Key Insights

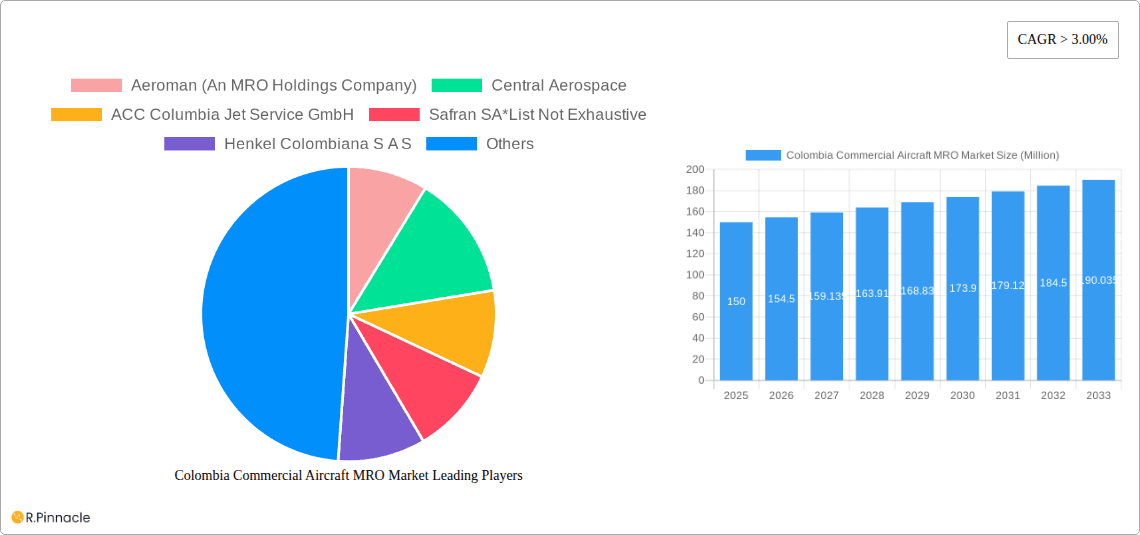

The Colombian commercial aircraft Maintenance, Repair, and Overhaul (MRO) market presents a compelling investment opportunity, projected to experience robust growth over the forecast period (2025-2033). The market's expansion is fueled by a steady increase in air passenger traffic within Colombia and the broader Latin American region, leading to a higher demand for aircraft maintenance services. Growth is further driven by the aging aircraft fleet requiring more frequent and extensive MRO activities. While the exact market size in 2025 is unavailable, based on a CAGR of over 3% and considering regional market trends, a reasonable estimate places the market value at approximately $150 million. This figure is supported by the presence of established MRO providers like Aeroman and Central Aerospace, alongside international players, indicating a mature yet expanding market. The market is segmented by aircraft type (wide-body, narrow-body, regional jets) and MRO type (airframe, engine, component, line maintenance), offering diverse investment and growth opportunities across different specializations.

Colombia Commercial Aircraft MRO Market Market Size (In Million)

The market's growth trajectory is anticipated to be influenced by factors such as government regulations concerning aviation safety and technological advancements within the MRO sector. The adoption of advanced technologies like predictive maintenance and digital solutions is expected to enhance efficiency and reduce operational costs, driving further market expansion. However, potential restraints include economic fluctuations impacting airline budgets and the availability of skilled labor within the MRO sector. While precise figures for each segment are unavailable, the airframe segment is likely to dominate due to the higher maintenance requirements of aircraft structures. The continued expansion of Avianca and other airlines operating within Colombia will continue to underpin demand for MRO services over the next decade. Strategic partnerships between international MRO companies and local providers can be expected to shape the market's competitive landscape in the coming years.

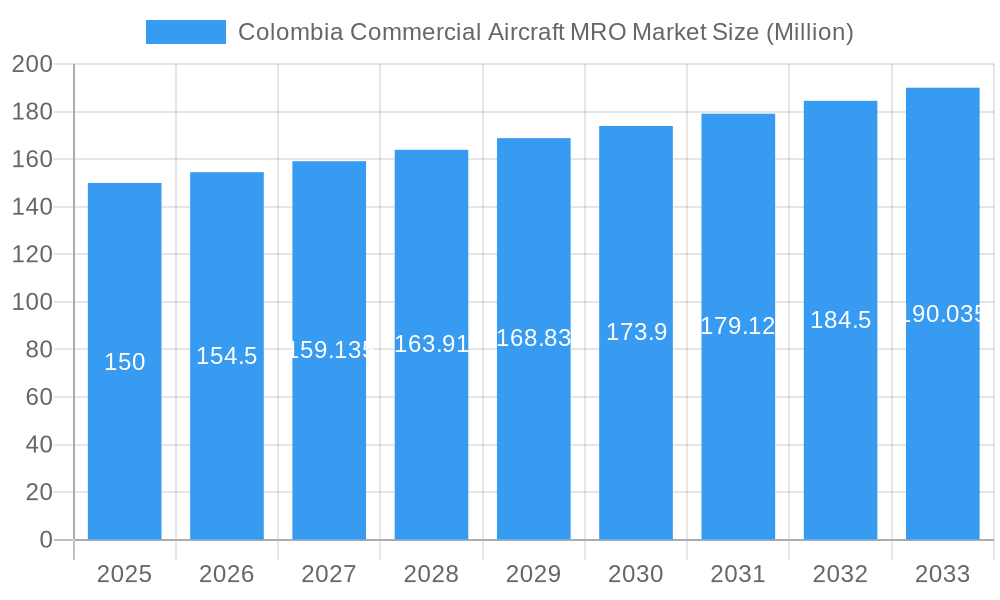

Colombia Commercial Aircraft MRO Market Company Market Share

Colombia Commercial Aircraft MRO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Colombia Commercial Aircraft MRO market, offering invaluable insights for industry professionals, investors, and stakeholders. With a detailed examination of market dynamics, competitive landscape, and future growth projections, this report is an essential resource for understanding this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025 to 2033, using data from the historical period of 2019-2024.

Colombia Commercial Aircraft MRO Market Structure & Innovation Trends

This section analyzes the structure of the Colombian commercial aircraft MRO market, exploring its concentration, innovation drivers, regulatory landscape, and competitive dynamics. The market is characterized by a mix of international and domestic players, with varying levels of market share. While precise market share data for each player is unavailable for this report, Aeroman (An MRO Holdings Company), Central Aerospace, ACC Columbia Jet Service GmbH, Safran SA, Henkel Colombiana S A S, Nediar InnLab, Avianca Cargo, SGS (Société Générale de Surveillance SA), and Indaer Aviation Technical Services S A S represent key participants. The market concentration is estimated to be xx, indicating a moderately consolidated market with potential for further consolidation through mergers and acquisitions (M&A). Recent M&A activity in the region has been valued at approximately $xx Million, reflecting a trend towards larger, more integrated MRO providers. Innovation is driven by the need for increased efficiency, reduced costs, and the adoption of advanced technologies such as predictive maintenance and digital solutions. The regulatory framework, while generally supportive, presents some challenges related to certification and compliance. The report also considers the impact of substitute products and services, as well as end-user demographics (i.e., airlines, and independent operators) and their evolving maintenance needs.

Colombia Commercial Aircraft MRO Market Dynamics & Trends

The Colombian commercial aircraft MRO market is experiencing significant growth, driven by factors such as the expansion of the domestic airline industry, increasing air travel demand, and a growing fleet of commercial aircraft. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, reflecting strong market momentum. This growth is further fueled by technological advancements in aircraft maintenance and repair technologies, leading to increased efficiency and reduced downtime. Market penetration of advanced MRO technologies is estimated to reach xx% by 2033. However, competitive pressures from regional and international MRO providers pose a challenge, necessitating continuous innovation and strategic partnerships to maintain market share. Consumer preferences are shifting towards faster turnaround times, higher quality services, and cost-effective solutions, all influencing the overall market dynamics.

Dominant Regions & Segments in Colombia Commercial Aircraft MRO Market

The Colombian commercial aircraft MRO market is significantly concentrated in major aviation hubs such as Bogotá, Medellín, and Cali. These urban centers benefit from the presence of key international airports, a well-established MRO infrastructure, and a robust network of aviation service providers. The primary factors fueling this regional dominance include:

- Advanced Infrastructure: Access to state-of-the-art airport facilities, hangars, and specialized workshops.

- Proximity to Airlines: Strategic locations close to the main operating bases of Colombian carriers, facilitating quicker turnaround times and reduced logistical complexities.

- Skilled Workforce: A readily available pool of certified aviation technicians, engineers, and support staff.

- Government Support: Favorable policies and investments aimed at fostering the growth and modernization of Colombia's aviation sector and its supporting industries.

When examining market segmentation, the following are prominent:

- By Aircraft Type: The narrow-body aircraft segment currently holds the largest share. This is a direct reflection of the operational fleet composition of major Colombian airlines, which predominantly utilize narrow-body aircraft for domestic and regional routes. The ongoing expansion of low-cost carriers (LCCs) further amplifies the demand for MRO services tailored to this aircraft category.

- By MRO Type: Airframe and engine maintenance are the leading segments, underscoring their paramount importance in ensuring flight safety and operational continuity. These services require specialized expertise and significant investment. Following closely are component maintenance (including avionics, landing gear, and other systems) and line maintenance (routine checks and minor repairs performed between flights), which collectively demonstrate the comprehensive spectrum of MRO capabilities required by the Colombian aviation industry.

The continued expansion of low-cost carrier operations is a significant catalyst, driving substantial demand for the maintenance, repair, and overhaul of their narrow-body fleets. The airframe maintenance segment is experiencing robust growth, propelled by increasing air traffic volumes and the aging of the existing aircraft fleet, necessitating more frequent and in-depth maintenance interventions. Furthermore, supportive economic policies for the aviation industry, coupled with ongoing improvements in airport infrastructure, are collectively stimulating sustained growth across these dominant regions and market segments.

Colombia Commercial Aircraft MRO Market Product Innovations

Recent innovations in the Colombian commercial aircraft MRO market focus on leveraging advanced technologies such as predictive maintenance and data analytics to enhance operational efficiency and reduce costs. The adoption of digital tools for maintenance scheduling, parts management, and remote diagnostics improves turnaround times and minimizes disruptions. These innovations are tailored to meet the evolving needs of airlines, emphasizing speed, reliability, and cost optimization. The adoption of these advanced technologies delivers significant competitive advantages, positioning MRO providers to offer premium services within an increasingly competitive landscape.

Report Scope & Segmentation Analysis

This report segments the Colombia Commercial Aircraft MRO market based on aircraft type (wide-body, narrow-body, regional jets) and MRO type (airframe, engine, component, line).

By Aircraft Type: Wide-body aircraft are expected to experience xx% growth during the forecast period, while narrow-body and regional jets are projected to grow at xx% and xx%, respectively. Competitive dynamics within each segment vary based on the specific aircraft models and their maintenance requirements.

By MRO Type: The airframe and engine MRO segments are expected to dominate the market, owing to the high maintenance intensity of these components. Component and line maintenance also have potential for growth, driven by increasing aircraft utilization and the adoption of cost-effective maintenance practices. The market size and growth for each segment are detailed in the full report.

Key Drivers of Colombia Commercial Aircraft MRO Market Growth

The Colombian commercial aircraft MRO market is experiencing robust expansion, propelled by a confluence of dynamic factors. The sustained growth of the domestic airline industry, characterized by increasing passenger traffic and a progressively larger fleet size, forms the bedrock of this upward trajectory. Economic development within Colombia is directly translating into higher demand for air travel, consequently boosting the need for comprehensive MRO services. Government initiatives aimed at fostering the aviation sector, including regulatory support and infrastructure development, play a crucial role in stimulating this growth. Beyond these foundational elements, technological advancements are acting as significant growth accelerators. Innovations in areas such as predictive maintenance, leveraging advanced sensors and data analytics, are significantly enhancing operational efficiency and driving down costs for MRO providers. The adoption of digital tools for inventory management and workflow optimization further contributes to a more streamlined and cost-effective MRO ecosystem, positioning Colombia for continued expansion in this vital sector.

Challenges in the Colombia Commercial Aircraft MRO Market Sector

Despite its promising growth, the Colombian commercial aircraft MRO market encounters several significant challenges that can impact its trajectory. Intense competition from established international MRO providers, who often possess greater economies of scale and broader technological capabilities, poses a considerable hurdle for domestic players. Furthermore, a persistent shortage of highly skilled and certified aviation maintenance personnel, including technicians and engineers, can lead to operational delays and increased labor costs. The requirement for continuous investment in cutting-edge technologies and advanced equipment to remain competitive presents a substantial financial burden for many MRO companies. Navigating the complexities of evolving regulatory frameworks and ensuring compliance with international standards can also be demanding. Finally, potential supply chain disruptions, affecting the availability and timely delivery of critical spare parts, can significantly impact operational efficiency and increase turnaround times. These challenges collectively contribute to operational limitations and can, at times, affect profitability, necessitating strategic planning and investment to mitigate their impact.

Emerging Opportunities in Colombia Commercial Aircraft MRO Market

Opportunities exist in expanding into specialized MRO services such as component repair, leveraging advanced technologies like predictive maintenance, and developing strategic partnerships with international MRO providers. Growth in low-cost carriers, regional airlines, and increased demand for air freight present further opportunities for expansion. Focusing on sustainable MRO practices will also be crucial for both regulatory compliance and attracting environmentally-conscious customers.

Leading Players in the Colombia Commercial Aircraft MRO Market Market

- Aeroman (An MRO Holdings Company)

- Central Aerospace

- ACC Columbia Jet Service GmbH

- Safran SA

- Henkel Colombiana S A S

- Nediar InnLab

- Avianca Cargo

- SGS (Société Générale de Surveillance SA)

- Indaer Aviation Technical Services S A S

Key Developments in Colombia Commercial Aircraft MRO Market Industry

- November 2022: Safran Nacelles solidified its presence in the Colombian market by entering into a strategic four-year agreement with Avianca. This partnership focuses on the comprehensive support and maintenance of the nacelles for Avianca's Airbus A320neo aircraft fleet, specifically those powered by CFM International LEAP-1A turbofan engines. This development underscores the growing confidence in Safran Nacelles' capabilities and further strengthens its position within the region's MRO landscape.

- April 2022: Ultra Air, a nascent Colombian airline, demonstrated its commitment to operational excellence by selecting Airbus' Flight Hours Services (FHS) for its fleet of A320 aircraft. This adoption of FHS highlights the increasing airline preference for integrated and comprehensive MRO solutions, offering predictable costs and ensuring high aircraft availability. It also signifies a growing trend towards outsourcing complex maintenance operations to specialized providers within the Colombian market.

- Recent Expansion of MRO Capabilities: Several domestic MRO providers are actively investing in expanding their service offerings and infrastructure. This includes the development of specialized capabilities for newer generation aircraft, the integration of digital MRO solutions, and the establishment of strategic partnerships with original equipment manufacturers (OEMs) to enhance their technical expertise and service portfolios.

- Focus on Sustainability: With growing global emphasis on environmental responsibility, MRO providers in Colombia are increasingly exploring and implementing sustainable practices. This includes initiatives for waste reduction, responsible disposal of materials, and the adoption of eco-friendly maintenance procedures, aligning with international aviation industry trends.

Future Outlook for Colombia Commercial Aircraft MRO Market Market

The future of the Colombian commercial aircraft MRO market looks promising, driven by sustained growth in air travel demand, increased fleet sizes, and the adoption of innovative maintenance technologies. Strategic partnerships, investment in advanced infrastructure, and a skilled workforce will be key to realizing the market's full potential. The market is poised for continued growth, offering lucrative opportunities for both established and emerging players.

Colombia Commercial Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe

- 1.2. Engine

- 1.3. Component

- 1.4. Line

Colombia Commercial Aircraft MRO Market Segmentation By Geography

- 1. Colombia

Colombia Commercial Aircraft MRO Market Regional Market Share

Geographic Coverage of Colombia Commercial Aircraft MRO Market

Colombia Commercial Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Air Traffic Across Colombia Propels the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Commercial Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe

- 5.1.2. Engine

- 5.1.3. Component

- 5.1.4. Line

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aeroman (An MRO Holdings Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Aerospace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ACC Columbia Jet Service GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henkel Colombiana S A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nediar InnLab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avianca Cargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS (Société Générale de Surveillance SA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indaer Aviation Technical Services S A S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Aeroman (An MRO Holdings Company)

List of Figures

- Figure 1: Colombia Commercial Aircraft MRO Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Colombia Commercial Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 2: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 4: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Commercial Aircraft MRO Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Colombia Commercial Aircraft MRO Market?

Key companies in the market include Aeroman (An MRO Holdings Company), Central Aerospace, ACC Columbia Jet Service GmbH, Safran SA*List Not Exhaustive, Henkel Colombiana S A S, Nediar InnLab, Avianca Cargo, SGS (Société Générale de Surveillance SA), Indaer Aviation Technical Services S A S.

3. What are the main segments of the Colombia Commercial Aircraft MRO Market?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Air Traffic Across Colombia Propels the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Safran Nacelles signed a four-year agreement with Avianca for the support of the nacelles of the airline's Airbus A320neo powered by CFM International LEAP-1A turbofan engines. Under the agreement, the airline will get OEM-guaranteed MRO solutions at the Safran Nacelles repair station.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Commercial Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Commercial Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Commercial Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Colombia Commercial Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence