Key Insights

The Spain Life & Non-Life Insurance market demonstrates robust growth potential, driven by increasing awareness of risk management and a burgeoning middle class with greater disposable income. The historical period (2019-2024) likely saw fluctuating growth, influenced by economic cycles and regulatory changes within the Spanish insurance sector. However, a positive CAGR projected from 2025 onwards suggests a sustained upward trajectory. The life insurance segment is anticipated to experience steady growth, fueled by rising demand for retirement planning products and increasing concerns about healthcare costs. Conversely, the non-life insurance sector is projected to show slightly faster growth, particularly in areas like motor and property insurance, reflecting Spain's expanding urban landscape and increasing vehicle ownership. Competition within the market remains intense, with both established domestic players and international insurers vying for market share. Technological advancements, such as digital distribution channels and AI-powered risk assessment tools, are transforming the sector, presenting opportunities for agile insurers to enhance customer experience and operational efficiency. Regulatory reforms focused on consumer protection and market transparency will continue to shape the competitive landscape.

The forecast period (2025-2033) offers significant opportunities for growth, especially for insurers that can successfully adapt to the evolving technological and regulatory environment. The market is expected to see a rise in demand for specialized insurance products catering to niche segments, such as cyber insurance and travel insurance. Insurers are likely to invest heavily in digital infrastructure and data analytics to better understand customer needs and personalize their offerings. Furthermore, strategic mergers and acquisitions might reshape the market structure, leading to consolidation among players. The overall outlook for the Spanish Life & Non-Life Insurance market is optimistic, though careful navigation of macroeconomic factors and regulatory changes remains crucial for sustained growth. Focus on personalized customer service, technological innovation, and robust risk management will be essential for success.

Spain Life & Non-Life Insurance Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Spain Life & Non-Life Insurance industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils the market's structure, dynamics, and future outlook, empowering you with data-driven strategies for success.

Spain Life & Non-Life Insurance Industry Market Structure & Innovation Trends

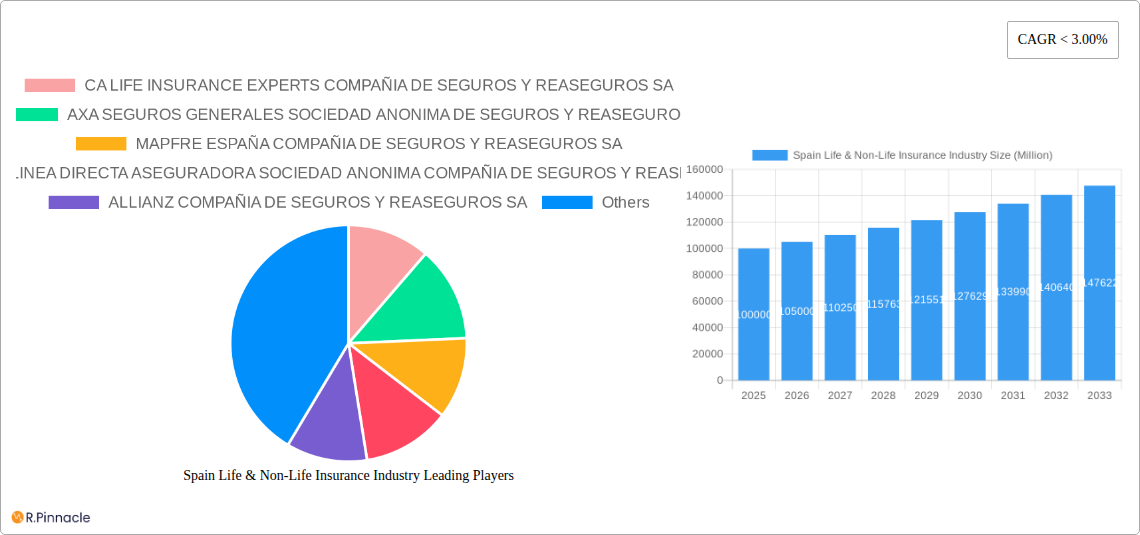

This section analyzes the competitive landscape of the Spanish insurance market, focusing on market concentration, innovation drivers, regulatory changes, and key industry activities. The report delves into the market share held by major players, including CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA, AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS, MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA, LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS, ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA, REALE SEGUROS GENERALES SA, MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA, FIATC MUTUA DE SEGUROS Y REASEGUROS, MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS, and LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA (list not exhaustive). We examine the impact of mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market structure. The report also assesses the influence of regulatory frameworks, the presence of product substitutes, and the evolving demographics of end-users on market dynamics. We further explore innovation drivers, including technological advancements and changing consumer preferences, providing quantifiable data on market share distribution and M&A deal values (in Millions). For example, we analyze the impact of a xx Million deal in 2024 on market consolidation.

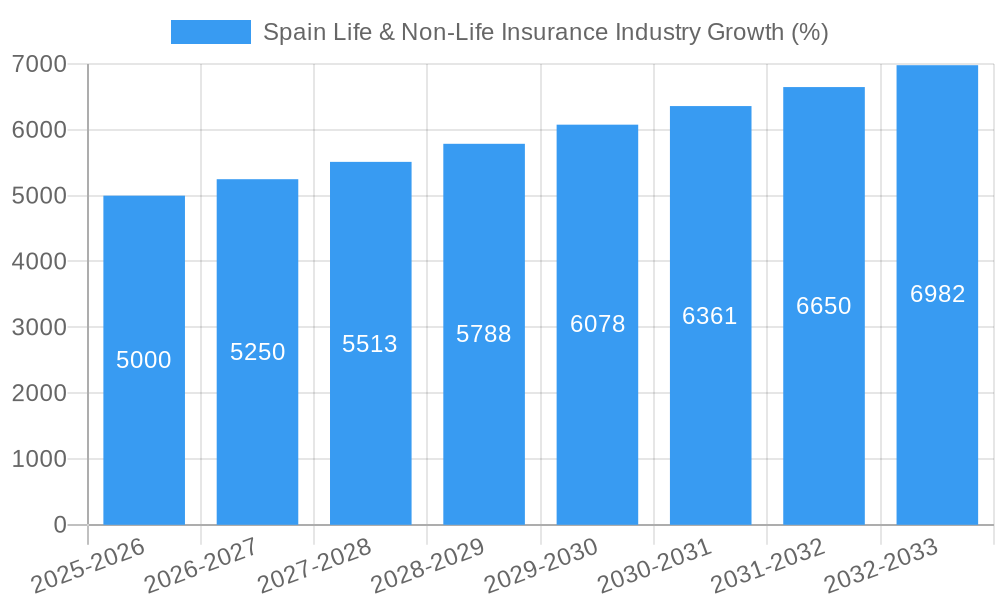

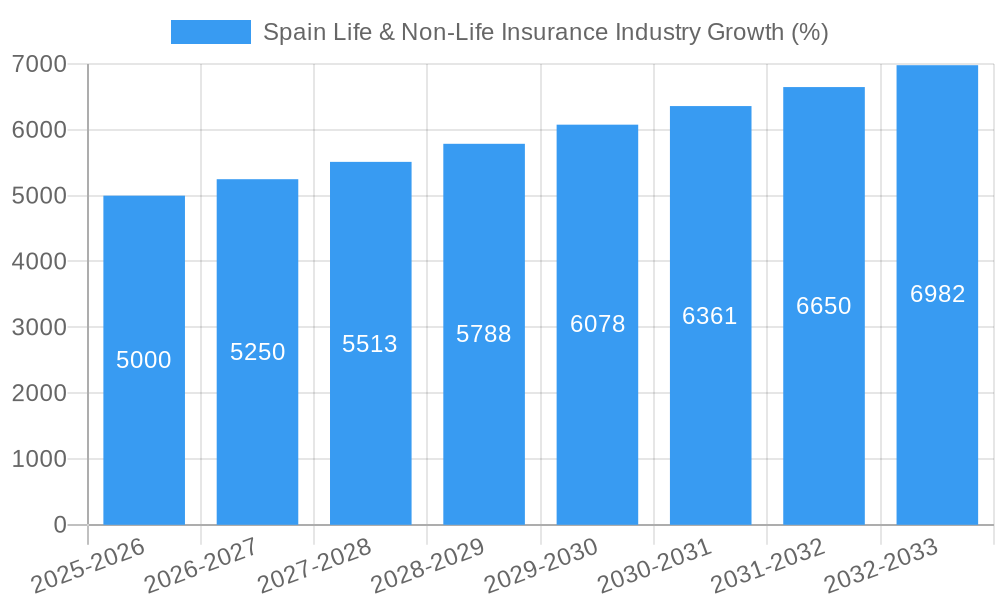

Spain Life & Non-Life Insurance Industry Market Dynamics & Trends

This section offers a comprehensive overview of the Spain Life & Non-Life Insurance market's dynamic growth trajectory. We analyze key market growth drivers, technological disruptions reshaping the industry, evolving consumer preferences, and intense competitive dynamics. The report presents concrete metrics, including Compound Annual Growth Rate (CAGR) projections and market penetration rates, providing insights into the market's trajectory. Specific examples of technological disruptions, such as the adoption of InsurTech solutions and the rise of digital distribution channels, are discussed. The impact of macroeconomic factors, regulatory changes, and shifts in consumer behavior on market dynamics is also thoroughly examined. We project a CAGR of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Regions & Segments in Spain Life & Non-Life Insurance Industry

This section identifies the leading regions and segments within the Spanish Life & Non-Life Insurance market. We provide a detailed dominance analysis, pinpointing the key factors driving growth in these segments. This includes a thorough examination of regional variations, economic policies influencing the industry, and the role of infrastructure development.

- Key Drivers of Regional Dominance:

- Robust economic growth in specific regions.

- Favorable regulatory environments.

- Well-developed infrastructure supporting insurance operations.

- High population density and consumer spending power.

The report will analyze how these factors contribute to the dominance of specific regions and segments, providing a granular understanding of market opportunities and challenges. We anticipate the xx region to maintain its leading position due to [specific reason].

Spain Life & Non-Life Insurance Industry Product Innovations

This section summarizes recent product developments, highlighting their applications and competitive advantages. We examine how technological trends, such as AI and big data analytics, are influencing product innovation and shaping market competitiveness. The analysis focuses on how new products meet evolving consumer needs and preferences, creating unique value propositions. The report will also analyze the adoption of new technologies, the competitive advantages they provide, and their impact on market share.

Report Scope & Segmentation Analysis

This section details the market segmentation analyzed in the report.

Life Insurance: This segment is projected to experience xx% CAGR driven by [specific factors]. Competitive dynamics are shaped by [key factors].

Non-Life Insurance: This segment is forecast to grow at a CAGR of xx%, influenced by [specific factors]. The competitive landscape is characterized by [key factors].

Each segment's growth projections, market sizes (in Millions), and competitive dynamics are thoroughly explored.

Key Drivers of Spain Life & Non-Life Insurance Industry Growth

This section identifies the key factors propelling growth in the Spanish Life & Non-Life Insurance industry. We will analyze technological advancements (e.g., digitalization, AI), economic factors (e.g., GDP growth, disposable income), and regulatory changes impacting market expansion. Specific examples of each driver and their quantifiable impact on market growth are provided.

Challenges in the Spain Life & Non-Life Insurance Industry Sector

This section examines the key challenges hindering growth in the Spanish insurance sector. These include regulatory hurdles (e.g., compliance costs, licensing), supply chain disruptions (e.g., impact of global events), and intense competitive pressures (e.g., price wars, market saturation). The report quantifies the impact of these challenges on market growth and profitability. For example, regulatory changes in xx resulted in a xx Million loss for the industry in xx.

Emerging Opportunities in Spain Life & Non-Life Insurance Industry

This section highlights emerging opportunities for growth. We explore the potential of new markets (e.g., underserved segments), innovative technologies (e.g., blockchain, IoT), and changing consumer preferences (e.g., demand for personalized products). Specific examples of opportunities, including the potential for growth in the xx segment and the benefits of adopting xx technology, are discussed.

Leading Players in the Spain Life & Non-Life Insurance Industry Market

- CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- REALE SEGUROS GENERALES SA

- MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- FIATC MUTUA DE SEGUROS Y REASEGUROS

- MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA

(List not exhaustive)

Key Developments in Spain Life & Non-Life Insurance Industry Industry

March 2023: Citizens, Inc. partnered with Alliance Group for white-label life insurance distribution, expanding market access and potentially increasing competition.

October 2022: Generali Spain and Sanitas' strategic agreement broadened health insurance offerings to over 150,000 customers, indicating a shift towards integrated healthcare solutions and market consolidation.

Future Outlook for Spain Life & Non-Life Insurance Industry Market

The future of the Spain Life & Non-Life Insurance market looks promising, driven by sustained economic growth, evolving consumer needs, and technological advancements. Strategic opportunities exist for insurers who embrace innovation, digital transformation, and personalized offerings. The market's potential for growth is significant, particularly in underserved segments and through the adoption of new technologies. We project continued expansion in the coming years, with particular growth in [specific segments].

Spain Life & Non-Life Insurance Industry Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Bank

- 2.4. Others

Spain Life & Non-Life Insurance Industry Segmentation By Geography

- 1. Spain

Spain Life & Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing in fintech adoption in top European Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Bank

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 REALE SEGUROS GENERALES SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIATC MUTUA DE SEGUROS Y REASEGUROS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

List of Figures

- Figure 1: Spain Life & Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Life & Non-Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Life & Non-Life Insurance Industry?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Spain Life & Non-Life Insurance Industry?

Key companies in the market include CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA, AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS, MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA, LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS, ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA, REALE SEGUROS GENERALES SA, MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA, FIATC MUTUA DE SEGUROS Y REASEGUROS, MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS, LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive.

3. What are the main segments of the Spain Life & Non-Life Insurance Industry?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing in fintech adoption in top European Countries.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Citizens, Inc., a diversified financial services company providing life, living benefits, final expense, and limited liability property insurance, announced that it entered into a white-label partnership with Alliance Group (Alliance). It is a large Independent Marketing Organization that is a leader in providing life insurance with living benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Life & Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Life & Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Life & Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Spain Life & Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence