Key Insights

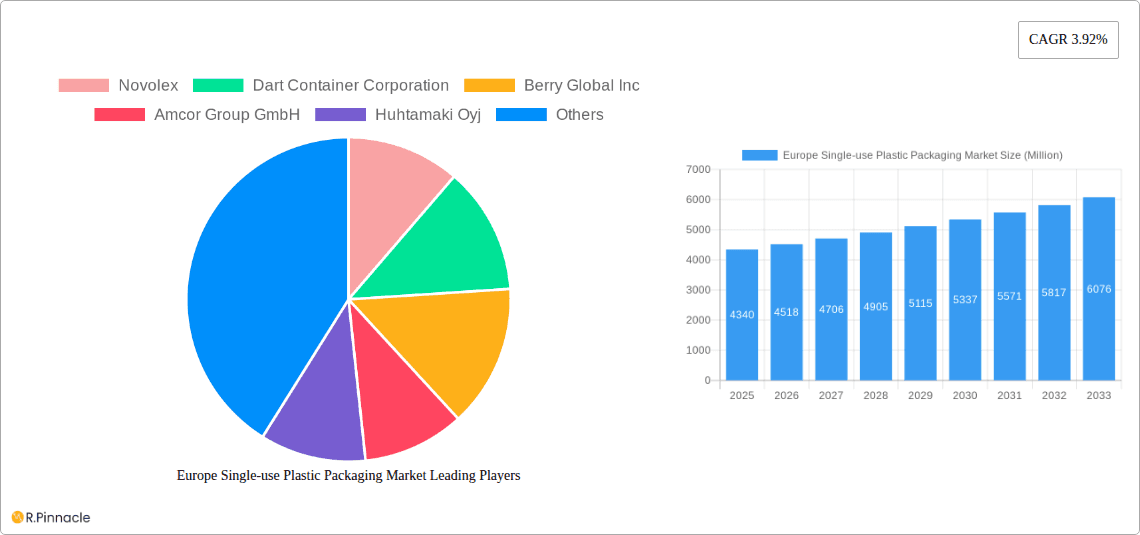

The Europe single-use plastic packaging market, valued at €4.34 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.92% from 2025 to 2033. This growth is driven by several factors. The burgeoning e-commerce sector fuels demand for convenient and protective packaging solutions. Furthermore, the increasing consumption of packaged food and beverages, particularly in convenience formats, significantly contributes to market expansion. The rising popularity of ready-to-eat meals and on-the-go snacks further propels demand for single-use plastic packaging. However, stringent regulations aimed at reducing plastic waste, coupled with growing environmental concerns and the push for sustainable alternatives, pose significant challenges to market growth. The industry is responding with innovations in biodegradable and compostable plastics, though these currently represent a smaller portion of the overall market. Competition among major players like Novolex, Dart Container Corporation, and Berry Global Inc. is intense, fostering innovation and price competitiveness. Regional variations within Europe exist, with higher consumption rates in more densely populated and economically developed regions.

Europe Single-use Plastic Packaging Market Market Size (In Billion)

The forecast for 2026-2033 anticipates continued growth, albeit at a potentially moderated pace due to regulatory pressures. The market segmentation (data not provided) likely includes various plastic types (e.g., PET, PP, PE), packaging formats (bottles, films, containers), and end-use applications (food and beverage, healthcare, consumer goods). Successful companies will likely be those that effectively balance the demand for cost-effective solutions with the growing need for environmentally responsible practices, perhaps by focusing on recyclable or sustainable material options and improving recycling infrastructure. The historical period (2019-2024) likely saw a more rapid growth phase before the intensification of regulatory action and heightened consumer awareness of environmental issues.

Europe Single-use Plastic Packaging Market Company Market Share

Europe Single-use Plastic Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe single-use plastic packaging market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis and incorporates recent industry developments to deliver actionable strategies.

Europe Single-use Plastic Packaging Market Structure & Innovation Trends

The European single-use plastic packaging market is characterized by a moderately concentrated structure with several key players holding significant market share. While precise market share figures for individual companies remain confidential, major players like Novolex, Dart Container Corporation, Berry Global Inc, Amcor Group GmbH, and Huhtamaki Oyj dominate the landscape. The market exhibits robust innovation driven by stringent regulations aimed at reducing plastic waste, growing consumer demand for sustainable packaging, and technological advancements in materials science.

Key innovation drivers include:

- Sustainable Packaging Solutions: The increasing adoption of recycled content and biodegradable materials.

- Lightweighting Technologies: Reducing plastic consumption without compromising functionality.

- Improved Recycling Infrastructure: Facilitating better waste management and circular economy initiatives.

- Evolving Regulatory Landscape: The EU's Single-Use Plastics Directive is a significant catalyst.

Significant M&A activity has been observed in recent years, though precise deal values are often undisclosed and fluctuate. These transactions are primarily driven by companies aiming to expand their product portfolios, geographical reach, and technological capabilities. The ongoing regulatory changes are prompting consolidation and strategic partnerships to meet sustainability targets. End-user demographics are diverse, encompassing food and beverage, healthcare, personal care, and other sectors. The market is projected to exhibit consistent growth, fueled by evolving consumer preferences and innovation in packaging technologies.

Europe Single-use Plastic Packaging Market Dynamics & Trends

The European single-use plastic packaging market is experiencing a period of significant transformation. Driven by environmental concerns and regulatory pressures, the market is shifting toward sustainable and eco-friendly solutions. Market growth is primarily fueled by:

- Increased Demand for Convenience: Single-use packaging remains prevalent due to its ease of use and cost-effectiveness in specific applications.

- E-commerce Boom: The surge in online shopping has increased the demand for protective single-use packaging.

- Growing Focus on Sustainability: Consumer preference for eco-friendly alternatives is forcing companies to adopt more sustainable packaging practices.

Technological disruptions, such as the development of biodegradable plastics and improved recycling technologies, are profoundly reshaping the market. The competitive landscape is intensely dynamic, with companies continually innovating to maintain their market positions. The market's CAGR is estimated at xx% during the forecast period (2025-2033), while market penetration varies significantly across segments and regions. Consumer preferences are gradually shifting towards sustainable options, pushing the adoption of recycled and renewable materials.

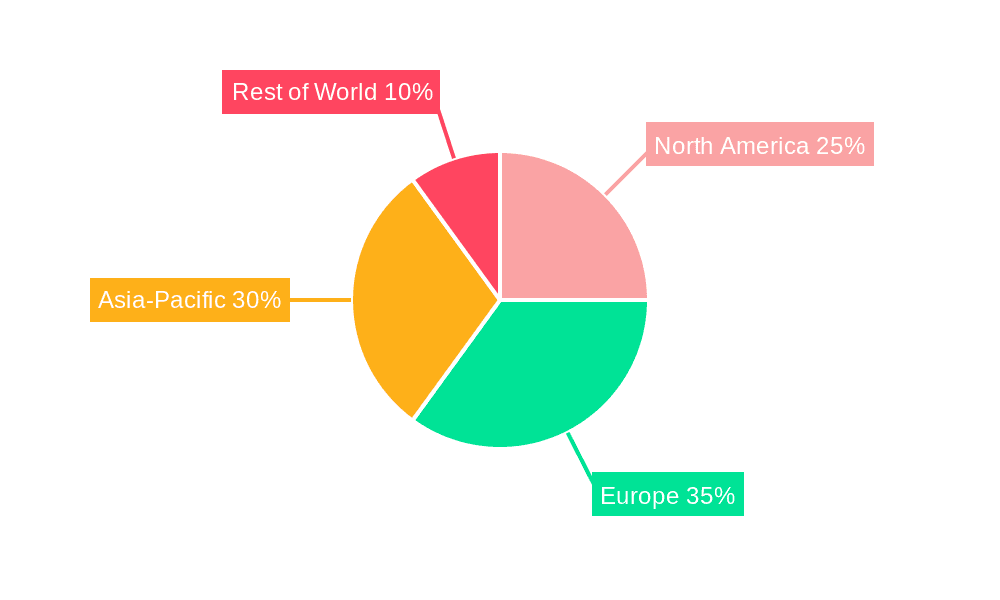

Dominant Regions & Segments in Europe Single-use Plastic Packaging Market

The Western European region currently holds the largest share of the European single-use plastic packaging market. This dominance stems from several factors:

- Robust economies: Higher disposable incomes lead to increased consumption of packaged goods.

- Developed infrastructure: Efficient logistics and distribution networks facilitate the smooth flow of packaged goods.

- Stringent environmental regulations: Driving innovation in sustainable packaging solutions.

Germany, France, and the UK are key players within this region. Within the various segments (food, beverage, healthcare, etc.), the food and beverage sector contributes most significantly, due to high consumption levels and the need for robust, hygienic packaging. Detailed dominance analysis within sub-segments and regions requires further investigation due to data limitations but the food and beverage segment clearly dominates.

Europe Single-use Plastic Packaging Market Product Innovations

Recent product innovations focus on sustainability and improved recyclability. Key trends include the use of recycled plastics, biodegradable materials, and lightweighting techniques to reduce environmental impact. For example, the introduction of 100% recycled PET trays by Klöckner Pentaplast demonstrates a significant step toward a circular economy. These innovations aim to enhance product differentiation and meet growing consumer demand for environmentally responsible packaging. The market fit for these innovations is strong, driven by both consumer preference and regulatory compliance.

Report Scope & Segmentation Analysis

This report segments the European single-use plastic packaging market based on material type (e.g., PET, PE, PP, etc.), packaging type (e.g., bottles, films, trays, etc.), end-use industry (e.g., food & beverage, healthcare, consumer goods, etc.), and region. Each segment presents unique growth projections, market sizes, and competitive dynamics. While specific numerical data is not available at this point, growth projections are expected to be stronger in segments focused on sustainable materials. Competitive dynamics are intense in each segment with key players striving for market share leadership.

Key Drivers of Europe Single-use Plastic Packaging Market Growth

Several factors drive growth in the European single-use plastic packaging market:

- Technological advancements: Development of sustainable and recyclable materials are driving growth.

- Economic growth: Increased consumer spending and demand for packaged goods fuel the market.

- Regulatory frameworks: Stringent environmental regulations push innovation toward sustainable packaging.

The EU's Single-Use Plastics Directive, for example, compels manufacturers to adopt more environmentally conscious packaging solutions, contributing significantly to market growth.

Challenges in the Europe Single-use Plastic Packaging Market Sector

The market faces certain challenges:

- Regulatory hurdles: Complex and evolving regulations present compliance challenges and impact costs.

- Fluctuating raw material prices: Impact profitability and sustainability initiatives.

- Intense competition: Requires continuous innovation and cost optimization.

These factors can hinder market growth, necessitating strategic adaptations by market players. Quantitative impacts are difficult to specify without more detailed data.

Emerging Opportunities in Europe Single-use Plastic Packaging Market

Emerging opportunities include:

- Bioplastics and compostable packaging: Growing demand for eco-friendly alternatives presents significant potential.

- Smart packaging: Incorporating technologies for improved traceability and product safety.

- Circular economy initiatives: Opportunities to improve recycling and waste management systems.

These trends indicate a positive market outlook for companies embracing sustainable and innovative approaches.

Leading Players in the Europe Single-use Plastic Packaging Market Market

- Novolex

- Dart Container Corporation

- Berry Global Inc

- Amcor Group GmbH

- Huhtamaki Oyj

- Hotpack Packaging Industries LLC

- Graphic Packaging International LLC

- Caterline

- Celebration Packaging Limited

- Nutripack *List Not Exhaustive

Key Developments in Europe Single-use Plastic Packaging Market Industry

- August 2023: Holmen Iggesund developed Inverform PET 30, a ready-to-eat meal tray reducing plastic content by over 25%.

- February 2024: Faerch Group launched its Tumbler range, beverage containers with at least 30% post-consumer recycled material.

- April 2024: Klöckner Pentaplast created a closed-loop system for PET trays using 100% recycled PET.

These developments highlight a strong industry push toward sustainability and circularity.

Future Outlook for Europe Single-use Plastic Packaging Market Market

The future of the European single-use plastic packaging market is promising, driven by ongoing innovations in sustainable materials and technologies. The increasing focus on reducing plastic waste and the adoption of circular economy principles will continue to shape the market. Opportunities lie in developing and implementing innovative packaging solutions that meet both environmental and consumer demands. Companies that adapt to these changes and invest in sustainable technologies are poised to thrive in this evolving market.

Europe Single-use Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polyethylene (PE)

- 1.3. Other Material Types

-

2. Product Type

- 2.1. Bottles

- 2.2. Bags and Pouches

- 2.3. Clamshells

- 2.4. Trays, Cups, and Lids

- 2.5. Other Product Types

-

3. End-user Type

- 3.1. Quick Service Restaurants

- 3.2. Full Service Restaurants

- 3.3. Institutional

- 3.4. Retail

- 3.5. Other End-user Types

Europe Single-use Plastic Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Single-use Plastic Packaging Market Regional Market Share

Geographic Coverage of Europe Single-use Plastic Packaging Market

Europe Single-use Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising number of QSRs in the region

- 3.3. Market Restrains

- 3.3.1. Rising number of QSRs in the region

- 3.4. Market Trends

- 3.4.1. Quick Service Restaurants to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Single-use Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Bags and Pouches

- 5.2.3. Clamshells

- 5.2.4. Trays, Cups, and Lids

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Type

- 5.3.1. Quick Service Restaurants

- 5.3.2. Full Service Restaurants

- 5.3.3. Institutional

- 5.3.4. Retail

- 5.3.5. Other End-user Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Novolex

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dart Container Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huhtamaki Oyj

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hotpack Packaging Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Graphic Packaging International LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterline

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Celebration Packaging Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nutripack*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Novolex

List of Figures

- Figure 1: Europe Single-use Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Single-use Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 3: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by End-user Type 2020 & 2033

- Table 7: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 10: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 11: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 14: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by End-user Type 2020 & 2033

- Table 15: Europe Single-use Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Single-use Plastic Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Single-use Plastic Packaging Market?

The projected CAGR is approximately 3.92%.

2. Which companies are prominent players in the Europe Single-use Plastic Packaging Market?

Key companies in the market include Novolex, Dart Container Corporation, Berry Global Inc, Amcor Group GmbH, Huhtamaki Oyj, Hotpack Packaging Industries LLC, Graphic Packaging International LLC, Caterline, Celebration Packaging Limited, Nutripack*List Not Exhaustive.

3. What are the main segments of the Europe Single-use Plastic Packaging Market?

The market segments include Material Type, Product Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising number of QSRs in the region.

6. What are the notable trends driving market growth?

Quick Service Restaurants to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Rising number of QSRs in the region.

8. Can you provide examples of recent developments in the market?

April 2024: Klöckner Pentaplast (KP), a Germany-based food packaging manufacturer, achieved a significant milestone by establishing a closed loop for PET trays. It introduced pioneering trays crafted entirely from 100% recycled PET, sourced solely from the trays.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Single-use Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Single-use Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Single-use Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Single-use Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence