Key Insights

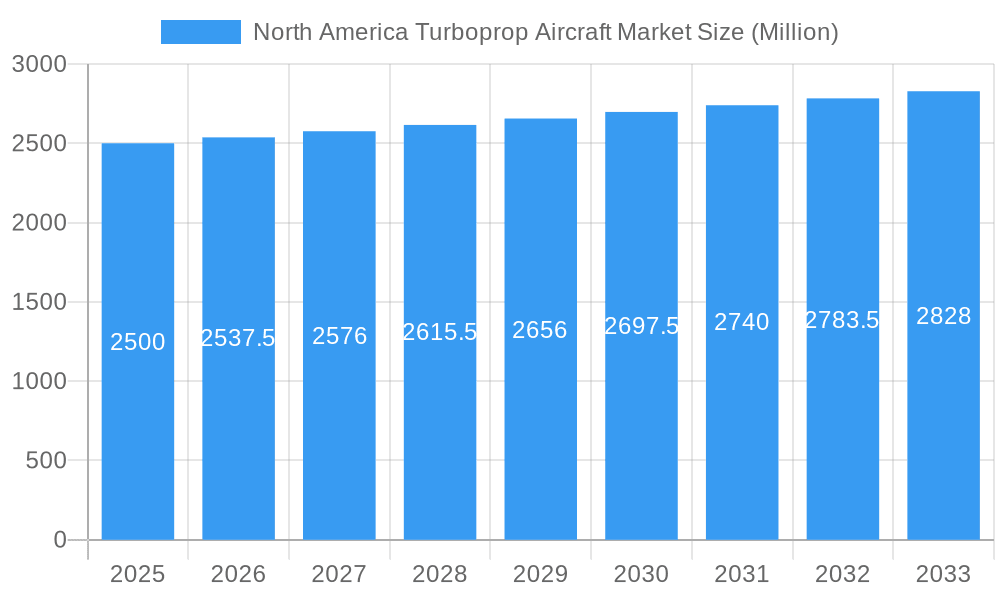

The North American turboprop aircraft market is projected to reach $8.47 billion by 2025, with a compound annual growth rate (CAGR) of 5.47% through 2033. This growth is driven by increasing demand for regional air travel and cargo transport across commercial and general aviation sectors. Military applications, including surveillance, training, and light transport, also contribute significantly. Technological advancements in engine efficiency and avionics, coupled with a focus on sustainability and lower fuel consumption, are further propelling market expansion.

North America Turboprop Aircraft Market Market Size (In Billion)

Despite challenges such as the high initial cost of new aircraft, market segmentation presents numerous growth opportunities. The United States and Canada represent the largest market segments, supported by robust aviation infrastructure and substantial demand for passenger and cargo services. Leading manufacturers like Textron, Lockheed Martin, and Airbus are instrumental in this growth through the development of advanced turboprop aircraft. The market's positive outlook is further reinforced by fleet modernization, ongoing technological innovation, and strategic investments from key industry players.

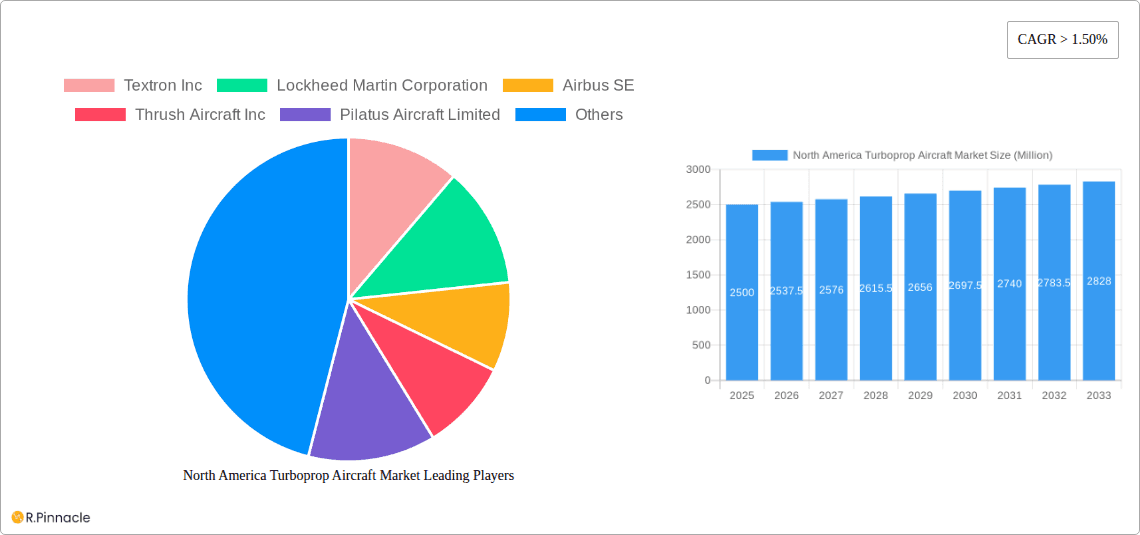

North America Turboprop Aircraft Market Company Market Share

North America Turboprop Aircraft Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America turboprop aircraft market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects.

North America Turboprop Aircraft Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The North American turboprop aircraft market exhibits a moderately concentrated structure, with key players like Textron Inc, Lockheed Martin Corporation, and Airbus SE holding significant market share (estimated at xx% combined in 2025). Smaller players like Thrush Aircraft Inc and Pilatus Aircraft Limited cater to niche segments.

Key Market Structure Aspects:

- Market Share Distribution: Dominated by a few major players, with a significant portion attributed to smaller, specialized manufacturers. Further detailed market share breakdown is available within the full report.

- Innovation Drivers: Focus on fuel efficiency, advanced avionics, and enhanced safety features are driving innovation. Competition for superior technological capabilities is intense.

- Regulatory Frameworks: Stringent safety regulations and environmental concerns influence market dynamics and technological advancements.

- Product Substitutes: While turboprops occupy a distinct niche, they face competition from smaller jets in certain segments.

- End-User Demographics: The market is primarily driven by commercial airlines, military organizations, and general aviation operators.

- M&A Activities: The past five years have witnessed moderate M&A activity, with deal values totaling approximately USD xx Billion (2019-2024). Specific details on deals and their impact are provided in the report.

North America Turboprop Aircraft Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The North America turboprop aircraft market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by factors including increasing demand for regional air travel, modernization of military fleets, and the growing popularity of general aviation.

Market penetration within the general aviation segment is projected to reach xx% by 2033, driven by rising leisure travel and the demand for cost-effective aircraft. Technological advancements, including the integration of advanced materials and efficient engine technologies, are key drivers of market expansion. However, economic conditions and fluctuations in fuel prices represent challenges. Competitive dynamics are shaped by technological innovation, cost efficiency, and the ability to fulfill specific end-user needs.

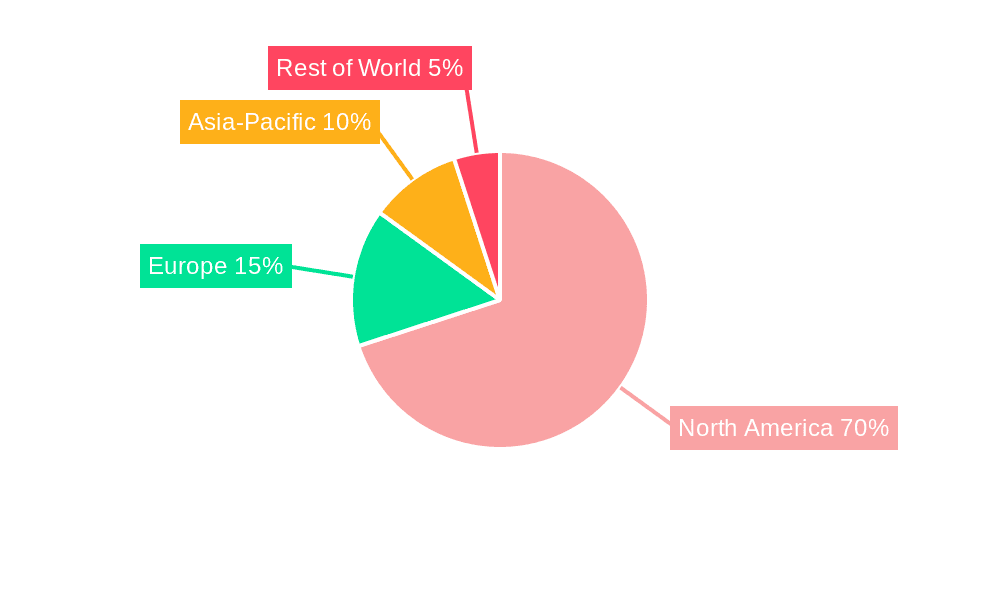

Dominant Regions & Segments in North America Turboprop Aircraft Market

The United States constitutes the largest market segment within North America, driven by significant demand across all application sectors (commercial, military, and general aviation). Canada displays considerable growth potential, particularly in the general aviation segment, attributed to a burgeoning tourism sector and increasing demand for aircraft in remote areas.

Key Drivers of US Market Dominance:

- Robust Commercial Aviation Sector: Large and well-established airline networks drive high demand for turboprop aircraft in regional and short-haul operations.

- Significant Military Spending: Regular upgrades and modernization of military fleets contribute significantly to the demand for military-grade turboprop aircraft.

- Developed General Aviation Infrastructure: A strong network of airports and flight schools boosts the growth of the general aviation sector.

Key Drivers of Canadian Market Growth:

- Growing Tourism Industry: Increased tourism creates demand for air transportation in remote regions and national parks, supporting turboprop usage.

- Resource Exploration and Management: The need for efficient transportation to remote mining sites and resource areas drives demand.

- Government Support for Regional Connectivity: Government policies and initiatives promoting regional air connectivity foster growth in the turboprop market.

North America Turboprop Aircraft Market Product Innovations

Recent innovations in turboprop aircraft technology include advancements in engine efficiency, the incorporation of advanced materials for reduced weight and improved fuel consumption, and the integration of sophisticated avionics systems for enhanced safety and operational efficiency. These technological advancements are enhancing the market appeal of turboprop aircraft, enabling better fuel economy, reduced maintenance costs, and improved passenger experiences. The market is witnessing a steady shift towards larger, more capable turboprop aircraft to meet the increasing demand for regional transportation and cargo operations.

Report Scope & Segmentation Analysis

This report segments the North America turboprop aircraft market by application (commercial, military, general aviation) and geography (United States, Canada). The commercial segment is expected to dominate in terms of market size, followed by the military and general aviation segments. Growth projections for each segment are detailed within the report, incorporating projected market sizes and detailed competitive dynamics.

Key Drivers of North America Turboprop Aircraft Market Growth

Key drivers include increased demand from the commercial aviation sector for regional connectivity, investments in military aircraft modernization programs, and rising popularity in the general aviation market. Technological improvements such as enhanced fuel efficiency and advanced avionics systems further fuel market growth. Favorable government regulations and supportive economic conditions contribute to expansion.

Challenges in the North America Turboprop Aircraft Market Sector

Challenges include fluctuating fuel prices, which directly impact operational costs and profitability. Supply chain disruptions, particularly concerning critical engine components, can also hamper production and delivery timelines. Intense competition from alternative aircraft types (e.g., small jets) and stringent regulatory compliance requirements pose further obstacles.

Emerging Opportunities in North America Turboprop Aircraft Market

Emerging opportunities lie in the expanding regional connectivity initiatives, particularly in underserved areas, and the potential for growth in emerging markets within both countries. The increasing adoption of sustainable aviation fuels (SAFs) and the development of hybrid-electric turboprop technology present further growth prospects.

Leading Players in the North America Turboprop Aircraft Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Thrush Aircraft Inc

- Pilatus Aircraft Limited

- Daher

- Longview Aviation Capital

- Epic Aircraft LLC

- ATR

- Pacific Aerospace Corporation

- Northrop Grumman Corporation

Key Developments in North America Turboprop Aircraft Market Industry

- September 2022: Rolls-Royce secured two DoD contracts totaling over USD 1.8 Billion for engine servicing of US Navy T-45 aircraft and Marine Corps C-130J/KC-130J transport aircraft. This significantly impacts the maintenance and support segment of the turboprop market.

- August 2022: Mountain Air Cargo requested USDOT authorization for large aircraft operations and planned fleet expansion with an ATR-72-600F freighter. This indicates increasing demand for larger turboprop cargo aircraft.

Future Outlook for North America Turboprop Aircraft Market Market

The future of the North America turboprop aircraft market appears promising, driven by continued technological innovation, increasing demand for regional air travel, and government initiatives promoting sustainable aviation. The market is poised for significant growth, with strategic opportunities for players who can effectively address the evolving needs of the market and adapt to the challenges of a dynamic industry. The projected growth rate, detailed within the report, suggests a positive outlook for investors and market participants alike.

North America Turboprop Aircraft Market Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Military

- 1.3. General Aviation

North America Turboprop Aircraft Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Turboprop Aircraft Market Regional Market Share

Geographic Coverage of North America Turboprop Aircraft Market

North America Turboprop Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Military Segment is Expected to Show the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Turboprop Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Military

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thrush Aircraft Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pilatus Aircraft Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daher

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Longview Aviation Capital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Epic Aircraft LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ATR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pacific Aerospace Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Northrop Grumman Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North America Turboprop Aircraft Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Turboprop Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: North America Turboprop Aircraft Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: North America Turboprop Aircraft Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Turboprop Aircraft Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Turboprop Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Turboprop Aircraft Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Turboprop Aircraft Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Turboprop Aircraft Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Turboprop Aircraft Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the North America Turboprop Aircraft Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Thrush Aircraft Inc, Pilatus Aircraft Limited, Daher, Longview Aviation Capital, Epic Aircraft LLC, ATR, Pacific Aerospace Corporatio, Northrop Grumman Corporation.

3. What are the main segments of the North America Turboprop Aircraft Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.47 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Military Segment is Expected to Show the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: Rolls-Royce was awarded two contracts by the US Department of Defense (DoD) worth over USD 1.8 billion for the next five years. The contracts are for servicing engines used in the US Navy's T-45 flight trainer aircraft and Marine Corps C-130J and KC-130J transport aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Turboprop Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Turboprop Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Turboprop Aircraft Market?

To stay informed about further developments, trends, and reports in the North America Turboprop Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence