Key Insights

The Japan paper packaging market is projected to reach an estimated $76.88 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.3% from 2025 to 2033. This expansion is primarily attributed to the nation's thriving food and beverage, personal care, and e-commerce industries, alongside a growing consumer preference for sustainable and convenient packaging. Key drivers include the demand for eco-friendly materials such as recycled paperboard and the adoption of innovative packaging designs. While the market navigates challenges like raw material price volatility and stringent environmental regulations, the outlook remains robust. Leading segments include corrugated board, vital for e-commerce due to its versatility and cost-efficiency, and paperboard, essential for food and beverage applications. Major companies like Rengo and Oji Paper are investing in advanced technologies and sustainable practices to maintain competitiveness and meet evolving consumer demands.

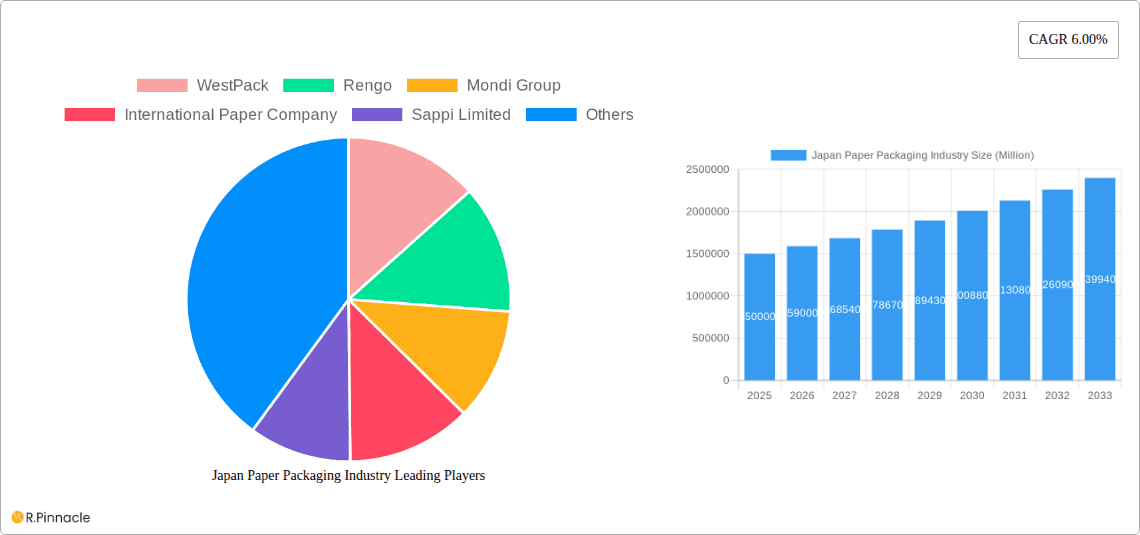

Japan Paper Packaging Industry Market Size (In Billion)

The competitive environment features both domestic leaders and international entities competing for market share. Emphasis is placed on customization and value-added services, with companies developing tailored solutions to meet specific client requirements, further stimulating market growth. Enhanced supply chain efficiency and reduced carbon footprints are significant market influencers. Strategic partnerships and collaborations are anticipated to streamline operations and advance sustainable practices, solidifying market positions. The projected growth offers considerable opportunities for industry players who can effectively balance sustainability, cost-effectiveness, and innovation to align with consumer preferences and regulatory mandates.

Japan Paper Packaging Industry Company Market Share

Japan Paper Packaging Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Japan paper packaging industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, innovation trends, competitive landscape, and future growth prospects. The report leverages extensive data analysis to provide actionable intelligence and strategic recommendations.

Japan Paper Packaging Industry Market Structure & Innovation Trends

The Japanese paper packaging market exhibits a moderately concentrated structure, with key players like Rengo, Oji Paper, and leading international companies such as WestPack, Mondi Group, International Paper Company, Sappi Limited, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith, Amcor PLC, Metsa Group holding significant market share. The combined market share of the top five players is estimated at xx%. Innovation is driven by increasing demand for sustainable packaging solutions, advances in printing technologies, and the need for enhanced product protection. Regulatory frameworks focused on recyclability and environmental sustainability are shaping industry practices. Product substitutes, such as plastic packaging, pose a significant competitive challenge, although the growing preference for eco-friendly options is mitigating this impact. M&A activity has been moderate, with deal values totaling approximately ¥xx Million in the past five years.

- Market Concentration: Top 5 players hold xx% market share.

- Innovation Drivers: Sustainability, advanced printing, product protection.

- Regulatory Framework: Focus on recyclability and environmental compliance.

- M&A Activity: Total deal value (2019-2024): ¥xx Million.

Japan Paper Packaging Industry Market Dynamics & Trends

The Japan paper packaging market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the rising demand from the food and beverage, personal care, and e-commerce sectors. Technological disruptions, such as automation in production and digital printing, are enhancing efficiency and product customization. Consumer preference for convenient and sustainable packaging is pushing innovation towards eco-friendly materials and designs. Competitive dynamics are shaped by price competition, product differentiation, and strategic partnerships. Market penetration of sustainable packaging is projected to reach xx% by 2033.

Dominant Regions & Segments in Japan Paper Packaging Industry

The Kanto region dominates the Japanese paper packaging market due to its high concentration of manufacturing and consumer activity. Within product segments, Corrugated Board holds the largest market share, driven by the burgeoning e-commerce sector. In terms of end-user industries, Food and Beverage accounts for the largest segment.

- Key Drivers for Kanto Region Dominance:

- High concentration of manufacturing facilities.

- Strong consumer demand.

- Developed infrastructure.

- Key Drivers for Corrugated Board Segment Dominance:

- E-commerce boom.

- Versatile application.

- Cost-effectiveness.

- Key Drivers for Food and Beverage End-User Segment Dominance:

- Large and established food processing industry.

- Stringent regulations on food safety and packaging.

Japan Paper Packaging Industry Product Innovations

Recent innovations focus on sustainable materials, such as recycled fiber and bio-based alternatives. Advancements in printing technology, including digital printing and enhanced graphic capabilities, enable highly customized packaging solutions. Antiviral paper, such as Nippon Paper Industries' "NPI antiviral paper," demonstrates a move towards enhanced hygiene and safety features. These innovations are enhancing both product appeal and market competitiveness.

Report Scope & Segmentation Analysis

This report segments the Japan paper packaging market by product type (Paperboard, Container Board, Corrugated Board, Other Products) and end-user industry (Food and Beverage, Personal Care, Home Care, Healthcare, Retail, Other Industry Verticals). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The report provides specific market sizes and growth projections for each segment for the study period (2019-2033). For instance, the Corrugated Board segment is expected to show a CAGR of xx% during the forecast period, driven by increased demand from the e-commerce sector.

Key Drivers of Japan Paper Packaging Industry Growth

Growth is driven by several factors: the expanding e-commerce sector fuels demand for corrugated board; increasing focus on sustainable packaging solutions leads to innovation in eco-friendly materials; technological advancements enhance efficiency and product quality; and rising consumer spending power boosts demand across various end-use sectors.

Challenges in the Japan Paper Packaging Industry Sector

Challenges include fluctuations in raw material prices impacting profitability, intense competition from substitute materials such as plastics, and environmental regulations requiring compliance with stringent sustainability standards. Supply chain disruptions can cause production delays and cost increases, negatively affecting profitability. The cost of raw materials is a significant challenge and is predicted to rise by xx% over the forecast period.

Emerging Opportunities in Japan Paper Packaging Industry

Emerging opportunities lie in the growing demand for sustainable and functional packaging solutions. Innovation in eco-friendly materials, like recycled paper and bioplastics, presents significant growth potential. The development of smart packaging with features such as traceability and temperature monitoring offers new avenues for growth. The increased focus on hygiene is driving demand for antimicrobial packaging.

Leading Players in the Japan Paper Packaging Industry Market

- WestPack

- Rengo

- Mondi Group

- International Paper Company

- Sappi Limited

- Oji Paper

- Graphic Packaging International Corporation

- Smurfit Kappa

- DS Smith

- Amcor PLC

- Metsa Group (List Not Exhaustive)

Key Developments in Japan Paper Packaging Industry

- December 2021: Nippon Paper Industries, Ltd. obtains SIAA antiviral processing certification for "NPI antiviral paper," expanding applications in hygiene-sensitive products.

- November 2021: AMETEK Surface Vision and Rengo Co. Ltd. collaborate to enhance Rengo's papermaking quality through advanced technology integration.

Future Outlook for Japan Paper Packaging Industry Market

The Japan paper packaging market is poised for continued growth, driven by e-commerce expansion, increasing demand for sustainable packaging, and technological advancements. Companies focusing on innovation, sustainability, and efficient supply chains are expected to gain a competitive edge. Strategic partnerships and M&A activities will likely shape the industry landscape in the coming years. The market is projected to reach ¥xx Million by 2033.

Japan Paper Packaging Industry Segmentation

-

1. Product

- 1.1. Paperboard

- 1.2. Container Board

- 1.3. Corrugated Board

- 1.4. Other Products

-

2. End User Industry

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Home Care

- 2.4. Healthcare

- 2.5. Retail

- 2.6. Other Industry Verticals

Japan Paper Packaging Industry Segmentation By Geography

- 1. Japan

Japan Paper Packaging Industry Regional Market Share

Geographic Coverage of Japan Paper Packaging Industry

Japan Paper Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism

- 3.3. Market Restrains

- 3.3.1. Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries

- 3.4. Market Trends

- 3.4.1. The Processed Food and Beverage Industry to Drive the Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Paper Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Paperboard

- 5.1.2. Container Board

- 5.1.3. Corrugated Board

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Home Care

- 5.2.4. Healthcare

- 5.2.5. Retail

- 5.2.6. Other Industry Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestPack

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rengo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Paper Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sappi Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji Paper

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Graphic Packaging International Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smurfit Kappa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DS Smith

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Metsa Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 WestPack

List of Figures

- Figure 1: Japan Paper Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Paper Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Paper Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Japan Paper Packaging Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 3: Japan Paper Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Paper Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Japan Paper Packaging Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 6: Japan Paper Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Paper Packaging Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Japan Paper Packaging Industry?

Key companies in the market include WestPack, Rengo, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith, Amcor PLC*List Not Exhaustive, Metsa Group.

3. What are the main segments of the Japan Paper Packaging Industry?

The market segments include Product, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism.

6. What are the notable trends driving market growth?

The Processed Food and Beverage Industry to Drive the Demand in the Market.

7. Are there any restraints impacting market growth?

Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries.

8. Can you provide examples of recent developments in the market?

December 2021: Nippon Paper Industries, Ltd. has obtained SIAA antiviral processing certification established by the Antibacterial Product Technology Council for "NPI antiviral paper." This is the first acquisition in the category of "Inorganic materials such as paper and making. Since this product can be printed and processed in the same way as ordinary printing paper, it is a product that can provide safety and security in various applications. It was launched in September 2020 and is used in mask cases, notebooks, envelopes, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Paper Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Paper Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Paper Packaging Industry?

To stay informed about further developments, trends, and reports in the Japan Paper Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence