Key Insights

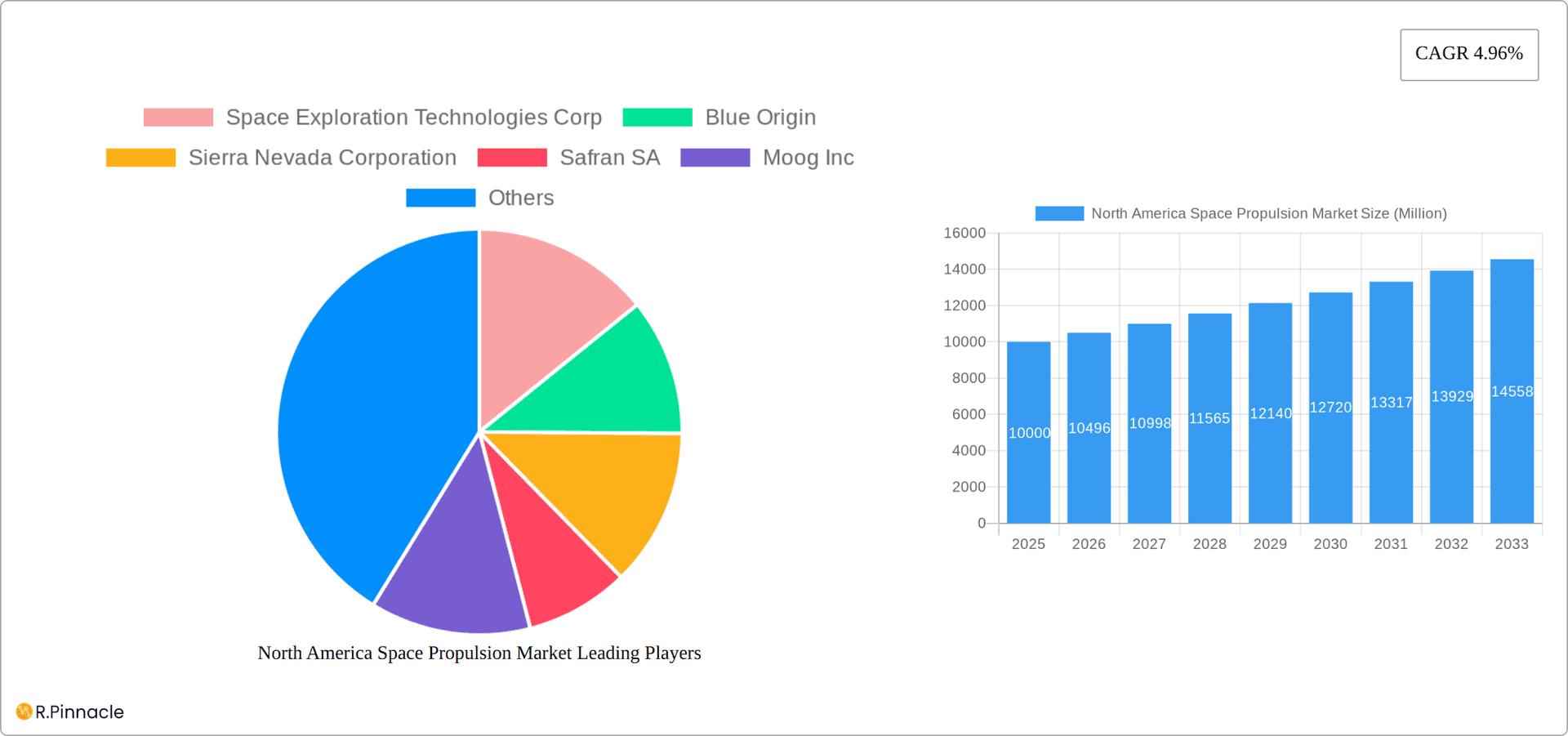

The North American space propulsion market, encompassing the United States and Canada, is experiencing robust growth, projected to reach a substantial market size. While the exact 2025 market value isn't provided, considering a CAGR of 4.96% from a base year of 2025 and the significant investments in space exploration by both government and private entities (like SpaceX, Blue Origin, and others listed), a reasonable estimation places the 2025 market value in the billions of dollars. The market is driven by increasing demand for launch services, growing satellite constellations for communication and Earth observation, and the burgeoning space tourism sector. Technological advancements in electric propulsion, offering greater efficiency and cost-effectiveness compared to traditional gas-based and liquid fuel systems, are significantly influencing market trends. Furthermore, government initiatives promoting space exploration and national security applications are acting as strong catalysts for market expansion. However, high development and launch costs, along with the inherent risks associated with space missions, pose considerable restraints to market growth. Segmentation by propulsion technology reveals a clear shift towards electric propulsion, although gas-based and liquid fuel systems will continue to play a significant role, especially in heavy-lift launch vehicles. The United States is expected to dominate the North American market due to its advanced space infrastructure and significant government funding, while Canada will contribute a sizable share, primarily through its involvement in international space collaborations and its emerging commercial space sector. The forecast period (2025-2033) anticipates sustained growth, fueled by continued technological advancements, increasing private sector investments, and a growing need for reliable and cost-effective space launch and propulsion solutions.

North America Space Propulsion Market Market Size (In Billion)

The continued growth trajectory is largely dependent on several factors including successful commercialization of reusable launch systems, reduced launch costs, and the emergence of new space-based applications. The competitive landscape is characterized by a mix of established aerospace giants (like Safran SA, Northrop Grumman) and innovative private companies (SpaceX, Blue Origin). This dynamic interplay fosters innovation and competition, ultimately benefiting the market's expansion. Future growth will also be shaped by governmental policies, regulations related to space debris mitigation, and international collaborations in space exploration endeavors. The market's segmentation by country (primarily US and Canada) and propulsion technology (electric, gas-based, and liquid fuel) provides valuable insights for stakeholders to strategize for market penetration and growth within specific niches. A detailed analysis of these segments will reveal further granular insights into market opportunities and potential challenges.

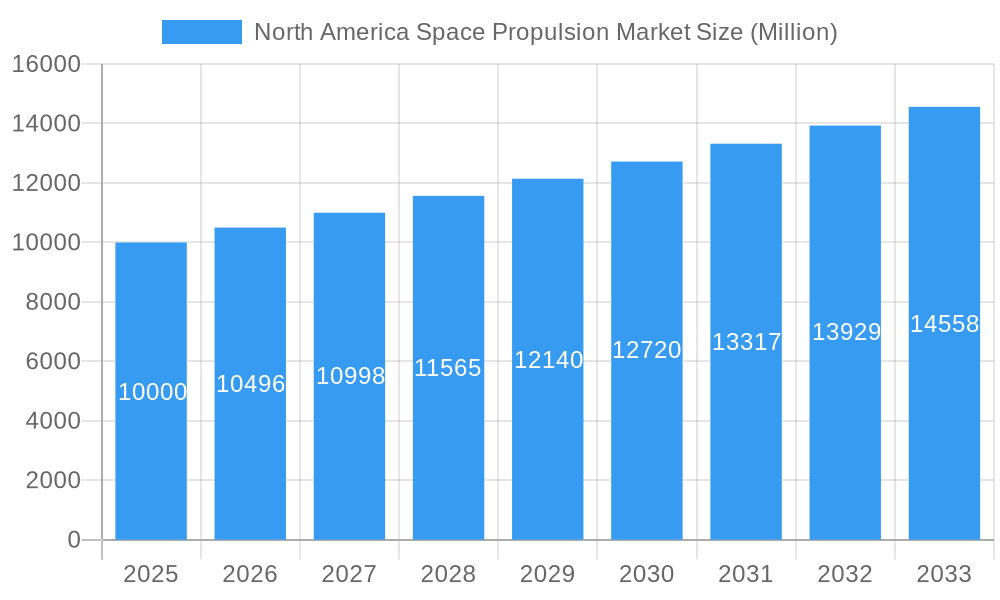

North America Space Propulsion Market Company Market Share

This comprehensive report provides a detailed analysis of the North America space propulsion market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and researchers seeking to understand the market's dynamics, growth potential, and key players. The report meticulously examines market segmentation by country (Canada, United States), propulsion technology (electric, gas-based, liquid fuel), and competitive landscape, incorporating recent industry developments and future projections.

North America Space Propulsion Market Structure & Innovation Trends

The North American space propulsion market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller companies specializing in niche technologies. Market share is heavily influenced by technological advancements, regulatory approvals, and successful contract wins. Significant M&A activity has been observed, with deal values exceeding xx Million in recent years, primarily driven by the desire to consolidate market share and access new technologies. Innovation is fueled by government funding (e.g., NASA contracts), increasing commercial space activities, and the demand for more efficient and reliable propulsion systems. The regulatory landscape, while generally supportive of space exploration, presents challenges related to safety and environmental compliance. Product substitution is influenced by advancements in electric propulsion, which offers advantages in terms of fuel efficiency and mission duration. End-user demographics encompass government agencies (NASA, CSA), commercial satellite operators, and emerging private space companies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- M&A Activity: xx deals concluded between 2019-2024, with total deal value exceeding xx Million.

- Innovation Drivers: Government funding, commercial space launch growth, and demand for efficient propulsion systems.

- Regulatory Framework: Supportive, but with emphasis on safety and environmental regulations.

North America Space Propulsion Market Dynamics & Trends

The North American space propulsion market is experiencing robust growth, driven by increased demand for satellite launches, space exploration missions, and the rise of the NewSpace industry. The market's CAGR during the forecast period (2025-2033) is estimated at xx%. This growth is propelled by technological advancements in electric propulsion, reusable launch vehicles, and improved fuel efficiency. Consumer preferences are shifting towards greener and more cost-effective propulsion solutions. Competitive dynamics are intensifying, with companies focusing on innovation, strategic partnerships, and securing government contracts. Market penetration of electric propulsion systems is steadily increasing, while liquid fuel remains the dominant technology.

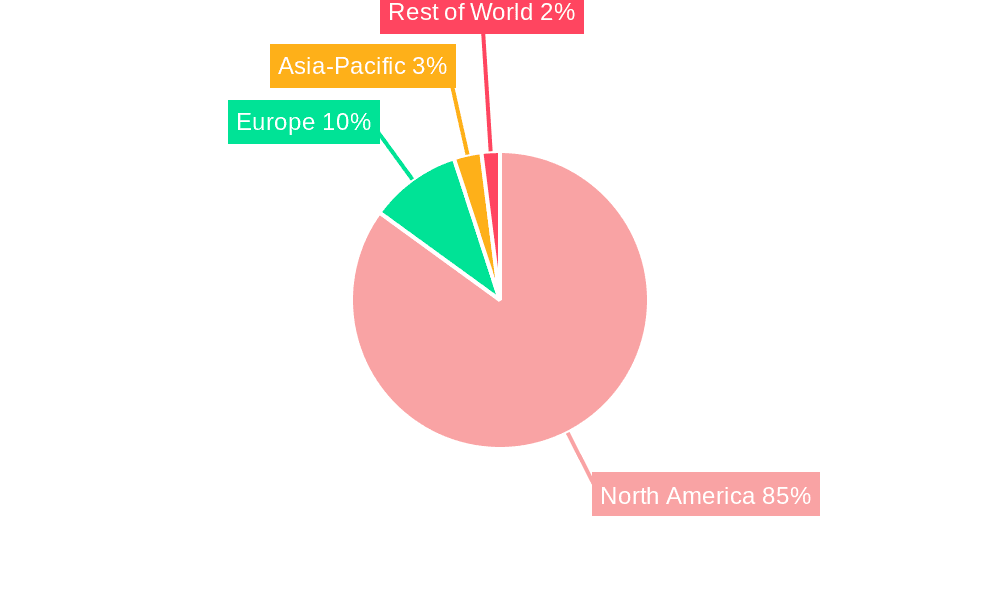

Dominant Regions & Segments in North America Space Propulsion Market

The North American space propulsion market is characterized by the significant dominance of the United States. This leadership is underpinned by a thriving aerospace ecosystem, substantial and consistent government investment from agencies like NASA, and the strong presence of leading global players. Within this dynamic market, the electric propulsion segment is poised for the highest growth trajectory. This is attributed to its exceptional fuel efficiency, its inherent versatility across a wide range of mission profiles, and its ability to enable longer operational durations for spacecraft. The ongoing advancements in electric propulsion technology are making it an increasingly attractive and cost-effective solution for various space applications.

- United States:

- Key Drivers: A mature and innovative aerospace industry, substantial government funding and support for space exploration and defense, and the strategic presence of major global propulsion manufacturers and integrators.

- Market Share: Expected to hold the largest share due to extensive domestic satellite manufacturing and launch activities.

- Canada:

- Key Drivers: A burgeoning space technology sector with a focus on niche solutions, active government support for space-related research and development initiatives, and growing participation in international space programs.

- Market Share: While smaller than the US, Canada is demonstrating consistent growth with its specialized contributions.

- Electric Propulsion:

- Key Drivers: Unparalleled fuel efficiency leading to reduced launch mass and cost, the capability for extended mission durations and precise orbital maneuvers, and a growing demand for sustainable and cost-effective propulsion solutions for both commercial and scientific missions.

- Market Trend: Rapidly gaining traction as a preferred technology for satellites, deep space probes, and constellation deployments.

- Gas-Based Propulsion:

- Market Characteristics: Represents a mature and well-established technology, often favored for its reliability and cost-effectiveness in applications where high thrust is not the primary requirement, such as station-keeping and attitude control.

- Market Niche: Continues to serve specific market needs, particularly for smaller satellites and certain governmental applications.

- Liquid Fuel Propulsion:

- Market Characteristics: Remains the dominant technology for high-thrust applications, essential for orbital insertion, large satellite maneuvers, and launch vehicle stages. However, it is associated with higher propellant consumption and complexity compared to electric propulsion.

- Market Significance: Crucial for applications demanding rapid acceleration and significant propulsive force, maintaining a strong presence in the launch vehicle sector.

North America Space Propulsion Market Product Innovations

Recent product innovations focus on enhancing fuel efficiency, reducing launch costs, and improving the reliability of propulsion systems. Electric propulsion technology is at the forefront of innovation, with several companies developing advanced ion thrusters and Hall-effect thrusters for various space applications. Reusable launch vehicles are also gaining traction, offering significant cost savings compared to traditional expendable rockets. These innovations cater to the increasing demand for cost-effective and sustainable space transportation solutions.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the North American space propulsion market. The segmentation is performed based on geographical country, encompassing the leading market of the United States and the growing contribution of Canada. Furthermore, the analysis delves into the distinct propulsion technology segments, including electric, gas-based, and liquid fuel propulsion systems. The United States is projected to maintain its market dominance, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025-2033. The electric propulsion segment is anticipated to witness the most substantial growth, driven by its inherent advantages in fuel efficiency, extended mission duration capabilities, and the increasing adoption for satellite constellations and deep-space missions. The competitive landscape within these segments is dynamic, with established industry giants facing increasing competition from agile, emerging companies that are specializing in innovative niche technologies and advanced propulsion solutions.

- By Country: United States, Canada.

- By Propulsion Technology: Electric, Gas-based, Liquid fuel.

Key Drivers of North America Space Propulsion Market Growth

The North American space propulsion market is experiencing a sustained growth phase, propelled by a confluence of powerful factors. Foremost among these is the continuous and increasing government spending allocated to space exploration, national security initiatives, and scientific research programs. This is complemented by a burgeoning demand for commercial satellite launches, particularly driven by the expansion of satellite constellations for telecommunications, Earth observation, and internet services. Technological advancements are also playing a pivotal role, with significant progress in electric propulsion systems, the development of highly efficient reusable launch vehicles, and the application of advanced materials that enhance performance and reduce weight. The growing interest and substantial investments from private companies venturing into space-related activities, including space tourism and resource utilization, further catalyze market expansion.

Challenges in the North America Space Propulsion Market Sector

Challenges include: stringent regulatory compliance requirements; the high cost of research and development; supply chain disruptions affecting the availability of critical components; and intense competition among established and emerging players. These factors contribute to fluctuating market dynamics and affect profit margins.

Emerging Opportunities in North America Space Propulsion Market

The North American space propulsion market is rife with promising emerging opportunities that are set to shape its future trajectory. A significant area of focus is the continued development, refinement, and widespread deployment of advanced electric propulsion systems, including next-generation Hall thrusters and ion engines, offering greater power and efficiency. The rapid expansion of commercial space transportation services, from payload delivery to satellite servicing and in-orbit assembly, presents a substantial growth avenue. Furthermore, the exploration of novel applications for space propulsion technology, such as in-space tugs for orbital transfer and debris removal, and the development of robust propulsion solutions for lunar and Martian exploration, are opening new frontiers. Critically, there is a growing imperative and a significant opportunity in developing sustainable and environmentally friendly propulsion systems, aligning with global efforts towards greener space operations.

Leading Players in the North America Space Propulsion Market Market

Key Developments in North America Space Propulsion Market Industry

- February 2023: Thales Alenia Space secured a significant contract with KARI (Korea Aerospace Research Institute) to provide integrated electric propulsion systems for the GEO-KOMPSAT-3 (GK3) satellite. This development underscores the accelerating adoption and increasing reliance on advanced electric propulsion for critical commercial and scientific satellite missions, highlighting its growing maturity and capability.

- February 2023: NASA's Launch Services Program (LSP) awarded Blue Origin a crucial contract for ESCAPADE, a mission that will leverage Blue Origin's reusable New Glenn launch vehicle technology. This signifies the increasing confidence in and utilization of reusable launch systems for cost-effectiveness and mission flexibility in governmental space programs.

- December 2023: NASA further reinforced Blue Origin's role in the launch services market by awarding them a NASA Launch Services II Indefinite Delivery, Indefinite Quantity (IDIQ) contract. This allows for the launch of various satellites using the New Glenn heavy-lift rocket. This award highlights the sustained government investment in space exploration and the strategic importance of reliable and capable launch providers in the North American market.

Future Outlook for North America Space Propulsion Market Market

The North American space propulsion market is poised for continued growth, driven by increasing government and commercial investments in space exploration and the ongoing advancements in propulsion technologies. Strategic partnerships, technological innovations, and the successful execution of ambitious space missions will be crucial factors shaping the future of this dynamic market. The growing demand for smaller, more efficient satellites and the exploration of new space domains will further fuel market expansion in the coming years.

North America Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

North America Space Propulsion Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Space Propulsion Market Regional Market Share

Geographic Coverage of North America Space Propulsion Market

North America Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Product innovation in propulsion technology is expected to boost growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Blue Origin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sierra Nevada Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moog Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Busek Co Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thale

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Space Propulsion Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: North America Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 2: North America Space Propulsion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 4: North America Space Propulsion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Space Propulsion Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the North America Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Blue Origin, Sierra Nevada Corporation, Safran SA, Moog Inc, Ariane Group, OHB SE, Busek Co Inc, Thale, Northrop Grumman Corporation.

3. What are the main segments of the North America Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Product innovation in propulsion technology is expected to boost growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: NASA awarded Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract to launch planetary, Earth observation, exploration, and scientific satellites for the agency aboard New Glenn, Blue Origin's orbital reusable launch vehicle.February 2023: NASA's Launch Services Program (LSP) awarded Blue Origin the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) contract. Under the contract Blue Origin will provide its New Glenn reusable technology for the mission.February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Space Propulsion Market?

To stay informed about further developments, trends, and reports in the North America Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence