Key Insights

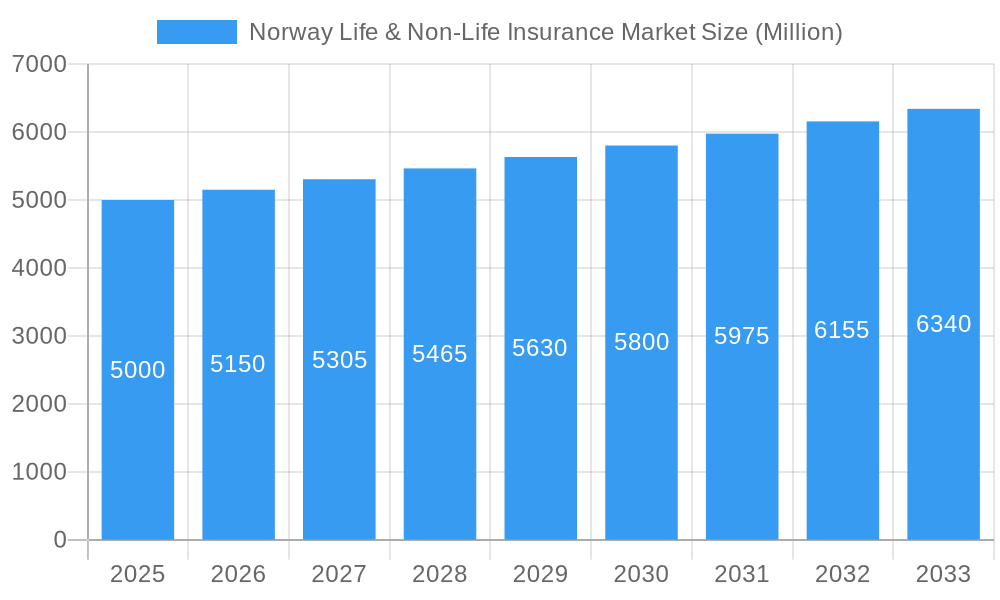

Norway's Life & Non-Life Insurance market is projected for significant expansion, driven by an aging demographic and robust regulatory frameworks. The market is currently valued at 16.33 billion, with a projected Compound Annual Growth Rate (CAGR) of 8.86% from the base year 2024 to 2033. Key growth catalysts include heightened demand for life insurance due to an aging population, stringent regulations fostering financial security, and increasing risk management awareness among individuals and businesses. The digital transformation within the insurance sector, marked by online policy acquisition and streamlined claims, further fuels market growth.

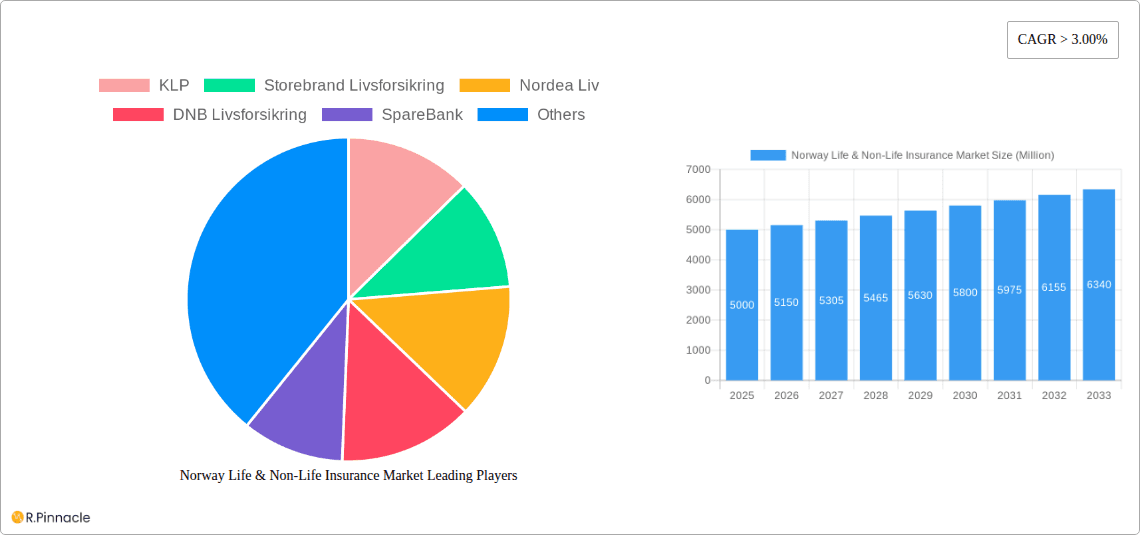

Norway Life & Non-Life Insurance Market Market Size (In Billion)

While established insurers like KLP, Storebrand Livsforsikring, and Nordea Liv face competition from emerging Insurtech firms, market expansion is anticipated to continue. Economic stability and adaptive regulatory strategies will be crucial for sustained growth. The market is segmented by product type (life, non-life, health) and distribution channels (online, agents, brokers), with regional variations being minimal due to Norway's economic homogeneity.

Norway Life & Non-Life Insurance Market Company Market Share

Looking ahead to 2033, the market's growth trajectory is supported by favorable demographic and economic indicators. Increased insurance product penetration, particularly in health and specialized risk segments, will be a primary driver. Insurers are prioritizing personalized offerings and enhanced customer experiences. The integration of advanced analytics and AI is expected to optimize operational efficiency and risk assessment, positioning Norway's insurance sector for continued success and evolution.

Norway Life & Non-Life Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Norwegian life and non-life insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth prospects.

Norway Life & Non-Life Insurance Market Market Structure & Innovation Trends

This section analyzes the market's competitive structure, highlighting key players and their market share, innovation drivers, regulatory landscape, product substitution trends, and M&A activity. The study period is 2019–2033, with 2025 as the base and estimated year.

Market Concentration: The Norwegian insurance market exhibits a moderate level of concentration, with a few dominant players controlling a significant portion of the market share. KLP, Storebrand Livsforsikring, and Nordea Liv are among the key players, each holding an estimated xx% market share in 2025. The remaining share is distributed amongst numerous smaller insurers.

Innovation Drivers: Digitalization, particularly in areas like InsurTech and telematics, is a major driver of innovation. The increasing adoption of AI and data analytics is also transforming risk assessment and customer service. Stringent regulatory frameworks encourage innovation in risk management and product development.

Regulatory Frameworks: The Norwegian Financial Supervisory Authority (Finanstilsynet) plays a significant role in shaping the regulatory landscape, emphasizing solvency, consumer protection, and market conduct. These regulations influence product design, pricing strategies, and operational efficiency.

Product Substitutes: The emergence of alternative risk-financing mechanisms, such as peer-to-peer insurance and crowdfunding platforms, presents a degree of competitive pressure. However, the extent of their market penetration remains limited.

End-User Demographics: The aging Norwegian population and its increasing wealth drive demand for life insurance and related financial products. Changing consumer preferences towards digital and personalized services are reshaping the market.

M&A Activities: The Norwegian life and non-life insurance market has witnessed a moderate level of M&A activity in recent years, with deal values averaging approximately xx Million in 2024. These deals primarily involve smaller players consolidating to enhance their market position and gain scale.

Norway Life & Non-Life Insurance Market Market Dynamics & Trends

This section delves into the market's growth trajectory, analyzing key drivers, technological disruptions, consumer behaviors, and competitive pressures. The study period is 2019–2033, with 2025 as the base and estimated year.

The Norwegian life and non-life insurance market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including a rising middle class, increasing disposable income, and a growing awareness of the need for risk mitigation. Technological advancements such as AI-powered risk assessment and personalized insurance products are further driving market expansion. However, intense competition among established players and the emergence of new InsurTech companies pose significant challenges to market participants. Market penetration of digital insurance products is expected to reach xx% by 2033, indicating a significant shift in consumer preferences towards digital channels.

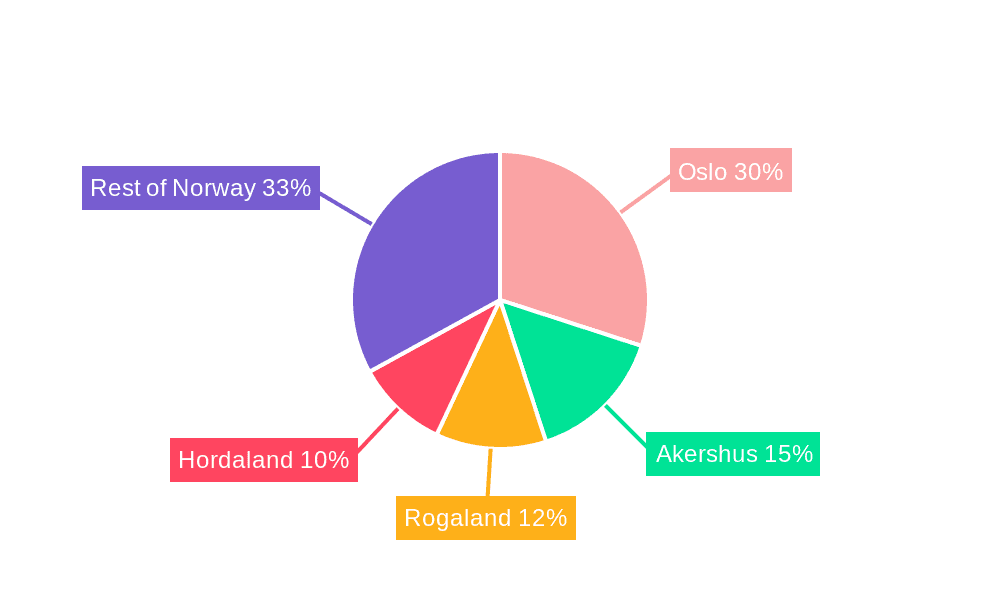

Dominant Regions & Segments in Norway Life & Non-Life Insurance Market

This section identifies the leading regions and segments within the Norwegian insurance market, analyzing the key drivers behind their dominance. The study period is 2019–2033, with 2025 as the base and estimated year.

The Oslo region dominates the Norwegian life and non-life insurance market, driven by factors such as a high concentration of financial institutions, a large and affluent population, and robust economic activity.

- Key Drivers of Oslo's Dominance:

- High concentration of financial institutions and insurance companies.

- High per capita income and a large affluent population.

- Developed infrastructure and business-friendly environment.

- Strong regulatory framework.

The life insurance segment is expected to maintain its dominance, driven by the aging population and increasing awareness of long-term financial planning. The non-life insurance segment will exhibit healthy growth, spurred by factors like growing car ownership and increasing awareness about property insurance. Detailed analysis of regional variations and segment-specific dynamics are provided in the full report.

Norway Life & Non-Life Insurance Market Product Innovations

The Norwegian insurance market is witnessing continuous product innovation, driven by technological advancements and evolving consumer preferences. New products incorporate digital capabilities, offering personalized risk assessment, faster claims processing, and enhanced customer experiences. The integration of telematics data into auto insurance policies is a notable example, providing risk-based pricing models and incentivizing safe driving behaviors. These innovative products enhance competitiveness and provide a better fit for customer needs.

Report Scope & Segmentation Analysis

This report segments the Norwegian life and non-life insurance market based on various parameters, providing detailed analysis of each segment's size, growth projections, and competitive dynamics. Segments include Life Insurance (individual and group), Non-Life Insurance (motor, property, health, etc.), and distribution channels (direct, brokers, agents). Each segment’s specific market sizes and growth projections for 2025 and beyond are detailed in the complete report.

Key Drivers of Norway Life & Non-Life Insurance Market Growth

Several factors are driving the growth of the Norwegian life and non-life insurance market. These include a burgeoning middle class, an aging population creating increased demand for life insurance products, stringent regulatory frameworks promoting financial stability and customer protection, and technological advancements enabling personalized insurance products and efficient risk management. Furthermore, rising disposable incomes and increased awareness of insurance benefits are contributing factors.

Challenges in the Norway Life & Non-Life Insurance Market Sector

The Norwegian insurance market faces challenges like increased competition from both established and new players, stringent regulatory requirements impacting operational costs, and economic fluctuations impacting consumer spending. Cybersecurity threats and data privacy concerns also pose significant challenges. These factors can impede market growth and profitability.

Emerging Opportunities in Norway Life & Non-Life Insurance Market

Emerging opportunities include the growing adoption of InsurTech solutions, expansion into niche markets like cyber insurance, and increased focus on sustainable and ESG-compliant investment strategies. Leveraging data analytics for personalized insurance offerings and developing innovative products catering to specific customer segments present significant opportunities for growth.

Leading Players in the Norway Life & Non-Life Insurance Market Market

- KLP

- Storebrand Livsforsikring

- Nordea Liv

- DNB Livsforsikring

- SpareBank

- Oslo Pensjonsforsikring

- Gjensidige Forsikring ASA

- Fremtind Forsikring AS

- Protector Forsikring ASA

- Eika Forsikring AS

- DNB Forsikring AS

- Frende Skadeforsikring AS (List Not Exhaustive)

Key Developments in Norway Life & Non-Life Insurance Market Industry

February 2022: The Norwegian Agency for Development Cooperation (NORAD) provided a NOK 500 million (approximately USD 56 million) grant to the African Trade Insurance Agency (ATI) for renewable energy initiatives. This highlights the growing focus on sustainable investments and green insurance products.

February 2022: KLP partnered with Nordic financial institutions and the Norwegian government to develop guidelines for shipping industry financing, promoting transparency and supporting the transition to climate-friendly fuels. This underscores the increasing importance of ESG considerations within the industry.

Future Outlook for Norway Life & Non-Life Insurance Market Market

The Norwegian life and non-life insurance market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and a focus on sustainability. Strategic partnerships, product innovation, and effective risk management will be crucial for success in this dynamic market. The market is expected to continue its expansion, particularly within the digital insurance space, presenting significant opportunities for both established players and new entrants.

Norway Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Channels of Distribution

Norway Life & Non-Life Insurance Market Segmentation By Geography

- 1. Norway

Norway Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Norway Life & Non-Life Insurance Market

Norway Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Online Sale of Insurance Policy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Channels of Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KLP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Storebrand Livsforsikring

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nordea Liv

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNB Livsforsikring

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SpareBank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oslo Pensjonsforsikring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gjensidige Forsikring ASA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fremtind Forsikring AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protector Forsikring ASA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eika Forsikring AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DNB Forsikring AS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Frende Skadeforsikring AS**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 KLP

List of Figures

- Figure 1: Norway Life & Non-Life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 6: Norway Life & Non-Life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Life & Non-Life Insurance Market?

The projected CAGR is approximately 8.86%.

2. Which companies are prominent players in the Norway Life & Non-Life Insurance Market?

Key companies in the market include KLP, Storebrand Livsforsikring, Nordea Liv, DNB Livsforsikring, SpareBank, Oslo Pensjonsforsikring, Gjensidige Forsikring ASA, Fremtind Forsikring AS, Protector Forsikring ASA, Eika Forsikring AS, DNB Forsikring AS, Frende Skadeforsikring AS**List Not Exhaustive.

3. What are the main segments of the Norway Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Online Sale of Insurance Policy.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022- The Norwegian Agency for Development Cooperation (NORAD) Partners with and Commits Funding toward African Trade Insurance Agency's (ATI) Renewable Energy Sector Initiatives.The grant of NOK 500 million (approximately USD 56 million) is geared towards the continued implementation of ATI's Regional Liquidity Support Facility (RLSF) and the development of additional insurance or guarantee products in support of small and medium sized renewable energy sector initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Norway Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence