Key Insights

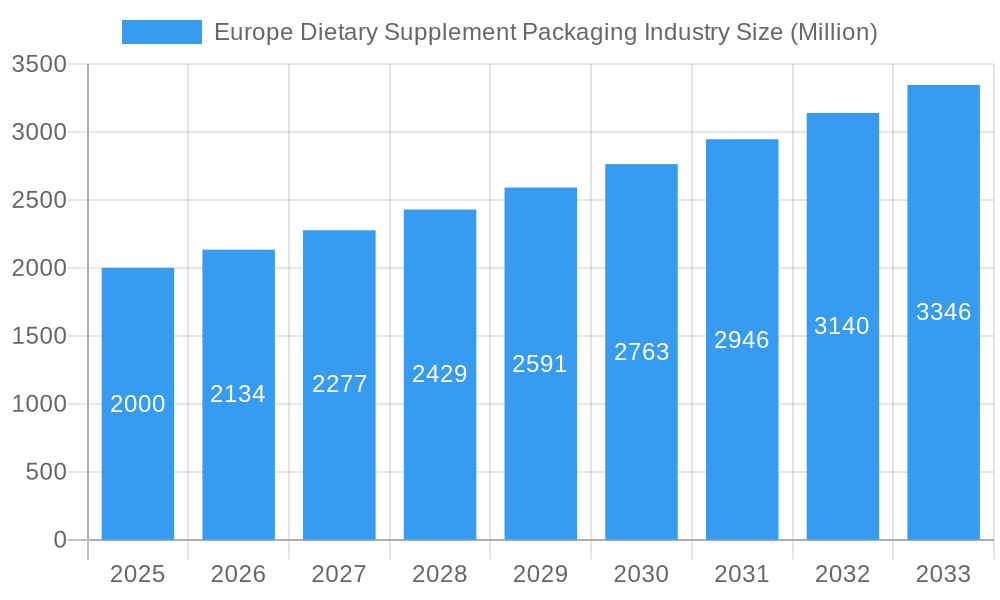

The European dietary supplement packaging market is experiencing robust growth, fueled by a surge in demand for convenient and appealing packaging solutions. The market, valued at approximately €[Estimate based on market size XX and Value Unit Million - Assume XX represents a number like 2000 leading to a Market size of €2000 Million in 2025], is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This expansion is driven by several key factors: the increasing popularity of dietary supplements across various age groups, the growing preference for convenient and tamper-evident packaging formats (like pouches and blister packs), and the rising consumer awareness of product quality and safety. The market's segmentation reflects this diversity, with plastic bottles maintaining a significant share, followed by glass bottles and pouches. However, the growing emphasis on sustainability is leading to increased adoption of eco-friendly materials such as paperboard and glass, presenting a significant opportunity for manufacturers. Furthermore, the market is witnessing innovation in packaging designs that enhance product shelf life and appeal to consumer preferences for convenient portioning and usage.

Europe Dietary Supplement Packaging Industry Market Size (In Billion)

The geographical distribution of the market reveals strong performance across major European economies, including Germany, France, the United Kingdom, and Italy. However, untapped potential exists in smaller markets within the region, presenting opportunities for expansion. Key players are actively investing in research and development to create innovative packaging solutions that address consumer demands for sustainability, convenience, and product integrity. This includes advancements in barrier technologies to protect sensitive supplement formulations and designs aimed at reducing environmental impact. Competitive dynamics are characterized by both established players and emerging companies introducing new materials and formats to capture market share. Regulatory changes related to packaging waste and sustainability are also shaping the market landscape, pushing companies to adopt more environmentally friendly practices. Successful companies will be those that effectively combine innovative packaging design with a focus on sustainable and eco-conscious materials to meet the evolving needs of consumers and address evolving environmental regulations.

Europe Dietary Supplement Packaging Industry Company Market Share

Europe Dietary Supplement Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Dietary Supplement Packaging Industry, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. The market is segmented by material (plastic, glass, metal, paper & paperboard), product type (bottles, pouches, blisters, boxes, etc.), formulation (tablets, capsules, powders, liquids), and country (UK, Germany, France, Italy, Spain, and others). The report values are expressed in Millions.

Europe Dietary Supplement Packaging Industry Market Structure & Innovation Trends

The European dietary supplement packaging market exhibits a moderately concentrated structure, with several major players holding significant market share. Novio Packaging B V, OPM (labels and packaging) Group Ltd, Law Print & Packaging Management Ltd, Alpha Packaging, Moulded Packaging Solutions Limited, Graham Packaging Company, and Gerresheimer AG are key players, although the market is not limited to these companies. Market share data for these companies varies depending on segment and year but typically ranges from 2% to 15% for each. Recent M&A activity has been modest, with deal values averaging around xx Million annually over the historical period. Innovation is driven by increasing demand for sustainable packaging, stricter regulatory compliance, and consumer preference for convenience and enhanced product presentation. The regulatory landscape is constantly evolving, influencing material choices and labeling requirements. The market witnesses competition from alternative packaging types and materials. End-user demographics show a growing segment of health-conscious consumers driving demand for innovative and eco-friendly packaging solutions.

Europe Dietary Supplement Packaging Industry Market Dynamics & Trends

The European dietary supplement packaging market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors including the increasing popularity of dietary supplements, expanding health and wellness consciousness among consumers, and evolving consumer preferences toward eco-friendly packaging materials. Technological disruptions, like the adoption of advanced printing techniques and smart packaging solutions, are further driving market expansion. Market penetration of sustainable packaging materials is steadily increasing, with a projected xx% market share by 2033. Competitive dynamics remain intense, with companies focusing on product differentiation, cost optimization, and innovation to gain a competitive edge.

Dominant Regions & Segments in Europe Dietary Supplement Packaging Industry

- Leading Region: Western Europe, driven by high disposable incomes and health awareness.

- Leading Country: The United Kingdom, due to a mature dietary supplements market and strong regulatory frameworks.

- Dominant Material Segment: Plastic, driven by cost-effectiveness and versatility.

- Dominant Product Type Segment: Plastic bottles, favored for their wide use in the supplement industry.

- Dominant Formulation Segment: Capsules, due to their popularity and suitability for various supplement types.

Key Drivers: Strong regulatory frameworks in certain countries, well-established distribution channels, consumer preference for specific packaging types, and significant investments in research and development (R&D) for packaging innovations. Germany and France also exhibit strong growth due to their established dietary supplement industries and supporting infrastructure. Italy and Spain, while showing slower growth than the UK and Germany, still represent significant markets with potential for expansion.

Europe Dietary Supplement Packaging Industry Product Innovations

Recent innovations center on sustainable materials like biodegradable plastics and recycled paperboard, alongside advancements in printing and labeling technologies to enhance product visibility and consumer appeal. Smart packaging solutions, such as tamper-evident seals and RFID tags, are gaining traction, enhancing product security and traceability. These innovations address growing consumer concerns about sustainability and product authenticity, providing a competitive advantage for manufacturers.

Report Scope & Segmentation Analysis

The report segments the market by material (Plastic, Glass, Metal, Paper & Paperboard), product type (Plastic Bottles, Glass Bottles, Pouches, Blisters, Paperboard Boxes, Other Product Types), formulation (Tablets, Capsules, Powder, Liquids, Others), and country (United Kingdom, Germany, France, Italy, Spain, Others). Each segment’s growth is analyzed, considering market size, competitive landscape, and projected growth. For example, the plastic segment displays strong growth driven by cost-effectiveness, while the paperboard segment benefits from increasing sustainability awareness. Market size projections for each segment vary, with larger segments like plastic and glass bottles expected to maintain dominance.

Key Drivers of Europe Dietary Supplement Packaging Industry Growth

The industry's growth is spurred by the increasing demand for dietary supplements due to rising health awareness, aging populations, and the prevalence of chronic diseases. Technological advancements in packaging materials and manufacturing processes also contribute. Favorable regulatory frameworks in several European countries, supportive government policies, and a robust supply chain infrastructure further propel growth.

Challenges in the Europe Dietary Supplement Packaging Industry Sector

The sector faces challenges like stringent environmental regulations requiring eco-friendly packaging solutions, increasing raw material costs impacting profitability, and intense competition among packaging manufacturers. Supply chain disruptions resulting from geopolitical events further contribute to challenges in meeting demand consistently. These factors can influence pricing and market stability.

Emerging Opportunities in Europe Dietary Supplement Packaging Industry

Emerging opportunities exist in the development of sustainable and innovative packaging solutions, including biodegradable materials and reusable containers. Expanding into e-commerce channels and targeting niche markets like personalized supplements also present promising avenues for growth. Furthermore, incorporating smart packaging features to enhance consumer engagement and product authentication offers significant potential.

Leading Players in the Europe Dietary Supplement Packaging Industry Market

- Novio Packaging B V

- OPM (labels and packaging) Group Ltd

- Law Print & Packaging Management Ltd

- Alpha Packaging

- Moulded Packaging Solutions Limited

- Graham Packaging Company

- Gerresheimer AG

Key Developments in Europe Dietary Supplement Packaging Industry Industry

- August 2022: ePac Flexible Packaging expands its operations worldwide, including a second site in the UK, with further expansion planned for Poland, France, and Austria (Q4 2022), along with the Netherlands and Scandinavia. This signifies a significant investment in capacity and market reach, potentially impacting competition and product availability.

Future Outlook for Europe Dietary Supplement Packaging Market

The future outlook for the European dietary supplement packaging market remains positive, driven by continuous growth in the dietary supplements market, increasing consumer demand for convenient and sustainable packaging options, and ongoing technological advancements. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for companies to capitalize on the growth potential. The market is expected to witness a sustained growth trajectory throughout the forecast period.

Europe Dietary Supplement Packaging Industry Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polypropylene (PP)

- 1.1.2. Polyethylene Terephthalate (PET)

- 1.1.3. Polyethylene (PE)

- 1.1.4. Other Types of Materials

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper & Paperboard

-

1.1. Plastic

-

2. Product Type

- 2.1. Plastic Bottles

- 2.2. Glass Bottles

- 2.3. Pouches

- 2.4. Blisters

- 2.5. Paperboard Boxes

- 2.6. Other Product Types

-

3. Formulation

- 3.1. Tablets

- 3.2. Capsules

- 3.3. Powder

- 3.4. Liquids

- 3.5. Others

Europe Dietary Supplement Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Dietary Supplement Packaging Industry Regional Market Share

Geographic Coverage of Europe Dietary Supplement Packaging Industry

Europe Dietary Supplement Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Prevalence of Diseases like Diabetes

- 3.2.2 Cardiovascular disease

- 3.2.3 and other Chronic diseases; Increasing Adoption of Lightweight Packaging Methods

- 3.3. Market Restrains

- 3.3.1. Lower Shelf Life of Active Ingredients and the Higher Manufacturing Cost

- 3.4. Market Trends

- 3.4.1. Glass Material to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Dietary Supplement Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polypropylene (PP)

- 5.1.1.2. Polyethylene Terephthalate (PET)

- 5.1.1.3. Polyethylene (PE)

- 5.1.1.4. Other Types of Materials

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper & Paperboard

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles

- 5.2.2. Glass Bottles

- 5.2.3. Pouches

- 5.2.4. Blisters

- 5.2.5. Paperboard Boxes

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Formulation

- 5.3.1. Tablets

- 5.3.2. Capsules

- 5.3.3. Powder

- 5.3.4. Liquids

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novio Packaging B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OPM (labels and packaging) Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Law Print & Packaging Management Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpha Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moulded Packaging Solutions Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Graham Packaging Company*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerresheimer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Novio Packaging B V

List of Figures

- Figure 1: Europe Dietary Supplement Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Dietary Supplement Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Formulation 2020 & 2033

- Table 4: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Formulation 2020 & 2033

- Table 8: Europe Dietary Supplement Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Dietary Supplement Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dietary Supplement Packaging Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Dietary Supplement Packaging Industry?

Key companies in the market include Novio Packaging B V, OPM (labels and packaging) Group Ltd, Law Print & Packaging Management Ltd, Alpha Packaging, Moulded Packaging Solutions Limited, Graham Packaging Company*List Not Exhaustive, Gerresheimer AG.

3. What are the main segments of the Europe Dietary Supplement Packaging Industry?

The market segments include Material, Product Type, Formulation.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Diseases like Diabetes. Cardiovascular disease. and other Chronic diseases; Increasing Adoption of Lightweight Packaging Methods.

6. What are the notable trends driving market growth?

Glass Material to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lower Shelf Life of Active Ingredients and the Higher Manufacturing Cost.

8. Can you provide examples of recent developments in the market?

August 2022 - ePac Flexible Packaging expands its operations worldwide, including a second site in the UK. The expansion plans include second sites in Poland and France, while a new operation in Austria is set to open in Q4 2022. Additionally, other sites to serve are the Netherlands and Scandinavia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dietary Supplement Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dietary Supplement Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dietary Supplement Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Dietary Supplement Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence