Key Insights

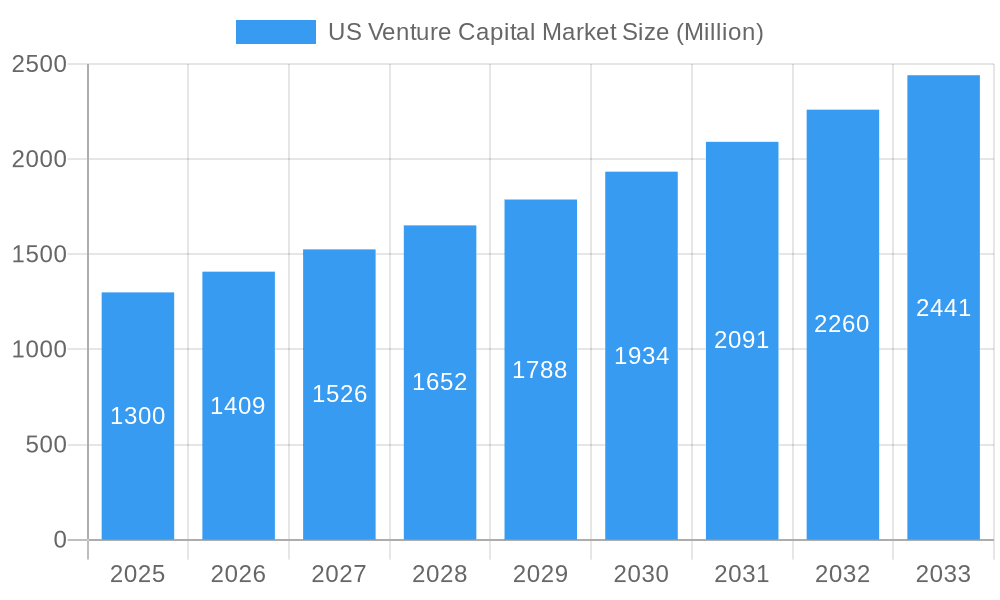

The US venture capital (VC) market, valued at $1.30 billion in 2025, is projected to experience robust growth, fueled by a compound annual growth rate (CAGR) of 8.25% from 2025 to 2033. This expansion is driven by several key factors. The increasing number of technology startups and innovative companies seeking funding contributes significantly to the market's dynamism. Furthermore, a favorable regulatory environment and the presence of substantial government incentives encourage investment in emerging technologies and high-growth sectors like artificial intelligence, biotechnology, and renewable energy. The influx of capital from both domestic and international investors, including prominent firms like Intel Capital, Tiger Global Management, and Sequoia Capital, further strengthens the market's trajectory. While economic downturns could pose a risk, the resilience of the US VC market, historically proven by its ability to recover from market corrections, indicates a positive long-term outlook. The market's segmentation reflects the diverse investment opportunities across various technological sectors, making it an attractive investment destination for both established and emerging venture capital firms. Competitive pressures among venture capitalists are driving innovation and efficiency in investment strategies, leading to a more sophisticated and refined VC ecosystem.

US Venture Capital Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates a significant increase in the market size, potentially reaching several billion dollars by 2033. This growth is expected to be relatively consistent across different segments, though some, such as those related to artificial intelligence and biotechnology, might show higher growth rates compared to others. The geographical distribution of investment may also see variations, with regions like the West Coast and Silicon Valley maintaining a significant share, but other regions, like the South and Midwest, also showing increased activity due to growing startup ecosystems. The historical period (2019-2024) provides a valuable benchmark for understanding market fluctuations and predicting future trends. Analyzing the data from this period, along with current market dynamics, allows for a more accurate projection of the market's future performance and potential risks.

US Venture Capital Market Company Market Share

US Venture Capital Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Venture Capital market from 2019 to 2033, offering crucial insights for industry professionals, investors, and strategic decision-makers. Leveraging a robust data set and expert analysis, this report delivers actionable intelligence on market trends, key players, and future growth projections. The report covers significant events, market dynamics, and emerging opportunities within the US Venture Capital landscape. The base year for this report is 2025, with the forecast period spanning 2025-2033 and historical data encompassing 2019-2024.

US Venture Capital Market Structure & Innovation Trends

The US Venture Capital market exhibits a concentrated structure with a few dominant players commanding significant market share. Key firms like Sequoia Capital, Accel Partners, and NEA consistently secure prominent positions, influencing deal flow and investment strategies. Innovation is driven by technological advancements in areas like AI, Fintech, and Biotech, attracting substantial VC funding. The regulatory landscape, while generally supportive of innovation, faces ongoing scrutiny regarding antitrust concerns and data privacy. Product substitutes are limited, given the specialized nature of venture capital investment, yet alternative funding sources, such as angel investors and crowdfunding platforms, exert a degree of competitive pressure. End-user demographics are broad, spanning from early-stage startups to mature growth companies across diverse sectors. M&A activity is prevalent, with large VC firms strategically acquiring smaller firms to expand their portfolios and expertise. In 2024, the total value of M&A deals in the sector reached approximately USD xx Billion. Key metrics reflecting market concentration and M&A activity are detailed within the report, offering a nuanced understanding of market dynamics.

- Market Share: Sequoia Capital holds an estimated xx% market share in 2024.

- M&A Deal Value (2024): Approximately USD xx Billion.

US Venture Capital Market Market Dynamics & Trends

The US Venture Capital market is characterized by robust growth, driven by a confluence of factors. Technological disruptions, particularly in AI and cloud computing, are fueling demand for innovative solutions and attracting significant VC investment. Evolving consumer preferences towards digitally-native products and services further stimulate market expansion. The competitive landscape is fiercely competitive, with established firms vying for market share against emerging players. Market penetration continues to increase, driven by rising investments in early-stage startups and the increasing number of successful exits through IPOs or acquisitions. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, reflecting sustained market dynamism and growth potential. Detailed analysis of market growth drivers and competitive dynamics are presented within the report.

Dominant Regions & Segments in US Venture Capital Market

California's Silicon Valley continues its reign as the undisputed epicenter of US Venture Capital activity, drawing a disproportionately large share of investment capital. Its enduring success is attributed to a meticulously cultivated ecosystem, state-of-the-art infrastructure, and an unparalleled concentration of top-tier talent. The key pillars supporting Silicon Valley's dominance include:

- Vibrant Entrepreneurial Ecosystem: A dense network of cutting-edge startups, dynamic incubators, and agile accelerators fosters a fertile ground for innovation.

- Unrivaled Talent Pool: A vast reservoir of highly skilled engineers, visionary designers, and astute business strategists fuels the growth of ambitious ventures.

- Conducive Regulatory Landscape: Favorable tax policies and progressive regulations create an environment that actively encourages and rewards pioneering spirit.

- Powerful Network Effects: Deep-rooted connections and synergistic relationships among investors, founders, and established corporations create a self-reinforcing cycle of success.

Beyond Silicon Valley, New York City and Boston have solidified their positions as formidable venture capital hubs, propelled by their robust technology sectors and access to a skilled workforce. For a deeper dive into regional dynamics, emerging segments, growth forecasts, and competitive analyses, consult the comprehensive full report.

US Venture Capital Market Product Innovations

The landscape of the US Venture Capital market is being reshaped by a wave of product innovations, prominently featuring a strategic pivot towards highly specialized fund strategies. These funds are meticulously designed to target specific industry verticals or distinct investment stages, ranging from seed-stage ventures brimming with disruptive potential to growth-stage enterprises poised for rapid scaling, and niche technological domains. The competitive edge in this evolving market is increasingly derived from the ability to identify and nurture high-potential startups in their nascent stages, coupled with the provision of invaluable strategic guidance and the cultivation of synergistic partnerships across a diversified portfolio. Furthermore, the integration of advanced technological trends, such as artificial intelligence (AI) and machine learning (ML), is revolutionizing investment analysis and portfolio management. The sophisticated application of these technologies is significantly enhancing due diligence processes, sharpening risk assessment capabilities, and optimizing investment outcomes.

Report Scope & Segmentation Analysis

This report comprehensively segments the US Venture Capital market based on several key parameters. These include investment stage (seed, Series A, Series B, etc.), industry vertical (technology, healthcare, consumer goods, etc.), and fund size. Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed, offering granular insights for targeted investment strategies.

Key Drivers of US Venture Capital Market Growth

Several key factors fuel the growth of the US Venture Capital market. Technological advancements, particularly in AI, blockchain, and biotechnology, create lucrative investment opportunities. A robust entrepreneurial ecosystem, supportive government policies, and the availability of abundant capital further enhance market expansion. The increasing number of successful exits through IPOs and acquisitions fuels investor confidence and attracts further capital inflows.

Challenges in the US Venture Capital Market Sector

The US Venture Capital market navigates a complex terrain marked by several persistent challenges. Navigating evolving regulatory uncertainties and the dynamic nature of data privacy regulations can introduce complexities that influence investment decisions and operational strategies. The fierce competition for access to groundbreaking startups is driving up valuations, creating pressure on expected returns. Moreover, the inherent cyclicality of the broader economy can precipitate periods of reduced funding activity during times of economic unease, directly impacting the pace and volume of investment.

Emerging Opportunities in US Venture Capital Market

Several emerging opportunities exist within the US Venture Capital market. The growing prevalence of impact investing and the increasing focus on sustainable and environmentally friendly businesses present a significant avenue for capital deployment. The expansion of the technology sector in emerging markets provides new investment prospects, while continued advancements in AI, blockchain, and other technologies unlock further opportunities.

Leading Players in the US Venture Capital Market Market

Key Developments in US Venture Capital Market Industry

- January 2023: NEA (New Enterprise Associates) closed on approximately USD 6.2 billion across two funds, increasing its assets under management to over USD 25 billion. This reflects a strategic shift towards early-stage and growth-stage investing.

- March 2022: Intel Corporation acquired Granulate Cloud Solutions Ltd, enhancing its cloud optimization capabilities and strengthening its position in the data center market.

Future Outlook for US Venture Capital Market Market

The US Venture Capital market is charting a course for sustained and robust growth, propelled by the relentless pace of technological innovation and the continuous emergence of new and exciting investment frontiers. Strategic collaborations between venture capital firms and established corporations, alongside the ever-increasing adoption of transformative technologies, are set to act as powerful catalysts for accelerated market expansion. Emerging investment themes, such as the burgeoning fields of sustainable investing and the decentralized landscape of Web3, are poised to significantly influence future investment flows. The market's long-term potential remains exceptionally promising, offering substantial and lucrative opportunities for both astute investors and forward-thinking entrepreneurs.

US Venture Capital Market Segmentation

-

1. Industry Type

- 1.1. Banking & Financial Services

- 1.2. Healthcare

- 1.3. Telecommunications

- 1.4. Government Agencies

- 1.5. Other Industries

-

2. Startup Stage

- 2.1. Seed Stage

- 2.2. First Stage

- 2.3. Expansion Stage

- 2.4. Bridge Stage

-

3. Major States

- 3.1. California

- 3.2. New York

- 3.3. Massachusettes

- 3.4. Washington

- 3.5. Others

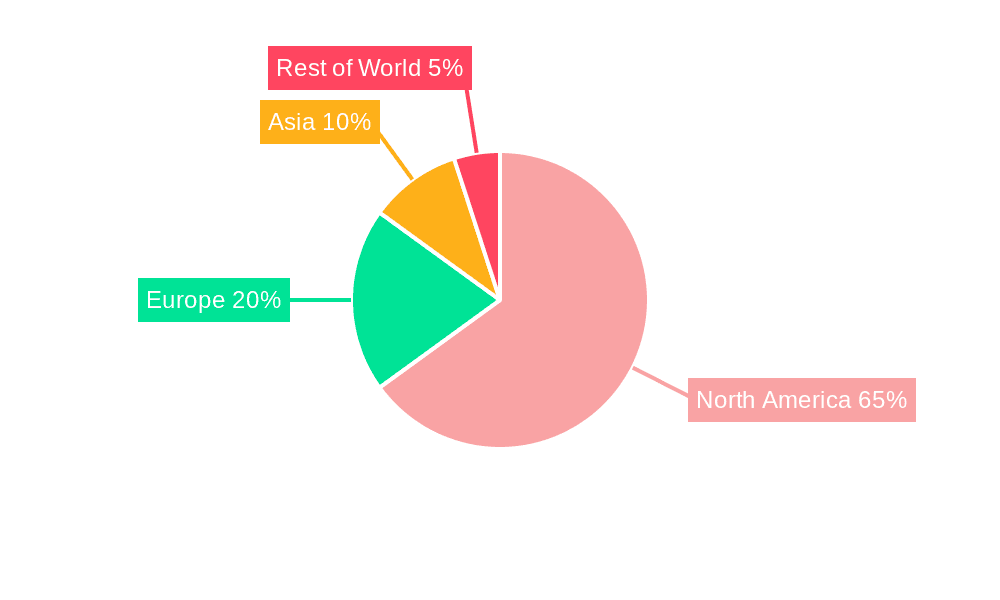

US Venture Capital Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Venture Capital Market Regional Market Share

Geographic Coverage of US Venture Capital Market

US Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Healthtech trends toward record-breaking year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry Type

- 5.1.1. Banking & Financial Services

- 5.1.2. Healthcare

- 5.1.3. Telecommunications

- 5.1.4. Government Agencies

- 5.1.5. Other Industries

- 5.2. Market Analysis, Insights and Forecast - by Startup Stage

- 5.2.1. Seed Stage

- 5.2.2. First Stage

- 5.2.3. Expansion Stage

- 5.2.4. Bridge Stage

- 5.3. Market Analysis, Insights and Forecast - by Major States

- 5.3.1. California

- 5.3.2. New York

- 5.3.3. Massachusettes

- 5.3.4. Washington

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Industry Type

- 6. North America US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Industry Type

- 6.1.1. Banking & Financial Services

- 6.1.2. Healthcare

- 6.1.3. Telecommunications

- 6.1.4. Government Agencies

- 6.1.5. Other Industries

- 6.2. Market Analysis, Insights and Forecast - by Startup Stage

- 6.2.1. Seed Stage

- 6.2.2. First Stage

- 6.2.3. Expansion Stage

- 6.2.4. Bridge Stage

- 6.3. Market Analysis, Insights and Forecast - by Major States

- 6.3.1. California

- 6.3.2. New York

- 6.3.3. Massachusettes

- 6.3.4. Washington

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Industry Type

- 7. South America US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Industry Type

- 7.1.1. Banking & Financial Services

- 7.1.2. Healthcare

- 7.1.3. Telecommunications

- 7.1.4. Government Agencies

- 7.1.5. Other Industries

- 7.2. Market Analysis, Insights and Forecast - by Startup Stage

- 7.2.1. Seed Stage

- 7.2.2. First Stage

- 7.2.3. Expansion Stage

- 7.2.4. Bridge Stage

- 7.3. Market Analysis, Insights and Forecast - by Major States

- 7.3.1. California

- 7.3.2. New York

- 7.3.3. Massachusettes

- 7.3.4. Washington

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Industry Type

- 8. Europe US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Industry Type

- 8.1.1. Banking & Financial Services

- 8.1.2. Healthcare

- 8.1.3. Telecommunications

- 8.1.4. Government Agencies

- 8.1.5. Other Industries

- 8.2. Market Analysis, Insights and Forecast - by Startup Stage

- 8.2.1. Seed Stage

- 8.2.2. First Stage

- 8.2.3. Expansion Stage

- 8.2.4. Bridge Stage

- 8.3. Market Analysis, Insights and Forecast - by Major States

- 8.3.1. California

- 8.3.2. New York

- 8.3.3. Massachusettes

- 8.3.4. Washington

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Industry Type

- 9. Middle East & Africa US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Industry Type

- 9.1.1. Banking & Financial Services

- 9.1.2. Healthcare

- 9.1.3. Telecommunications

- 9.1.4. Government Agencies

- 9.1.5. Other Industries

- 9.2. Market Analysis, Insights and Forecast - by Startup Stage

- 9.2.1. Seed Stage

- 9.2.2. First Stage

- 9.2.3. Expansion Stage

- 9.2.4. Bridge Stage

- 9.3. Market Analysis, Insights and Forecast - by Major States

- 9.3.1. California

- 9.3.2. New York

- 9.3.3. Massachusettes

- 9.3.4. Washington

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Industry Type

- 10. Asia Pacific US Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Industry Type

- 10.1.1. Banking & Financial Services

- 10.1.2. Healthcare

- 10.1.3. Telecommunications

- 10.1.4. Government Agencies

- 10.1.5. Other Industries

- 10.2. Market Analysis, Insights and Forecast - by Startup Stage

- 10.2.1. Seed Stage

- 10.2.2. First Stage

- 10.2.3. Expansion Stage

- 10.2.4. Bridge Stage

- 10.3. Market Analysis, Insights and Forecast - by Major States

- 10.3.1. California

- 10.3.2. New York

- 10.3.3. Massachusettes

- 10.3.4. Washington

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Industry Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intel Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tiger Global Management

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bessemer Venture

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kleiner Perkins

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 New Enterprise Associates (NEA)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accel Partners

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sequoia Capital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Khosla Ventures**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Intel Capital

List of Figures

- Figure 1: Global US Venture Capital Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Venture Capital Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 4: North America US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 5: North America US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 6: North America US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 7: North America US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 8: North America US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 9: North America US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 10: North America US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 11: North America US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 12: North America US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 13: North America US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 14: North America US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 15: North America US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 20: South America US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 21: South America US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 22: South America US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 23: South America US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 24: South America US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 25: South America US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 26: South America US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 27: South America US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 28: South America US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 29: South America US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 30: South America US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 31: South America US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: South America US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 36: Europe US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 37: Europe US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 38: Europe US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 39: Europe US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 40: Europe US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 41: Europe US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 42: Europe US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 43: Europe US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 44: Europe US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 45: Europe US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 46: Europe US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 47: Europe US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Europe US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 52: Middle East & Africa US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 53: Middle East & Africa US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 54: Middle East & Africa US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 55: Middle East & Africa US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 56: Middle East & Africa US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 57: Middle East & Africa US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 58: Middle East & Africa US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 59: Middle East & Africa US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 60: Middle East & Africa US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 61: Middle East & Africa US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 62: Middle East & Africa US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 63: Middle East & Africa US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: Middle East & Africa US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa US Venture Capital Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific US Venture Capital Market Revenue (Million), by Industry Type 2025 & 2033

- Figure 68: Asia Pacific US Venture Capital Market Volume (Trillion), by Industry Type 2025 & 2033

- Figure 69: Asia Pacific US Venture Capital Market Revenue Share (%), by Industry Type 2025 & 2033

- Figure 70: Asia Pacific US Venture Capital Market Volume Share (%), by Industry Type 2025 & 2033

- Figure 71: Asia Pacific US Venture Capital Market Revenue (Million), by Startup Stage 2025 & 2033

- Figure 72: Asia Pacific US Venture Capital Market Volume (Trillion), by Startup Stage 2025 & 2033

- Figure 73: Asia Pacific US Venture Capital Market Revenue Share (%), by Startup Stage 2025 & 2033

- Figure 74: Asia Pacific US Venture Capital Market Volume Share (%), by Startup Stage 2025 & 2033

- Figure 75: Asia Pacific US Venture Capital Market Revenue (Million), by Major States 2025 & 2033

- Figure 76: Asia Pacific US Venture Capital Market Volume (Trillion), by Major States 2025 & 2033

- Figure 77: Asia Pacific US Venture Capital Market Revenue Share (%), by Major States 2025 & 2033

- Figure 78: Asia Pacific US Venture Capital Market Volume Share (%), by Major States 2025 & 2033

- Figure 79: Asia Pacific US Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific US Venture Capital Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Asia Pacific US Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific US Venture Capital Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 2: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 3: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 4: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 5: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 6: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 7: Global US Venture Capital Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global US Venture Capital Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 10: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 11: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 12: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 13: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 14: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 15: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: United States US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Canada US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Mexico US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 24: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 25: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 26: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 27: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 28: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 29: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Brazil US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: Argentina US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 38: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 39: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 40: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 41: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 42: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 43: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Germany US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: France US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Italy US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Spain US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Russia US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: Benelux US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Nordics US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 64: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 65: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 66: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 67: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 68: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 69: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 71: Turkey US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Israel US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: GCC US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: North Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: South Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Global US Venture Capital Market Revenue Million Forecast, by Industry Type 2020 & 2033

- Table 84: Global US Venture Capital Market Volume Trillion Forecast, by Industry Type 2020 & 2033

- Table 85: Global US Venture Capital Market Revenue Million Forecast, by Startup Stage 2020 & 2033

- Table 86: Global US Venture Capital Market Volume Trillion Forecast, by Startup Stage 2020 & 2033

- Table 87: Global US Venture Capital Market Revenue Million Forecast, by Major States 2020 & 2033

- Table 88: Global US Venture Capital Market Volume Trillion Forecast, by Major States 2020 & 2033

- Table 89: Global US Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global US Venture Capital Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 91: China US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 93: India US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 95: Japan US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 97: South Korea US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 101: Oceania US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific US Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific US Venture Capital Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Venture Capital Market?

The projected CAGR is approximately 8.25%.

2. Which companies are prominent players in the US Venture Capital Market?

Key companies in the market include Intel Capital, Tiger Global Management, Bessemer Venture, Kleiner Perkins, New Enterprise Associates (NEA), Accel Partners, Sequoia Capital, Khosla Ventures**List Not Exhaustive.

3. What are the main segments of the US Venture Capital Market?

The market segments include Industry Type , Startup Stage , Major States .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.30 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Healthtech trends toward record-breaking year.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: NEA (New Enterprise Associates) announced it closed on approximately USD 6.2 billion across two funds, bringing the firm's assets under management to over USD 25 billion as of December 31, 2022. The new pair of funds marks a first for NEA, with one dedicated to early-stage investing and the other to venture growth-stage opportunities. It reflects the 45-year-old firm's continuous evolution of its model over decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Venture Capital Market?

To stay informed about further developments, trends, and reports in the US Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence