Key Insights

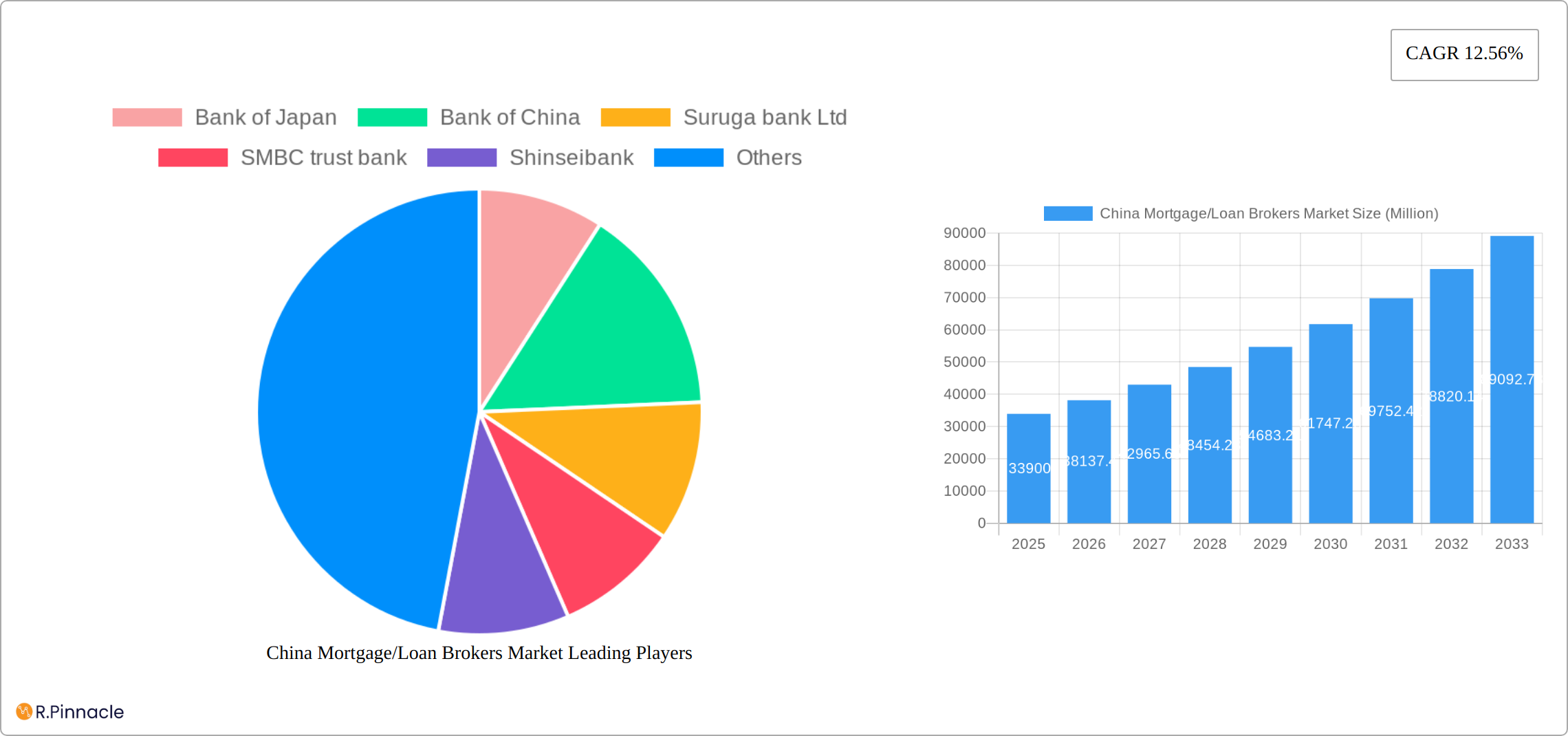

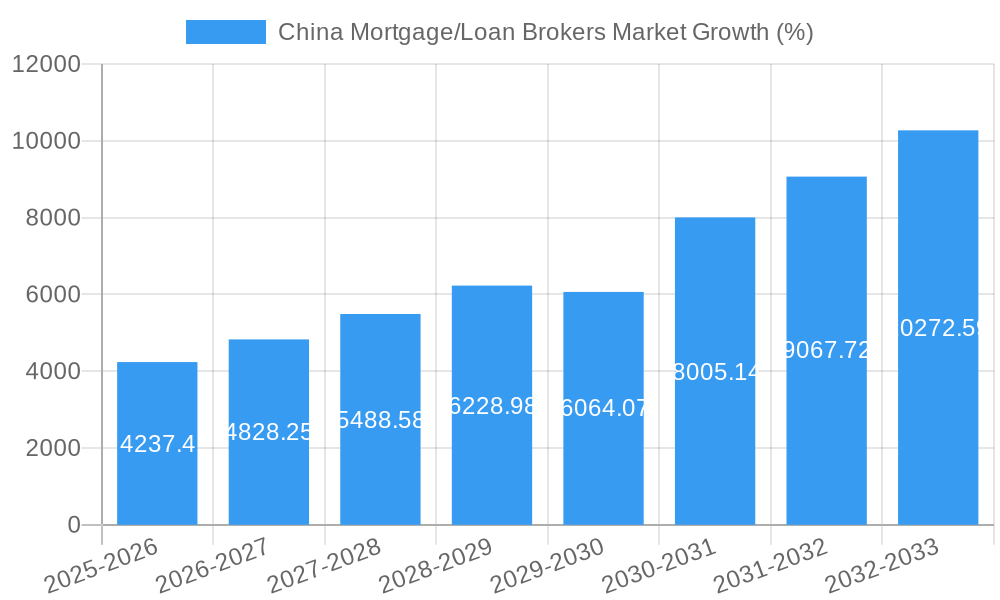

The China mortgage/loan broker market exhibits robust growth, projected to reach $33.90 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.56% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning middle class with increasing disposable income and a desire for homeownership is significantly boosting demand for mortgage services. Secondly, the ongoing urbanization process in China continues to drive housing demand, creating a fertile ground for mortgage brokers. Furthermore, the increasing complexity of mortgage products and financial regulations necessitates the expertise of brokers to navigate the process for both lenders and borrowers. The rising adoption of fintech solutions, including online platforms and digital lending tools, further streamlines the process and fuels market growth. While regulatory changes and potential economic fluctuations could pose some restraints, the overall positive economic outlook and the continued expansion of the housing market suggest strong future growth for the sector. Major players like Bank of Japan, Bank of China, and several prominent Japanese and Singaporean banks are actively involved, demonstrating the market's attractiveness and significant potential for further consolidation and expansion in the coming years. The market segmentation likely involves distinctions based on loan type (residential, commercial), customer demographics, and service offerings (online vs. traditional brokerage).

The forecast period (2025-2033) promises continued expansion, driven by sustained economic growth, increasing urbanization, and the ongoing need for professional mortgage brokerage services. Competition will likely intensify among both established banks and emerging fintech companies striving to capture market share. The market's success hinges on the ability of brokers to adapt to evolving technological advancements, customer expectations, and regulatory landscapes. This requires continuous innovation in service offerings, leveraging technology to enhance efficiency and transparency, and maintaining ethical and compliant business practices. Strategic partnerships between brokers and financial institutions can further enhance market penetration and establish robust, long-term growth.

China Mortgage/Loan Brokers Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Mortgage/Loan Brokers Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market structure, dynamics, leading players, and future growth potential. Discover actionable intelligence to navigate the complexities of this dynamic market.

China Mortgage/Loan Brokers Market Market Structure & Innovation Trends

This section provides a comprehensive analysis of the competitive landscape within the China Mortgage/Loan Brokers Market. We delve into key aspects such as market concentration, identifying the share held by prominent players and evaluating the financial significance of recent mergers and acquisitions. Furthermore, we explore the influential forces driving innovation, including technological advancements, evolving regulatory frameworks, and shifting consumer demands. The impact of alternative financial products and the changing demographic profile of end-users on market dynamics are thoroughly examined. A detailed assessment of the current and anticipated regulatory environment, which significantly shapes the market's trajectory, is also presented.

- Market Concentration: An in-depth analysis of market share distribution among key players, with data points such as the collective market share of the top three entities and their aggregated revenue figures (e.g., Top 3 players hold xx% of the market, contributing xx Billion in revenue).

- Innovation Drivers: Examination of the primary catalysts for innovation in the mortgage brokerage sector, encompassing cutting-edge technological solutions (e.g., AI-powered loan processing, digital platforms), evolving regulatory requirements, and changing borrower expectations.

- Regulatory Framework: A detailed overview of the pertinent Chinese regulations governing mortgage brokerage activities, including stringent licensing prerequisites, operational compliance standards, and data privacy mandates.

- Product Substitutes: An assessment of alternative financial instruments and services that may compete with traditional mortgage brokerage services, such as peer-to-peer lending platforms or direct bank offerings, and their influence on market demand.

- End-User Demographics: Analysis of the evolving demographic characteristics of potential and existing mortgage borrowers in China, including age, income levels, and urban-rural distribution, and how these shifts impact market demand and service offerings.

- M&A Activities: A review of recent mergers and acquisitions within the market, providing insights into deal motivations, strategic implications, and the financial valuation of significant transactions (e.g., a recent strategic acquisition valued at xx Billion).

China Mortgage/Loan Brokers Market Market Dynamics & Trends

This section explores the key drivers and trends shaping the growth trajectory of the China Mortgage/Loan Brokers Market. We analyze market growth rates (CAGR), market penetration, and the impact of technological disruptions, evolving consumer preferences, and competitive pressures. The analysis will identify emerging opportunities and potential challenges for market participants.

- Market Growth Drivers: Detailed examination of factors stimulating market growth, including macroeconomic trends, rising disposable incomes, and increasing urbanization. (e.g., CAGR of xx% projected from 2025 to 2033).

- Technological Disruptions: Assessment of the influence of fintech innovations, such as online platforms and AI-powered tools, on the market.

- Consumer Preferences: Analysis of shifts in consumer preferences and their influence on mortgage product demand.

- Competitive Dynamics: Evaluation of the competitive landscape, including strategies employed by key players and emerging competitive pressures. (e.g., Market penetration of online mortgage platforms reaching xx% by 2033).

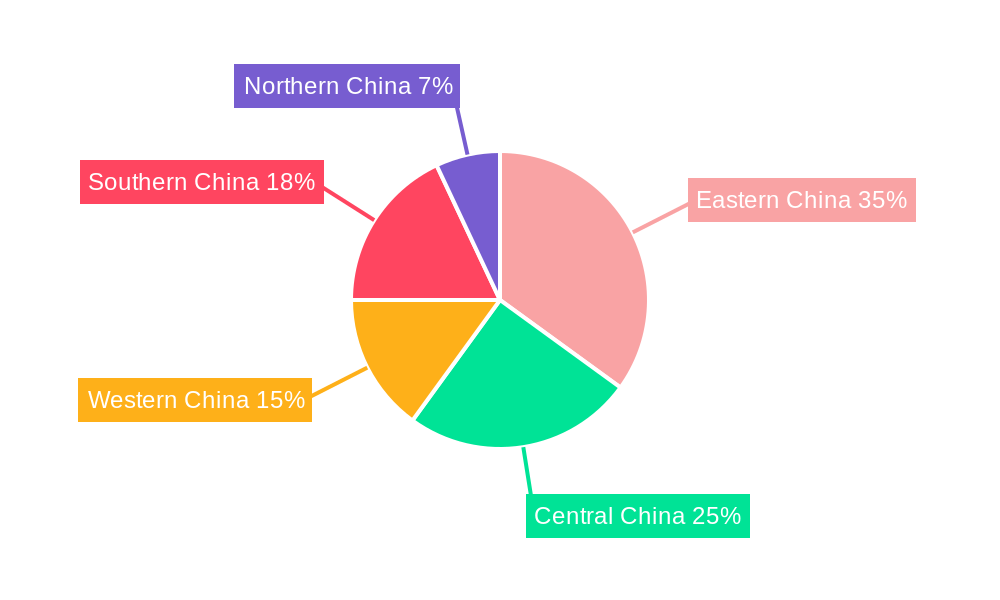

Dominant Regions & Segments in China Mortgage/Loan Brokers Market

This section identifies the leading regions and segments within the China Mortgage/Loan Brokers Market. The analysis highlights key drivers of dominance, including economic policies, infrastructure development, and regional disparities in market demand.

- Leading Region/Segment: Identification of the most dominant region or segment (e.g., Tier 1 cities in Eastern China).

- Key Drivers of Dominance: Bullet points outlining factors contributing to the dominance of the identified region/segment:

- Favorable economic policies.

- Robust infrastructure development.

- High concentration of target customer base.

- Presence of established mortgage brokers.

- Dominance Analysis: Detailed analysis explaining the reasons behind the dominance of the identified region/segment.

China Mortgage/Loan Brokers Market Product Innovations

This section summarizes recent advancements in mortgage brokerage products, emphasizing the role of technology and market fit. The analysis assesses the competitive advantages offered by innovative products and their impact on market dynamics. (e.g., Introduction of AI-driven mortgage recommendation engines, streamlining the application process).

Report Scope & Segmentation Analysis

This report offers a granular understanding of the China Mortgage/Loan Brokers Market through meticulous segmentation. Each identified segment's projected growth trajectory, estimated market size, and unique competitive dynamics are comprehensively detailed. The segmentation strategy aims to provide actionable insights for stakeholders by dissecting the market across various critical dimensions, which may include, but are not limited to, segmentation by loan type (e.g., residential, commercial), customer segment (e.g., first-time homebuyers, investors), and geographic location within China. For illustrative purposes, the residential mortgage segment is projected to achieve an impressive revenue of xx Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% throughout the forecast period.

Key Drivers of China Mortgage/Loan Brokers Market Growth

This section identifies the key factors propelling the growth of the China Mortgage/Loan Brokers Market. These drivers include technological advancements, favorable economic conditions, and supportive government policies. Examples of specific drivers and their impacts will be provided.

Challenges in the China Mortgage/Loan Brokers Market Sector

This section highlights the challenges and restraints affecting the China Mortgage/Loan Brokers Market. These might include regulatory hurdles, supply chain disruptions, and competitive pressures. The report quantifies the impact of these challenges on market growth. (e.g., Stringent regulatory requirements increasing operational costs by xx%).

Emerging Opportunities in China Mortgage/Loan Brokers Market

This section explores emerging opportunities within the China Mortgage/Loan Brokers Market. These opportunities might include expansion into new markets, adoption of innovative technologies, or catering to evolving consumer preferences. (e.g., Growth potential in underserved rural markets).

Leading Players in the China Mortgage/Loan Brokers Market Market

This section profiles the key entities actively shaping the China Mortgage/Loan Brokers Market. Where publicly accessible, hyperlinks to official company websites, preferably global versions if available, are provided for further exploration.

- Bank of China

- Agricultural Bank of China (ABC)

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Ping An Bank

- China Merchants Bank

- HDFC Bank (representative of international players with Chinese operations or interests)

- Standard Chartered Bank (China) Limited

- Citibank (China) Co., Ltd.

- HSBC Bank (China) Company Limited

- (List is not exhaustive and includes key domestic and international financial institutions with significant mortgage/loan brokerage operations or influence in China)

Key Developments in China Mortgage/Loan Brokers Market Industry

This section highlights significant recent developments and strategic initiatives that are actively influencing the dynamics and future trajectory of the China Mortgage/Loan Brokers Market.

- September 2023: The Agricultural Bank of China (ABC) unveiled a comprehensive global matchmaking platform designed to streamline international property investments and facilitate cross-border mortgage services, signaling a strategic move to expand its global reach and client base.

- June 2023: HSBC Bank (China) Company Limited successfully completed the acquisition of Citi’s retail wealth management portfolio in mainland China. This strategic consolidation aims to enhance HSBC's market presence and broaden its offerings in the high-net-worth segment, potentially impacting mortgage product demand and brokerage services.

- Ongoing: Increased adoption of digital lending platforms and AI-driven credit assessment tools by major Chinese banks and fintech companies, leading to faster loan approvals and improved customer experiences, thereby intensifying competition for traditional brokerage services.

- Recent: Government initiatives promoting housing affordability and urban development are expected to sustain a healthy demand for mortgage loans, creating new opportunities for brokers to connect borrowers with suitable financing solutions.

Future Outlook for China Mortgage/Loan Brokers Market Market

This section synthesizes the future growth potential of the China Mortgage/Loan Brokers Market, identifying critical strategic opportunities for market participants. The analysis meticulously considers overarching macroeconomic trends, rapid technological advancements, and the dynamic evolution of regulatory landscapes. The persistent urbanization of China's population, coupled with the enduring aspiration for homeownership among a growing middle class, presents substantial and sustained long-term growth potential for the mortgage brokerage sector. Furthermore, the increasing demand for specialized financial advisory services and the diversification of housing finance products are expected to create new avenues for market expansion and innovation.

China Mortgage/Loan Brokers Market Segmentation

-

1. Type of Mortgage Loan

- 1.1. Conventional Mortgage Loan

- 1.2. Jumbo Loans

- 1.3. Government-insured Mortgage Loans

- 1.4. Other Type of Mortgage Loans

-

2. Mortgage Loan Terms

- 2.1. 30- years Mortgage

- 2.2. 20-year Mortgage

- 2.3. 15-year Mortgage

- 2.4. Other Mortgage Loan Terms

-

3. Interest Rate

- 3.1. Fixed-Rate

- 3.2. Adjustable-Rate

-

4. Provider

- 4.1. Primary Mortgage Lender

- 4.2. Secondary Mortgage Lender

China Mortgage/Loan Brokers Market Segmentation By Geography

- 1. China

China Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in China household Wealth; Increasing Penetration rate among investors

- 3.3. Market Restrains

- 3.3.1. Surge in China household Wealth; Increasing Penetration rate among investors

- 3.4. Market Trends

- 3.4.1. Change in Monetary factors affecting China Mortgage/Loan Brokers market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 5.1.1. Conventional Mortgage Loan

- 5.1.2. Jumbo Loans

- 5.1.3. Government-insured Mortgage Loans

- 5.1.4. Other Type of Mortgage Loans

- 5.2. Market Analysis, Insights and Forecast - by Mortgage Loan Terms

- 5.2.1. 30- years Mortgage

- 5.2.2. 20-year Mortgage

- 5.2.3. 15-year Mortgage

- 5.2.4. Other Mortgage Loan Terms

- 5.3. Market Analysis, Insights and Forecast - by Interest Rate

- 5.3.1. Fixed-Rate

- 5.3.2. Adjustable-Rate

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Primary Mortgage Lender

- 5.4.2. Secondary Mortgage Lender

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bank of Japan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suruga bank Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SMBC trust bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinseibank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 United Overseas Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Overseas Chinese Banking Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Mitsui Financial Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi UFJ Financial Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mizuho Financial Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank of Japan

List of Figures

- Figure 1: China Mortgage/Loan Brokers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Mortgage/Loan Brokers Market Share (%) by Company 2024

List of Tables

- Table 1: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 4: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 5: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan Terms 2019 & 2032

- Table 6: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan Terms 2019 & 2032

- Table 7: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2019 & 2032

- Table 8: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2019 & 2032

- Table 9: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 11: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 14: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 15: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan Terms 2019 & 2032

- Table 16: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan Terms 2019 & 2032

- Table 17: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2019 & 2032

- Table 18: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2019 & 2032

- Table 19: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 20: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 21: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Mortgage/Loan Brokers Market?

The projected CAGR is approximately 12.56%.

2. Which companies are prominent players in the China Mortgage/Loan Brokers Market?

Key companies in the market include Bank of Japan, Bank of China, Suruga bank Ltd, SMBC trust bank, Shinseibank, United Overseas Bank, Overseas Chinese Banking Corp, Sumitomo Mitsui Financial Group, Mitsubishi UFJ Financial Group, Mizuho Financial Group**List Not Exhaustive.

3. What are the main segments of the China Mortgage/Loan Brokers Market?

The market segments include Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in China household Wealth; Increasing Penetration rate among investors.

6. What are the notable trends driving market growth?

Change in Monetary factors affecting China Mortgage/Loan Brokers market..

7. Are there any restraints impacting market growth?

Surge in China household Wealth; Increasing Penetration rate among investors.

8. Can you provide examples of recent developments in the market?

In September 2023, the Agricultural Bank of China (ABC), one of the four major state-owned banks in the country, launched a global matchmaking platform during the Belt and Road Agricultural Cooperation and Development Forum in Beijing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the China Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence