Key Insights

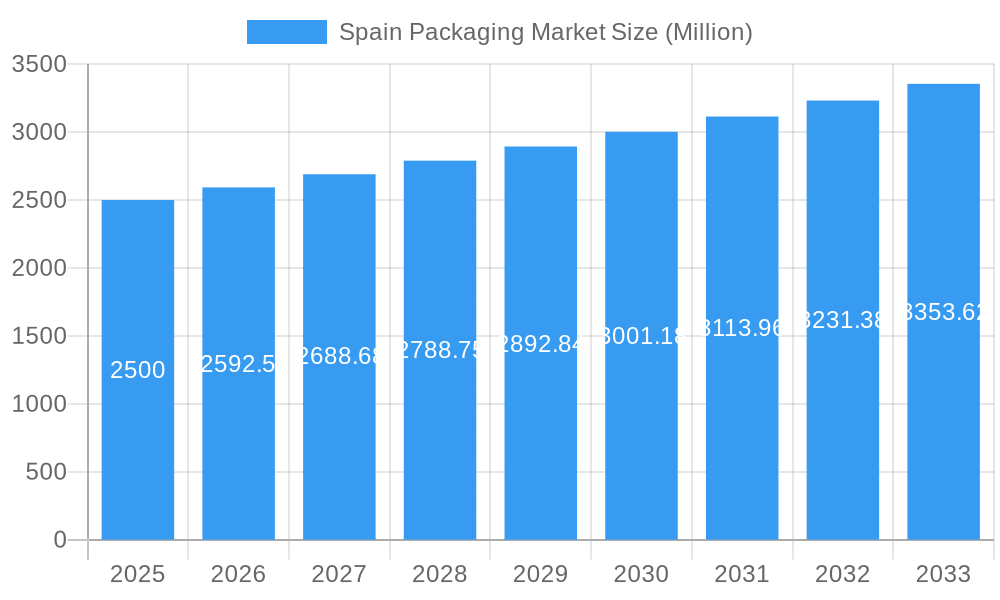

The Spain packaging market, projected at 620 million in 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.01% from 2025 to 2033. Key drivers include the robust food and beverage sector, increasing demand for convenient and sustainable packaging, and the critical requirements of the healthcare and pharmaceutical industries for product safety. The burgeoning e-commerce landscape further propels demand for protective transit packaging. Innovations in biodegradable and recyclable materials are addressing environmental concerns, fostering sustainable development amidst challenges like fluctuating raw material prices. Plastic packaging currently leads due to its cost-effectiveness, yet flexible and eco-friendly alternatives are gaining significant traction driven by consumer awareness and regulatory shifts. Market participants are actively investing in R&D for innovative, sustainable, and efficient solutions, fostering market dynamism and competition.

Spain Packaging Market Market Size (In Million)

Significant growth opportunities exist across the Spanish packaging market. The primary packaging segment, essential for product protection and presentation, commands a substantial share. While plastics remain dominant, paper-based and biodegradable materials are increasing in adoption. The food and beverage sector represents the largest end-user, followed by healthcare and pharmaceuticals. Regional market dynamics may vary. The forecast period (2025-2033) offers considerable potential for companies delivering sustainable, innovative, and efficient packaging solutions aligned with evolving industry and consumer needs within Spain.

Spain Packaging Market Company Market Share

Spain Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain Packaging Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, leading segments, key players, and future growth prospects. The analysis incorporates granular data on market size (in Millions), CAGR, and market share, providing a 360-degree view of this dynamic sector.

Spain Packaging Market Market Structure & Innovation Trends

The Spain packaging market exhibits a moderately consolidated structure, with several multinational corporations and domestic players vying for market share. Key factors shaping this structure include evolving regulatory frameworks focused on sustainability, the rise of innovative packaging materials, and ongoing mergers and acquisitions (M&A) activity. The market’s innovation landscape is driven by a growing demand for eco-friendly packaging solutions, sophisticated packaging designs for enhanced product protection and consumer appeal, and the adoption of advanced technologies for packaging automation and optimization.

- Market Concentration: The top 10 players hold an estimated xx% market share in 2025.

- Innovation Drivers: Sustainability concerns, e-commerce growth, and brand differentiation are major drivers.

- Regulatory Landscape: EU directives on packaging waste and recyclability significantly influence market dynamics.

- Product Substitutes: Biodegradable and compostable packaging are gaining traction as substitutes for traditional materials.

- M&A Activity: Recent acquisitions, such as Smurfit Kappa's purchase of Pusa Pack, highlight the consolidation trend. The total value of M&A deals in the sector between 2019 and 2024 is estimated at xx Million.

Spain Packaging Market Market Dynamics & Trends

The Spain packaging market is experiencing robust growth, driven by a combination of factors. The increasing demand from various end-use sectors, particularly food & beverage and healthcare, coupled with the rise of e-commerce and changing consumer preferences towards convenience and sustainability, are key drivers. Technological advancements in packaging materials and manufacturing processes are further accelerating market expansion. However, the market also faces challenges, including fluctuating raw material prices and regulatory pressures. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration for sustainable packaging solutions steadily increasing.

Dominant Regions & Segments in Spain Packaging Market

The Spanish packaging market demonstrates a strong concentration of activity in its major urban centers and established industrial hubs, which are the primary drivers of market growth. While specific granular regional data is subject to further detailed analysis, the presence of key industries and robust consumer bases dictates regional leadership. In terms of market segmentation:

- By Layers of Packaging: Primary packaging commands the largest market share, owing to its direct and essential role in protecting and presenting the product. Secondary and tertiary packaging follow, supporting distribution and bulk handling.

- By Packaging Material: Plastics continue to lead the market due to their versatility and cost-effectiveness. However, there is a pronounced and accelerating shift towards sustainable alternatives, with paper-based and flexible packaging materials gaining significant traction. The metal packaging segment remains robust, particularly within the indispensable food and beverage sectors. Glass packaging, while occupying a niche, maintains a stable and valued market presence.

- By End Users: The Food & Beverage sector is the predominant end-use segment, leveraging packaging for preservation, convenience, and marketing. The Healthcare & Pharmaceutical sector follows, driven by strict regulatory demands for safety and sterility. The Beauty & Personal Care industry is another substantial contributor, distinguished by its constant pursuit of innovative and aesthetically pleasing packaging designs that enhance brand appeal.

Key Drivers (varying by segment):

- Food & Beverage: The escalating demand for convenient, portable, and shelf-stable packaging solutions that extend product life and cater to on-the-go consumption.

- Healthcare & Pharmaceutical: An unwavering focus on stringent regulatory compliance, ensuring product integrity, sterility, and patient safety, which mandates sophisticated and secure packaging.

- Beauty & Personal Care: A strong emphasis on premiumization and sophisticated aesthetics, where packaging plays a pivotal role in brand storytelling, consumer perception, and luxury appeal.

Spain Packaging Market Product Innovations

Recent innovations focus on sustainable and functional packaging. This includes advancements in biodegradable materials, lightweight designs to reduce transportation costs and environmental impact, and intelligent packaging incorporating features like sensors for monitoring product freshness or tamper evidence. These innovations are directly improving product shelf-life, enhancing consumer experience, and boosting brand appeal.

Report Scope & Segmentation Analysis

This report segments the Spain packaging market by layers of packing (primary, secondary, tertiary), packaging material (plastic, flexible packaging, paper, glass, metal), and end-user (food & beverage, healthcare & pharmaceutical, beauty & personal care, industrial, other). Each segment's growth projections, market size (in Millions), and competitive landscape are analyzed in detail. Growth rates will vary across segments due to specific industry demands and evolving consumer trends.

Key Drivers of Spain Packaging Market Growth

Several factors fuel the market's growth. These include a growing economy, increasing disposable incomes boosting consumer spending, a rise in e-commerce driving demand for robust packaging solutions, and stringent regulatory compliance driving the adoption of sustainable and eco-friendly materials. Government initiatives promoting recycling and waste reduction further contribute to market expansion.

Challenges in the Spain Packaging Market Sector

The Spanish packaging sector is currently navigating a landscape marked by several significant challenges. Fluctuations in the cost of raw materials, particularly for plastics and paper, directly impact production expenses and profit margins. Furthermore, increasingly stringent environmental regulations, coupled with escalating waste management costs, necessitate substantial investment in sustainable practices and technologies. The imperative for continuous innovation to align with evolving consumer preferences and demands for eco-friendly and functional packaging adds another layer of complexity. Moreover, the volatility of global supply chains can lead to disruptions in production and delivery schedules, posing a threat to market stability and operational efficiency.

Emerging Opportunities in Spain Packaging Market

The Spanish packaging market is ripe with opportunities, particularly in the domain of sustainable packaging solutions. The development and adoption of innovative materials, such as advanced bioplastics and compostable alternatives, are gaining momentum. The integration of smart packaging technologies, offering features like traceability, authentication, and enhanced consumer engagement, presents a significant growth avenue. The burgeoning e-commerce sector, which relies heavily on robust and specialized packaging for product protection during transit, is a key area for expansion. Additionally, catering to an increasingly health-conscious consumer base by offering packaging that highlights functional benefits, supports product integrity, and demonstrates a clear commitment to environmental responsibility offers particularly lucrative prospects for market players.

Leading Players in the Spain Packaging Market Market

Key Developments in Spain Packaging Market Industry

- November 2022: Plastipak significantly bolstered its sustainable packaging capabilities with the inauguration of a new PET recycling plant in Toledo, Spain. This state-of-the-art facility boasts an impressive annual capacity of 20,000 tonnes of food-grade rPET pellets, thereby substantially enhancing the domestic supply of recycled materials crucial for packaging production.

- November 2022: Smurfit Kappa strategically expanded its presence and capabilities within the flexible packaging sector through the acquisition of Pusa Pack. This acquisition, aimed at meeting the escalating market demand for bag-in-box solutions, further solidifies Smurfit Kappa's leadership position in the Spanish market for innovative and efficient packaging.

Future Outlook for Spain Packaging Market Market

The Spain packaging market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and a focus on sustainability. Strategic investments in eco-friendly packaging solutions and the development of innovative materials will be crucial for market leadership. The market's future potential lies in capitalizing on opportunities within e-commerce, personalized packaging, and the rising demand for sustainable and convenient packaging options.

Spain Packaging Market Segmentation

-

1. Layers of Packing

- 1.1. Primary

- 1.2. Secondary & Tertiary

-

2. Packaging Material

-

2.1. Plastic

- 2.1.1. Rigid Packaging

- 2.1.2. Flexible Packaging

- 2.2. Paper

- 2.3. Glass

- 2.4. Metal

-

2.1. Plastic

-

3. End Users

- 3.1. Food & Beverage

- 3.2. Healthcare & Pharmaceutical

- 3.3. Beauty & Personal Care

- 3.4. Industrial

- 3.5. Other End Users

Spain Packaging Market Segmentation By Geography

- 1. Spain

Spain Packaging Market Regional Market Share

Geographic Coverage of Spain Packaging Market

Spain Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Food & Pharmaceutical Sectors; Rising Demand for Small and Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Rules and Regulations on Packaging Materials

- 3.4. Market Trends

- 3.4.1. Surging Demand For Packaging in Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Layers of Packing

- 5.1.1. Primary

- 5.1.2. Secondary & Tertiary

- 5.2. Market Analysis, Insights and Forecast - by Packaging Material

- 5.2.1. Plastic

- 5.2.1.1. Rigid Packaging

- 5.2.1.2. Flexible Packaging

- 5.2.2. Paper

- 5.2.3. Glass

- 5.2.4. Metal

- 5.2.1. Plastic

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Food & Beverage

- 5.3.2. Healthcare & Pharmaceutical

- 5.3.3. Beauty & Personal Care

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Layers of Packing

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company (BD)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crown Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Quadpack Industries SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrado SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Paper Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Coveris Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company (BD)

List of Figures

- Figure 1: Spain Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Spain Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Packaging Market Revenue million Forecast, by Layers of Packing 2020 & 2033

- Table 2: Spain Packaging Market Revenue million Forecast, by Packaging Material 2020 & 2033

- Table 3: Spain Packaging Market Revenue million Forecast, by End Users 2020 & 2033

- Table 4: Spain Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Spain Packaging Market Revenue million Forecast, by Layers of Packing 2020 & 2033

- Table 6: Spain Packaging Market Revenue million Forecast, by Packaging Material 2020 & 2033

- Table 7: Spain Packaging Market Revenue million Forecast, by End Users 2020 & 2033

- Table 8: Spain Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Packaging Market?

The projected CAGR is approximately 7.01%.

2. Which companies are prominent players in the Spain Packaging Market?

Key companies in the market include Becton Dickinson and Company (BD), Ball Corporation, Crown Holdings Inc, Quadpack Industries SA, Amcor PLC, Agrado SA, International Paper Company, Coveris Holdings, Berry Global Inc, Sealed Air Corporation.

3. What are the main segments of the Spain Packaging Market?

The market segments include Layers of Packing, Packaging Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 620 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Food & Pharmaceutical Sectors; Rising Demand for Small and Convenient Packaging.

6. What are the notable trends driving market growth?

Surging Demand For Packaging in Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Stringent Rules and Regulations on Packaging Materials.

8. Can you provide examples of recent developments in the market?

November 2022: Plastipak opened a new PET recycling plant at its Toledo, Spain, manufacturing location. The recycling plant would ensure that PET flake is converted into food-grade recycled PET (rPET) pellets for use in bottles, new preforms, and containers at the new recycling facility. The recycling factory, which was scheduled to begin operations in the summer of 2022, is planned to produce 20,000 Tonnes of food-grade pellets per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Packaging Market?

To stay informed about further developments, trends, and reports in the Spain Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence