Key Insights

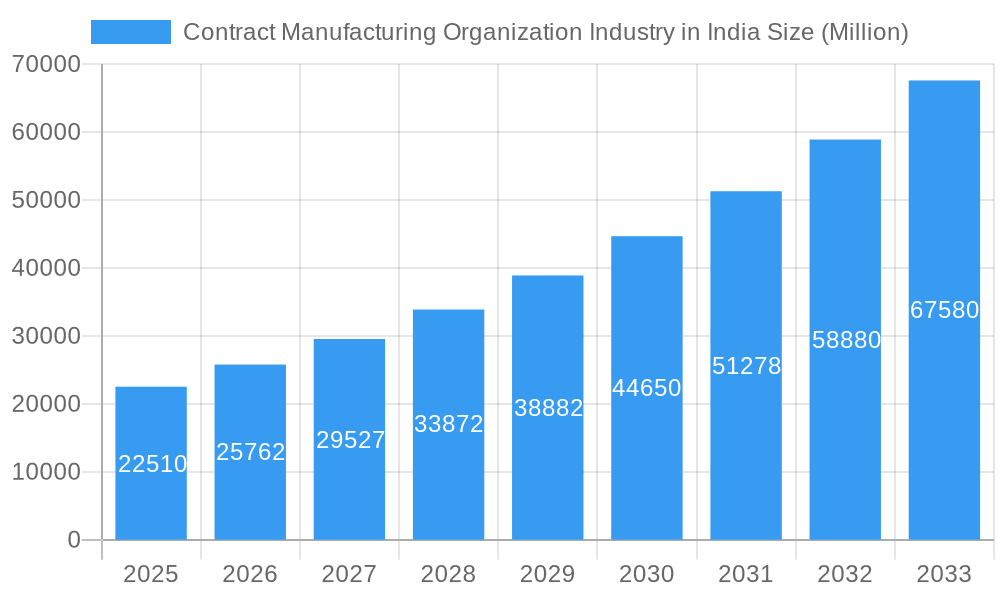

The Indian Contract Manufacturing Organization (CMO) industry is experiencing robust growth, driven by increasing demand for pharmaceuticals, rising outsourcing trends among pharmaceutical companies, and a focus on cost optimization. The market, valued at $22.51 billion in 2025, exhibits a Compound Annual Growth Rate (CAGR) of 14.67%, projecting significant expansion through 2033. This growth is fueled by several key factors. Firstly, the burgeoning Indian pharmaceutical sector, both domestically and for exports, necessitates reliable and cost-effective CMO services. Secondly, global pharmaceutical giants increasingly leverage Indian CMOs to access a skilled workforce and lower manufacturing costs. Finally, the Indian government's supportive policies and initiatives aimed at strengthening the pharmaceutical industry further bolster the sector's growth trajectory. The industry is segmented by service type, primarily encompassing API and intermediates and finished dosage forms. API and intermediates manufacturing is likely to experience faster growth due to increasing demand for bulk drugs, while finished dosage manufacturing provides a wider market reach. Competition is intense, with numerous domestic and multinational players vying for market share, including Akums Drugs, Rhydburg Pharmaceuticals, MSN Laboratories, and industry giants like Cipla and Dr. Reddy's Laboratories. Regional variations exist, with potential for accelerated growth in regions like South India, known for its strong pharmaceutical manufacturing infrastructure. However, challenges remain including regulatory hurdles and the need for continuous technological advancements to maintain competitiveness in the global market.

Contract Manufacturing Organization Industry in India Market Size (In Billion)

The forecast period (2025-2033) promises continued expansion, with the market potentially exceeding $70 Billion by 2033, based on the provided CAGR. This growth will likely be influenced by further consolidation within the industry, increased investments in research and development, and a greater focus on specialized services such as sterile injectables and biologics. The market will continue to be shaped by evolving global regulations and the ongoing need for efficient and reliable supply chains. Geographical diversification and strategic partnerships will be critical success factors for players aiming to capture a larger share of this expanding market.

Contract Manufacturing Organization Industry in India Company Market Share

Contract Manufacturing Organization (CMO) Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Manufacturing Organization (CMO) industry in India, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period from 2019 to 2033, with a focus on the year 2025, providing both historical data and future projections. The Indian CMO market, valued at xx Million in 2025, is poised for significant growth, driven by various factors analyzed within this report.

Contract Manufacturing Organization Industry in India Market Structure & Innovation Trends

The Indian CMO market exhibits a moderately concentrated structure, with a few large players holding significant market share alongside numerous smaller, specialized firms. Market share data for individual companies is unavailable, but analysis suggests that companies like Dr. Reddy's Laboratories, Cipla Ltd, and Sun Pharmaceuticals (though not solely a CMO) exert considerable influence. Innovation is driven by increasing demand for complex generics, a rising focus on biologics, and the growing adoption of advanced technologies like AI in drug discovery and manufacturing. Regulatory frameworks, primarily overseen by the Drug Controller General of India (DCGI), play a crucial role in shaping the market landscape. The industry faces competition from other manufacturing models, but the advantages of cost-effectiveness and scalability inherent to CMOs maintain market demand. The M&A activity in the sector is moderate, with deal values ranging from xx Million to xx Million in recent years, indicating consolidation and strategic expansion among players. The end-user demographic is largely dominated by pharmaceutical companies, both domestic and multinational.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Complex generics, biologics, AI in drug discovery

- Regulatory Framework: DCGI regulations

- M&A Activity: Moderate, deal values ranging from xx Million to xx Million.

Contract Manufacturing Organization Industry in India Market Dynamics & Trends

The Indian CMO market is characterized by robust growth, propelled by factors such as increasing domestic pharmaceutical production, a growing generics market, and rising demand for contract manufacturing services from multinational pharmaceutical companies seeking cost-effective solutions. Technological disruptions, including advancements in manufacturing processes and automation, are enhancing efficiency and driving down costs. Consumer preferences (in this context, pharmaceutical companies) are increasingly focused on quality, reliability, and speed of delivery, which puts pressure on CMOs to invest in modern technologies. Competitive dynamics are intense, with players competing on price, quality, and service offerings. The overall market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), and market penetration for CMO services is projected to reach xx% by 2033.

Dominant Regions & Segments in Contract Manufacturing Organization Industry in India

While precise, officially published data on regional dominance is still evolving, the western and southern regions of India are widely recognized as the powerhouses of the CMO industry. This leadership is attributed to their well-established pharmaceutical hubs, robust research and development ecosystems, and superior infrastructure, including reliable supply chains and skilled workforces. Within the service type category, the Finished Dose segment is poised for continued dominance. This is driven by the escalating global and domestic demand for finished dosage forms across a broad spectrum of therapeutic areas, coupled with the increasing complexity of drug formulations and the need for specialized manufacturing capabilities.

-

Key Drivers for Finished Dose Segment Dominance:

- Higher Value-Added Services: CMOs in this segment often offer comprehensive services from formulation development to packaging, representing a more integrated and profitable offering.

- Stringent Regulatory Compliance Requirements: The global emphasis on product quality and patient safety necessitates rigorous adherence to international regulatory standards (e.g., USFDA, EMA), which specialized CMOs are adept at meeting.

- Growing Demand for Specialized Formulations: The shift towards more targeted therapies, patient-centric drug delivery systems (like controlled-release and orally disintegrating tablets), and personalized medicine fuels the demand for CMOs with advanced formulation expertise.

- Outsourcing of Complex Manufacturing: Many large pharmaceutical companies are increasingly outsourcing the manufacturing of complex finished dosage forms to specialized CMOs to optimize costs and focus on R&D.

-

Key Drivers for API and Intermediates Segment:

- Cost-Effective Manufacturing: India's inherent advantage in cost-effective production of Active Pharmaceutical Ingredients (APIs) and intermediates continues to attract global business.

- Opportunity for Bulk Production: The large-scale manufacturing capabilities of Indian CMOs are crucial for meeting the global demand for generic drugs, which often require significant volumes of APIs and intermediates.

- Increased Demand for Generic Drugs: The global push for affordable healthcare solutions and the patent expirations of blockbuster drugs continue to drive the demand for generic medicines, thereby boosting the API and intermediates segment.

- Supply Chain Diversification: Geopolitical factors and supply chain disruptions have prompted global pharmaceutical companies to diversify their sourcing of APIs and intermediates, benefiting Indian CMOs.

Contract Manufacturing Organization Industry in India Product Innovations

The Contract Manufacturing Organization (CMO) industry in India is a hotbed of innovation, with significant advancements shaping the future of pharmaceutical production. Key innovations include the adoption of continuous manufacturing processes, which offer enhanced efficiency, reduced waste, and improved product quality compared to traditional batch manufacturing. Furthermore, there's a strong focus on developing specialized formulations, such as advanced controlled-release systems, targeted drug delivery mechanisms, and patient-friendly dosage forms like orally disintegrating tablets and transdermal patches. The integration of cutting-edge technologies like 3D printing for personalized medications and micro-dosing, alongside the application of Artificial Intelligence (AI) and Machine Learning (ML) for process optimization and predictive quality control, are also gaining traction. These innovations not only address the evolving needs of pharmaceutical companies for more effective and patient-centric products but also create significant competitive advantages for CMOs who invest in technological upgrades and proactively adapt to emerging market trends and regulatory landscapes.

Report Scope & Segmentation Analysis

This report segments the Indian CMO market by service type: API and Intermediates and Finished Dose. The API and Intermediates segment is projected to witness a CAGR of xx% during the forecast period, driven by increasing demand for generic drugs. The Finished Dose segment is expected to exhibit a CAGR of xx% due to the growth of branded and generic pharmaceutical products. Competitive dynamics vary between segments, with higher competition in the Finished Dose segment due to greater market size and higher entry barriers.

Key Drivers of Contract Manufacturing Organization Industry in India Growth

The growth of the Indian CMO industry is driven by several factors: a large and expanding domestic pharmaceutical market, cost advantages compared to Western counterparts, government initiatives promoting pharmaceutical manufacturing, and increasing outsourcing by multinational pharmaceutical companies. Technological advancements, like automation and advanced analytics, enhance efficiency and reduce costs. Stringent regulatory frameworks ensure product quality and safety, adding credibility to Indian CMOs globally.

Challenges in the Contract Manufacturing Organization Industry in India Sector

The Indian CMO sector faces challenges such as stringent regulatory compliance requirements, which can lead to high compliance costs and lengthy approval processes. Supply chain disruptions and increased raw material costs also pose significant challenges. Intense competition both domestically and internationally necessitates continuous innovation and operational efficiency for market survival. These issues can result in reduced profit margins and market share pressures.

Emerging Opportunities in Contract Manufacturing Organization Industry in India

The Indian CMO industry is witnessing a surge of emerging opportunities driven by evolving global healthcare demands and technological advancements. A significant growth area is the manufacturing of biologics, including biosimilars and complex protein-based therapies, as pharmaceutical companies increasingly outsource this specialized and capital-intensive production. The rapid adoption of advanced technologies like AI and machine learning in drug discovery, development, and manufacturing processes presents a paradigm shift, enabling greater efficiency, faster timelines, and improved quality. Furthermore, the growing focus on niche therapeutic areas, such as rare diseases and oncology, opens doors for CMOs specializing in these complex treatment modalities. The burgeoning field of personalized medicine, tailoring treatments to individual patient profiles, offers substantial growth potential for CMOs capable of handling smaller, more intricate production runs. Lastly, the continuous expansion of the Indian pharmaceutical export market, fueled by cost competitiveness and a strong regulatory track record, provides a robust platform for CMOs to scale their operations and capture global market share.

Leading Players in the Contract Manufacturing Organization Industry in India Market

- Akums Drugs and Pharmaceuticals Limited

- Rhydburg Pharmaceuticals Ltd

- MSN Laboratories Pvt Ltd

- BDR Pharmaceuticals International

- Eisai Pharmaceuticals India Pvt Ltd

- Ciron Drugs & Pharmaceuticals Pvt Ltd

- Wockhardt Limited

- Cipla Ltd

- Delwis Healthcare Pvt Ltd

- Unichem Laboratories Ltd

- Dr Reddy's Laboratories

- Theon Pharmaceuticals Limited

- Viatris Inc (Mylan Laboratories Ltd)

- Maxheal Pharmaceuticals India Ltd

- Medipaams India Pvt Ltd

- AMRI India Pvt Ltd

- Cadila Healthcare Limited

- Laurus Labs Limited

- Divi's Laboratories Limited

- Piramal Pharma Solutions

Key Developments in Contract Manufacturing Organization Industry in India Industry

- June 2022: Glenmark Pharmaceuticals launched Indamet, a fixed-dose combination (FDC) medication for asthma, marking a significant milestone as the first such FDC commercialized in India, showcasing innovation in complex formulation.

- May 2022: Sun Pharma announced the launch of Bempedoic Acid, a first-in-class oral drug for reducing LDL cholesterol, under the brand name 'Brillo'. This highlights the industry's capability to bring novel therapies to market.

- March 2022: Themis Medicare Ltd. received DCGI approval for VIRALEX, an antiviral medication for mild to moderate Covid-19. This demonstrates the industry's agility in responding to public health crises with effective treatments.

- Ongoing Trend: Increased investment by major Indian CMOs in expanding their capacities for biologics and specialized sterile injectables manufacturing to cater to global demand and higher-value segments.

- Strategic Partnerships: Growing trend of strategic collaborations between Indian CMOs and global pharmaceutical giants for co-development and manufacturing of novel drug candidates, underscoring India's emergence as a preferred outsourcing destination.

Future Outlook for Contract Manufacturing Organization Industry in India Market

The Indian CMO market is poised for significant growth in the coming years, driven by continuous technological advancements, increasing outsourcing by pharmaceutical companies, and the expansion of the domestic and export markets. Strategic partnerships, investments in advanced technologies, and a focus on regulatory compliance will be key factors determining the success of CMOs in this dynamic landscape. The sector’s future appears bright, with considerable room for expansion and consolidation.

Contract Manufacturing Organization Industry in India Segmentation

-

1. Service Type

- 1.1. API and Intermediates

-

1.2. Finished Dose

- 1.2.1. Solids

- 1.2.2. Liquids

- 1.2.3. Semi-Solids and Injectables

Contract Manufacturing Organization Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contract Manufacturing Organization Industry in India Regional Market Share

Geographic Coverage of Contract Manufacturing Organization Industry in India

Contract Manufacturing Organization Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. API and Intermediates

- 5.1.2. Finished Dose

- 5.1.2.1. Solids

- 5.1.2.2. Liquids

- 5.1.2.3. Semi-Solids and Injectables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. API and Intermediates

- 6.1.2. Finished Dose

- 6.1.2.1. Solids

- 6.1.2.2. Liquids

- 6.1.2.3. Semi-Solids and Injectables

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. API and Intermediates

- 7.1.2. Finished Dose

- 7.1.2.1. Solids

- 7.1.2.2. Liquids

- 7.1.2.3. Semi-Solids and Injectables

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. API and Intermediates

- 8.1.2. Finished Dose

- 8.1.2.1. Solids

- 8.1.2.2. Liquids

- 8.1.2.3. Semi-Solids and Injectables

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. API and Intermediates

- 9.1.2. Finished Dose

- 9.1.2.1. Solids

- 9.1.2.2. Liquids

- 9.1.2.3. Semi-Solids and Injectables

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. API and Intermediates

- 10.1.2. Finished Dose

- 10.1.2.1. Solids

- 10.1.2.2. Liquids

- 10.1.2.3. Semi-Solids and Injectables

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rhydburg Pharmaceuticals Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Laboratories Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BDR Pharmaceuticals International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Pharmaceuticals India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wockhardt Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delwis Healthcare Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unichem Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Reddy's Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Theon Pharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Viatris Inc (Mylan Laboratories Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxheal Pharmaceuticals India Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Medipaams India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AMRI India Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cadila Healthcare Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

List of Figures

- Figure 1: Global Contract Manufacturing Organization Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 7: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Organization Industry in India?

The projected CAGR is approximately 14.67%.

2. Which companies are prominent players in the Contract Manufacturing Organization Industry in India?

Key companies in the market include Akums Drugs and Pharmaceuticals Limited, Rhydburg Pharmaceuticals Ltd, MSN Laboratories Pvt Ltd, BDR Pharmaceuticals International, Eisai Pharmaceuticals India Pvt Ltd, Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive, Wockhardt Limited, Cipla Ltd, Delwis Healthcare Pvt Ltd, Unichem Laboratories Ltd, Dr Reddy's Laboratories, Theon Pharmaceuticals Limited, Viatris Inc (Mylan Laboratories Ltd), Maxheal Pharmaceuticals India Ltd, Medipaams India Pvt Ltd, AMRI India Pvt Ltd, Cadila Healthcare Limited.

3. What are the main segments of the Contract Manufacturing Organization Industry in India?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region.

6. What are the notable trends driving market growth?

Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

In June of 2022: Glenmark Pharmaceuticals introduced the cutting-edge fixed-dose combination (FDC) medication Indacaterol + Mometasone for patients with uncontrolled asthma in India. The business introduced this FDC under the name Indamet. Glenmark is the first business in India to commercialize the ground-breaking FDC of Indacaterol, a long-acting beta-agonist, and Mometasone Furoate, an inhaled corticosteroid that has been authorized by the Drug Controller General of India (DCGI),

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Organization Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Organization Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Organization Industry in India?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Organization Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence