Key Insights

The North American spectator sports market, encompassing major sports like baseball, basketball, football, and hockey, is poised for significant expansion. With a current market size of $235.23 billion and a projected Compound Annual Growth Rate (CAGR) of 6%, the market is expected to reach substantial value by 2025. Key growth drivers include rising disposable incomes, increasing televised sports viewership, enhanced fan engagement via digital platforms, and strategic investments in infrastructure and fan experience by teams and leagues. Emerging trends such as the rise of esports, fantasy sports, and social media's influence on fan loyalty further fuel market growth. Challenges include economic downturns impacting ticket sales and sponsorship, competition from other entertainment sectors, and concerns over athlete injuries affecting viewership. Market segmentation reveals that media rights, driven by broadcasting deals and streaming services, command a dominant revenue share, supplemented by merchandising and sponsorship. Geographically, the United States leads the market, followed by Canada, with moderate growth anticipated in the "Rest of North America" segment. Leading entities include established players like ESPN and Endeavor, alongside team management organizations and digital marketing firms such as Viral Nation, all competing for market share and innovation.

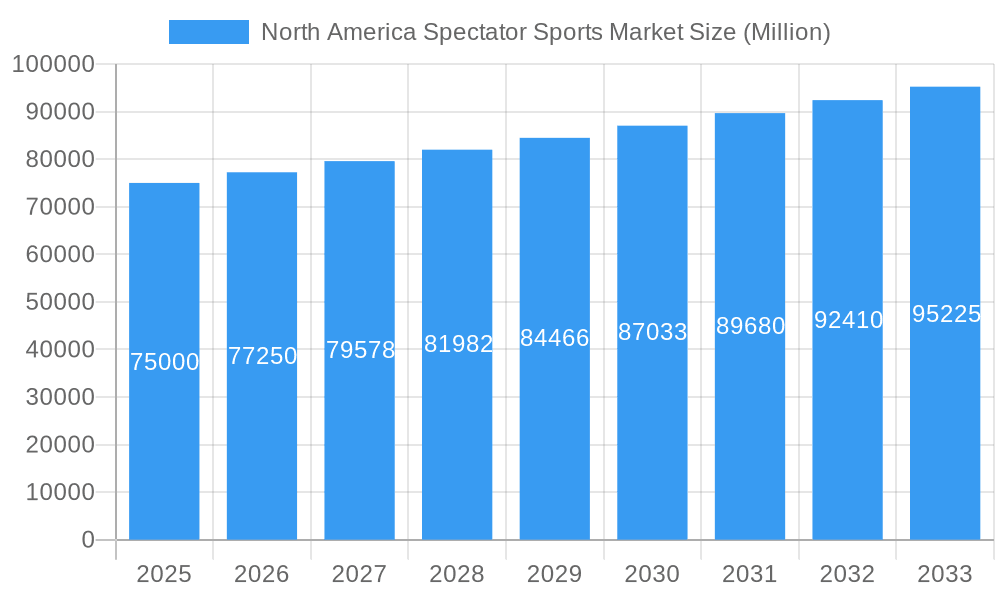

North America Spectator Sports Market Market Size (In Billion)

Analyzing the market by revenue source highlights the financial dynamics. While media rights remain a primary revenue stream, growth is also driven by merchandising, ticketing, and sponsorship, fueled by the demand for experiential engagement. Understanding the regional breakdown, with the US as the dominant market and growth potential in Canada and other North American regions, is vital for strategic planning. The competitive landscape features both established industry leaders and agile digital marketing companies, indicating a dynamic environment ripe for innovation and expansion within the North American spectator sports market. Further analysis of team performance, local economic indicators, and technological advancements will provide more precise future market projections.

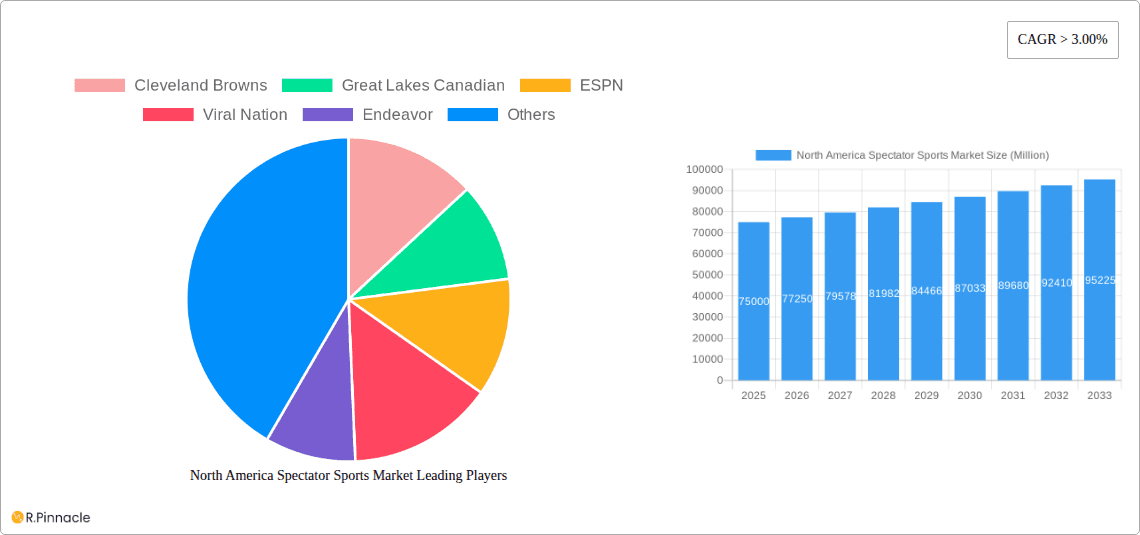

North America Spectator Sports Market Company Market Share

North America Spectator Sports Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America spectator sports market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, segmentation, leading players, and future trends. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Spectator Sports Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key trends and influencing factors. We delve into market concentration, examining the market share held by major players like ESPN and Endeavor, alongside the impact of mergers and acquisitions (M&A) activity on market structure. The report assesses the influence of regulatory frameworks, the presence of substitute products, and the evolving demographics of spectator sports fans.

- Market Concentration: The North American spectator sports market displays a moderately concentrated structure, with a few dominant players controlling significant market share, particularly in media rights and sponsorship. The combined market share of the top 5 players is estimated at xx%.

- M&A Activity: The period 2019-2024 witnessed significant M&A activity, with deal values totaling approximately xx Million. This activity reflects a trend of consolidation and expansion within the industry. For example, the acquisition of smaller regional teams by larger corporations significantly alters the market balance.

- Innovation Drivers: Technological advancements, particularly in digital media and fan engagement, are major drivers of innovation. The rise of fantasy sports and esports are also reshaping the industry.

- Regulatory Frameworks: Government regulations concerning broadcasting rights, antitrust laws, and stadium construction influence market dynamics.

North America Spectator Sports Market Market Dynamics & Trends

This section explores the key factors driving market growth, technological disruptions, evolving consumer preferences, and the intensifying competitive landscape. We examine the impact of macroeconomic conditions, changes in consumer spending habits, and the evolving media consumption patterns on market performance. The report further investigates the influence of technological advancements such as virtual reality (VR) and augmented reality (AR) applications on enhancing fan experience and engagement.

Market growth is primarily driven by the increasing popularity of spectator sports, rising disposable incomes, and the expansion of digital platforms. The market is experiencing a shift in consumer preferences towards personalized experiences and digital engagement. Competitive dynamics are shaped by the constant struggle for media rights and sponsorship deals.

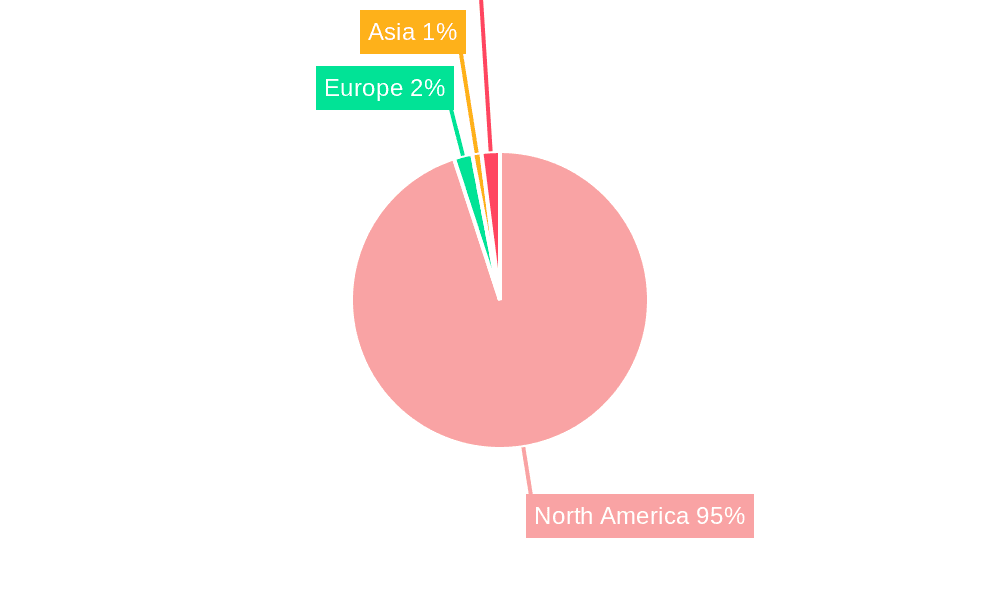

Dominant Regions & Segments in North America Spectator Sports Market

This section identifies the leading regions, countries, and segments within the North American spectator sports market.

By Country: The United States holds the largest market share, driven by a large and passionate fanbase, extensive media coverage, and a robust infrastructure. Canada and the Rest of North America constitute smaller, but still significant markets.

By Revenue Source: Media rights generate the highest revenue, followed by sponsorship, tickets, and merchandising. The digitalization of media rights has significantly impacted revenue streams, creating new opportunities and challenges for players.

By Sport: Football (NFL, CFL) and baseball (MLB) hold the largest market share due to their established fan bases and extensive media deals. Basketball (NBA) and Hockey (NHL) also hold considerable market shares, along with the growing popularity of other sports.

Key Drivers (United States): Strong economy, large population base, extensive media infrastructure, significant investments in sports facilities.

Key Drivers (Canada): Growing interest in sports, supportive government policies, and a well-developed sports infrastructure.

North America Spectator Sports Market Product Innovations

The North American spectator sports market is witnessing significant product innovations, including enhanced fan engagement through mobile applications, improved stadium technology, and virtual/augmented reality experiences. These innovations aim to provide more interactive and personalized experiences, catering to the evolving demands of modern fans. The integration of data analytics to improve team performance and fan engagement further demonstrates the technological advancements within the industry.

Report Scope & Segmentation Analysis

This report segments the North American spectator sports market based on revenue source (media rights, merchandising, tickets, sponsorship), country (United States, Canada, Rest of North America), and sport (baseball, basketball, football, hockey, other sports). Each segment's market size, growth projections, and competitive landscape are analyzed in detail, providing a comprehensive understanding of market dynamics. For example, the media rights segment is expected to grow at a CAGR of xx% over the forecast period.

Key Drivers of North America Spectator Sports Market Growth

The market's growth is driven by several factors, including increasing disposable incomes, growing fan engagement through digital platforms, technological advancements enhancing fan experience, and favorable government policies supporting sports infrastructure development.

Challenges in the North America Spectator Sports Market Sector

The industry faces challenges including high operating costs, intense competition for talent and media rights, the increasing influence of digital streaming services on traditional broadcasting models, and potential economic downturns that impact fan spending.

Emerging Opportunities in North America Spectator Sports Market

Opportunities exist in enhancing fan engagement through immersive technologies, expanding into new markets (e.g., esports), developing innovative revenue streams through personalized marketing, and capitalizing on the growth of international sports fans.

Leading Players in the North America Spectator Sports Market Market

- Cleveland Browns

- Great Lakes Canadian

- ESPN

- Viral Nation

- Endeavor

- Wasserman Media

- BC Lions

- Austin FC

- CF Montreal

- US Sports Management

Key Developments in North America Spectator Sports Market Industry

- August 2023: Catena Media partnered with The Sporting News for a three-year content and commercial media deal, focusing on US sports, casino gaming, and fantasy sports.

- August 2023: Playmaker Capital Inc. acquired La Poche Bleue, expanding its presence in Quebec's sports media market.

Future Outlook for North America Spectator Sports Market Market

The North America spectator sports market is poised for continued growth, driven by technological innovation, expanding digital platforms, and the enduring appeal of live sports events. Strategic investments in infrastructure, fan engagement, and diversified revenue streams will be crucial for players seeking sustainable success in this dynamic market.

North America Spectator Sports Market Segmentation

-

1. Sports

- 1.1. Baseball

- 1.2. Basketball

- 1.3. Football

- 1.4. Hockey

- 1.5. Other Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

North America Spectator Sports Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Spectator Sports Market Regional Market Share

Geographic Coverage of North America Spectator Sports Market

North America Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sports Event In North America Driving The Market

- 3.3. Market Restrains

- 3.3.1. A Large number of sports fan engagement is limited to a few sports

- 3.4. Market Trends

- 3.4.1. Rising Sports Viewership Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 5.1.1. Baseball

- 5.1.2. Basketball

- 5.1.3. Football

- 5.1.4. Hockey

- 5.1.5. Other Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleveland Browns

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Great Lakes Canadian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ESPN

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viral Nation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Endeavor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wasserman Media

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BC Lions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Austin FC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CF Montreal

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 US Sports Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cleveland Browns

List of Figures

- Figure 1: North America Spectator Sports Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Spectator Sports Market Share (%) by Company 2025

List of Tables

- Table 1: North America Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 2: North America Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 5: North America Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: North America Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Spectator Sports Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Spectator Sports Market?

Key companies in the market include Cleveland Browns, Great Lakes Canadian, ESPN, Viral Nation, Endeavor, Wasserman Media, BC Lions, Austin FC, CF Montreal, US Sports Management.

3. What are the main segments of the North America Spectator Sports Market?

The market segments include Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 235.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Sports Event In North America Driving The Market.

6. What are the notable trends driving market growth?

Rising Sports Viewership Driving The Market.

7. Are there any restraints impacting market growth?

A Large number of sports fan engagement is limited to a few sports.

8. Can you provide examples of recent developments in the market?

August 2023: Catena Media entered into a three-year content and commercial media partnership with The Sporting News, existing as a sports publisher brand in the United States. The agreement centers primarily on the United States, where The Sporting News has a national presence with a large audience across multiple sports. Under the agreement, Catena Media will create dedicated digital content for sports, casino gaming, and fantasy sports audiences for Sporting News.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Spectator Sports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Spectator Sports Market?

To stay informed about further developments, trends, and reports in the North America Spectator Sports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence