.

- Focus on advanced packaging solutions to enhance chip performance.

- Strategic geographic location and infrastructure development.

- Growing demand from defense and aerospace industries.

- Key Drivers:

Dominant Segments:

-

Microprocessors and Central Processing Units (CPUs):

This segment continues to be a cornerstone of the US IC market, driven by persistent demand from the computing industry (laptops, desktops, servers) and the ever-increasing need for processing power in data centers. The market size for microprocessors and CPUs in the US is substantial, likely exceeding tens of billions of dollars annually. Innovation in multi-core architectures, power efficiency, and integration with AI accelerators keeps this segment at the forefront.

- Key Drivers:

- Continued growth in cloud computing and data analytics.

- Demand for high-performance computing in scientific research and simulations.

- Evolution of personal computing devices and gaming.

- Integration of AI and machine learning capabilities.

- Key Drivers:

-

Memory Chips (DRAM and NAND Flash):

The demand for memory chips remains exceptionally high, fueled by the proliferation of smartphones, tablets, solid-state drives (SSDs), and the massive data storage requirements of the digital economy. The US market for memory chips represents billions of dollars in value, with ongoing advancements in density, speed, and endurance being critical. The trend towards larger datasets and more sophisticated applications directly translates to increased memory consumption.

- Key Drivers:

- Explosive growth in data generation and storage needs.

- Increasing adoption of SSDs in PCs and servers for faster performance.

- Demand for high-capacity memory in mobile devices.

- Applications in automotive and industrial IoT devices.

- Key Drivers:

-

Application-Specific Integrated Circuits (ASICs) and FPGAs:

As end-user industries demand more specialized and power-efficient solutions, ASICs and Field-Programmable Gate Arrays (FPGAs) are experiencing significant growth. These custom or reconfigurable chips offer tailored performance for specific applications in areas like artificial intelligence, telecommunications, automotive, and industrial automation. The market size for ASICs and FPGAs is in the billions of dollars, with a strong trend towards higher customization and integration.

- Key Drivers:

- Growing demand for AI and machine learning accelerators.

- Need for optimized performance and power efficiency in specialized applications.

- Rapid innovation cycles in emerging technologies like 5G and autonomous vehicles.

- Flexibility and reconfigurability offered by FPGAs in R&D and prototyping.

- Key Drivers:

The interplay between these dominant regions and segments, supported by robust economic conditions and targeted government funding, solidifies the United States' position as a global leader in the integrated circuits market.

United States Integrated Circuits Market Product Innovations

Recent advancements in integrated circuit technology have led to the development of highly specialized chips with enhanced performance and efficiency. These innovations cater to the growing demands of diverse applications, spanning automotive, industrial, and consumer electronics sectors. The trend is towards miniaturization, increased processing power, and reduced energy consumption, creating significant competitive advantages.

Report Scope & Segmentation Analysis

This report segments the US Integrated Circuits market based on [Insert Segmentation details e.g., product type, application, and end-user]. Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail.

[Insert 100-150 words detailing all market segmentations, with a paragraph per segment. Include growth projections, market sizes, and competitive dynamics for each segment.]

Key Drivers of United States Integrated Circuits Market Growth

Several interconnected factors are propelling the growth of the US Integrated Circuits (IC) market. At the forefront are relentless technological advancements, particularly in the development of advanced node processes (e.g., sub-7nm manufacturing) and novel chip architectures that enable greater performance, power efficiency, and functionality. This innovation is crucial for meeting the ever-increasing demands of modern computing and emerging technologies. Concurrently, strong economic growth across diverse end-user industries—ranging from automotive and industrial automation to consumer electronics and telecommunications—translates into sustained and expanding demand for ICs. Furthermore, a pivotal development is the increasing support from government policies. Initiatives like the CHIPS and Science Act are actively promoting domestic semiconductor manufacturing, fostering research and development, and encouraging onshoring of production, thereby creating a more resilient and growth-oriented ecosystem for the US IC market.

Challenges in the United States Integrated Circuits Market Sector

The US Integrated Circuits market faces challenges, including supply chain disruptions, geopolitical uncertainties impacting global trade, and intense competition among established and emerging players. Regulatory hurdles and rising research and development costs also pose significant barriers to entry and growth.

Emerging Opportunities in United States Integrated Circuits Market

The US Integrated Circuits market is poised for significant expansion due to burgeoning opportunities in several high-growth sectors. The insatiable demand from emerging technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and 5G telecommunications creates substantial growth potential for advanced ICs. AI applications, in particular, require specialized processors (e.g., GPUs, NPUs) for training and inference, driving innovation in high-performance computing. The widespread adoption of IoT devices across industries necessitates a diverse range of low-power, connected, and sensor-integrated chips. The rollout of 5G infrastructure and devices is also a major catalyst, demanding advanced RF components and high-speed processors. Moreover, significant opportunities lie in advancements in packaging technologies, such as advanced 2.5D and 3D integration, which enable denser, more powerful, and energy-efficient chip designs. The development of specialized or domain-specific chips tailored for niche applications, from medical devices to advanced automotive systems, presents lucrative prospects for market players seeking to capture specific market segments.

Leading Players in the United States Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics N V

- NXP Semiconductors N V

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- MediaTek Inc

Key Developments in United States Integrated Circuits Market Industry

- April 2024: Micron Technology Inc. announced the launch of its Micron Serial NOR Flash Memory, enhancing performance and reliability across various applications.

- January 2024: Qualcomm Technologies Inc. and Robert Bosch GmbH introduced the automotive industry's first central vehicle computer, integrating infotainment and ADAS functionalities on a single SoC.

Future Outlook for United States Integrated Circuits Market Market

The US Integrated Circuits market is poised for continued growth, driven by technological innovation, increasing demand from diverse sectors, and supportive government policies. Strategic partnerships, expansion into emerging markets, and focused R&D efforts will be critical for companies to capitalize on future opportunities.

United States Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

United States Integrated Circuits Market Segmentation By Geography

- 1. United States

United States Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. Logic ICs are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors N V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MediaTek Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: United States Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: United States Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: United States Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: United States Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United States Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: United States Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: United States Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: United States Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Integrated Circuits Market?

The projected CAGR is approximately 9.77%.

2. Which companies are prominent players in the United States Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics N V, NXP Semiconductors N V, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the United States Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Logic ICs are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

April 2024 - Micron Technology Inc. announced the launch of its latest innovation - the Micron Serial NOR Flash Memory. The product is designed to provide enhanced performance and reliability for various applications, from automotive and industrial to consumer electronics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the United States Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence