Key Insights

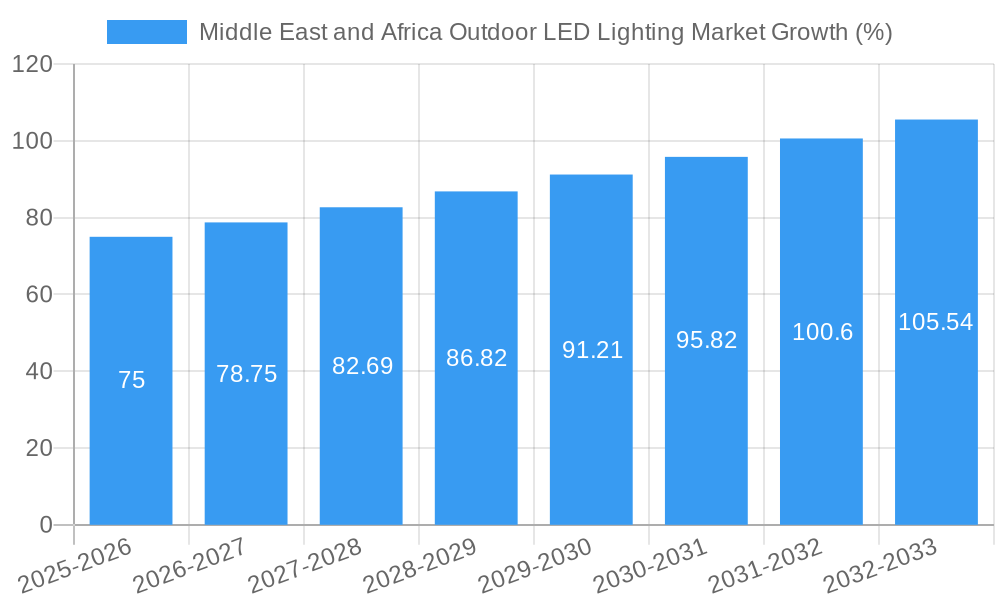

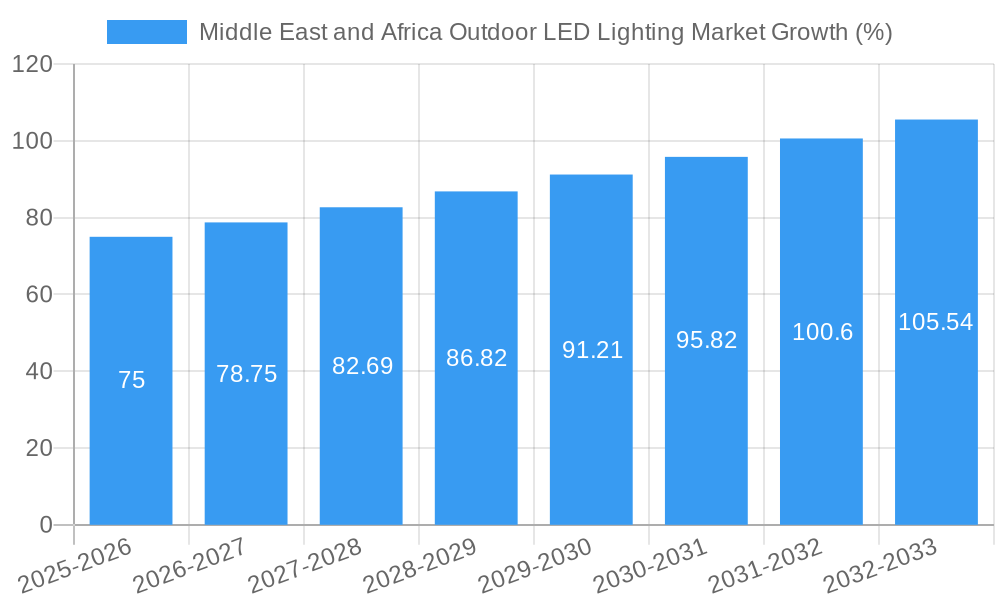

The Middle East and Africa Outdoor LED Lighting Market is experiencing robust growth, driven by increasing urbanization, infrastructure development, and government initiatives promoting energy efficiency. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.10% and a 2019-2024 historical period), is projected to expand significantly over the forecast period (2025-2033). Key drivers include the rising adoption of energy-efficient LED lighting solutions to reduce operational costs and carbon footprint, coupled with increasing awareness of the environmental benefits of LED technology. Furthermore, the burgeoning tourism sector in several African nations and ongoing smart city projects across the Middle East contribute to the market's expansion. The market is segmented by product type (LED Street Lights, LED Floodlights, LED Area Lights, LED Decorative Lights) and application (Public Places, Streets and Roadways, Commercial, Industrial, Residential). LED street lights dominate the product segment, driven by large-scale government projects focusing on improved public lighting infrastructure. The Public Places and Streets and Roadways application segments exhibit the highest growth potential, fueled by extensive road network expansions and urban development initiatives across the region. While the market faces certain restraints, such as high initial investment costs for LED lighting installations and potential supply chain disruptions, the long-term benefits of energy savings and reduced maintenance outweigh these challenges, ensuring sustained market growth.

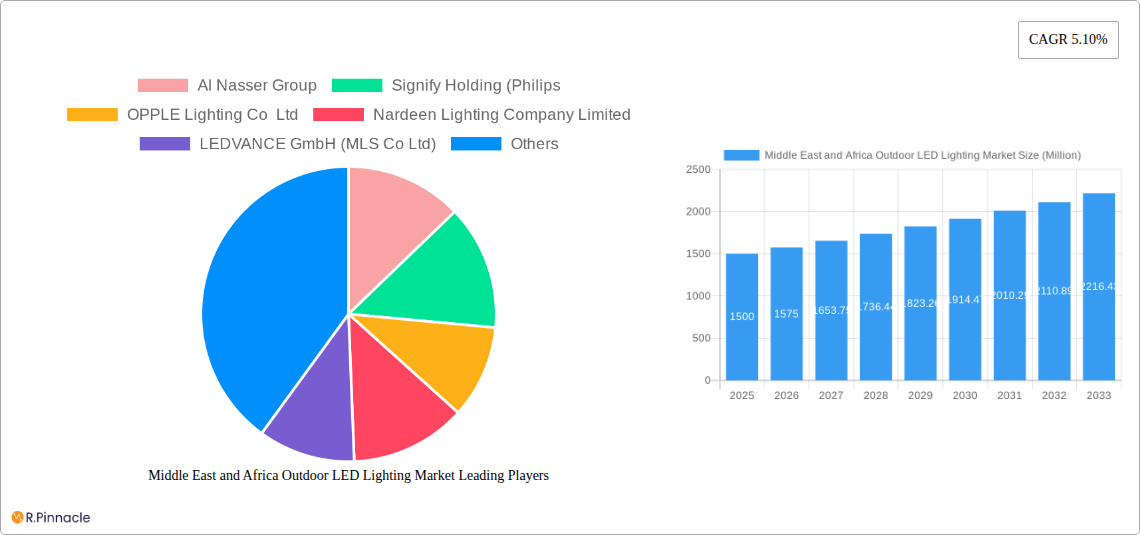

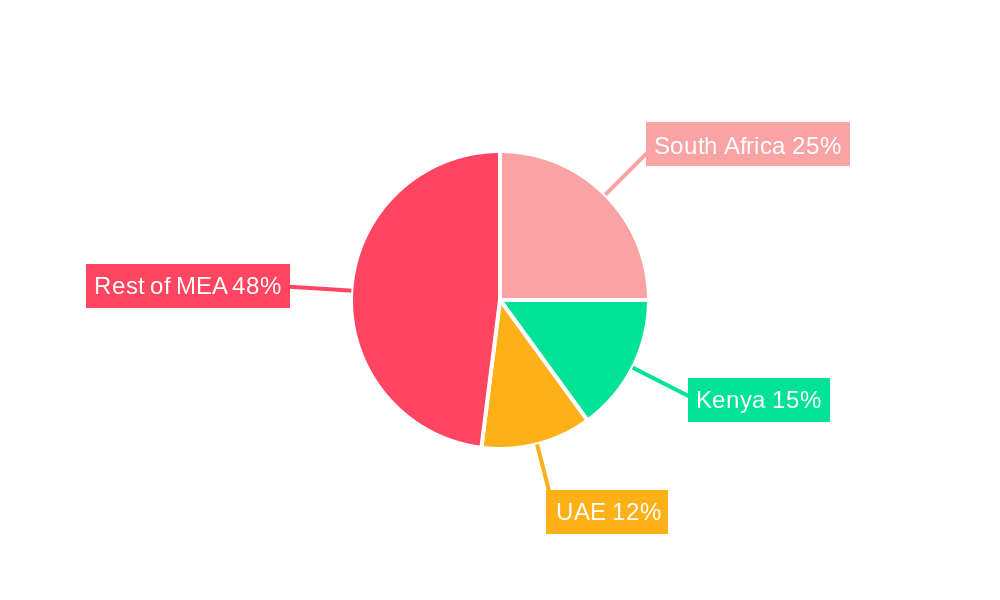

Competitive landscape analysis reveals the presence of both international and regional players, including Al Nasser Group, Signify Holding (Philips), OPPLE Lighting Co Ltd, Nardeen Lighting Company Limited, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, ams-OSRAM AG, ACUITY BRANDS INC, and Dialight PLC. These companies are actively involved in product innovation, strategic partnerships, and market expansion strategies to capitalize on the growing market opportunities. Focus on providing smart lighting solutions integrated with IoT technologies is expected to gain traction in the coming years, further accelerating market growth. Regional variations in market growth are expected, with countries such as South Africa, Kenya, and the UAE demonstrating faster adoption rates due to favorable government policies and robust economic growth. The forecast period presents significant opportunities for market players to capitalize on the substantial growth potential of the Middle East and Africa Outdoor LED Lighting Market.

Middle East and Africa Outdoor LED Lighting Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Outdoor LED Lighting Market, offering valuable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a complete understanding of market dynamics, growth drivers, and future potential. The market is segmented by product type (LED Street Lights, LED Floodlights, LED Area Lights, LED Decorative Lights) and application (Public Places, Streets and Roadways, Commercial, Industrial, Residential). Key players analyzed include Al Nasser Group, Signify Holding (Philips), OPPLE Lighting Co Ltd, Nardeen Lighting Company Limited, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, ams-OSRAM AG, ACUITY BRANDS INC, and Dialight PLC. The report projects a market value of xx Million by 2033.

Middle East and Africa Outdoor LED Lighting Market Market Structure & Innovation Trends

The Middle East and Africa outdoor LED lighting market exhibits a moderately concentrated structure, with a few major players holding significant market share. Signify Holding (Philips) and other multinational companies command a substantial portion, while regional players like Al Nasser Group cater to specific niches. Market share fluctuations are influenced by factors such as technological advancements, pricing strategies, and government regulations. Innovation is driven by the need for energy-efficient, durable, and smart lighting solutions. Government initiatives promoting energy conservation and sustainable infrastructure development further fuel innovation. The regulatory landscape varies across countries, impacting market access and product compliance. LED technology has largely replaced traditional lighting, with minimal presence of significant substitutes. End-user demographics are diverse, spanning public entities, commercial businesses, and residential consumers, with varying needs and preferences. M&A activity has been moderate, with deal values averaging xx Million in recent years, primarily focused on consolidating market share and expanding product portfolios.

Middle East and Africa Outdoor LED Lighting Market Market Dynamics & Trends

The Middle East and Africa outdoor LED lighting market is experiencing robust growth, driven by increasing urbanization, infrastructure development, and government initiatives promoting energy efficiency. The market is expected to register a CAGR of xx% during the forecast period. Technological advancements, such as the integration of smart features and IoT capabilities, are transforming the market landscape. Consumer preferences are shifting towards aesthetically pleasing, energy-efficient, and long-lasting lighting solutions. The competitive dynamics are intense, with both multinational and regional players vying for market share. Market penetration of LED lighting is high in major urban centers, but significant opportunities remain in less developed regions.

Dominant Regions & Segments in Middle East and Africa Outdoor LED Lighting Market

Dominant Region: The UAE and Saudi Arabia dominate the market due to extensive infrastructure projects and high government spending on smart city initiatives. South Africa also holds significant market share within Africa.

Dominant Product Type: LED Street Lights constitute the largest segment due to extensive roadway networks and government investments in public infrastructure.

Dominant Application: Public places and streets and roadways hold the largest share, driven by government investments in urban development and smart city projects.

Several factors contribute to regional dominance:

- Economic growth: Rapid economic growth in several MEA countries fuels infrastructure development and increased demand for lighting solutions.

- Government policies: Supportive government policies encouraging energy efficiency and smart city initiatives propel market growth.

- Infrastructure investments: Significant investment in public infrastructure projects, such as roads, highways, and public spaces drives demand for outdoor lighting.

- Urbanization: Rapid urbanization increases the need for effective and energy-efficient lighting in urban areas.

Middle East and Africa Outdoor LED Lighting Market Product Innovations

Recent product developments focus on enhancing energy efficiency, durability, and smart features. Companies are introducing advanced LED chips with improved lumen output and longer lifespans. Smart lighting systems with remote monitoring and control capabilities are gaining traction. Product innovations cater to diverse applications, including aesthetically appealing decorative lights for residential areas and high-performance floodlights for industrial settings.

Report Scope & Segmentation Analysis

Product Type: The market is segmented into LED Street Lights, LED Floodlights, LED Area Lights, and LED Decorative Lights. Each segment exhibits unique growth trajectories and competitive dynamics, with LED Street Lights currently dominating. Market size projections for each segment are detailed within the report.

Application: The market is segmented by application into Public Places, Streets and Roadways, Commercial, Industrial, and Residential. Growth projections vary based on infrastructure development plans and consumer preferences within each application area.

Key Drivers of Middle East and Africa Outdoor LED Lighting Market Growth

The growth of the Middle East and Africa outdoor LED lighting market is fueled by several key factors:

- Government initiatives promoting energy efficiency and smart city development—These initiatives provide financial incentives and regulatory support for LED lighting adoption.

- Rapid urbanization and infrastructure development—The expansion of urban areas necessitates increased investment in public lighting infrastructure.

- Technological advancements resulting in improved energy efficiency and durability of LED lighting products. This drives cost savings and longer lifecycles.

- Falling prices of LED lighting products making them more accessible to a wider range of consumers.

Challenges in the Middle East and Africa Outdoor LED Lighting Market Sector

The market faces challenges such as:

- High initial investment costs for smart lighting solutions can hinder widespread adoption, particularly in developing regions.

- Supply chain disruptions can impact the availability and pricing of LED lighting products.

- Fluctuations in energy prices can influence the overall cost-effectiveness of LED lighting.

Emerging Opportunities in Middle East and Africa Outdoor LED Lighting Market

Significant opportunities exist in:

- Expanding into less developed regions where LED lighting penetration is still low.

- Developing smart lighting solutions integrated with IoT and advanced monitoring systems.

- Focus on energy-efficient solutions which meet the needs of environmentally conscious consumers and governments.

Leading Players in the Middle East and Africa Outdoor LED Lighting Market Market

- Al Nasser Group

- Signify Holding (Philips)

- OPPLE Lighting Co Ltd

- Nardeen Lighting Company Limited

- LEDVANCE GmbH (MLS Co Ltd)

- EGLO Leuchten GmbH

- Current Lighting Solutions LLC

- ams-OSRAM AG

- ACUITY BRANDS INC

- Dialight PLC

Key Developments in Middle East and Africa Outdoor LED Lighting Market Industry

- May 2023: Cyclone Lighting launched the Elencia luminaire, featuring high-performance optics and a modern design.

- May 2023: Dialight introduced the ProSite High Mast, expanding its ProSite Floodlight range for industrial applications.

- April 2023: Hydrel added the M9700 RGBW fixture to its M9000 ingrade luminaire family.

Future Outlook for Middle East and Africa Outdoor LED Lighting Market Market

The Middle East and Africa outdoor LED lighting market is poised for continued growth, driven by sustained infrastructure development, increasing urbanization, and government support for energy-efficient technologies. Strategic partnerships, technological innovations, and expansion into untapped markets will be key success factors for companies operating in this dynamic sector. The market is expected to witness further consolidation, with larger players acquiring smaller companies to expand their market reach and product portfolios.

Middle East and Africa Outdoor LED Lighting Market Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

Middle East and Africa Outdoor LED Lighting Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Outdoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. Africa Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. South Africa Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Sudan Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Uganda Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Tanzania Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Kenya Middle East and Africa Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Al Nasser Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Signify Holding (Philips

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 OPPLE Lighting Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nardeen Lighting Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LEDVANCE GmbH (MLS Co Ltd)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 EGLO Leuchten GmbH

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Current Lighting Solutions LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ams-OSRAM AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ACUITY BRANDS INC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Dialight PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Al Nasser Group

List of Figures

- Figure 1: Middle East and Africa Outdoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Outdoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 5: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 20: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 21: Middle East and Africa Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Middle East and Africa Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Saudi Arabia Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: United Arab Emirates Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Israel Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Qatar Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Qatar Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Kuwait Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Kuwait Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Oman Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Oman Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Bahrain Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Bahrain Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Jordan Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Jordan Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Lebanon Middle East and Africa Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Lebanon Middle East and Africa Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Outdoor LED Lighting Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Middle East and Africa Outdoor LED Lighting Market?

Key companies in the market include Al Nasser Group, Signify Holding (Philips, OPPLE Lighting Co Ltd, Nardeen Lighting Company Limited, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, ams-OSRAM AG, ACUITY BRANDS INC, Dialight PLC.

3. What are the main segments of the Middle East and Africa Outdoor LED Lighting Market?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires, announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look due to high-performance optics and revised, modern lantern style.May 2023: Dialight, a company in hazardous and industrial LED lighting innovation, introduced the ProSite High Mast, an expansion of the company's extremely successful ProSite Floodlight range. This new model is carefully constructed to withstand mounting heights of up to 130 feet for a wide range of outdoor industrial applications such as airports, container yards, rail yards, product stockpiles, transportation, perimeter lighting, and parking applications. With a total lumen output of up to 65,000, the ProSite High Mast improves site security by providing uniform, crisp, and clear illumination.April 2023: Hydrel, an established innovator and producer of outdoor architectural and landscape lighting systems, announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Outdoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Outdoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Outdoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Outdoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence