Key Insights

The European Space Propulsion Market, estimated at €10.21 billion in 2024, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 11.9% from 2024 to 2033. Key growth drivers include escalating investments in European space exploration endeavors and heightened demand for sophisticated satellite technologies and launch services. The market is segmented by propulsion technology (electric, gas-based, liquid fuel) and geography (France, Germany, Russia, United Kingdom, Italy, Netherlands, Sweden, and Rest of Europe). Germany and France currently lead national markets, supported by robust governmental space programs and a strong industrial foundation. A notable trend is the increasing adoption of electric propulsion systems, recognized for their superior fuel efficiency and mission adaptability. Challenges include substantial development costs for novel propulsion technologies and the inherent risks associated with space missions. Nevertheless, the long-term outlook is optimistic, propelled by the expanding commercialization of space and the burgeoning NewSpace sector, which stimulates innovation and competition.

Europe Space Propulsion Market Market Size (In Billion)

Established entities such as ArianeGroup, Safran SA, and OHB SE are experiencing increased competition from emerging players and specialized firms focusing on niche technologies. This dynamic competitive environment fosters innovation and accelerates technological progress. Collaborative efforts between European nations and international partnerships further bolster market expansion. Future growth will be significantly shaped by governmental policies supporting space exploration, successful commercial constellation deployments, and ongoing advancements in propulsion technology, particularly in sustainable and reusable launch systems. Growing environmental consciousness is also expected to drive the adoption of cleaner, more efficient propulsion solutions, thereby influencing market development.

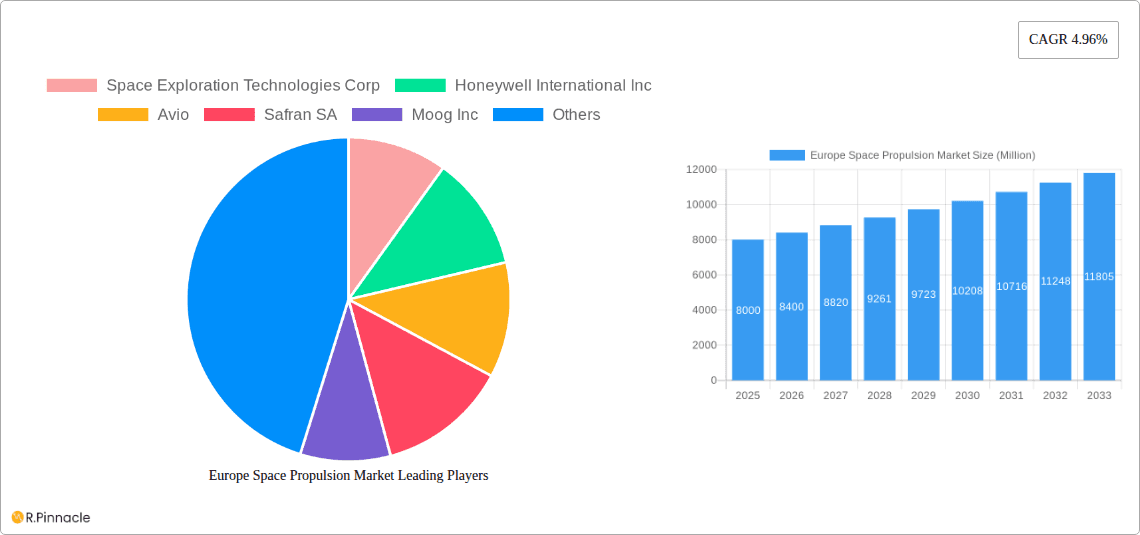

Europe Space Propulsion Market Company Market Share

Europe Space Propulsion Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Space Propulsion Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by propulsion technology (Electric, Gas-based, Liquid Fuel) and key countries (France, Germany, Russia, United Kingdom). Leading players such as Space Exploration Technologies Corp, Honeywell International Inc, Avio, Safran SA, Moog Inc, Ariane Group, OHB SE, Sitael S p A, and Thales are profiled. Expect to find actionable intelligence on market size (in Millions), CAGR, and future growth potential.

Europe Space Propulsion Market Structure & Innovation Trends

The European space propulsion market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Market share data for 2025 indicates that Ariane Group and Safran SA together hold approximately xx% of the market, while other key players such as SpaceX and Honeywell International Inc contribute to the remaining share. Innovation is primarily driven by the demand for more efficient, reliable, and cost-effective propulsion systems for various space applications. Stringent regulatory frameworks, especially concerning environmental impact and safety, significantly influence market dynamics. The market witnesses continuous development of substitute technologies, particularly in electric propulsion, challenging the dominance of traditional liquid fuel systems. The end-user demographic consists primarily of government space agencies, commercial satellite operators, and research institutions. M&A activity has been moderate, with deal values averaging approximately xx Million in recent years, driven by strategic expansion and technological integration. Examples include:

- Significant investments in R&D for electric propulsion technologies by various players.

- Consolidation through strategic partnerships and acquisitions aiming for technological synergies.

- Increasing focus on reusable launch systems impacting the long-term market dynamics.

- Government funding and collaborative projects to accelerate innovation and competitiveness.

Europe Space Propulsion Market Market Dynamics & Trends

The European space propulsion market is characterized by robust growth, driven by increasing demand for satellite launches, space exploration missions, and the growing commercialization of space. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, especially the advancements in electric propulsion and reusable launch vehicles, are transforming the landscape, offering cost-effective and environmentally friendly alternatives. Consumer preferences are shifting towards higher reliability, improved performance, and reduced operational costs. Competitive dynamics are intense, characterized by continuous innovation, strategic partnerships, and acquisitions among major players. Market penetration of electric propulsion systems is expected to increase from xx% in 2025 to xx% by 2033, driven by its higher efficiency and cost-effectiveness for specific applications. The rising adoption of small satellites and constellations is also boosting demand for smaller, lighter, and more efficient propulsion systems.

Dominant Regions & Segments in Europe Space Propulsion Market

France and Germany emerge as the dominant regions within the European space propulsion market. Their strong space programs, established industrial base, and substantial investments in R&D contribute to their market leadership.

Key Drivers for France:

- Strong government support for the aerospace industry.

- Presence of major players such as ArianeGroup and Safran SA.

- Well-developed infrastructure and skilled workforce.

Key Drivers for Germany:

- Significant investments in space research and technology.

- Presence of key players like OHB SE.

- Focus on developing innovative and environmentally friendly propulsion systems.

Segment Dominance:

The liquid fuel segment currently dominates the market due to its established technology and reliability. However, the electric propulsion segment is experiencing rapid growth, driven by its increasing efficiency and cost-effectiveness for various applications, particularly in satellite constellations and small satellite launches.

Europe Space Propulsion Market Product Innovations

Recent years have witnessed significant advancements in space propulsion technologies. Electric propulsion systems are gaining traction due to their high specific impulse, enabling longer mission durations and reduced propellant mass. Reusable launch vehicle technologies are revolutionizing access to space, reducing launch costs and increasing launch frequency. These innovations are improving overall mission efficiency and affordability, driving market growth and shaping future competitive landscapes. The market is increasingly focused on developing miniaturized, more efficient, and cost-effective propulsion solutions for smaller satellites and constellations.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Europe Space Propulsion Market across various segments:

By Propulsion Technology:

- Electric Propulsion: This segment is expected to witness significant growth due to its efficiency and cost advantages. The market size for electric propulsion in 2025 is estimated at xx Million, projected to reach xx Million by 2033. Key players focusing on this technology include Thales Alenia Space and Sitael S.p.A.

- Gas-based Propulsion: This segment provides established propulsion solutions, characterized by reliability and maturity. Market size in 2025 is estimated at xx Million.

- Liquid Fuel Propulsion: This remains the dominant segment, driven by its established technology and high thrust capabilities. The market size in 2025 is xx Million and is predicted to remain substantial throughout the forecast period.

By Country:

- France: A major player driven by governmental investments and established industry players. Market size in 2025 is estimated at xx Million.

- Germany: Significant R&D and substantial contributions to the European space program influence the German market. Market size in 2025 is estimated at xx Million.

- Russia: A substantial player with contributions to the global space programs, although the market is impacted by geopolitical factors. Market size in 2025 is estimated at xx Million.

- United Kingdom: A growing player with strategic investments in space exploration and commercial space ventures. Market size in 2025 is estimated at xx Million.

Key Drivers of Europe Space Propulsion Market Growth

The growth of the European Space Propulsion market is primarily fueled by:

- Increasing demand for satellite launches, both governmental and commercial.

- Technological advancements in electric propulsion and reusable launch vehicles.

- Government funding and initiatives to promote space exploration and innovation.

- Growing investments from private companies in the space industry.

Challenges in the Europe Space Propulsion Market Sector

The European space propulsion market faces several challenges, including:

- High initial investment costs associated with developing and manufacturing advanced propulsion systems.

- Intense competition among established and emerging players impacting pricing and margins.

- Stringent regulatory requirements concerning safety, environmental impact, and export controls.

- Supply chain complexities and potential disruptions impacting timely project delivery.

Emerging Opportunities in Europe Space Propulsion Market

Significant opportunities exist in the European space propulsion market:

- Growing demand for small satellites and constellations, driving innovation in miniaturized propulsion systems.

- Expansion of commercial space activities, leading to increased demand for launch services and propulsion technologies.

- Development of sustainable and environmentally friendly propulsion systems.

- Increased collaboration between governmental and private sector entities promoting innovation and investment.

Leading Players in the Europe Space Propulsion Market Market

- Space Exploration Technologies Corp

- Honeywell International Inc

- Avio

- Safran SA

- Moog Inc

- Ariane Group

- OHB SE

- Sitael S p A

- Thales

Key Developments in Europe Space Propulsion Market Industry

- February 2023: Thales Alenia Space contracted with the Korea Aerospace Research Institute (KARI) to supply electric propulsion for their GEO-KOMPSAT-3 satellite, highlighting the increasing adoption of electric propulsion for geostationary satellites.

- December 2022: GKN Aerospace contracted with ArianeGroup to supply components for the Ariane 6 launcher, demonstrating continued investment in the development of next-generation launch vehicles.

- September 2022: OHB Sweden and Atlantis partnered to supply microsatellites, showcasing collaboration and innovation within the small satellite market.

Future Outlook for Europe Space Propulsion Market Market

The European space propulsion market is poised for significant growth driven by sustained governmental investment, increasing commercialization of space, and continuous technological advancements. The market will see increased competition, a greater focus on sustainability, and a strong emphasis on miniaturization and cost reduction. Strategic partnerships and acquisitions are likely to reshape the market landscape, driving further innovation and consolidation. The electric propulsion segment is anticipated to lead the market's future growth, offering long-term sustainability and cost-effectiveness for various space applications.

Europe Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

Europe Space Propulsion Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Space Propulsion Market Regional Market Share

Geographic Coverage of Europe Space Propulsion Market

Europe Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moog Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sitael S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thale

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Europe Space Propulsion Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Space Propulsion Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 2: Europe Space Propulsion Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Space Propulsion Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 4: Europe Space Propulsion Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Space Propulsion Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Space Propulsion Market?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Europe Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Honeywell International Inc, Avio, Safran SA, Moog Inc, Ariane Group, OHB SE, Sitael S p A, Thale.

3. What are the main segments of the Europe Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.December 2022: GKN Aerospace has contracted with ArianeGroup to supply the next stage of the Ariane 6 turbine and Vulcain nozzle. The contract covers the manufacturing and supply of units for the following 14 Ariane 6 launchers, which will go into production by 2025. GKN Aerospace is currently focused on industrializing and integrating novel and innovative technologies into the Ariane 6 product.September 2022: OHB Sweden, a subsidiary of space group OHB SE, and Atlantis, a Spanish space technology company, have signed a contract to jointly supply two microsatellites based on OHB Sweden's InnoSat platformThe satellites will carry four optical channels provided by Satlantis and will be launched in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Space Propulsion Market?

To stay informed about further developments, trends, and reports in the Europe Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence