Key Insights

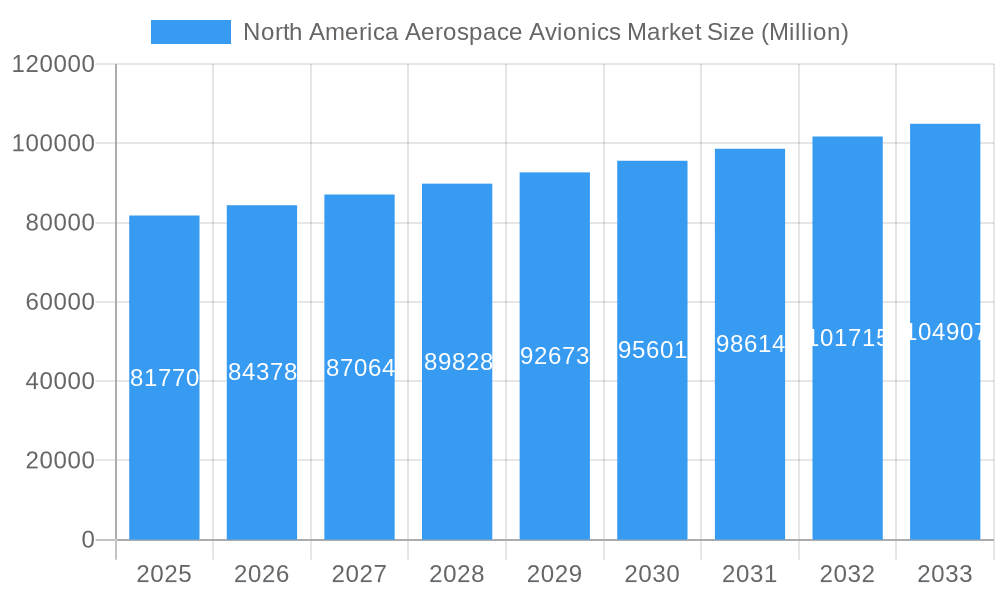

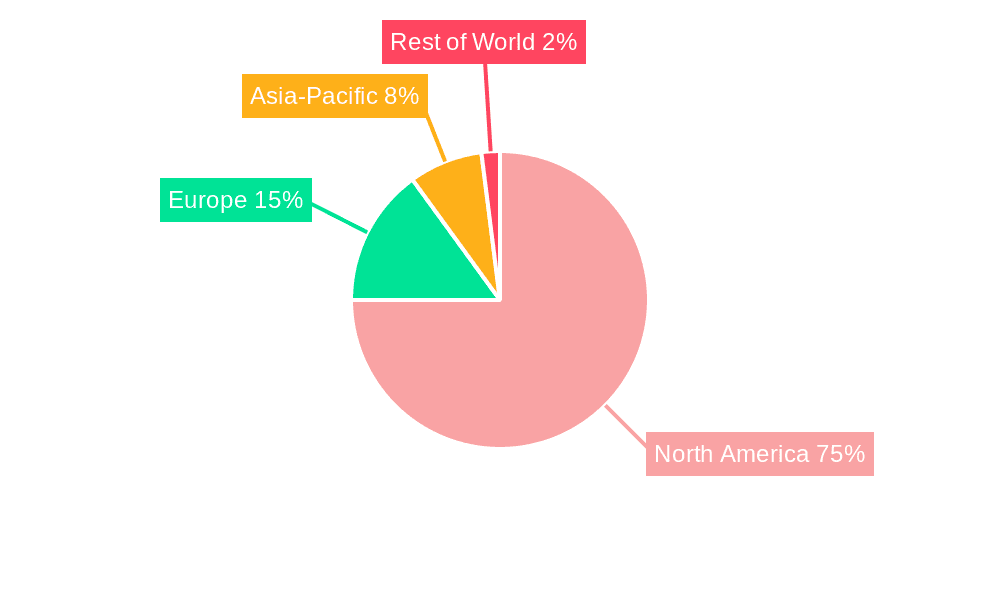

The North American aerospace avionics market, valued at $81.77 billion in 2025, is projected to experience steady growth, driven by increasing demand for advanced aircraft technologies and modernization initiatives within both commercial and military sectors. The 2.90% CAGR suggests a consistent expansion over the forecast period (2025-2033). Key drivers include the rising adoption of sophisticated avionics systems enhancing flight safety, efficiency, and passenger comfort in commercial aircraft. Furthermore, government investments in military aircraft upgrades and new platforms are significantly boosting demand. Specific growth within segments like commercial aircraft avionics is likely to outpace that of military or general aviation due to higher production volumes and ongoing fleet renewal cycles across major North American airlines. However, potential restraints include supply chain vulnerabilities and the cyclical nature of the aerospace industry, sensitive to economic fluctuations and global events. The market's regional concentration in North America, particularly the United States, reflects the significant presence of major aerospace manufacturers and a robust domestic aviation market. This regional dominance is expected to continue, albeit with potential growth opportunities in other North American regions (Canada and Mexico) driven by their own aviation modernization efforts.

North America Aerospace Avionics Market Market Size (In Billion)

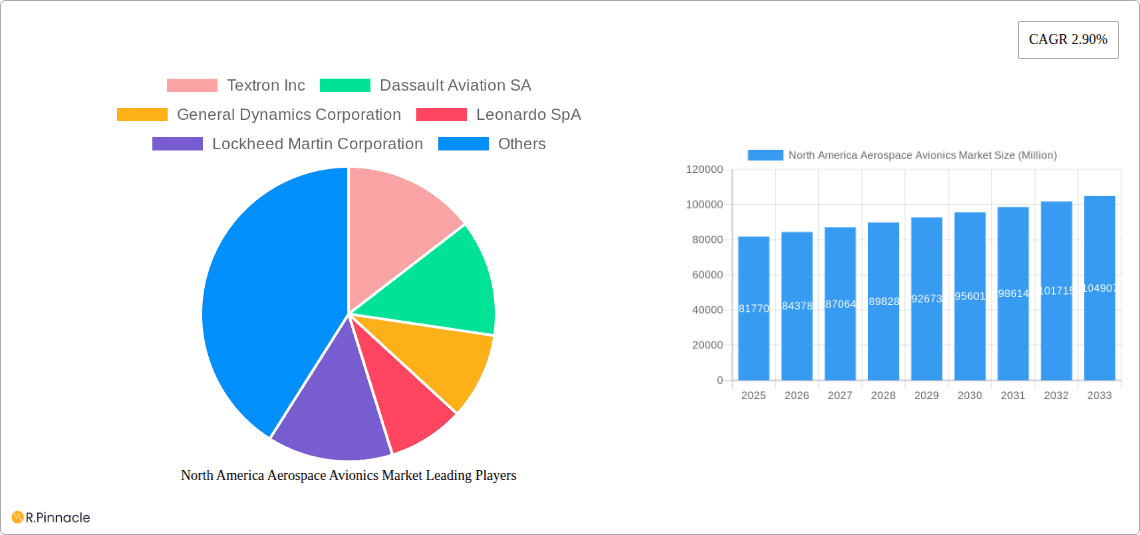

Within the North American Aerospace Avionics Market, the Commercial Aircraft segment commands a dominant share, reflecting the large-scale production and widespread use of these aircraft. The Freighter Aircraft segment exhibits a moderate growth trajectory, driven by the rise in e-commerce and global trade. Military and Non-combat segments are influenced by government spending cycles and technological advancements in defense systems. The General Aviation segment, while smaller, presents opportunities due to increased private aircraft ownership and advancements in smaller-scale avionics. Key players like Boeing, Lockheed Martin, and Textron are positioned to benefit from these trends, capitalizing on their established market presence, technology leadership, and strategic partnerships within the supply chain. The forecast period will likely witness further consolidation and strategic alliances within the industry, as companies adapt to evolving technologies and regulations.

North America Aerospace Avionics Market Company Market Share

North America Aerospace Avionics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Aerospace Avionics market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, key players, and future outlook. The market is segmented by aircraft type: Commercial Aircraft, Freighter Aircraft, Military Aircraft, Non-combat Aircraft, and General Aviation. Expect detailed analysis of market size (in Millions), CAGR, and key growth drivers.

North America Aerospace Avionics Market Structure & Innovation Trends

The North American aerospace avionics market exhibits a moderately concentrated structure, with key players like The Boeing Company, Lockheed Martin Corporation, and Airbus SE holding significant market share. However, the presence of several smaller, specialized companies fosters competition and innovation. Market share data for 2024 indicates The Boeing Company holds approximately xx% market share, followed by Lockheed Martin Corporation at xx% and Airbus SE at xx%. The market is driven by continuous technological advancements, particularly in areas like artificial intelligence, augmented reality, and improved sensor technologies. Stringent regulatory frameworks, particularly from the FAA, shape product development and safety standards. The increasing demand for fuel-efficient aircraft and enhanced safety features fuels the market. M&A activities, though not frequent, significantly impact market consolidation. For instance, a recent deal valued at approximately $xx Million showcases a consolidation trend among smaller players to improve their competitiveness. Furthermore, product substitution, mainly through upgrades and advancements in existing systems, influences market dynamics. Finally, the end-user demographics are primarily driven by airlines, military forces, and general aviation operators, each with their specific requirements and budget considerations.

North America Aerospace Avionics Market Dynamics & Trends

The North America aerospace avionics market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing air travel demand, modernization of existing fleets, and the adoption of advanced avionics systems for improved safety and efficiency. Technological disruptions, such as the integration of advanced sensor technologies, AI-powered analytics, and the increasing use of IoT (Internet of Things) devices, are transforming the industry. Consumer preference for safer and more comfortable air travel is pushing the demand for advanced avionics features. The competitive landscape is characterized by fierce competition among established players and the emergence of innovative startups. Market penetration of advanced avionics systems is progressively increasing, particularly in commercial aviation, driven by the need for enhanced operational efficiency and reduced maintenance costs. The market shows an overall positive growth trajectory, driven by the continual growth of the broader aerospace industry.

Dominant Regions & Segments in North America Aerospace Avionics Market

The United States dominates the North American aerospace avionics market, driven by a strong domestic aerospace industry, significant military spending, and a large commercial aviation sector.

Key Drivers for US Dominance:

- Robust domestic aerospace manufacturing base.

- High military spending on advanced avionics systems.

- Significant investment in research and development.

- Favorable regulatory environment.

Segment Dominance:

The Commercial Aircraft segment holds the largest market share, largely due to its size and continuous fleet modernization. The Military Aircraft segment, while smaller, exhibits high growth potential due to ongoing defense modernization programs. The General Aviation sector also contributes significantly, driven by the popularity of private and corporate aviation. The freighter aircraft segment experiences steady growth driven by e-commerce growth and global trade. A detailed analysis of each segment reveals unique growth drivers and competitive landscapes.

North America Aerospace Avionics Market Product Innovations

Recent product innovations focus on improving situational awareness, enhancing automation, and reducing fuel consumption. The integration of advanced sensors, artificial intelligence (AI), and machine learning (ML) algorithms allows for better predictive maintenance and real-time data analysis. This not only enhances flight safety but also optimizes operational efficiency. These technological advancements lead to improved fuel efficiency and reduced operating costs, making them highly attractive to both commercial and military operators. The market is seeing a strong push towards more intuitive and user-friendly avionics systems.

Report Scope & Segmentation Analysis

Commercial Aircraft: This segment is characterized by high volume and a focus on cost-effectiveness and efficiency. Growth is projected at xx% CAGR.

Freighter Aircraft: This segment shows steady growth driven by e-commerce and global trade. Growth is projected at xx% CAGR.

Military Aircraft: This segment demonstrates strong growth, fueled by defense spending and technological advancements. Growth is projected at xx% CAGR.

Non-combat Aircraft: This niche segment features specific technological demands, growing steadily. Growth is projected at xx% CAGR.

General Aviation: This segment sees growth driven by leisure and business travel, characterized by a focus on smaller, lighter aircraft. Growth is projected at xx% CAGR.

Key Drivers of North America Aerospace Avionics Market Growth

Technological advancements like AI, machine learning, and sensor integration are paramount. Economic factors include increasing air passenger traffic and defense spending. Regulatory changes, like stricter safety standards, drive innovation. For example, the FAA's NextGen initiative compels airlines to upgrade their avionics systems, stimulating market expansion.

Challenges in the North America Aerospace Avionics Market Sector

High development and certification costs represent significant barriers. Supply chain disruptions and component shortages cause delays and increase production costs. Intense competition among established players and new entrants create pricing pressure. These factors can impact overall market growth by as much as xx% in certain years.

Emerging Opportunities in North America Aerospace Avionics Market

The rise of unmanned aerial vehicles (UAVs) and the integration of digital technologies present significant growth opportunities. The development of sustainable aviation fuels and the demand for environmentally friendly aircraft offer new market segments. Increased focus on cybersecurity and data protection creates opportunities for specialized solutions.

Leading Players in the North America Aerospace Avionics Market Market

Key Developments in North America Aerospace Avionics Market Industry

- January 2023: Lockheed Martin announces a new avionics system for the F-35 fighter jet.

- March 2024: Airbus unveils advanced flight management system for A320neo family.

- June 2024: Boeing partners with a startup to develop AI-powered predictive maintenance tools.

- October 2024: General Dynamics acquires a smaller avionics company specializing in sensor technologies.

Future Outlook for North America Aerospace Avionics Market Market

The North America aerospace avionics market is poised for continued growth, driven by technological advancements, increasing air travel demand, and ongoing defense modernization programs. The integration of advanced technologies, such as AI and IoT, will further enhance safety, efficiency, and operational capabilities. This positive trajectory offers significant strategic opportunities for companies in the sector, encouraging further investment in R&D and expansion into emerging markets.

North America Aerospace Avionics Market Segmentation

-

1. Type

-

1.1. Commercial Aircraft

- 1.1.1. Passenger Aircraft

- 1.1.2. Freighter Aircraft

-

1.2. Military Aircraft

- 1.2.1. Combat Aircraft

- 1.2.2. Non-combat Aircraft

-

1.3. General Aviation

- 1.3.1. Helicopter

- 1.3.2. Piston Fixed-wing Aircraft

- 1.3.3. Turboprop Aircraft

- 1.3.4. Business Jet

-

1.1. Commercial Aircraft

-

2. Geography

- 2.1. United States

- 2.2. Canada

North America Aerospace Avionics Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Aerospace Avionics Market Regional Market Share

Geographic Coverage of North America Aerospace Avionics Market

North America Aerospace Avionics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 By Type

- 3.4.2 The Commercial Aircraft Segment is Expected to Witness Significant Increase During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aerospace Avionics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Commercial Aircraft

- 5.1.1.1. Passenger Aircraft

- 5.1.1.2. Freighter Aircraft

- 5.1.2. Military Aircraft

- 5.1.2.1. Combat Aircraft

- 5.1.2.2. Non-combat Aircraft

- 5.1.3. General Aviation

- 5.1.3.1. Helicopter

- 5.1.3.2. Piston Fixed-wing Aircraft

- 5.1.3.3. Turboprop Aircraft

- 5.1.3.4. Business Jet

- 5.1.1. Commercial Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Aerospace Avionics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Commercial Aircraft

- 6.1.1.1. Passenger Aircraft

- 6.1.1.2. Freighter Aircraft

- 6.1.2. Military Aircraft

- 6.1.2.1. Combat Aircraft

- 6.1.2.2. Non-combat Aircraft

- 6.1.3. General Aviation

- 6.1.3.1. Helicopter

- 6.1.3.2. Piston Fixed-wing Aircraft

- 6.1.3.3. Turboprop Aircraft

- 6.1.3.4. Business Jet

- 6.1.1. Commercial Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Aerospace Avionics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Commercial Aircraft

- 7.1.1.1. Passenger Aircraft

- 7.1.1.2. Freighter Aircraft

- 7.1.2. Military Aircraft

- 7.1.2.1. Combat Aircraft

- 7.1.2.2. Non-combat Aircraft

- 7.1.3. General Aviation

- 7.1.3.1. Helicopter

- 7.1.3.2. Piston Fixed-wing Aircraft

- 7.1.3.3. Turboprop Aircraft

- 7.1.3.4. Business Jet

- 7.1.1. Commercial Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Textron Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Dassault Aviation SA

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 General Dynamics Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Leonardo SpA

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Lockheed Martin Corporation

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Airbus SE

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Pilatus Aircraft Ltd

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Embraer SA

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Bombardier Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Honda Aircraft Compan

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Piper Aircraft Inc

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 The Boeing Company

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.1 Textron Inc

List of Figures

- Figure 1: North America Aerospace Avionics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Aerospace Avionics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Aerospace Avionics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Aerospace Avionics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America Aerospace Avionics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Aerospace Avionics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Aerospace Avionics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Aerospace Avionics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America Aerospace Avionics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Aerospace Avionics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America Aerospace Avionics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aerospace Avionics Market?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the North America Aerospace Avionics Market?

Key companies in the market include Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Leonardo SpA, Lockheed Martin Corporation, Airbus SE, Pilatus Aircraft Ltd, Embraer SA, Bombardier Inc, Honda Aircraft Compan, Piper Aircraft Inc, The Boeing Company.

3. What are the main segments of the North America Aerospace Avionics Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.77 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

By Type. The Commercial Aircraft Segment is Expected to Witness Significant Increase During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aerospace Avionics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aerospace Avionics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aerospace Avionics Market?

To stay informed about further developments, trends, and reports in the North America Aerospace Avionics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence