Key Insights

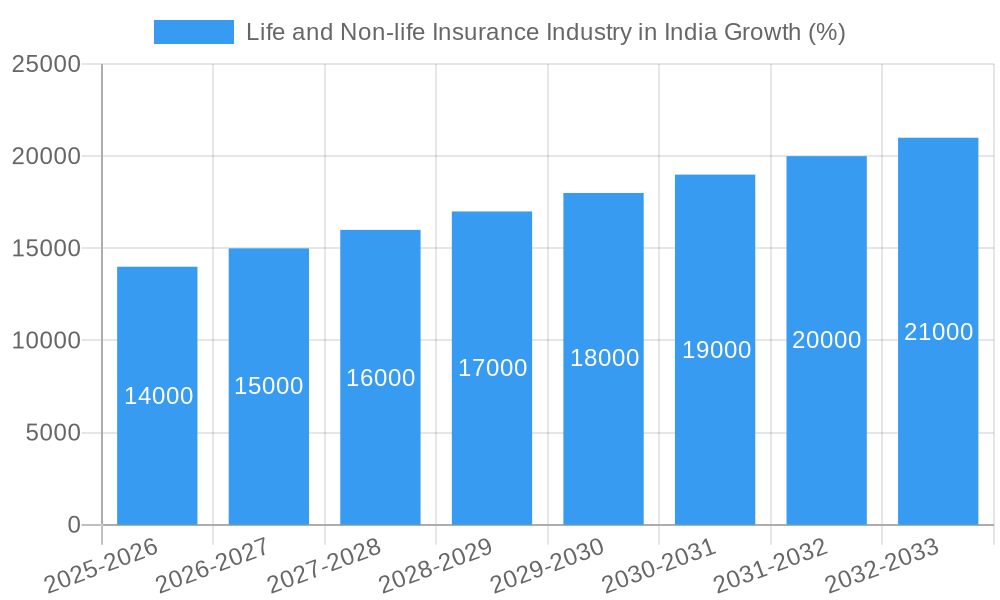

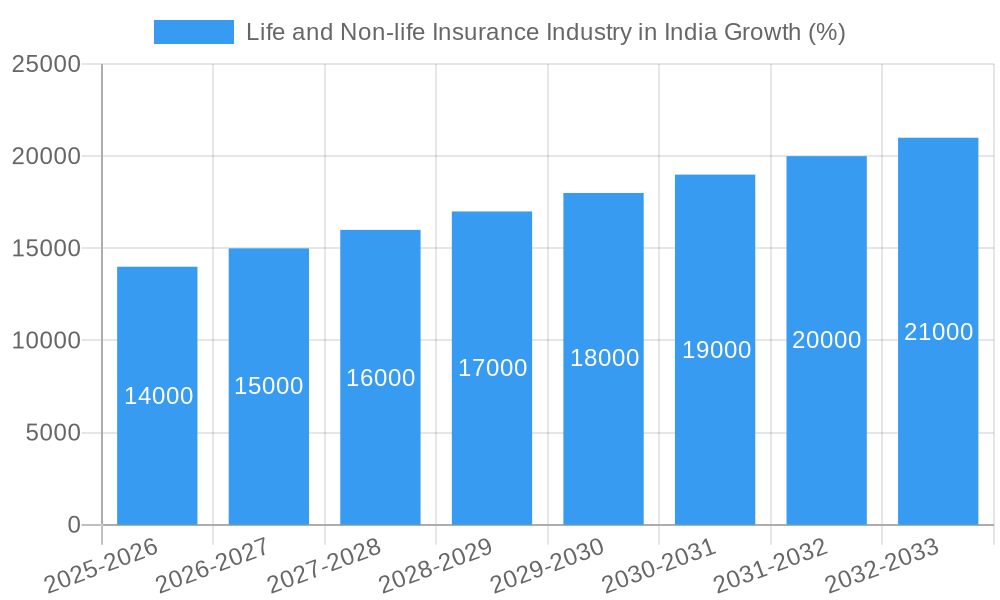

The Indian life and non-life insurance market presents a compelling growth story, projected to expand significantly over the forecast period (2025-2033). A CAGR exceeding 7% indicates robust market expansion driven by several factors. Rising disposable incomes, increasing awareness of insurance products (especially among the burgeoning middle class), and government initiatives promoting financial inclusion are key drivers. Technological advancements, such as digital platforms and insurtech solutions, are streamlining processes, improving customer experience, and expanding market reach. The increasing prevalence of chronic diseases and the growing demand for health insurance further fuels the life insurance segment's growth. However, challenges remain, including the relatively low insurance penetration compared to global averages, particularly in rural areas, and the need for greater consumer education to address misconceptions and promote wider adoption. Furthermore, regulatory hurdles and competition among established players and new entrants will continue to shape market dynamics.

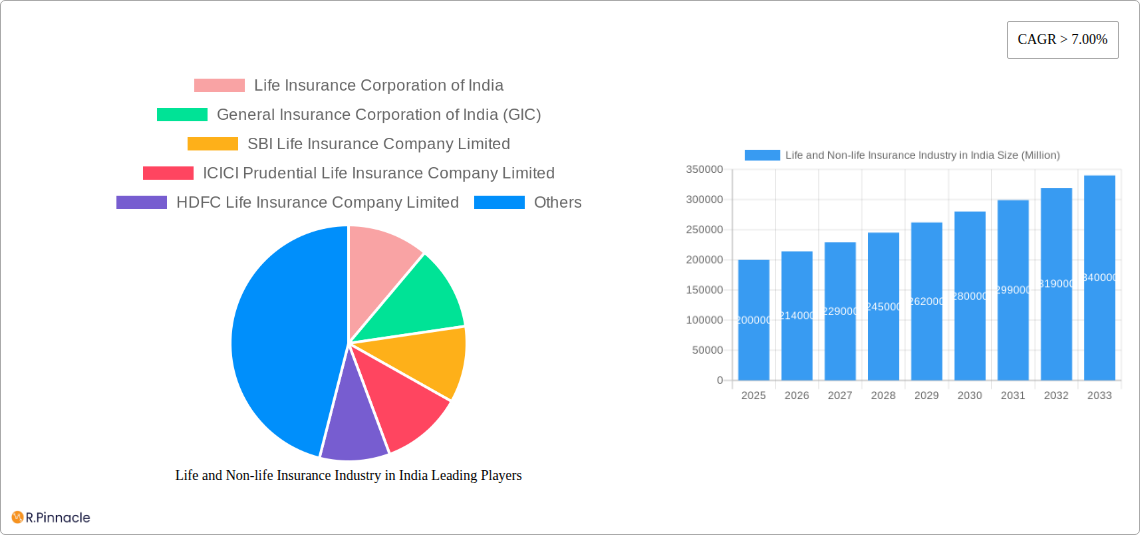

The market segmentation reveals a dominance by established players like LIC, GIC, SBI Life, and ICICI Prudential, but a growing number of private players are intensifying the competition. Regional variations in penetration rates necessitate targeted strategies for growth. The non-life sector is benefiting from the growth of sectors like automobile sales and infrastructure development leading to higher demand for motor and property insurance. The forecast period will likely witness further consolidation within the sector as companies strategically leverage digital technologies and expand their product portfolios to cater to evolving consumer needs. The continued focus on customer centricity, product innovation and the exploration of new insurance models will define the success stories in this market.

Life and Non-life Insurance Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Life and Non-life Insurance Industry in India, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages historical data, current market trends, and future projections to deliver actionable intelligence. The report meticulously examines market dynamics, competitive landscapes, and emerging opportunities within this rapidly evolving sector.

Life and Non-life Insurance Industry in India Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the Indian life and non-life insurance sectors. The Indian insurance market is characterized by a mix of public and private players, with LIC holding a significant market share. However, private players are increasingly gaining traction, fueled by technological advancements and changing consumer preferences.

Market Concentration: LIC dominates the life insurance segment, while GIC and other public sector players hold significant shares in the non-life segment. Private players are actively competing for market share, leading to increased competition and innovation. The market share of LIC in life insurance is estimated at xx% in 2025, while the top 5 private players collectively hold xx%. The non-life sector shows a similar pattern, with GIC and its subsidiaries commanding a significant share.

Innovation Drivers: Technological advancements like AI, big data analytics, and Insurtech are driving innovation in product development, customer service, and operational efficiency. Regulatory changes promoting financial inclusion and digitalization are also contributing factors.

Regulatory Framework: IRDAI plays a crucial role in regulating the industry, influencing product offerings, distribution channels, and overall market dynamics. The regulatory framework is constantly evolving to adapt to market changes and technological disruptions.

M&A Activities: The insurance sector witnesses periodic M&A activities, driven by strategic expansion, market consolidation, and access to new technologies. The total value of M&A deals in the Indian insurance sector in 2024 was approximately xx Million.

Product Substitutes: While traditional insurance products remain dominant, alternative financial products are emerging, posing competitive pressures.

End-User Demographics: The Indian insurance market is characterized by a large and diverse population, with varying insurance needs and penetration levels across different demographics.

Life and Non-life Insurance Industry in India Market Dynamics & Trends

This section explores the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Indian insurance landscape. The Indian insurance market is experiencing robust growth, driven by factors like rising disposable incomes, increasing awareness of insurance products, and government initiatives promoting financial inclusion.

The market is witnessing significant technological disruption, with Insurtech companies offering innovative products and services. Consumer preferences are evolving, with a growing demand for customized and digitally-enabled insurance solutions. Competitive dynamics are intensifying, with established players and new entrants vying for market share. The CAGR for the life insurance sector is projected at xx% during 2025-2033, while the non-life sector is expected to grow at xx% during the same period. Market penetration remains relatively low, indicating significant untapped potential for future growth. Factors like increasing urbanization, rising health consciousness, and changing lifestyle choices are further accelerating market growth.

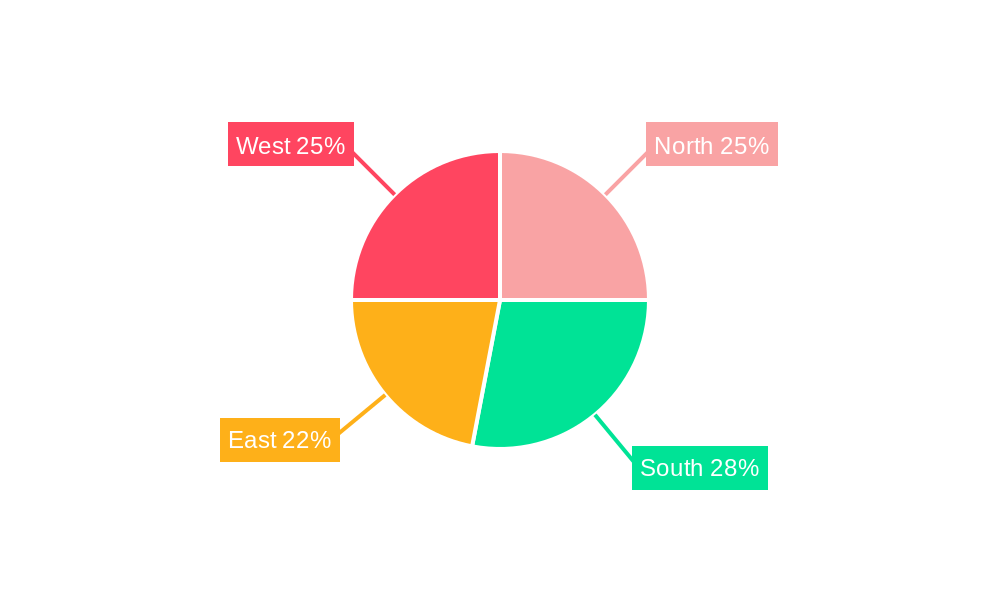

Dominant Regions & Segments in Life and Non-life Insurance Industry in India

This section highlights the leading regions and segments within the Indian life and non-life insurance markets. Metropolitan areas and economically developed states generally exhibit higher insurance penetration rates due to higher income levels and increased awareness.

- Key Drivers:

- Economic Policies: Government initiatives promoting financial inclusion and insurance penetration play a significant role.

- Infrastructure: Improved infrastructure and digital connectivity facilitate wider access to insurance services.

- Demographic Trends: A young and growing population creates a large pool of potential customers.

Urban areas demonstrate higher insurance penetration compared to rural areas. The life insurance segment shows strong growth in segments like term insurance and health insurance. The non-life segment sees significant demand in motor insurance and health insurance. Detailed analysis demonstrates that the dominance of specific regions and segments is primarily influenced by factors like economic development, infrastructure, and consumer awareness.

Life and Non-life Insurance Industry in India Product Innovations

The Indian insurance sector is witnessing significant product innovation, driven by technological advancements and evolving consumer preferences. New product offerings focus on customized solutions, digital distribution channels, and embedded insurance within other products and services. Technological trends like AI and machine learning are used to enhance underwriting processes, fraud detection, and customer service. The market fit for these innovative products is strong, reflecting the increasing demand for personalized and tech-enabled insurance solutions.

Report Scope & Segmentation Analysis

This report segments the Indian life and non-life insurance market based on various factors, including product type (term life, health, motor, etc.), distribution channel (online, offline), and customer demographics. Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The life insurance segment is further divided into participating and non-participating policies, while the non-life segment includes motor, health, fire, and other categories. Each segment demonstrates unique growth trajectories and competitive landscapes.

Key Drivers of Life and Non-life Insurance Industry in India Growth

Several factors drive the growth of the Indian life and non-life insurance sector. Technological advancements enable the development of innovative products and efficient operational processes. Favorable economic conditions, including rising disposable incomes and expanding middle class, contribute to increased insurance demand. Government regulations supporting financial inclusion and insurance penetration also stimulate market growth.

Challenges in the Life and Non-life Insurance Industry in India Sector

The Indian insurance sector faces several challenges, including low insurance penetration in rural areas, lack of awareness among certain demographic groups, and high operational costs. Regulatory hurdles and infrastructural limitations also pose significant obstacles. Intense competition among players further complicates the operational environment. These factors contribute to slower-than-expected growth in specific segments.

Emerging Opportunities in Life and Non-life Insurance Industry in India

The Indian insurance sector presents substantial opportunities for growth. Expanding into underserved markets, particularly rural areas, holds immense potential. Leveraging technology to enhance customer experience and product innovation offers significant competitive advantages. Developing customized products catering to specific needs of various demographic groups can drive significant market penetration.

Leading Players in the Life and Non-life Insurance Industry in India Market

- Life Insurance Corporation of India

- General Insurance Corporation of India (GIC)

- SBI Life Insurance Company Limited

- ICICI Prudential Life Insurance Company Limited

- HDFC Life Insurance Company Limited

- New India Assurance Co Ltd

- United India Insurance Company Limited

- National Insurance Company Limited

- The Oriental Insurance Company Ltd

- Shriram Life Insurance Company Ltd

Key Developments in Life and Non-life Insurance Industry in India Industry

- 2022: LIC paid out 70.39% of total insurance payouts, while private insurers accounted for the remaining 29.61%.

- 2021-22: Surrender and withdrawal benefits reached 1.58 Lakh crore, with LIC contributing 60.09% and private insurers the rest. ULIP surrender benefits: 1.96% for LIC, 78.29% for private insurers.

- 2022: LIC has offices in 688 of 750 districts (92%), while private insurers have offices in 596 districts (79%). Combined coverage of LIC and private insurers reaches 92% of all districts.

These developments highlight the dominance of LIC, while also indicating the increasing participation and market share of private insurers.

Future Outlook for Life and Non-life Insurance Industry in India Market

The future outlook for the Indian life and non-life insurance sector is positive, driven by strong economic growth, rising insurance awareness, and technological advancements. Untapped market potential in rural areas and the increasing demand for customized insurance products will fuel further expansion. Strategic partnerships and innovative business models will play a crucial role in shaping the future of the industry. The consistent growth in the sector, coupled with government support and technological innovation, promises a robust and dynamic insurance market in the coming years.

Life and Non-life Insurance Industry in India Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Fire

- 1.2.2. Motors

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Life and Non-life Insurance Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Life and Non-life Insurance Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Insurance Penetration at Global Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motors

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Fire

- 6.1.2.2. Motors

- 6.1.2.3. Marine

- 6.1.2.4. Health

- 6.1.2.5. Others

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Brokers

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Fire

- 7.1.2.2. Motors

- 7.1.2.3. Marine

- 7.1.2.4. Health

- 7.1.2.5. Others

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Brokers

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Fire

- 8.1.2.2. Motors

- 8.1.2.3. Marine

- 8.1.2.4. Health

- 8.1.2.5. Others

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Brokers

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Fire

- 9.1.2.2. Motors

- 9.1.2.3. Marine

- 9.1.2.4. Health

- 9.1.2.5. Others

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Brokers

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Life and Non-life Insurance Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-life Insurance

- 10.1.2.1. Fire

- 10.1.2.2. Motors

- 10.1.2.3. Marine

- 10.1.2.4. Health

- 10.1.2.5. Others

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Brokers

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Life Insurance Corporation of India

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Insurance Corporation of India (GIC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SBI Life Insurance Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICICI Prudential Life Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HDFC Life Insurance Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 New India Assurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United India Insurance Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 National Insurance Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Oriental Insurance Company Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shriram Life Insurance Company Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Life Insurance Corporation of India

List of Figures

- Figure 1: Global Life and Non-life Insurance Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2024 & 2032

- Figure 3: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2024 & 2032

- Figure 4: North America Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Life and Non-life Insurance Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2024 & 2032

- Figure 9: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2024 & 2032

- Figure 10: South America Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Life and Non-life Insurance Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2024 & 2032

- Figure 15: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2024 & 2032

- Figure 16: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Life and Non-life Insurance Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2024 & 2032

- Figure 21: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2024 & 2032

- Figure 22: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Insurance type 2024 & 2032

- Figure 27: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Insurance type 2024 & 2032

- Figure 28: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Life and Non-life Insurance Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 12: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 18: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 30: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 39: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Life and Non-life Insurance Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Life and Non-life Insurance Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life and Non-life Insurance Industry in India?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Life and Non-life Insurance Industry in India?

Key companies in the market include Life Insurance Corporation of India, General Insurance Corporation of India (GIC), SBI Life Insurance Company Limited, ICICI Prudential Life Insurance Company Limited, HDFC Life Insurance Company Limited, New India Assurance Co Ltd, United India Insurance Company Limited, National Insurance Company Limited, The Oriental Insurance Company Ltd, Shriram Life Insurance Company Ltd*List Not Exhaustive.

3. What are the main segments of the Life and Non-life Insurance Industry in India?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Insurance Penetration at Global Landscape.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, LIC paid out 70.39 % of the total payouts, and private insurers covered the remaining 29.61 %. The benefits paid as a result of surrenders or withdrawals rose to 1.58 lakh crore in 2021-22, with LIC accounting for 60.09 % and private insurers for the remainder. ULIP policies made for 1.96 % of the total surrender benefits for the LIC and 78.29 % for private insurers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life and Non-life Insurance Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life and Non-life Insurance Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life and Non-life Insurance Industry in India?

To stay informed about further developments, trends, and reports in the Life and Non-life Insurance Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence