Key Insights

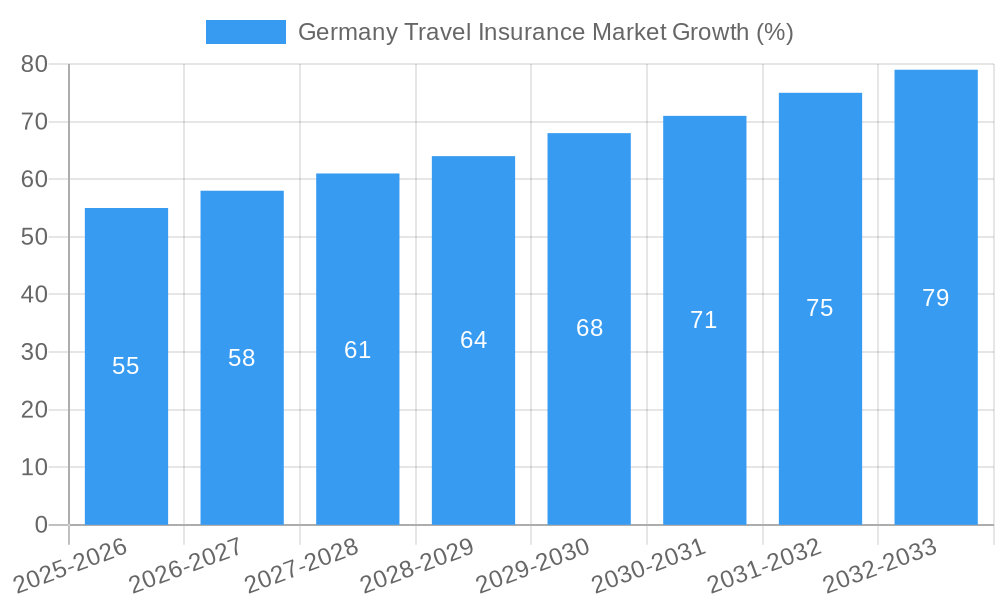

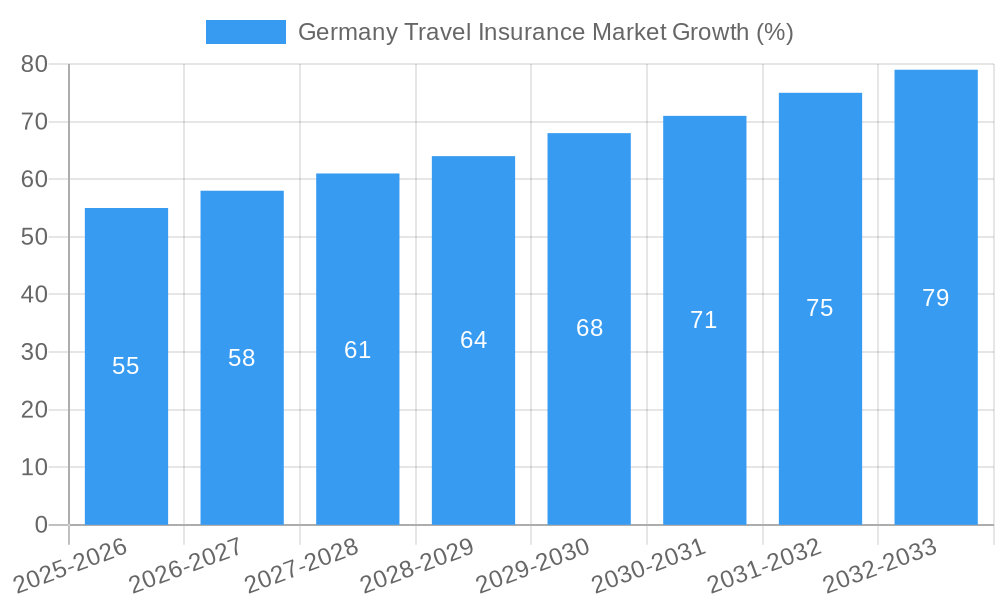

The German travel insurance market, currently valued at approximately €[Estimate based on market size XX and Value Unit Million – let's assume €1 Billion for illustrative purposes, adjust based on actual XX value] in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2025 to 2033. This expansion is driven by several key factors. The rising popularity of international travel among Germans, fueled by increased disposable incomes and a growing preference for exploring diverse destinations, significantly boosts demand for travel insurance. Furthermore, a heightened awareness of potential travel disruptions, such as medical emergencies, flight cancellations, and lost luggage, compels travelers to prioritize comprehensive coverage. The market segmentation reveals a diverse customer base, with senior citizens and families representing significant segments. The preference for annual multi-trip policies over single-trip policies reflects a growing trend towards frequent travel. The distribution channels are equally varied, with insurance intermediaries, companies, banks, brokers, and aggregators playing crucial roles in reaching the target audience. Competitive landscape is characterized by established players like Allianz Group, Munich Re, AXA, and others, who constantly strive for innovation and product differentiation to maintain their market share.

Looking ahead, the market will continue its upward trajectory, propelled by evolving consumer preferences and technological advancements. The growing adoption of online insurance platforms and mobile applications simplifies the purchase process and enhances customer experience. Regulatory changes focusing on consumer protection and transparency in insurance policies may also influence market dynamics. However, potential economic downturns or fluctuations in the travel industry could act as restraints. Nevertheless, the long-term outlook for the German travel insurance market remains positive, anticipating consistent growth driven by the factors outlined above and sustained by a strong demand for travel and associated risk mitigation.

Germany Travel Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany travel insurance market, covering market structure, dynamics, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic planners. The report leverages extensive data analysis to provide actionable insights and forecasts, empowering informed decision-making.

Germany Travel Insurance Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the German travel insurance market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational players and smaller, specialized insurers. The top players, commanding a significant portion of the market share, include Allianz Group, Talanx Konzern, Munich Re Group, AXA Konzern AG, and others. The xx% market share held by the top 5 players indicates a relatively consolidated market.

- Market Concentration: High, with top 5 players holding approximately xx% market share.

- Innovation Drivers: Increasing demand for digital insurance platforms, personalized travel insurance packages, and embedded insurance solutions are driving innovation.

- Regulatory Framework: The German regulatory environment impacts product offerings and pricing strategies. Compliance with Solvency II regulations and data privacy laws (GDPR) are key factors.

- Product Substitutes: Limited direct substitutes exist; however, consumers may opt for alternative risk mitigation strategies like credit card travel insurance or relying on personal savings.

- End-User Demographics: A growing aging population is driving demand for senior-citizen specific travel insurance, while the increasing popularity of educational and family travel fuels other segments.

- M&A Activities: While significant M&A activity in the broader insurance sector occurs, specific deal values in the German travel insurance sub-sector remain at xx Million for the period of 2019-2024.

Germany Travel Insurance Market Market Dynamics & Trends

The German travel insurance market is witnessing robust growth, driven by factors such as increasing outbound tourism, rising disposable incomes, and a growing preference for comprehensive travel protection. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and the forecast period (2025-2033) projects a CAGR of xx%. Market penetration is expected to reach xx% by 2033. Technological advancements, such as AI-powered risk assessment and personalized insurance solutions, are disrupting the traditional market structure and creating new opportunities. Increasing consumer awareness about travel risks, coupled with a preference for online purchasing channels, further fuel market growth. Competitive intensity remains high, with insurers focusing on product differentiation, customer service, and technological advancements to gain a competitive edge.

Dominant Regions & Segments in Germany Travel Insurance Market

The German travel insurance market displays significant regional variations in demand, with densely populated metropolitan areas and regions exhibiting high outbound tourism rates experiencing notably higher penetration. Distribution channels are dominated by insurance intermediaries, leveraging established networks and strong customer relationships. This is followed by direct sales from insurance companies and increasingly, online aggregators. Analyzing the end-user segments reveals a diverse landscape. Family travelers constitute a substantial portion, reflecting growing international travel amongst families. Senior citizens represent another key demographic, with their specific insurance needs driving a dedicated market segment. Educational travelers, encompassing students and faculty on academic trips, form another significant group. Single-trip policies continue to dominate the coverage landscape due to their cost-effectiveness and suitability for shorter vacations. However, a growing demand for comprehensive annual multi-trip policies is also observed.

- By Distribution Channel: Insurance intermediaries maintain a leading market share due to their extensive networks and established customer relationships, while the influence of online aggregators is steadily growing.

- By End User: Family travelers represent a significant and growing segment, driven by increased international family travel; senior citizens comprise a substantial and consistent market segment with specific needs; and educational travelers are a noteworthy niche.

- By Coverage Type: While single-trip travel insurance retains its leading position due to affordability and suitability for short trips, annual multi-trip policies are witnessing increasing popularity amongst frequent travelers.

Germany Travel Insurance Market Product Innovations

Recent innovations in the German travel insurance market include the integration of telematics and wearable technology for real-time risk assessment, personalized insurance plans tailored to individual travel profiles, and the rise of embedded insurance within travel booking platforms. These innovations enhance customer experience, optimize risk management, and provide competitive advantages to insurers.

Report Scope & Segmentation Analysis

This report segments the German travel insurance market across several key dimensions: distribution channels (insurance intermediaries, insurance companies, banks, insurance brokers, insurance aggregators), end users (senior citizens, education travelers, family travelers, others), and coverage types (single-trip, annual multi-trip). Each segment's growth projections, market size estimates, and competitive dynamics are detailed within the full report. The market size is projected to reach xx Million by 2033.

Key Drivers of Germany Travel Insurance Market Growth

The German travel insurance market's growth is propelled by several key factors. The increasing frequency of international travel, coupled with rising disposable incomes among the population, fuels the demand for travel insurance. Furthermore, heightened awareness of potential travel-related risks and the availability of convenient online purchasing channels are contributing to market expansion. Government regulations promoting travel safety also play a crucial role.

Challenges in the Germany Travel Insurance Market Sector

The German travel insurance market faces challenges including increasing competition, fluctuating travel patterns due to global events, and the need to adapt to rapidly evolving technological advancements. The regulatory environment also presents ongoing challenges, requiring insurers to adapt to changing compliance requirements. These factors can impact profitability and market share.

Emerging Opportunities in Germany Travel Insurance Market

Significant opportunities exist for insurers to tap into the growing demand for customized travel insurance products tailored to specific needs, leverage digital platforms to offer seamless customer experiences, and explore innovative product offerings that integrate with emerging travel technologies. The market offers opportunities for insurers to expand their reach into niche segments and geographic areas.

Leading Players in the Germany Travel Insurance Market Market

- Talanx Konzern

- Bayern

- Signal Iduna

- Allianz Group

- Munchener Ruck-Gruppe

- AXA Konzern AG

- R+V Konzern

- Huk-Coburg

- Generali Deutschland AG

Key Developments in Germany Travel Insurance Market Industry

- May 2022: Allianz Global Investors' strategic partnership with Voya Financial, involving asset transfers and equity stake acquisition, reflects the ongoing consolidation and strategic realignment within the broader financial services sector, indirectly impacting investment strategies in the insurance industry.

- March 2022: Allianz Real Estate's acquisition of multi-family residential assets in Tokyo indicates diversification into real estate investments, potentially influencing long-term financial stability and risk management practices within the Allianz Group, thus indirectly impacting its insurance arm's capabilities.

Future Outlook for Germany Travel Insurance Market Market

The German travel insurance market exhibits strong growth potential driven by persistent growth in outbound tourism, technological advancements facilitating personalized insurance solutions, and the potential for expansion into new niche segments. The market is poised for continued expansion, driven by evolving consumer demands and the ongoing adoption of digital technologies.

Germany Travel Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Single Trip Travel Insurance

- 1.2. Annual Multi Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Intermediaries

- 2.2. Insurance Companies

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Insurance Aggregators

-

3. End User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

Germany Travel Insurance Market Segmentation By Geography

- 1. Germany

Germany Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Robust Automotive Market will Augment the Multiple Trip Travel Insurance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Single Trip Travel Insurance

- 5.1.2. Annual Multi Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Intermediaries

- 5.2.2. Insurance Companies

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Insurance Aggregators

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. Germany Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Germany Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Talanx Konzern

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bayern

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Signal Iduna**List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Allianz Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Munchener-Ruck-Gruppe

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AXA Konzern AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 R+V Konzern

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Huk-Coburg

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Generali Deutschland AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Talanx Konzern

List of Figures

- Figure 1: Germany Travel Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Travel Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Travel Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Travel Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 3: Germany Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Germany Travel Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Germany Travel Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Germany Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Travel Insurance Market Revenue Million Forecast, by Coverage Type 2019 & 2032

- Table 14: Germany Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Germany Travel Insurance Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Germany Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Travel Insurance Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Germany Travel Insurance Market?

Key companies in the market include Talanx Konzern, Bayern, Signal Iduna**List Not Exhaustive, Allianz Group, Munchener-Ruck-Gruppe, AXA Konzern AG, R+V Konzern, Huk-Coburg, Generali Deutschland AG.

3. What are the main segments of the Germany Travel Insurance Market?

The market segments include Coverage Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Robust Automotive Market will Augment the Multiple Trip Travel Insurance Demand.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

On 17th May 2022, Allianz Global Investors ('AllianzGI') had entered into a memorandum of understanding ('MOU') with Voya Financial relating to a strategic partnership whereby AllianzGI would transfer selected investment teams and assets comprising most of its US business ('AGI US') to Voya Investment Management ('Voya IM') in return for an up to 24% equity stake in the enlarged asset manager.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Travel Insurance Market?

To stay informed about further developments, trends, and reports in the Germany Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence