Key Insights

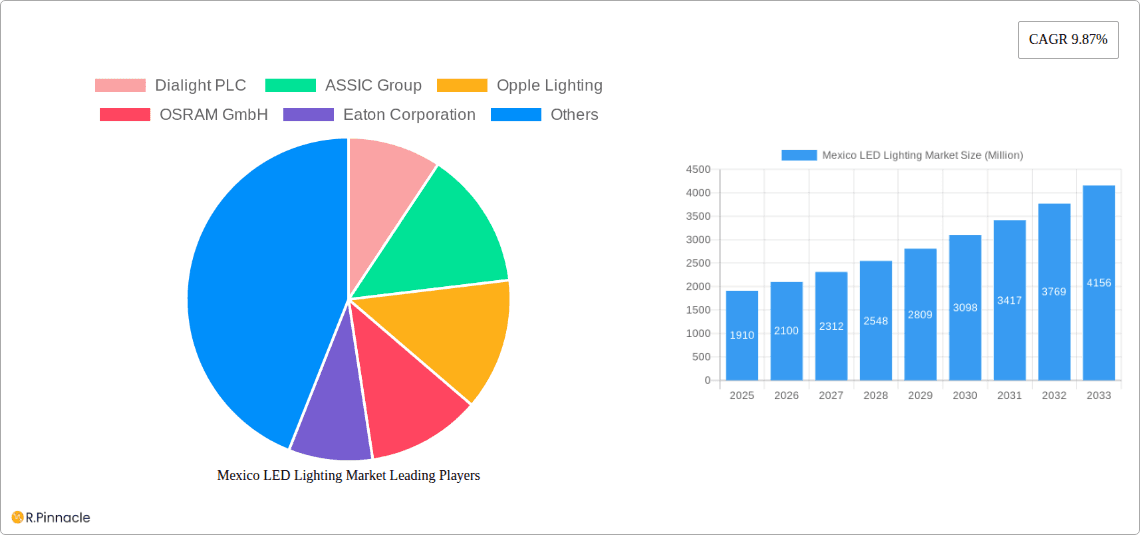

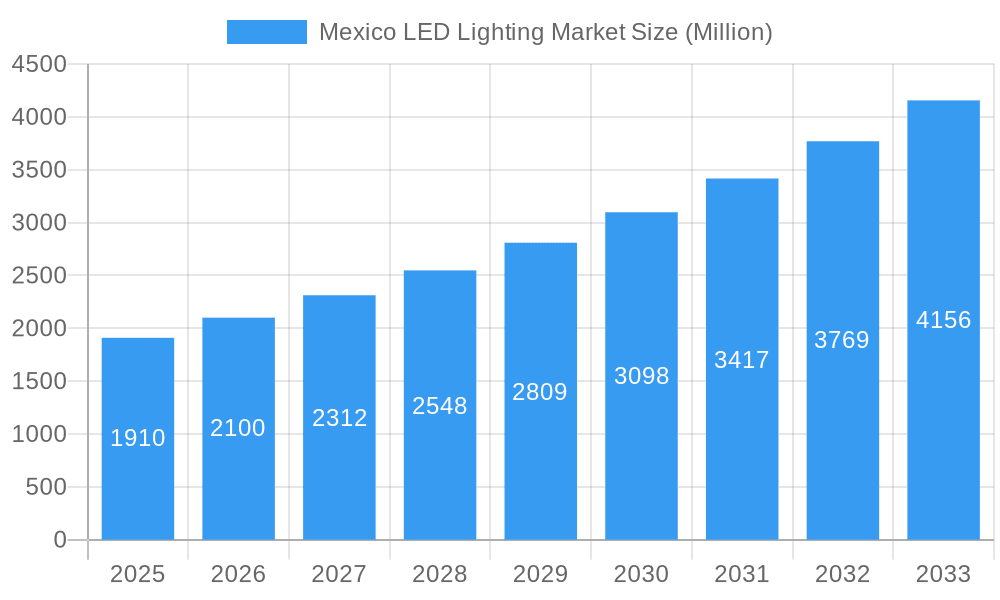

The Mexico LED lighting market, valued at $1.91 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.87% from 2025 to 2033. This robust expansion is driven by several key factors. Firstly, increasing government initiatives promoting energy efficiency and sustainability are fueling demand for energy-saving LED lighting solutions across residential, commercial, and industrial sectors. Secondly, the declining cost of LED technology makes it a more attractive and cost-effective alternative to traditional lighting, further accelerating market adoption. Furthermore, the rising urbanization in Mexico is creating opportunities for expanded street and urban lighting projects, contributing to market growth. The market is segmented by product type (lamps and luminaires) and end-user verticals, with the commercial sector (offices, retail, and hospitality) anticipated to show particularly strong growth due to the increasing adoption of smart lighting systems and the need for energy-efficient solutions in large commercial spaces. Major players like Dialight PLC, ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc, GE Lighting (Savant), and Signify Holdings BV are actively competing in this dynamic market, driving innovation and product diversification.

Mexico LED Lighting Market Market Size (In Billion)

The growth trajectory of the Mexican LED lighting market is expected to continue throughout the forecast period (2025-2033), driven by ongoing infrastructure development, expanding adoption of smart city initiatives, and increasing consumer awareness of energy-efficient lighting options. However, potential restraints include the initial higher investment cost compared to traditional lighting, although this is mitigated by long-term energy savings. The market's success also depends on the continued development of reliable power infrastructure to support widespread LED adoption, especially in rural areas. Nevertheless, given the strong government support, technological advancements, and increasing consumer preference for sustainable solutions, the Mexico LED lighting market is well-positioned for substantial growth in the coming years, presenting significant opportunities for both established and emerging players.

Mexico LED Lighting Market Company Market Share

Mexico LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico LED lighting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and opportunities within this rapidly evolving sector. The report leverages extensive data analysis and expert insights to provide actionable intelligence for navigating the complexities of the Mexican LED lighting landscape.

Mexico LED Lighting Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment shaping the Mexican LED lighting market. We examine market concentration, assessing the market share of key players like Dialight PLC, ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc, GE Lighting (Savant), and Signify Holdings BV. The report also delves into the impact of mergers and acquisitions (M&A) activities, including deal values where available (xx Million USD), and their influence on market dynamics. We explore the role of innovation, focusing on technological advancements in LED technology, smart lighting solutions, and energy efficiency improvements. Regulatory frameworks influencing market growth, including government initiatives and energy efficiency standards, are analyzed. Finally, we explore the prevalence and impact of product substitutes and their competitive threat. End-user demographics, including the growth of the residential and commercial sectors, will also be discussed.

Mexico LED Lighting Market Market Dynamics & Trends

This section provides a comprehensive overview of the market's dynamic evolution, including growth drivers, technological disruptions, consumer preferences, and competitive forces. The report will detail the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033), projected at xx%, and analyze market penetration rates across different segments. The influence of factors such as increasing energy costs, government incentives for energy efficiency, and growing environmental awareness will be examined. Technological disruptions, such as the rise of smart lighting and Internet of Things (IoT) integration, and their impact on market dynamics will be thoroughly explored. Furthermore, we will delve into evolving consumer preferences, focusing on design aesthetics, smart features, and cost-effectiveness in lighting solutions. The analysis will encompass a detailed examination of the competitive dynamics, including pricing strategies, product differentiation, and market positioning of major players.

Dominant Regions & Segments in Mexico LED Lighting Market

This section identifies the leading regions and segments within the Mexican LED lighting market. A detailed dominance analysis is presented for the leading segments (Lamps, Luminaires) and end-user verticals (Residential, Commercial – Offices, Retail, and Hospitality; Urban and Street Lighting; Industrial; Other). Key growth drivers for each dominant segment are highlighted using bullet points:

Dominant Segment: (e.g., Commercial Sector)

- Strong economic growth in major cities (Mexico City, Guadalajara, Monterrey).

- Government initiatives promoting energy-efficient infrastructure.

- Increased adoption of smart lighting technologies in office buildings and retail spaces.

Dominant Product Type: (e.g., Luminaires)

- Higher energy efficiency compared to traditional lighting.

- Aesthetically pleasing designs meeting diverse consumer preferences.

- Integration of smart functionalities and IoT capabilities.

Detailed Dominance Analysis: This section will explore in detail the reasons behind the dominance of specific segments, providing an in-depth analysis of market dynamics, growth rates, and future projections.

Mexico LED Lighting Market Product Innovations

This section summarizes recent product developments, highlighting key technological trends and their market fit. We will cover new LED technologies, smart lighting systems, and advancements in energy efficiency and cost-effectiveness. The competitive advantages offered by these innovations and their impact on market share will also be discussed. Examples include the introduction of new luminaire designs, the integration of IoT capabilities, and the development of energy-harvesting systems.

Report Scope & Segmentation Analysis

This report segments the Mexico LED lighting market by Product Type (Lamps, Luminaires) and End-user Vertical (Residential, Commercial – Offices, Retail, and Hospitality; Urban and Street Lighting; Industrial; Other). Each segment's growth projections, market size (in Million USD), and competitive dynamics will be thoroughly analyzed. For each segment, a detailed paragraph will be included to provide a comprehensive analysis of current and future prospects.

Key Drivers of Mexico LED Lighting Market Growth

Key drivers of Mexico LED lighting market growth include: increasing government support for energy efficiency programs, rising demand for energy-saving solutions from both residential and commercial sectors, and the continuous innovation in LED technology resulting in improved efficiency and lower costs. Furthermore, the expansion of infrastructure projects in urban areas is boosting demand for street lighting solutions.

Challenges in the Mexico LED Lighting Market Sector

Challenges within the sector include the high initial investment costs associated with LED lighting upgrades, supply chain disruptions impacting the availability of components, and intense competition among various lighting technology providers. Importantly, regulatory hurdles and complex installation processes can hinder market penetration. The report will quantify these challenges with specific data wherever possible, such as the impact of supply chain issues on pricing (e.g., a xx% increase in prices due to supply chain disruptions).

Emerging Opportunities in Mexico LED Lighting Market

Emerging opportunities are centered around the increasing adoption of smart lighting technologies and IoT integration, the growing demand for energy-efficient lighting solutions in the industrial and agricultural sectors, and the potential for growth in niche applications like horticultural lighting. The development of government policies supporting green initiatives is anticipated to further propel the market's growth trajectory.

Leading Players in the Mexico LED Lighting Market Market

- Dialight PLC

- ASSIC Group

- Opple Lighting

- OSRAM GmbH

- Eaton Corporation

- Acuity Brands Inc

- GE Lighting (Savant)

- Signify Holdings BV

Key Developments in Mexico LED Lighting Market Industry

- July 2022: ZKW's USD 102 Million investment in its Silao plant to increase headlight production capacity to 3.5 Million annually by 2025.

- May 2022: Signify's acquisition of Fluence from ams OSRAM, strengthening its position in the agricultural lighting market.

- March 2022: Acuity Brands launched Verjure, a professional-grade horticultural LED lighting solution.

Future Outlook for Mexico LED Lighting Market Market

The future outlook for the Mexican LED lighting market is positive, driven by ongoing technological advancements, increasing energy efficiency requirements, and government support for sustainable solutions. Significant growth opportunities exist in the smart lighting, horticultural lighting, and industrial sectors. Strategic partnerships and investments in research and development will further shape the market landscape. The report projects continued strong growth for the forecast period, with significant potential for market expansion in both established and emerging segments.

Mexico LED Lighting Market Segmentation

-

1. Product Type

- 1.1. Lamps

- 1.2. Luminaires

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Commercial (Offices, Retail, and Hospitality)

- 2.3. Urban and Street Lighting

- 2.4. Industrial

- 2.5. Other

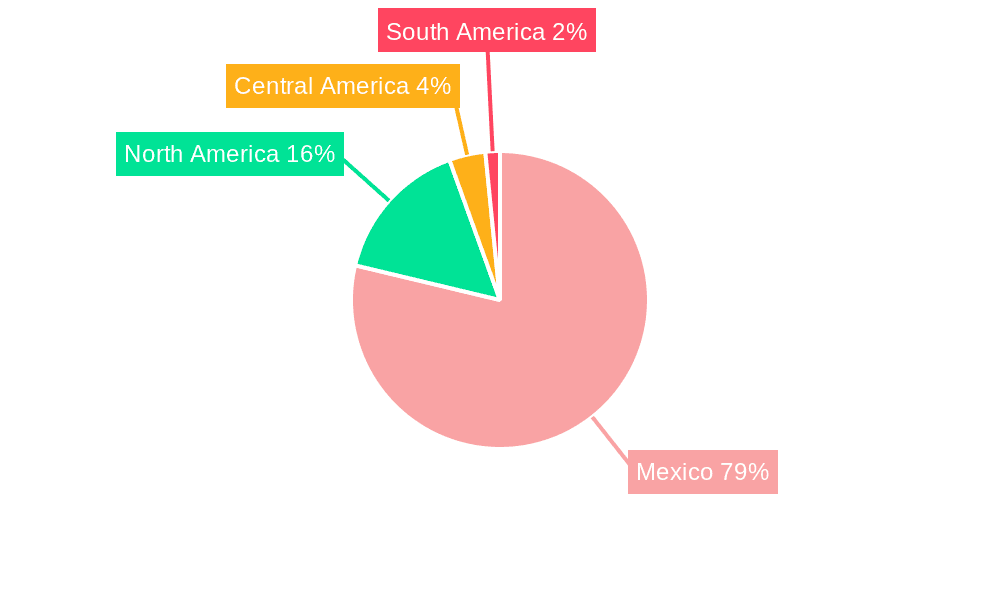

Mexico LED Lighting Market Segmentation By Geography

- 1. Mexico

Mexico LED Lighting Market Regional Market Share

Geographic Coverage of Mexico LED Lighting Market

Mexico LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Outdoor Lighting Due to Smart Development Initiatives to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lamps

- 5.1.2. Luminaires

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Commercial (Offices, Retail, and Hospitality)

- 5.2.3. Urban and Street Lighting

- 5.2.4. Industrial

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dialight PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ASSIC Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Opple Lighting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OSRAM GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eaton Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acuity Brands Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GE Lighting (Savant)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Signify Holdings BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dialight PLC

List of Figures

- Figure 1: Mexico LED Lighting Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico LED Lighting Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Mexico LED Lighting Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Mexico LED Lighting Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Mexico LED Lighting Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 5: Mexico LED Lighting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico LED Lighting Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Mexico LED Lighting Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Mexico LED Lighting Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Mexico LED Lighting Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Mexico LED Lighting Market Volume K Unit Forecast, by End-user Vertical 2020 & 2033

- Table 11: Mexico LED Lighting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico LED Lighting Market?

The projected CAGR is approximately 9.87%.

2. Which companies are prominent players in the Mexico LED Lighting Market?

Key companies in the market include Dialight PLC , ASSIC Group, Opple Lighting, OSRAM GmbH, Eaton Corporation, Acuity Brands Inc , GE Lighting (Savant), Signify Holdings BV.

3. What are the main segments of the Mexico LED Lighting Market?

The market segments include Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life .

6. What are the notable trends driving market growth?

Increasing Demand for Outdoor Lighting Due to Smart Development Initiatives to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Cost of Installations.

8. Can you provide examples of recent developments in the market?

July 2022 - ZKW, a specialist in lighting systems, disclosed its plan to invest a substantial sum of over USD 102 million in the expansion of its production plant located in Silao. This 3rd Phase expansion was expected to enable ZKW México to augment its production capacity with an impressive 1.5 million headlights. The newly constructed facility will be equipped with cutting-edge technologies, including plastic injection molding systems, surface treatments, and painting systems, to facilitate the production of automotive lighting systems. By the year 2025, ZKW Mexico aims to manufacture approximately 3.5 million headlights annually, employing a workforce of 2,522 individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico LED Lighting Market?

To stay informed about further developments, trends, and reports in the Mexico LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence