Key Insights

The South African protective packaging market is projected for significant expansion, estimated at 33.92 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.6% from 2025 to 2033. This growth is fueled by the booming e-commerce sector, the increasing need for robust protection of fragile goods across various industries, and a rising demand for sustainable packaging solutions. Key sectors contributing to this growth include food & beverage, pharmaceuticals, and consumer electronics. Demand for rigid and insulated shipping containers is expected to rise, prioritizing enhanced product safety and temperature control during transit and storage. While flexible packaging will maintain its importance, rigid solutions are predicted to outpace growth due to their superior protective attributes. Growing regulatory focus on packaging waste is also a catalyst for adopting eco-friendly, recyclable protective packaging. Market leaders are investing in advanced materials and technologies, intensifying competition and fostering innovation. Challenges include raw material price volatility and the need to balance cost-effectiveness with exceptional product protection.

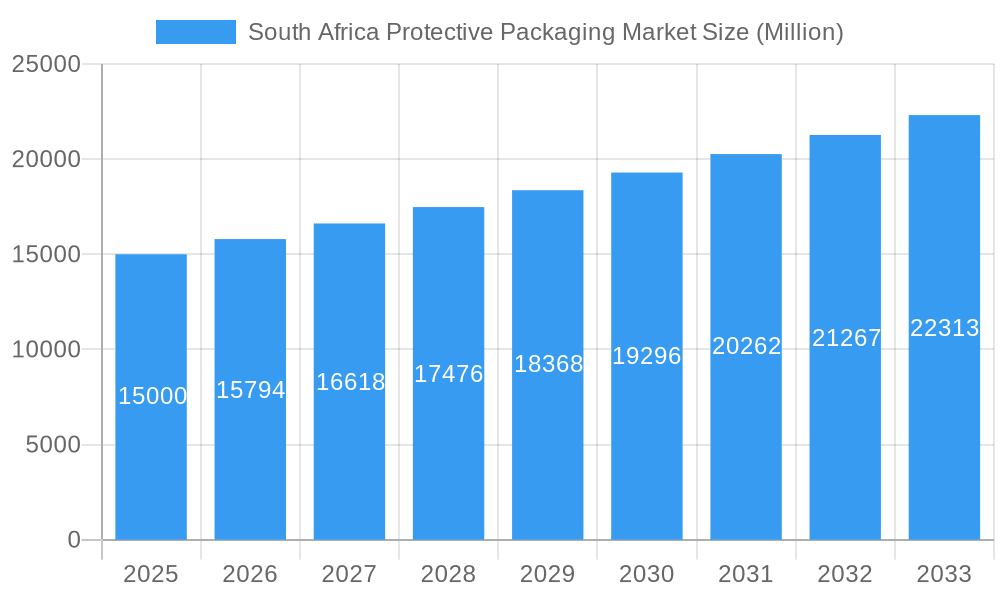

South Africa Protective Packaging Market Market Size (In Billion)

Regional market dynamics in South Africa show diverse growth patterns across provinces, with metropolitan areas demonstrating higher demand driven by concentrated industrial and commercial activities. Government policies supporting sustainable business practices and logistics infrastructure investments will also shape market expansion. Companies are strategically enhancing product portfolios, distribution networks, and forging partnerships to secure a competitive advantage. Technological advancements, particularly in automated and intelligent packaging systems featuring real-time condition monitoring sensors, will redefine the market. These innovations will generate new opportunities for specialized protective packaging solutions designed for specific product needs and complex delivery chains.

South Africa Protective Packaging Market Company Market Share

South Africa Protective Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa protective packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a thorough understanding of past performance, current market dynamics, and future growth projections. The market is segmented by product type (Rigid, Insulated Shipping Containers: Flexible, Other Flexible Products: Foam), end-user vertical (Food and Beverage, Industrial, Pharmaceuticals, Consumer Electronics, Beauty and Home Care, Other End-user Verticals), and key players including Air-Loc Protective Films, Dura Pack (Pty) Ltd, EndoPack Group, Wavepack Group, Mondi Group, Smurfit Kappa Group PLC, Danapack Packaging, Sealed Air Corporation, Packman Industrial Packaging, and VitaTex (Pty) Ltd. The market size is projected to reach xx Million by 2033.

South Africa Protective Packaging Market Structure & Innovation Trends

This section analyzes the South African protective packaging market's competitive landscape, innovation drivers, and regulatory environment. The market exhibits a moderately concentrated structure, with a few dominant players and several smaller niche players. Market share data for key players will be provided in the full report.

- Market Concentration: The report analyzes the market share held by major players and identifies the level of competition. The xx Million market displays a Herfindahl-Hirschman Index (HHI) of xx, suggesting a [Level of Concentration: Moderately Concentrated/Highly Concentrated/Fragmented - Choose One based on calculated HHI].

- Innovation Drivers: Sustainable packaging solutions, e-commerce growth, and advancements in material science are key drivers of innovation. Specific examples of innovative products and technologies will be analyzed.

- Regulatory Framework: The report assesses the impact of relevant regulations and standards on market participants, such as those related to sustainability and material safety.

- Product Substitutes: The availability and competitiveness of alternative packaging solutions are explored.

- End-User Demographics: Analysis of end-user industry segments and their packaging needs.

- M&A Activities: The report reviews recent mergers and acquisitions, including deal values (xx Million range estimated).

South Africa Protective Packaging Market Market Dynamics & Trends

The South African protective packaging market is characterized by dynamic growth and evolving trends, driven by a confluence of economic, technological, and consumer-driven factors. The market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR here]%** during the forecast period (2025-2033). This robust growth trajectory is underpinned by several key drivers. The burgeoning e-commerce sector, with its increasing parcel volumes, necessitates enhanced protective packaging solutions to ensure product integrity during transit. Concurrently, a growing consumer consciousness regarding product safety and the desire for premium unboxing experiences are fueling demand for high-quality protective packaging. Furthermore, a strong push towards environmental responsibility is accelerating the adoption of sustainable packaging alternatives, including recyclable, biodegradable, and compostable materials. Technological advancements are also playing a pivotal role, with innovations in material science leading to the development of lighter, stronger, and more efficient protective packaging. Automation in packaging processes is further streamlining operations, reducing costs, and improving output. The competitive landscape is dynamic, with established players and emerging innovators vying for market share. Key strategic initiatives include mergers and acquisitions, strategic alliances to leverage complementary strengths, and aggressive pricing strategies to capture market dominance. This report delves into the intricate market dynamics, analyzing shifts in market share across various product segments and end-user verticals, providing a granular view of market penetration and growth opportunities.

Dominant Regions & Segments in South Africa Protective Packaging Market

This section identifies the leading regions and segments within the South African protective packaging market. Detailed analysis will pinpoint the dominant areas and contributing factors.

- Leading Regions: [Insert Leading Region/Province and Reasons]. Key drivers include:

- [Driver 1, e.g., strong industrial presence]

- [Driver 2, e.g., favorable economic policies]

- [Driver 3, e.g., developed infrastructure]

- Leading Segments: Analysis of dominance across Insulated Shipping Containers (Flexible), Other Flexible Products (Foam), Rigid packaging, and end-user verticals such as Food and Beverage, Industrial, and Pharmaceuticals will be presented. This will include a detailed explanation of the factors driving the dominance of each segment.

South Africa Protective Packaging Market Product Innovations

Product innovation within the South African protective packaging market is predominantly centered on a trifecta of sustainability, superior protection, and enhanced user convenience. Manufacturers are actively investing in the development and deployment of eco-friendly materials, with a notable surge in the use of recycled paper-based solutions, advanced biodegradable polymers, and compostable alternatives. These innovations are directly responsive to increasing consumer demand for environmentally responsible products and stringent regulatory pressures. Simultaneously, there's a continuous pursuit of advanced protective solutions that offer superior cushioning, shock absorption, and moisture resistance, safeguarding goods throughout complex supply chains. The integration of smart packaging technologies, offering features like temperature monitoring and tamper-evidence, is also gaining traction. Furthermore, the focus on convenience is evident in the design of easy-to-use, easy-to-dispose-of packaging that simplifies the unboxing and recycling process for end-consumers. The market success of these innovative products hinges on a delicate balance of affordability, perceived value, convenience, and a demonstrable commitment to sustainability, aligning with the evolving preferences of both businesses and end-users.

Report Scope & Segmentation Analysis

The report provides a detailed analysis of the South Africa protective packaging market across various segments:

- By Product: Rigid, Insulated Shipping Containers (Flexible), Other Flexible Products (Foam). Growth projections, market sizes, and competitive dynamics will be detailed for each.

- By End-user Vertical: Food and Beverage, Industrial, Pharmaceuticals, Consumer Electronics, Beauty and Home Care, Other End-user Verticals. Each segment’s growth trajectory, market share, and key characteristics are thoroughly analyzed.

Key Drivers of South Africa Protective Packaging Market Growth

The South Africa protective packaging market is driven by several factors:

- E-commerce Boom: The rapid growth of online retail necessitates robust protective packaging to ensure product safety during transit.

- Rising Consumer Demand: Increasing consumer awareness of product safety and quality drives demand for effective protective packaging.

- Government Regulations: Environmental regulations are pushing the adoption of sustainable packaging materials.

Challenges in the South Africa Protective Packaging Market Sector

The South African protective packaging market is navigating several significant challenges that impact its growth and profitability:

- Volatile Raw Material Prices: The market is highly susceptible to fluctuations in the global prices of key raw materials, such as virgin pulp, recycled paper, and various polymers. These price swings directly affect production costs, impacting profit margins and necessitating agile procurement strategies.

- Supply Chain Vulnerabilities: Disruptions within local and international supply chains, including logistics bottlenecks, shipping delays, and geopolitical uncertainties, can lead to material shortages and impact the timely delivery of finished packaging products to customers.

- Intensified Competitive Pressures: The protective packaging sector in South Africa is characterized by a high degree of competition, with both domestic and international players vying for market share. This necessitates continuous innovation, cost optimization, and strategic differentiation to maintain a competitive edge.

- Economic Headwinds and Consumer Spending: Broader economic conditions within South Africa, including inflation and consumer spending power, can influence demand for packaged goods, indirectly affecting the protective packaging market.

- Evolving Regulatory Landscape: Changing environmental regulations, particularly concerning plastic waste and single-use packaging, require manufacturers to adapt their product portfolios and invest in sustainable alternatives, adding to operational complexity and cost.

Emerging Opportunities in South Africa Protective Packaging Market

Emerging opportunities include:

- Sustainable Packaging Solutions: Growing demand for eco-friendly materials presents significant growth potential.

- Specialized Packaging: The development of specialized packaging for niche products offers lucrative opportunities.

- Technological Advancements: The adoption of automation and advanced materials creates opportunities for efficiency and cost reduction.

Leading Players in the South Africa Protective Packaging Market Market

The South African protective packaging market is a competitive arena populated by a diverse range of key players, each contributing to the sector's innovation and supply chain efficiency. Prominent companies actively shaping the market include:

- Air-Loc Protective Films

- Dura Pack (Pty) Ltd

- EndoPack Group

- Wavepack Group

- Mondi Group

- Smurfit Kappa Group PLC

- Danapack Packaging

- Sealed Air Corporation

- Packman Industrial Packaging

- VitaTex (Pty) Ltd

Key Developments in South Africa Protective Packaging Market Industry

The South African protective packaging industry is witnessing strategic moves and innovations aimed at enhancing product offerings and market reach. Notable recent developments include:

- November 2022: Fair Cape Dairy successfully launched its innovative Combistyle carton pack. This development showcases advancements in packaging design, focusing on both product protection and effective brand promotion, a trend increasingly valued in the FMCG sector.

- July 2022: Sealed Air introduced its eco-friendly paper bubble mailer. This launch underscores a significant industry shift towards sustainable packaging solutions, offering an alternative to traditional plastic-based protective mailers and catering to growing environmental concerns among consumers and businesses.

Future Outlook for South Africa Protective Packaging Market Market

The South Africa protective packaging market is poised for sustained growth, driven by e-commerce expansion, increasing consumer demand, and a growing focus on sustainability. Strategic opportunities exist for companies that can effectively leverage these trends by investing in innovation, supply chain optimization, and sustainable practices. The market is projected to witness significant expansion in the coming years, creating promising prospects for existing and new market players alike.

South Africa Protective Packaging Market Segmentation

-

1. Product

-

1.1. Rigid

- 1.1.1. Corrugated Paperboard Protectors

- 1.1.2. Molded Pulp

- 1.1.3. Insulated Shipping Containers

-

1.2. Flexible

- 1.2.1. Protective Mailers

- 1.2.2. Bubble Wraps

- 1.2.3. Air Pillows/Air Bags

- 1.2.4. Paper Fill

- 1.2.5. Other Flexible Products

-

1.3. Foam

- 1.3.1. Molded Foam

- 1.3.2. Foam in Place (FIP)

- 1.3.3. Loose Fill

- 1.3.4. Foam Rolls/Sheets

- 1.3.5. Other Foam Products

-

1.1. Rigid

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Industrial

- 2.3. Pharmaceuticals

- 2.4. Consumer Electronics

- 2.5. Beauty and Home Care

- 2.6. Other End-user Verticals

South Africa Protective Packaging Market Segmentation By Geography

- 1. South Africa

South Africa Protective Packaging Market Regional Market Share

Geographic Coverage of South Africa Protective Packaging Market

South Africa Protective Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for E-commerce-based Products; Demand for Flexible Protective Packaging Products

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Related to Degradability; Space Inefficiencies and Additional Costs may Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for E-commerce-based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Protective Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Rigid

- 5.1.1.1. Corrugated Paperboard Protectors

- 5.1.1.2. Molded Pulp

- 5.1.1.3. Insulated Shipping Containers

- 5.1.2. Flexible

- 5.1.2.1. Protective Mailers

- 5.1.2.2. Bubble Wraps

- 5.1.2.3. Air Pillows/Air Bags

- 5.1.2.4. Paper Fill

- 5.1.2.5. Other Flexible Products

- 5.1.3. Foam

- 5.1.3.1. Molded Foam

- 5.1.3.2. Foam in Place (FIP)

- 5.1.3.3. Loose Fill

- 5.1.3.4. Foam Rolls/Sheets

- 5.1.3.5. Other Foam Products

- 5.1.1. Rigid

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Industrial

- 5.2.3. Pharmaceuticals

- 5.2.4. Consumer Electronics

- 5.2.5. Beauty and Home Care

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Air-Loc Protective Films

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dura Pack (Pty) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EndoPack Group*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wavepack Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smurfit Kappa Group PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danapack Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Packman Industrial Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VitaTex (Pty) Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Air-Loc Protective Films

List of Figures

- Figure 1: South Africa Protective Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Protective Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Protective Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: South Africa Protective Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: South Africa Protective Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Protective Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: South Africa Protective Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: South Africa Protective Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Protective Packaging Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the South Africa Protective Packaging Market?

Key companies in the market include Air-Loc Protective Films, Dura Pack (Pty) Ltd, EndoPack Group*List Not Exhaustive, Wavepack Group, Mondi Group, Smurfit Kappa Group PLC, Danapack Packaging, Sealed Air Corporation, Packman Industrial Packaging, VitaTex (Pty) Ltd.

3. What are the main segments of the South Africa Protective Packaging Market?

The market segments include Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for E-commerce-based Products; Demand for Flexible Protective Packaging Products.

6. What are the notable trends driving market growth?

Growing Demand for E-commerce-based Products.

7. Are there any restraints impacting market growth?

Stringent Regulations Related to Degradability; Space Inefficiencies and Additional Costs may Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Fair Cape, a South African Dairy brand, debuted its Combistyle, a specially formed carton pack from SIG Group, to provide South African consumers with a distinctively designed modern package. After introducing it to the Americas in May, SIG unveiled the design for the first time in the Middle East and Africa. The business states that the solutions help them stand out while making it simpler for customers to identify what they need, alluding to their combi-style carton design. For instance, Combistyle provides a chic corner panel that allows brand owners to promote their products while offering a secure and pleasant grasp.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Protective Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Protective Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Protective Packaging Market?

To stay informed about further developments, trends, and reports in the South Africa Protective Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence