Key Insights

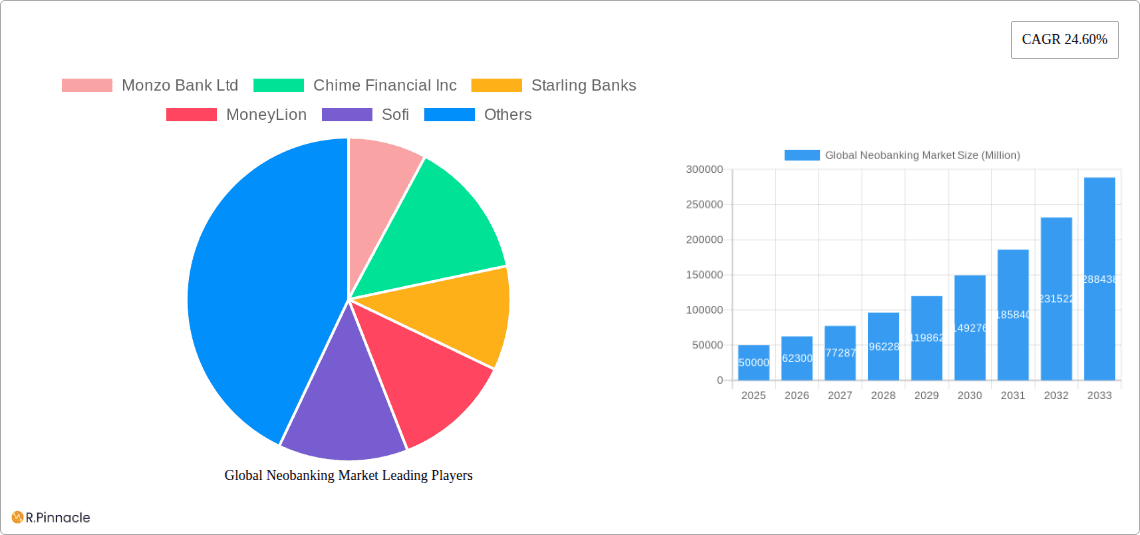

The global neobanking market is experiencing explosive growth, fueled by increasing demand for digital-first financial services and a younger generation comfortable with technology-driven solutions. The market, currently valued at an estimated $50 billion in 2025 (based on the provided CAGR of 24.60% and a reasonable extrapolation from a potentially smaller initial market size), is projected to witness a substantial expansion throughout the forecast period (2025-2033). Key drivers include the enhanced user experience offered by neobanks, their competitive pricing strategies, and their ability to cater to underserved populations. The rise of mobile banking and open banking APIs further empowers neobanks to innovate and integrate seamlessly with other financial services. This market segment is experiencing rapid innovation, with new features like embedded finance and advanced AI-powered functionalities constantly emerging. While challenges exist in terms of regulatory compliance and security concerns, the overall trajectory remains positive.

Global Neobanking Market Market Size (In Billion)

Continued growth is anticipated, driven by several factors. Firstly, the expanding adoption of smartphones and the pervasive use of the internet are creating a conducive environment for neobank proliferation. Secondly, the increasing financial literacy and awareness, particularly amongst younger demographics, are pushing demand for more accessible and transparent financial solutions. Thirdly, the strategic partnerships between neobanks and established financial institutions are facilitating faster growth and broader reach. The competitive landscape, characterized by prominent players like Monzo, Chime, Starling Bank, and Revolut, is expected to become even more intense as new entrants emerge and existing players expand their product offerings and geographic reach. Successful neobanks will differentiate themselves by offering hyper-personalized services, advanced data analytics capabilities, and seamless customer experiences to maintain a competitive edge.

Global Neobanking Market Company Market Share

Global Neobanking Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global neobanking market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market structure, dynamics, leading players, and future growth potential, empowering you to navigate this rapidly evolving landscape.

Global Neobanking Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the neobanking market. The report delves into market concentration, assessing the market share held by key players such as Monzo Bank Ltd, Chime Financial Inc, Starling Banks, MoneyLion, Sofi, N26, Judo Bank, Tinkoff Bank, Nubank, and Revolut (list not exhaustive). It also examines the impact of mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market structure. Furthermore, the report explores the role of regulatory frameworks in shaping market dynamics, the influence of product substitutes, and the evolving demographics of end-users. Innovation drivers, including technological advancements and changing consumer preferences, are also thoroughly examined. The analysis includes quantifiable metrics, such as market share distribution and M&A deal values (in Millions). Expected market share for top players in 2025: Monzo (xx Million), Chime (xx Million), Starling (xx Million), Revolut (xx Million), Nubank (xx Million). Total M&A deal value for the period 2019-2024 is estimated at xx Million.

Global Neobanking Market Market Dynamics & Trends

This section provides a comprehensive overview of the market dynamics and trends influencing the growth of the global neobanking market. It analyzes key growth drivers, including increasing smartphone penetration, rising demand for digital financial services, and the growing adoption of open banking APIs. The report further examines the impact of technological disruptions, such as the rise of artificial intelligence (AI) and blockchain technology, on the industry. It also explores evolving consumer preferences, competitive dynamics, and the strategies employed by leading players to gain a competitive edge. The analysis includes key metrics such as the compound annual growth rate (CAGR) and market penetration rates, offering valuable insights into the market's trajectory. The estimated CAGR for the forecast period (2025-2033) is projected at xx%. Market penetration in key regions is anticipated to reach xx% by 2033.

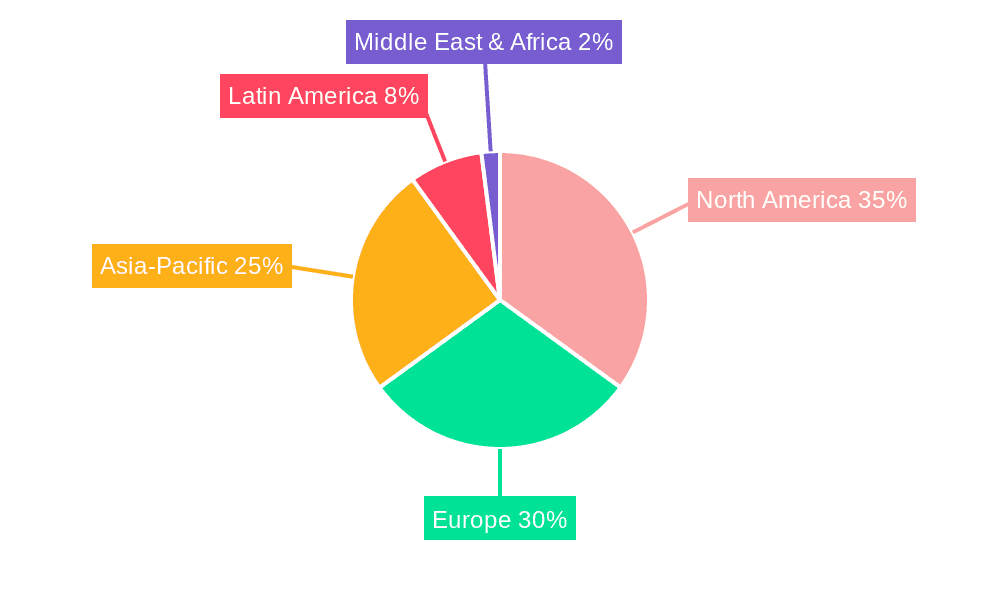

Dominant Regions & Segments in Global Neobanking Market

This section identifies the leading regions and segments within the global neobanking market. A detailed analysis of the dominant region's market size and growth drivers is provided.

- Key Drivers (Example – North America):

- Strong regulatory support for fintech innovation.

- High smartphone and internet penetration.

- Tech-savvy consumer base.

- Established venture capital ecosystem.

The report provides a comprehensive assessment of the factors contributing to the dominance of this region (or segment), including macroeconomic conditions, technological advancements, and consumer behavior.

Global Neobanking Market Product Innovations

This section highlights recent product innovations in the neobanking sector. It explores the development of new features and functionalities, such as personalized financial management tools, advanced security features, and seamless integration with other financial services. The analysis emphasizes the competitive advantages offered by these innovations and their alignment with evolving market demands. The technological trends driving these developments, such as AI and machine learning, are also discussed.

Report Scope & Segmentation Analysis

This report segments the global neobanking market based on various factors, including service type (e.g., personal, business), deployment mode (e.g., cloud, on-premise), and geographic region. Each segment’s growth projection, market size (in Millions), and competitive dynamics are analyzed in detail.

Key Drivers of Global Neobanking Market Growth

Several factors drive the growth of the global neobanking market. Technological advancements, such as the development of mobile-first platforms and AI-powered services, are key enablers of market expansion. Favorable economic conditions and supportive government regulations in several regions further fuel market growth. The increasing adoption of digital banking solutions by consumers and businesses contributes significantly to this trend.

Challenges in the Global Neobanking Market Sector

The neobanking sector faces various challenges, including stringent regulatory compliance requirements, the need for robust cybersecurity measures, and intense competition from established banks and other fintech players. These challenges can impact market growth and profitability. For example, the cost of regulatory compliance may hinder the entry of new players, while cybersecurity breaches could damage consumer trust.

Emerging Opportunities in Global Neobanking Market

The neobanking market presents numerous opportunities for growth. Expanding into new and underserved markets, particularly in developing economies, offers significant potential. The integration of new technologies, such as blockchain and AI, presents opportunities for enhancing service offerings and creating new revenue streams. Moreover, catering to the evolving needs of specific customer segments, such as millennials and Gen Z, presents significant opportunities for neobanks.

Leading Players in the Global Neobanking Market Market

- Monzo Bank Ltd

- Chime Financial Inc

- Starling Banks

- MoneyLion

- Sofi

- N26

- Judo Bank

- Tinkoff Bank

- Nubank

- Revolut (List Not Exhaustive)

Key Developments in Global Neobanking Market Industry

- October 2022: Kitzone Neo Bank in India introduces the country's first assured cashback debit cards, along with mini ATMs and POS terminals. This development significantly impacts market dynamics by enhancing customer offerings and driving adoption.

- September 2022: N26 becomes the first neobank to integrate with Bizum in Spain, allowing users with Spanish IBANs to send, receive, and request money via the popular mobile payment service. This expands N26’s service offerings and enhances its competitive position.

Future Outlook for Global Neobanking Market Market

The global neobanking market is poised for significant growth in the coming years. Continued technological advancements, increasing financial inclusion efforts, and evolving consumer preferences will drive market expansion. Strategic partnerships, mergers, and acquisitions will further shape the market landscape. The focus on personalized financial management tools, enhanced security features, and seamless user experiences will be crucial for success in this dynamic market.

Global Neobanking Market Segmentation

-

1. Account Type

- 1.1. Bussiness Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile- Banking

- 2.2. Payments

- 2.3. Money- Transfers

- 2.4. Savings Account

- 2.5. Loans

- 2.6. Others

-

3. Application

- 3.1. Personal

- 3.2. Enterprise

- 3.3. Other Application

Global Neobanking Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Global Neobanking Market Regional Market Share

Geographic Coverage of Global Neobanking Market

Global Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 58.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Digitalization of Banking Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Bussiness Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile- Banking

- 5.2.2. Payments

- 5.2.3. Money- Transfers

- 5.2.4. Savings Account

- 5.2.5. Loans

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Enterprise

- 5.3.3. Other Application

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. North America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Bussiness Account

- 6.1.2. Savings Account

- 6.2. Market Analysis, Insights and Forecast - by Services

- 6.2.1. Mobile- Banking

- 6.2.2. Payments

- 6.2.3. Money- Transfers

- 6.2.4. Savings Account

- 6.2.5. Loans

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal

- 6.3.2. Enterprise

- 6.3.3. Other Application

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. Europe Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Bussiness Account

- 7.1.2. Savings Account

- 7.2. Market Analysis, Insights and Forecast - by Services

- 7.2.1. Mobile- Banking

- 7.2.2. Payments

- 7.2.3. Money- Transfers

- 7.2.4. Savings Account

- 7.2.5. Loans

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal

- 7.3.2. Enterprise

- 7.3.3. Other Application

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Asia Pacific Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Bussiness Account

- 8.1.2. Savings Account

- 8.2. Market Analysis, Insights and Forecast - by Services

- 8.2.1. Mobile- Banking

- 8.2.2. Payments

- 8.2.3. Money- Transfers

- 8.2.4. Savings Account

- 8.2.5. Loans

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal

- 8.3.2. Enterprise

- 8.3.3. Other Application

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Middle East Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Bussiness Account

- 9.1.2. Savings Account

- 9.2. Market Analysis, Insights and Forecast - by Services

- 9.2.1. Mobile- Banking

- 9.2.2. Payments

- 9.2.3. Money- Transfers

- 9.2.4. Savings Account

- 9.2.5. Loans

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal

- 9.3.2. Enterprise

- 9.3.3. Other Application

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. South America Global Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Bussiness Account

- 10.1.2. Savings Account

- 10.2. Market Analysis, Insights and Forecast - by Services

- 10.2.1. Mobile- Banking

- 10.2.2. Payments

- 10.2.3. Money- Transfers

- 10.2.4. Savings Account

- 10.2.5. Loans

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal

- 10.3.2. Enterprise

- 10.3.3. Other Application

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Monzo Bank Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chime Financial Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Starling Banks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MoneyLion

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sofi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 N

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Judo Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tinkoff Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nubank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Revolut**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Monzo Bank Ltd

List of Figures

- Figure 1: Global Global Neobanking Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 3: North America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: North America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 5: North America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 6: North America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 11: Europe Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 12: Europe Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 13: Europe Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: Europe Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 19: Asia Pacific Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 20: Asia Pacific Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 21: Asia Pacific Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Asia Pacific Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 27: Middle East Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 28: Middle East Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 29: Middle East Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 30: Middle East Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Neobanking Market Revenue (undefined), by Account Type 2025 & 2033

- Figure 35: South America Global Neobanking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 36: South America Global Neobanking Market Revenue (undefined), by Services 2025 & 2033

- Figure 37: South America Global Neobanking Market Revenue Share (%), by Services 2025 & 2033

- Figure 38: South America Global Neobanking Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Global Neobanking Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Global Neobanking Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Neobanking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 2: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 3: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Neobanking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 6: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 7: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 10: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 11: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 14: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 15: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 18: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 19: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Neobanking Market Revenue undefined Forecast, by Account Type 2020 & 2033

- Table 22: Global Neobanking Market Revenue undefined Forecast, by Services 2020 & 2033

- Table 23: Global Neobanking Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Neobanking Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Neobanking Market?

The projected CAGR is approximately 58.6%.

2. Which companies are prominent players in the Global Neobanking Market?

Key companies in the market include Monzo Bank Ltd, Chime Financial Inc, Starling Banks, MoneyLion, Sofi, N, Judo Bank, Tinkoff Bank, Nubank, Revolut**List Not Exhaustive.

3. What are the main segments of the Global Neobanking Market?

The market segments include Account Type, Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Digitalization of Banking Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, India's First Assured Cashback Debit Cards are being introduced by Rajasthan-based Kitzone Neo Bank, which is also providing the Mini ATM and Pos Terminal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Neobanking Market?

To stay informed about further developments, trends, and reports in the Global Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence