Key Insights

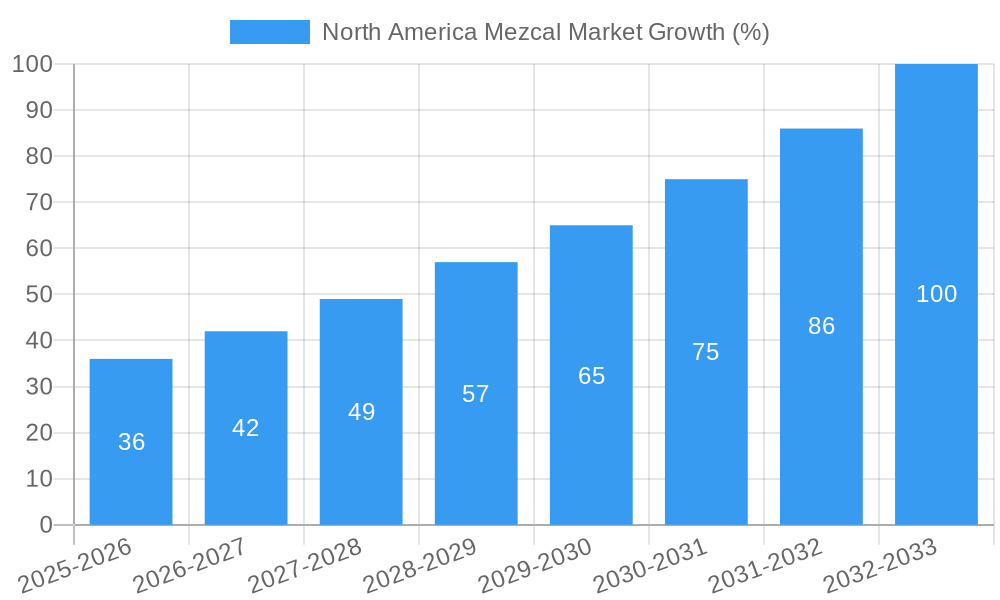

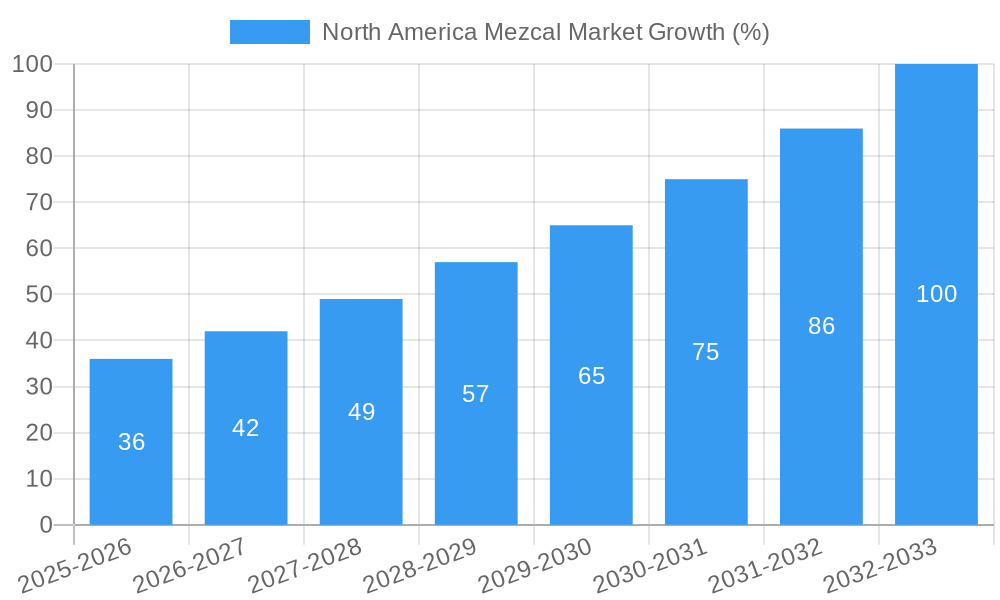

The North American mezcal market is experiencing robust growth, fueled by increasing consumer interest in premium spirits and authentic, handcrafted products. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 14.50% and a plausible starting point in 2019), is projected to expand significantly over the forecast period (2025-2033). This expansion is driven by several key factors. Firstly, the rising popularity of mezcal amongst millennial and Gen Z consumers, who are drawn to its unique flavor profile and artisanal production methods, is a significant contributor. Secondly, the increasing availability of mezcal in both on-trade (bars and restaurants) and off-trade (retail stores) channels is broadening its market reach. Furthermore, the growing number of craft distilleries and the rising demand for high-quality, premium spirits are boosting market growth. Finally, successful marketing campaigns emphasizing mezcal's heritage and cultural significance further solidify its position in the premium spirits market.

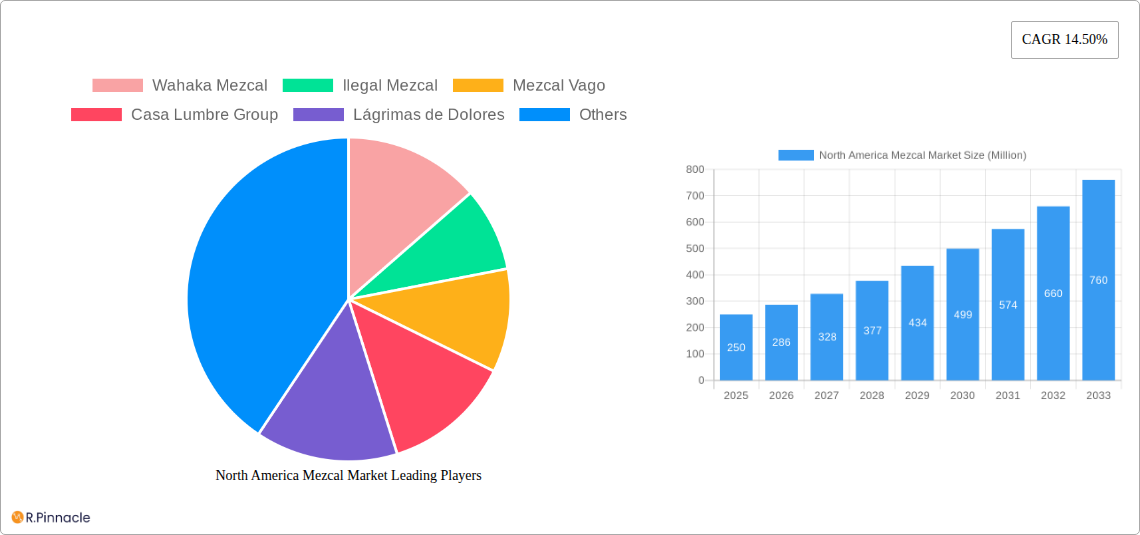

However, the market faces some challenges. Price sensitivity amongst a portion of the consumer base may limit wider adoption. Competition from other premium spirits, such as tequila and whiskey, also poses a threat. Furthermore, ensuring sustainable production practices and maintaining authenticity in the face of growing commercialization are crucial for long-term market stability. The segmentation reveals strong demand across various mezcal types, with Joven, Reposado, and Añejo likely dominating sales. The on-trade channel is vital for initial exposure and premium positioning, while the off-trade channel drives volume sales. Major players like Wahaka Mezcal and Ilegal Mezcal are leading the market, but the presence of larger global players like Pernod Ricard and Diageo signals a significant influx of investment and increased competition. This underscores a market poised for continued growth but requiring careful management of its unique characteristics and potential challenges.

North America Mezcal Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Mezcal market, offering invaluable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. This report leverages extensive market research and data analysis to provide a clear and actionable understanding of the current market landscape and future growth prospects. Expect in-depth analysis of market size (in Millions), key segments, leading players, and significant industry developments.

North America Mezcal Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North America Mezcal market, examining market concentration, innovation drivers, and regulatory factors. We delve into the dynamics of mergers and acquisitions (M&A), including deal values and their impact on market share. The report assesses the influence of product substitutes, end-user demographics, and prevailing regulatory frameworks. The market is characterized by a mix of established players and emerging brands, leading to a dynamic competitive environment. Market share data for key players like Wahaka Mezcal, Ilegal Mezcal, and Mezcal Vago will be provided, along with analysis of M&A activity and its influence on market consolidation. For example, the acquisition of a significant stake in Código 1530 Tequila by Pernod Ricard highlights the ongoing investment in the agave spirits category. The report also identifies key innovation drivers such as the growing demand for premium and artisanal mezcal, as well as the exploration of novel product variations like Cristalino mezcal. Regulatory changes impacting labeling, production, and distribution will also be considered.

North America Mezcal Market Dynamics & Trends

This section explores the key factors driving the growth of the North America Mezcal market. We will analyze market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape. The report will present a detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates for different segments. Factors influencing market growth include increasing consumer awareness of mezcal, the rise in popularity of premium spirits, and the growing demand for authentic and handcrafted products. Technological disruptions such as improved production techniques and innovative marketing strategies will be assessed. Furthermore, a deep dive into consumer preferences, including a preference for specific types of mezcal (Joven, Reposado, Añejo) and consumption habits, will be presented. The competitive dynamics will be explored, analyzing the strategies adopted by leading players to maintain their market positions.

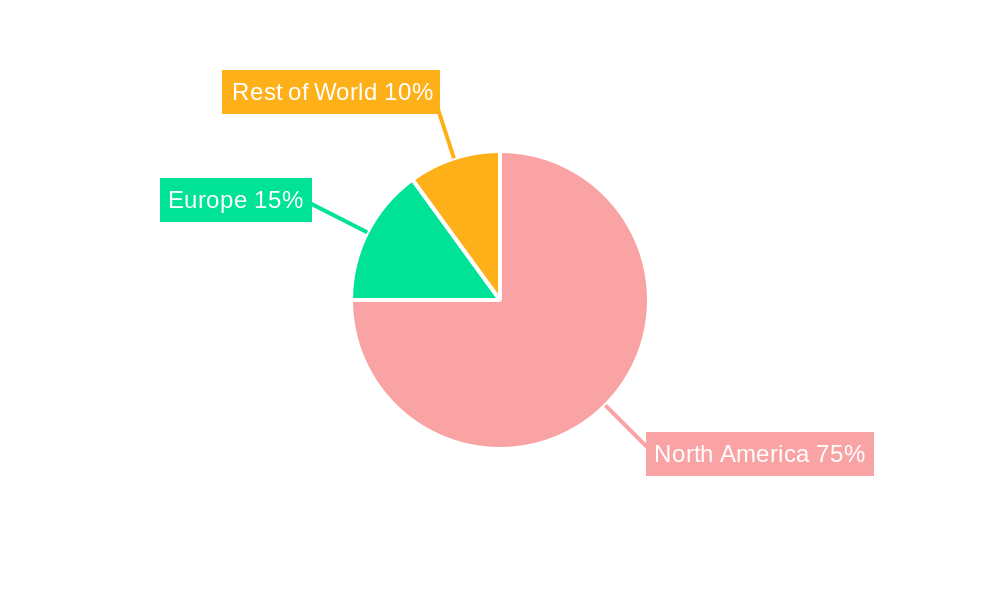

Dominant Regions & Segments in North America Mezcal Market

This section identifies the leading regions, countries, and segments within the North America Mezcal market. We will analyze dominance based on factors such as consumption patterns, consumer preferences, and economic indicators.

- Leading Region: [Region Name – e.g., The United States] will be highlighted due to [Reasons for dominance - e.g., higher disposable income, strong consumer demand, and established distribution networks].

- Leading Country: [Country Name – e.g., California] will be identified as a key market due to [Reasons for dominance - e.g., large consumer base, strong import infrastructure, and influential culinary culture].

- Dominant Segment (Type): [Segment Name - e.g., Mezcal Joven] is expected to be the leading type due to [Reasons for dominance - e.g., its lower price point and wide appeal to a broader consumer base].

- Dominant Segment (Distribution Channel): The [Segment Name - e.g., On-Trade Channel] is expected to hold a significant market share due to [Reasons for dominance - e.g., increased restaurant and bar sales].

The detailed analysis includes a discussion of economic policies, infrastructure, and other relevant factors that influence the dominance of specific regions, countries, and segments.

North America Mezcal Market Product Innovations

Recent product developments reflect a trend toward premiumization and diversification within the mezcal category. Casa Lumbre's launch of Contraluz, the first premium cristalino mezcal, showcases innovation in product types. The entry of new brands like The Producer, with its Ensamble and Tepeztate expressions, expands the range of available mezcals. These innovations cater to evolving consumer preferences for unique flavor profiles and high-quality spirits. Technological advancements in production and distillation methods are also driving product quality and efficiency.

Report Scope & Segmentation Analysis

This report segments the North America Mezcal market by type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Other Product Types) and distribution channel (On-Trade Channel, Off-Trade Channel).

Type: Each segment (Joven, Reposado, Añejo, Other) will have its market size, growth projections, and competitive landscape analyzed, highlighting variations in pricing, target consumer groups, and production techniques.

Distribution Channel: Analysis will distinguish between On-Trade (restaurants, bars) and Off-Trade (retail stores, online sales) channels, outlining unique characteristics of each and projected growth rates for each based on consumer behavior and market trends.

Key Drivers of North America Mezcal Market Growth

The growth of the North America Mezcal market is propelled by several factors. The increasing popularity of agave spirits amongst younger demographics is a significant driver. The rise in demand for premium and artisanal products, fuelled by growing disposable incomes, fuels market expansion. Positive media coverage, brand building by producers, and innovative marketing strategies play a vital role. Moreover, favorable regulatory environments in certain regions promote market growth.

Challenges in the North America Mezcal Market Sector

The North America Mezcal market faces challenges, including regulatory hurdles related to labeling, production standards, and import/export regulations. Supply chain disruptions, particularly those affecting the agave supply, can impact production volumes. Intense competition from established spirits brands and the emergence of new entrants pose a continuous threat to market share. Furthermore, educating consumers about mezcal and differentiating it from tequila requires ongoing marketing efforts.

Emerging Opportunities in North America Mezcal Market

The North America Mezcal market presents various opportunities. Untapped markets within the US and Canada offer significant potential for expansion. Technological advancements in sustainable agave farming and production processes enhance efficiency. Catering to evolving consumer preferences through product innovation (e.g., flavored mezcals, ready-to-drink cocktails) provides new avenues for growth. Furthermore, strategic partnerships with distributors and retailers can increase market penetration.

Leading Players in the North America Mezcal Market

- Wahaka Mezcal

- Ilegal Mezcal

- Mezcal Vago

- Casa Lumbre Group

- Lágrimas de Dolores

- William Grant & Sons Ltd

- Rey Campero

- El Silencio Holdings Inc

- The Producer

- Pernod Ricard

- Diageo PLC

Key Developments in North America Mezcal Market Industry

- September 2021: The Producer launched in the US market with its Ensamble and Tepeztate mezcals.

- July 2022: Casa Lumbre introduced Contraluz, a premium cristalino mezcal.

- October 2022: Pernod Ricard acquired a majority stake in Código 1530 Tequila, demonstrating further investment in the agave spirits category.

Future Outlook for North America Mezcal Market

The future outlook for the North America Mezcal market is positive, driven by continued growth in consumer demand, product innovation, and expanding distribution networks. Strategic partnerships, new product launches, and targeted marketing campaigns will shape the market's trajectory. The market's potential for expansion across different regions and demographics suggests significant growth opportunities in the coming years. The predicted CAGR for the forecast period (2025-2033) is xx%.

North America Mezcal Market Segmentation

-

1. Type

- 1.1. Mezcal Joven

- 1.2. Mezcal Reposado

- 1.3. Mezcal Anejo

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade Channel

- 2.2. Off-Trade Channel

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Mezcal Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Mezcal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Agave-based Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mezcal Joven

- 5.1.2. Mezcal Reposado

- 5.1.3. Mezcal Anejo

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade Channel

- 5.2.2. Off-Trade Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mezcal Joven

- 6.1.2. Mezcal Reposado

- 6.1.3. Mezcal Anejo

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade Channel

- 6.2.2. Off-Trade Channel

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mezcal Joven

- 7.1.2. Mezcal Reposado

- 7.1.3. Mezcal Anejo

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade Channel

- 7.2.2. Off-Trade Channel

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mezcal Joven

- 8.1.2. Mezcal Reposado

- 8.1.3. Mezcal Anejo

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade Channel

- 8.2.2. Off-Trade Channel

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mezcal Joven

- 9.1.2. Mezcal Reposado

- 9.1.3. Mezcal Anejo

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade Channel

- 9.2.2. Off-Trade Channel

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Wahaka Mezcal

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ilegal Mezcal

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Mezcal Vago

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Casa Lumbre Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Lágrimas de Dolores

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 William Grant & Sons Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Rey Campero

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 El Silencio Holdings Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 The Producer*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Pernod Ricard

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Diageo PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Wahaka Mezcal

List of Figures

- Figure 1: North America Mezcal Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mezcal Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 9: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 23: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 27: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 29: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 31: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 35: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 37: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 39: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 43: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 45: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 47: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 51: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mezcal Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the North America Mezcal Market?

Key companies in the market include Wahaka Mezcal, Ilegal Mezcal, Mezcal Vago, Casa Lumbre Group, Lágrimas de Dolores, William Grant & Sons Ltd, Rey Campero, El Silencio Holdings Inc, The Producer*List Not Exhaustive, Pernod Ricard, Diageo PLC.

3. What are the main segments of the North America Mezcal Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Popularity of Agave-based Beverages.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Pernod Ricard announced the signing of an agreement for the acquisition of a majority shareholding of Código 1530 Tequila, a range of Ultra-Premium and Prestige tequila. This new investment into the fast-growing agave category, mainly driven by the US market, complements the Group's very comprehensive portfolio across price points and occasions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mezcal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mezcal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mezcal Market?

To stay informed about further developments, trends, and reports in the North America Mezcal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence