Key Insights

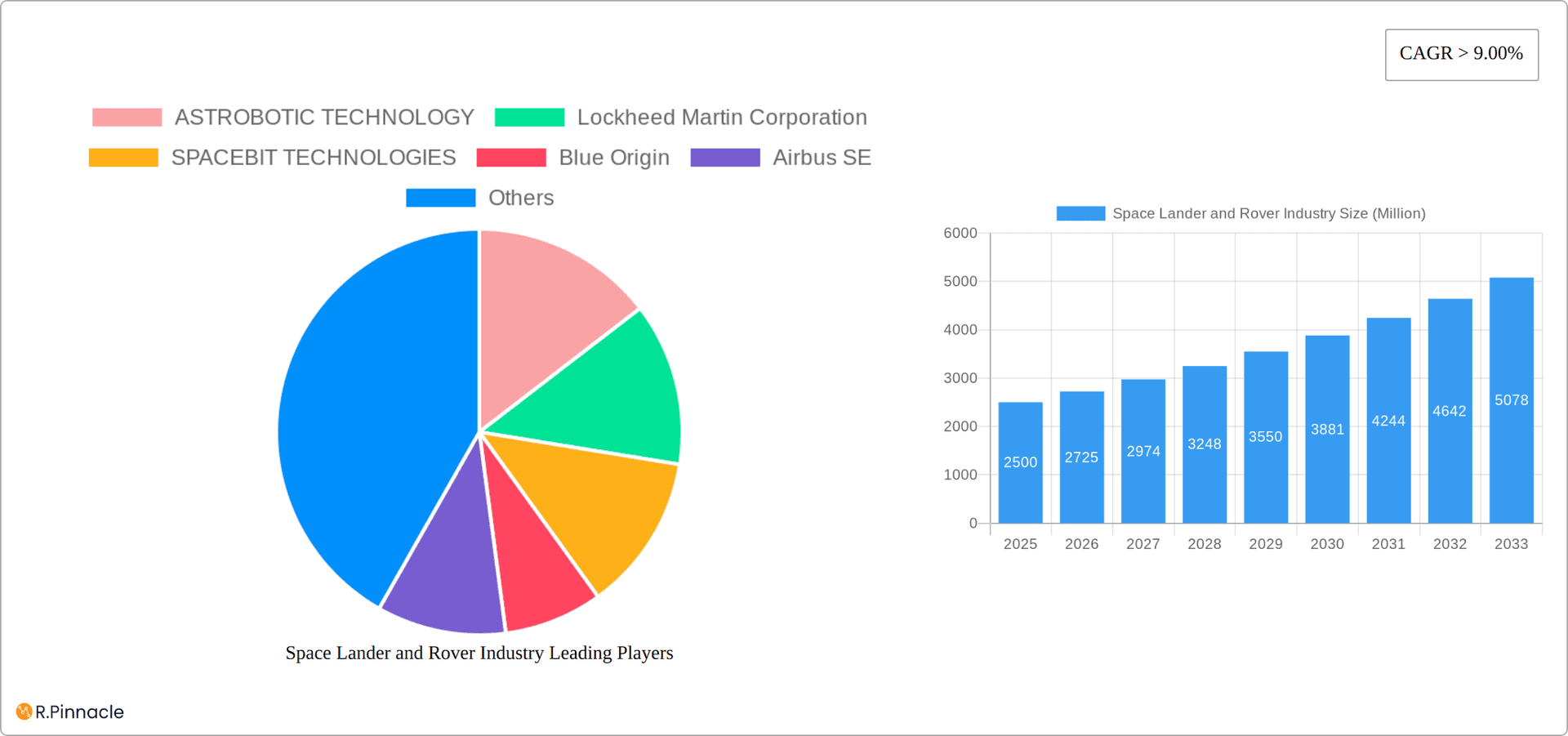

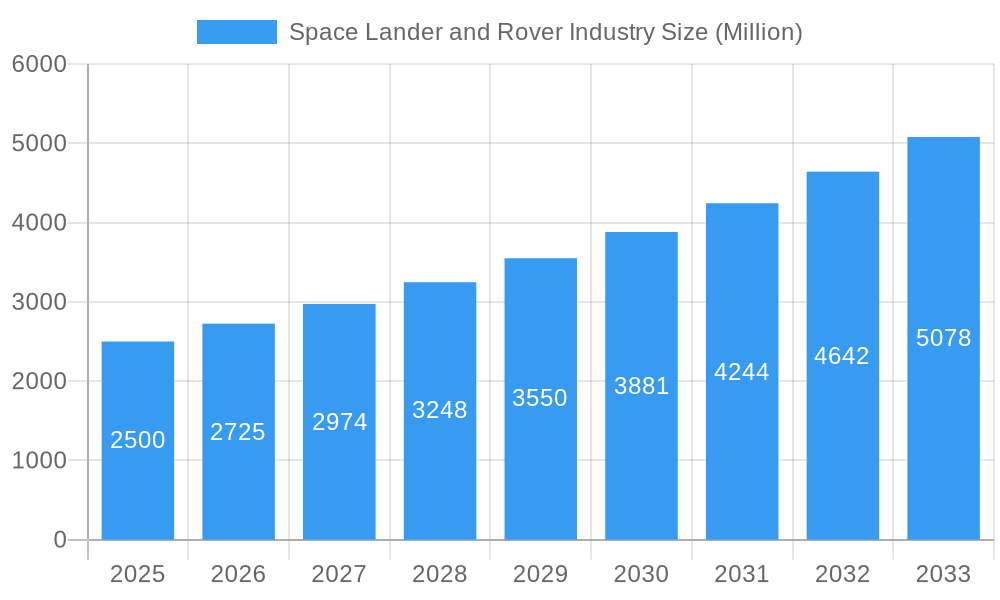

The global space lander and rover market is experiencing robust growth, driven by increasing investments in space exploration by both government agencies and private companies. A Compound Annual Growth Rate (CAGR) exceeding 9% from 2019 to 2033 indicates a significant expansion of this market, projected to reach substantial value. Key drivers include the rising demand for planetary surface exploration missions, advancements in robotics and autonomous navigation technologies, and the growing commercialization of space. The market is segmented by exploration target – Lunar, Martian, and Asteroid surfaces – with lunar exploration currently dominating due to increased accessibility and growing interest in establishing a lunar base. Technological advancements, such as improved power systems, enhanced scientific instrumentation, and advanced communication capabilities are pushing the market forward. However, the high development costs associated with space missions, stringent regulatory environments, and the inherent risks associated with space exploration pose significant restraints. The competitive landscape is populated by a diverse mix of players including major aerospace corporations like Lockheed Martin and Airbus, along with innovative space technology startups like Astrobotic Technology and Spacebit. Government space agencies like NASA, ESA, JAXA, ISRO, and Roscosmos play a crucial role, driving significant portions of the market through government-funded missions.

Space Lander and Rover Industry Market Size (In Billion)

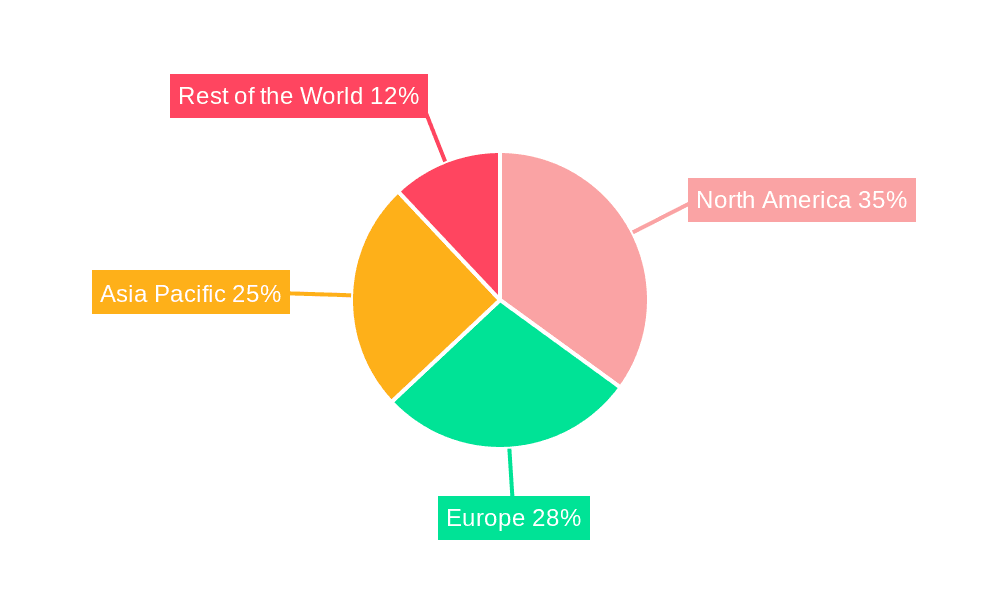

The market's regional distribution is likely to see Asia-Pacific showing strong growth due to increasing space exploration ambitions and investments from countries like China, Japan, and India. North America and Europe will also maintain significant market shares due to established aerospace industries and robust funding for space programs. Future growth will largely depend on successful missions, continuing technological innovation, and sustained government and private sector investment in deep space exploration. The long-term outlook remains positive, with continued exploration of the Moon, Mars, and asteroids expected to fuel market expansion throughout the forecast period. The commercialization of space resources further presents significant long-term growth potential, adding another layer to the already dynamic market landscape.

Space Lander and Rover Industry Company Market Share

Space Lander and Rover Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Space Lander and Rover industry, projecting robust growth from USD xx Million in 2025 to USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The report covers the historical period (2019-2024), with 2025 serving as the base year and estimated year. It delves into market dynamics, technological advancements, competitive landscapes, and key players, offering invaluable insights for industry professionals, investors, and researchers.

Space Lander and Rover Industry Market Structure & Innovation Trends

The Space Lander and Rover industry presents a dynamic market structure, evolving from a moderately concentrated landscape dominated by established players like Lockheed Martin Corporation, Northrop Grumman Corporation, and National Aeronautics and Space Administration (NASA), to a more competitive environment with the rise of innovative startups such as Astrobotic Technology and ispace inc. This increased competition is driving rapid innovation, fueled by the demand for enhanced capabilities in deep-space exploration. Key drivers include maximizing payload capacity, developing sophisticated autonomous navigation systems, and utilizing radiation-hardened components for extreme environments. Stringent regulatory frameworks, overseen by international space agencies and national regulatory bodies, play a critical role in ensuring safety and standardization across the industry. The sector also witnesses significant mergers and acquisitions (M&A) activity, with substantial deal values reflecting the strategic importance and growth potential of this sector.

- Market Concentration: While initially moderately concentrated, the market is becoming increasingly fragmented with the entry of new players and strategic partnerships.

- Innovation Drivers: Advancements in AI-powered autonomy, increased payload capacity, miniaturization of components, advanced propulsion systems, improved power generation (e.g., RTGs, advanced solar arrays), and robust robotic manipulation are key drivers of innovation.

- Regulatory Frameworks: International space law, national space agency regulations (e.g., FAA, ESA), and industry safety standards guide development and operation.

- Product Substitutes: Direct substitutes are limited; however, innovative solutions and alternative approaches are emerging for specific mission requirements.

- End-User Demographics: Government space agencies (NASA, ESA, JAXA, etc.), private space exploration companies (SpaceX, Blue Origin, etc.), and academic research institutions remain the primary end-users.

- M&A Activity: High levels of M&A activity continue, indicating industry consolidation and strategic expansion efforts.

Space Lander and Rover Industry Market Dynamics & Trends

The Space Lander and Rover industry is experiencing significant growth fueled by increasing government investments in space exploration, the rise of commercial space activities, and the pursuit of scientific discoveries on other celestial bodies. Technological disruptions, such as advancements in AI, robotics, and propulsion systems, are transforming the industry. Consumer preferences, while limited to the specific needs of space agencies and private companies, favor robust, reliable, and cost-effective solutions. Competitive dynamics are characterized by both cooperation and competition, with strategic alliances and partnerships becoming increasingly prevalent. The market penetration of advanced technologies, such as AI-powered autonomous navigation, is gradually increasing.

Dominant Regions & Segments in Space Lander and Rover Industry

The United States currently holds a dominant position in the Space Lander and Rover industry, driven by substantial government investment (NASA), a robust private space sector, and advanced technological capabilities. However, other regions, including Europe (Airbus SE, European Space Agency), Asia (ISRO, JAXA, China Academy of Space Technology), and even smaller spacefaring nations are actively participating.

- Lunar Surface Exploration: Dominated by the US, followed by China, and growing participation from other spacefaring nations. Key drivers include the Artemis program, the pursuit of lunar resources, and scientific interest in the Moon.

- Mars Surface Exploration: The US holds a leading position, with NASA's Perseverance and Curiosity rovers paving the way. International collaborations are increasing. Key drivers are the search for past or present life, understanding Martian geology, and preparing for future human missions.

- Asteroids Surface Exploration: Still in its nascent stages, with limited missions and significant technological challenges. Key drivers include the potential for resource extraction and understanding the formation of the solar system. Japan and the US are currently leading in this sector.

Key Drivers (across all segments):

- Government funding and space agency initiatives.

- Growing commercial interest in space resources.

- Advancements in robotics and AI.

- Demand for in-situ resource utilization (ISRU) technologies.

Space Lander and Rover Industry Product Innovations

Recent innovations include advancements in autonomous navigation systems, enhanced power sources (e.g., RTGs, solar panels), and improved robotic manipulation capabilities. These advancements contribute to increased operational efficiency, longer mission durations, and greater scientific return. The market demands systems that are reliable, durable, and adaptable to the harsh environments of other celestial bodies.

Report Scope & Segmentation Analysis

This report segments the Space Lander and Rover market based on exploration type: Lunar Surface Exploration, Mars Surface Exploration, and Asteroids Surface Exploration. Each segment presents unique challenges and opportunities, with growth projections varying based on mission plans, technological advancements, and government priorities. The competitive landscape within each segment is also analyzed, highlighting key players and their market strategies.

- Lunar Surface Exploration: Projected to reach USD xx Million by 2033, driven by increased lunar missions.

- Mars Surface Exploration: Expected to reach USD xx Million by 2033, with a focus on sample return missions and potential human exploration.

- Asteroids Surface Exploration: Poised for significant growth but still relatively small compared to other segments.

Key Drivers of Space Lander and Rover Industry Growth

The Space Lander and Rover industry's growth is primarily driven by increased government investment in space exploration programs (e.g., Artemis program, Mars sample return missions), advancements in robotics and AI, the emergence of commercial space activities, and the pursuit of in-situ resource utilization (ISRU) for long-duration missions. The demand for more sophisticated and capable exploration tools is another significant driver.

Challenges in the Space Lander and Rover Industry Sector

The industry faces challenges including high development costs, technological complexities, rigorous testing and validation requirements, and the inherent risks associated with space exploration. Supply chain constraints and the need for international collaborations also pose significant hurdles. Regulatory complexities and international agreements further complicate the landscape, impacting the time to market and overall project budgets. The cost of launching payloads into space also poses significant challenges.

Emerging Opportunities in Space Lander and Rover Industry

Emerging opportunities include the development of smaller, more affordable landers and rovers for scientific and commercial applications, the utilization of advanced materials for improved durability and efficiency, and the exploration of new celestial bodies, such as asteroids and moons of other planets. The potential for resource extraction from asteroids is also creating significant interest.

Leading Players in the Space Lander and Rover Industry Market

- ASTROBOTIC TECHNOLOGY

- Lockheed Martin Corporation

- SPACEBIT TECHNOLOGIES

- Blue Origin

- Airbus SE

- Canadian Space Agency

- ISRO

- National Aeronautics and Space Administration

- Roscosmos

- ispace inc

- Japanese Aerospace Exploration Agency (JAXA)

- Northrop Grumman Corporation

- China Academy of Space Technology

Key Developments in Space Lander and Rover Industry Industry

- May 2021: Lockheed Martin partnered with General Motors to develop next-generation lunar rovers. This collaboration signifies a shift towards more robust and capable vehicles for human exploration.

- March 2021: NASA awarded Northrop Grumman a USD 60.2-84.5 Million contract for the Mars Ascent Vehicle (MAV) and associated Sample Fetch Rover. This highlights the ongoing commitment to sample return missions from Mars.

Future Outlook for Space Lander and Rover Industry Market

The future outlook for the Space Lander and Rover industry is positive, driven by sustained government investment, increasing private sector participation, and technological advancements. The potential for resource extraction from celestial bodies will create new market opportunities, driving further innovation and investment in the sector. The expansion into new exploration targets and the development of reusable landing systems will further shape the industry’s future.

Space Lander and Rover Industry Segmentation

-

1. Type

- 1.1. Lunar Surface Exploration

- 1.2. Mars Surface Exploration

- 1.3. Asteroids Surface Exploration

Space Lander and Rover Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Space Lander and Rover Industry Regional Market Share

Geographic Coverage of Space Lander and Rover Industry

Space Lander and Rover Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Focus On Space Exploration Driving the Demand for Landers and Rovers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lunar Surface Exploration

- 5.1.2. Mars Surface Exploration

- 5.1.3. Asteroids Surface Exploration

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lunar Surface Exploration

- 6.1.2. Mars Surface Exploration

- 6.1.3. Asteroids Surface Exploration

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lunar Surface Exploration

- 7.1.2. Mars Surface Exploration

- 7.1.3. Asteroids Surface Exploration

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lunar Surface Exploration

- 8.1.2. Mars Surface Exploration

- 8.1.3. Asteroids Surface Exploration

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lunar Surface Exploration

- 9.1.2. Mars Surface Exploration

- 9.1.3. Asteroids Surface Exploration

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ASTROBOTIC TECHNOLOGY

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPACEBIT TECHNOLOGIES

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Blue Origin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Canadian Space Agency

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ISRO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National Aeronautics and Space Administration

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roscosmos

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ispace inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Japanese Aerospace Exploration Agency (JAXA)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Northrop Grumman Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 China Academy of Space Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 ASTROBOTIC TECHNOLOGY

List of Figures

- Figure 1: Global Space Lander and Rover Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Space Lander and Rover Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Lander and Rover Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Space Lander and Rover Industry?

Key companies in the market include ASTROBOTIC TECHNOLOGY, Lockheed Martin Corporation, SPACEBIT TECHNOLOGIES, Blue Origin, Airbus SE, Canadian Space Agency, ISRO, National Aeronautics and Space Administration, Roscosmos, ispace inc, Japanese Aerospace Exploration Agency (JAXA), Northrop Grumman Corporation, China Academy of Space Technology.

3. What are the main segments of the Space Lander and Rover Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Focus On Space Exploration Driving the Demand for Landers and Rovers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2021, Lockheed Martin announced that it has teamed up with General Motors to design the next generation of lunar rovers, capable of transporting astronauts across farther distances on the lunar surface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Lander and Rover Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Lander and Rover Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Lander and Rover Industry?

To stay informed about further developments, trends, and reports in the Space Lander and Rover Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence