Key Insights

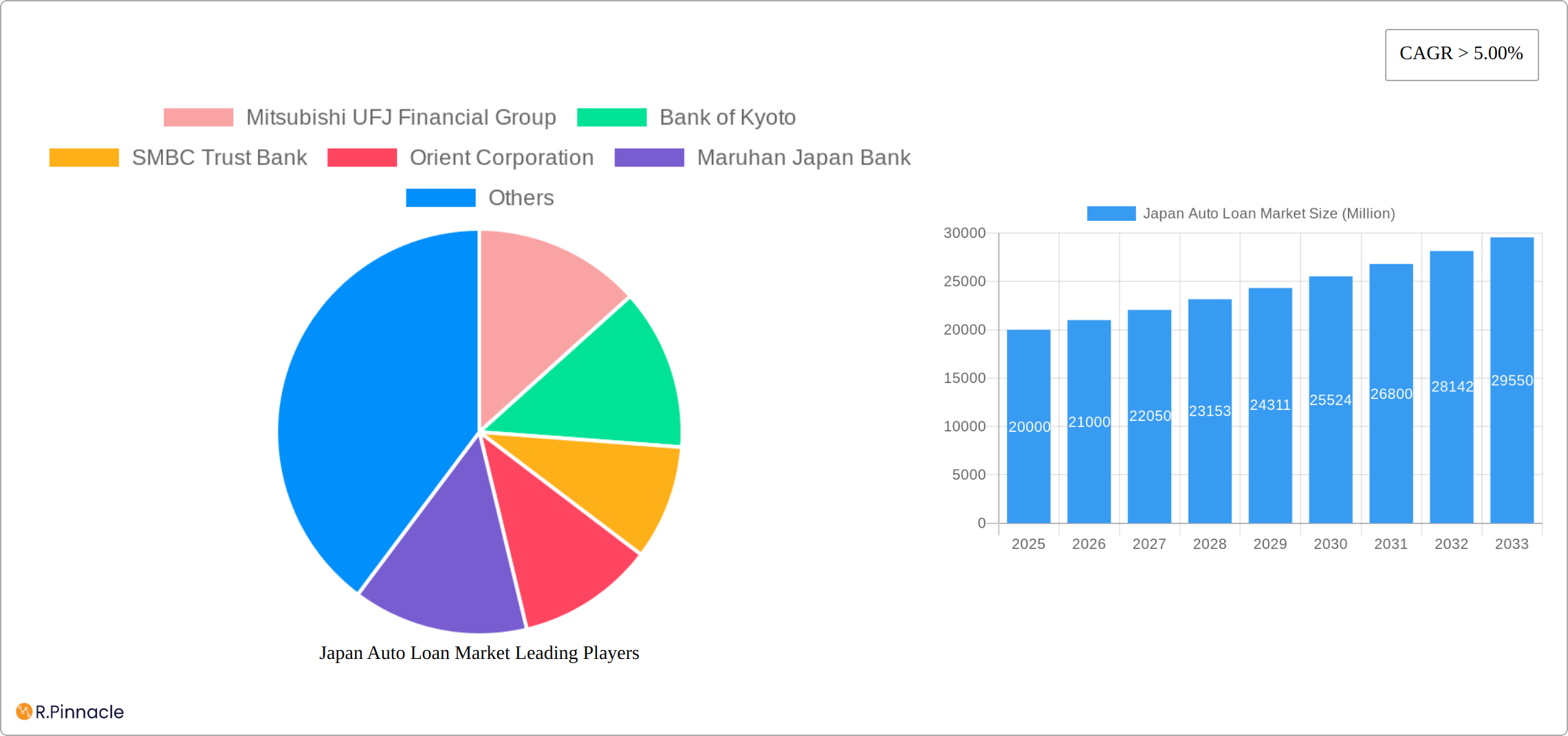

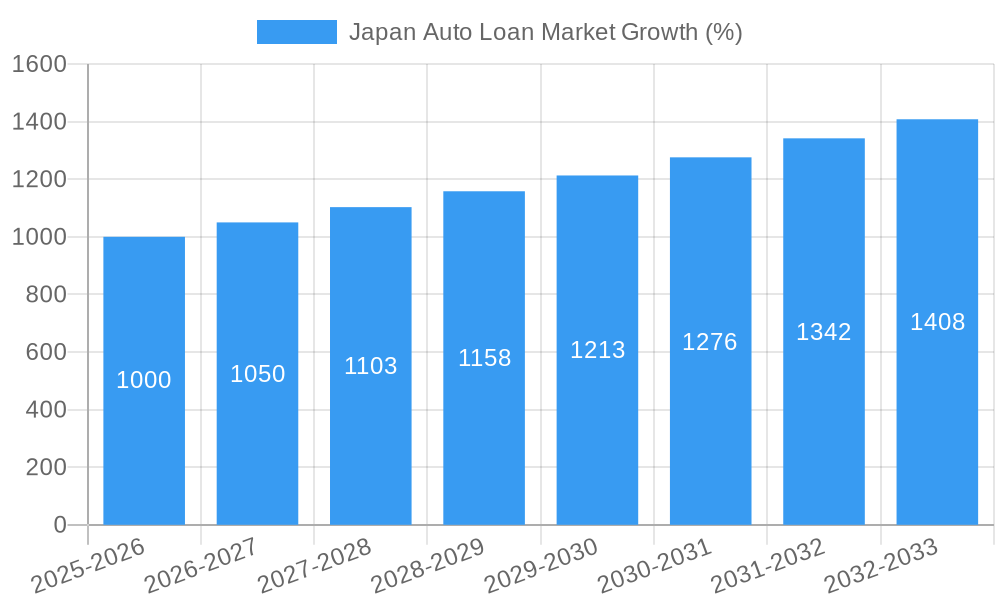

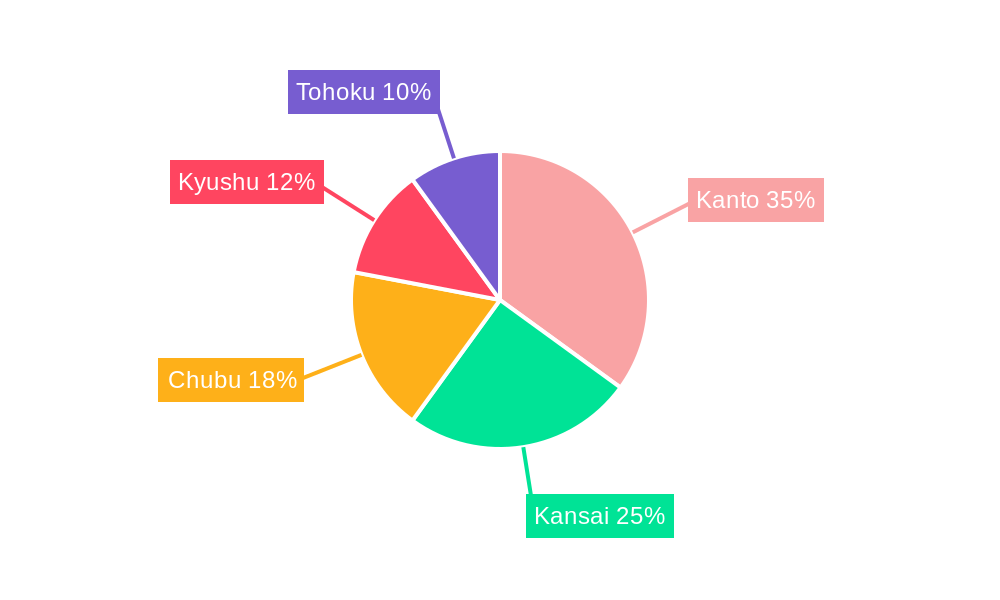

The Japan auto loan market, currently valued at an estimated ¥20 trillion (approximately $145 billion USD) in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) exceeding 5% from 2025 to 2033. This positive trajectory is fueled by several key drivers. Firstly, the increasing affordability of vehicles, coupled with attractive financing options offered by banks, OEMs, and credit unions, stimulates demand, particularly among younger demographics. Secondly, the government's initiatives promoting environmentally friendly vehicles are likely to further boost the market. Thirdly, the rising popularity of used vehicles, representing a significant portion of the market, contributes to overall growth. The market is segmented by end-user (individual vs. enterprise), loan provider (banks, OEMs, credit unions, others), vehicle type (passenger vs. commercial), and vehicle age (new vs. used). While precise market share data for each segment requires further analysis, it's evident that passenger vehicle loans to individuals dominate, followed by used vehicle financing. Regional variations exist, with the Kanto and Kansai regions likely leading in market share due to higher population densities and economic activity. However, growth is expected across all regions.

Despite the optimistic outlook, several factors could potentially restrain market growth. Fluctuations in interest rates, economic downturns, and potential tightening of lending criteria could impact consumer demand. Furthermore, the increasing adoption of alternative transportation methods, such as ride-sharing services, might pose a long-term challenge. Nevertheless, the strong underlying demand for personal and commercial vehicles in Japan, combined with innovative financial products, positions the auto loan market for sustained expansion over the forecast period. Competitive pressures among established players like Mitsubishi UFJ Financial Group, Toyota Financial Services, and Nissan Financial Services, alongside the potential entry of new lenders, will shape the market landscape in the coming years. Analyzing regional disparities and the evolving preferences for vehicle types and financing solutions will be crucial for understanding future market dynamics.

Japan Auto Loan Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Auto Loan Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages robust data and expert analysis to illuminate market trends, opportunities, and challenges. The report is meticulously segmented by end-user (individual, enterprise), loan provider (banks, OEMs, credit unions, others), vehicle type (passenger, commercial), and vehicle age (new, used). Key players such as Mitsubishi UFJ Financial Group, Bank of Kyoto, SMBC Trust Bank, Orient Corporation, Maruhan Japan Bank, Nissan Financial Services, Volkswagen Financial Services Japan, Toyota Financial Services, and HDB Financial Services are thoroughly examined.

Japan Auto Loan Market Market Structure & Innovation Trends

The Japanese auto loan market exhibits a moderately concentrated structure, dominated by major banks and captive finance companies. Mitsubishi UFJ Financial Group (MUFG) and Toyota Financial Services hold significant market share, estimated at xx% and xx% respectively in 2025. Innovation is driven by the increasing adoption of digital lending platforms, enhancing efficiency and accessibility. Regulatory frameworks, while generally stable, are subject to periodic updates impacting lending practices and consumer protection. The market witnesses some substitution from leasing options, particularly for commercial vehicles. End-user demographics are shifting towards younger age groups, increasing demand for online loan applications.

- Market Concentration: High, with top 5 players holding approximately xx% of market share in 2025.

- Innovation Drivers: Digitalization, Fintech integration, personalized lending solutions.

- Regulatory Framework: Relatively stable but subject to evolving consumer protection laws.

- M&A Activity: Recent deals include MUFG's acquisition of a stake in Mandala Multifinance (June 2023) suggesting a focus on expansion. Total M&A deal value in 2024 estimated at xx Million.

Japan Auto Loan Market Market Dynamics & Trends

The Japan auto loan market is projected to experience a robust Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR Value Here, e.g., 5.5%]%** during the forecast period (2025-2033). This sustained growth is propelled by a confluence of factors, including a consistent rise in vehicle sales, with a particular surge in the passenger vehicle segment, a burgeoning middle class with increasing disposable income and enhanced purchasing power, and supportive, albeit moderate, government initiatives aimed at promoting vehicle ownership. The market is also undergoing a significant transformation driven by technological disruptions. The rapid emergence of electric vehicles (EVs) and the proliferation of connected car technologies are fundamentally reshaping consumer preferences and, consequently, influencing the design and offerings of auto loan products. The competitive landscape is characterized by intense rivalry among established financial institutions, including major banks, Original Equipment Manufacturer (OEM) finance arms, and a diverse array of other lenders. This competitive pressure is fostering innovation in loan products and pricing strategies to attract and retain customers. The market penetration of auto loans is estimated to be **[Insert Specific Penetration Value Here, e.g., 60%]%** in 2025, with projections indicating a rise to **[Insert Specific Penetration Value Here, e.g., 75%]%** by 2033.

Dominant Regions & Segments in Japan Auto Loan Market

The Kanto region, a vibrant economic hub encompassing Tokyo and its surrounding prefectures, stands as the dominant force in the Japan auto loan market. This supremacy is attributed to its exceptionally high population density, significant economic activity, and a well-established, robust automotive industry presence.

- By End User: The individual segment commands the largest market share, predominantly driven by personal vehicle purchases. The enterprise segment, primarily catering to the financing needs of commercial vehicles, is exhibiting steady and consistent growth.

- By Loan Provider: Traditional banks continue to lead as the primary providers of auto loans, closely followed by OEM finance companies that effectively leverage their captive customer bases for financing solutions.

- By Vehicle Type: Passenger vehicles represent the most significant market segment, fueled by sustained and high consumer demand.

- By Vehicle Age: New vehicles contribute a substantial market share. However, the used vehicle segment is experiencing notable growth, driven by increasing consumer interest in affordability and value for money.

Key underlying drivers contributing to the dominance of these regions and segments include a well-developed and sophisticated financial infrastructure, strong and resilient consumer confidence in the automotive sector, and the presence of favorable government policies that actively support and encourage vehicle ownership.

Japan Auto Loan Market Product Innovations

The Japan auto loan market is witnessing a wave of innovative product development. A prominent advancement is the increasing integration and adoption of digital lending platforms, which significantly streamline the loan application process, offering enhanced convenience and speed to consumers. These platforms also facilitate the provision of highly personalized loan options tailored to individual borrower profiles and needs. Financial institutions, including both major banks and prominent OEMs, are actively engaged in developing specialized and bespoke loan products specifically designed for electric vehicles (EVs) and other alternative fuel vehicles. The strategic aim behind these specialized offerings is to effectively cater to the burgeoning demand from environmentally conscious consumer segments and to actively stimulate market adoption of these advanced automotive technologies. These tailored financing solutions provide a distinct competitive advantage by addressing the unique financial considerations and preferences of a growing eco-aware customer base.

Report Scope & Segmentation Analysis

This report comprehensively segments the Japan auto loan market across several dimensions:

- By End User: Individual and Enterprise, projecting a xx Million market size for individual users by 2033, and a xx Million market size for enterprise users. Competitive dynamics are shaped by differing risk profiles and pricing strategies tailored for each segment.

- By Loan Provider: Banks, OEMs, Credit Unions, and Other Loan Providers. Banks command the largest market share, while OEMs benefit from captive sales.

- By Vehicle Type: Passenger Vehicle and Commercial Vehicle, with passenger vehicles having higher growth projections.

- By Vehicle Age: New Vehicle and Used Vehicle, demonstrating varying risk-return profiles that impact lending decisions.

Key Drivers of Japan Auto Loan Market Growth

The growth trajectory of the Japan auto loan market is significantly propelled by a combination of positive economic and societal factors. Rising disposable incomes across the population are a primary catalyst, enabling more individuals to consider vehicle ownership. This is further amplified by increasing overall vehicle sales, with a particular emphasis on the passenger vehicle segment, reflecting changing mobility preferences. The enduring and growing preference for personal transportation solutions also plays a crucial role. While not a dominant force, government policies that moderately promote vehicle ownership continue to contribute to market expansion. Furthermore, technological advancements within automotive finance, such as the widespread adoption and sophistication of digital lending platforms, are crucial drivers by enhancing market accessibility and operational efficiency for both lenders and borrowers.

Challenges in the Japan Auto Loan Market Sector

The market faces challenges including a potentially fluctuating economy impacting consumer confidence, increasing competition among lenders leading to margin pressures, and the need to adapt to technological advancements to maintain market relevance. Strict regulatory compliance requirements add to the operational complexities for loan providers.

Emerging Opportunities in Japan Auto Loan Market

Opportunities exist in the growing demand for EV financing, expanding into underserved rural markets, and developing customized financial products for the growing elderly population and their unique needs. Developing fintech-based solutions for streamlined loan application and servicing presents a further opportunity.

Leading Players in the Japan Auto Loan Market Market

- Mitsubishi UFJ Financial Group

- Bank of Kyoto

- SMBC Trust Bank

- Orient Corporation

- Maruhan Japan Bank

- Nissan Financial Services (Note: Using US link as a global representation)

- Volkswagen Financial Services Japan

- Toyota Financial Services

- HDB Financial Service

Key Developments in Japan Auto Loan Market Industry

- June 2023: MUFG and its subsidiary acquired a majority stake in Mandala Multifinance, expanding their auto loan business.

- May 2023: Sojitz Corporation acquired Albert Automotive Holdings Pty Ltd, expanding its used car business domestically and internationally.

Future Outlook for Japan Auto Loan Market Market

The Japan auto loan market is strategically positioned for sustained and dynamic growth in the foreseeable future. This optimistic outlook is underpinned by continuously evolving consumer preferences, the relentless pace of technological advancements in the automotive and finance sectors, and proactive strategic expansions undertaken by key market players. The accelerating adoption of electric vehicles (EVs) and the subsequent development of associated, tailored financing opportunities represent a significant and potent growth accelerator for the market. Looking ahead, industry observers anticipate a degree of further consolidation within the sector as market participants strategically seek to achieve greater economies of scale, enhance operational efficiencies, and solidify their competitive positions in an increasingly dynamic landscape.

Japan Auto Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Vehicle Age

- 2.1. New Vehicle

- 2.2. Used Vehicle

-

3. End User

- 3.1. Individual

- 3.2. Enterprise

-

4. Loan Provider

- 4.1. Banks

- 4.2. OEM

- 4.3. Credit Unions

- 4.4. Other Loan Providers

Japan Auto Loan Market Segmentation By Geography

- 1. Japan

Japan Auto Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Demand For Passenger Vehicles; Quick Processing of Loan through Digital Banking

- 3.3. Market Restrains

- 3.3.1. Rise of Interest Rates

- 3.4. Market Trends

- 3.4.1. Increasing Sales Of Passenger Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Age

- 5.2.1. New Vehicle

- 5.2.2. Used Vehicle

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Individual

- 5.3.2. Enterprise

- 5.4. Market Analysis, Insights and Forecast - by Loan Provider

- 5.4.1. Banks

- 5.4.2. OEM

- 5.4.3. Credit Unions

- 5.4.4. Other Loan Providers

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Kanto Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Auto Loan Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsubishi UFJ Financial Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bank of Kyoto

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SMBC Trust Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Orient Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Maruhan Japan Bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nissan Financial Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volkswagen Financial Services Japan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyota Financial Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HDB Financial Service

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Mitsubishi UFJ Financial Group

List of Figures

- Figure 1: Japan Auto Loan Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Auto Loan Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Auto Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Auto Loan Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Japan Auto Loan Market Revenue Million Forecast, by Vehicle Age 2019 & 2032

- Table 4: Japan Auto Loan Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Japan Auto Loan Market Revenue Million Forecast, by Loan Provider 2019 & 2032

- Table 6: Japan Auto Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Japan Auto Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Kanto Japan Auto Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kansai Japan Auto Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chubu Japan Auto Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kyushu Japan Auto Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tohoku Japan Auto Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Auto Loan Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Japan Auto Loan Market Revenue Million Forecast, by Vehicle Age 2019 & 2032

- Table 15: Japan Auto Loan Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Japan Auto Loan Market Revenue Million Forecast, by Loan Provider 2019 & 2032

- Table 17: Japan Auto Loan Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Auto Loan Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Japan Auto Loan Market?

Key companies in the market include Mitsubishi UFJ Financial Group, Bank of Kyoto, SMBC Trust Bank, Orient Corporation, Maruhan Japan Bank, Nissan Financial Services, Volkswagen Financial Services Japan, Toyota Financial Services, HDB Financial Service.

3. What are the main segments of the Japan Auto Loan Market?

The market segments include Vehicle Type, Vehicle Age, End User, Loan Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase In Demand For Passenger Vehicles; Quick Processing of Loan through Digital Banking.

6. What are the notable trends driving market growth?

Increasing Sales Of Passenger Vehicles.

7. Are there any restraints impacting market growth?

Rise of Interest Rates.

8. Can you provide examples of recent developments in the market?

May 2023: Sojitz Corporation, existing as a pre-owned car dealer, acquired Albert Automotive Holdings Pty Ltd, which operates a wholesale and retail used car business as part of Dutton Group for expanding its business in domestic as well as international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Auto Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Auto Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Auto Loan Market?

To stay informed about further developments, trends, and reports in the Japan Auto Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence