Key Insights

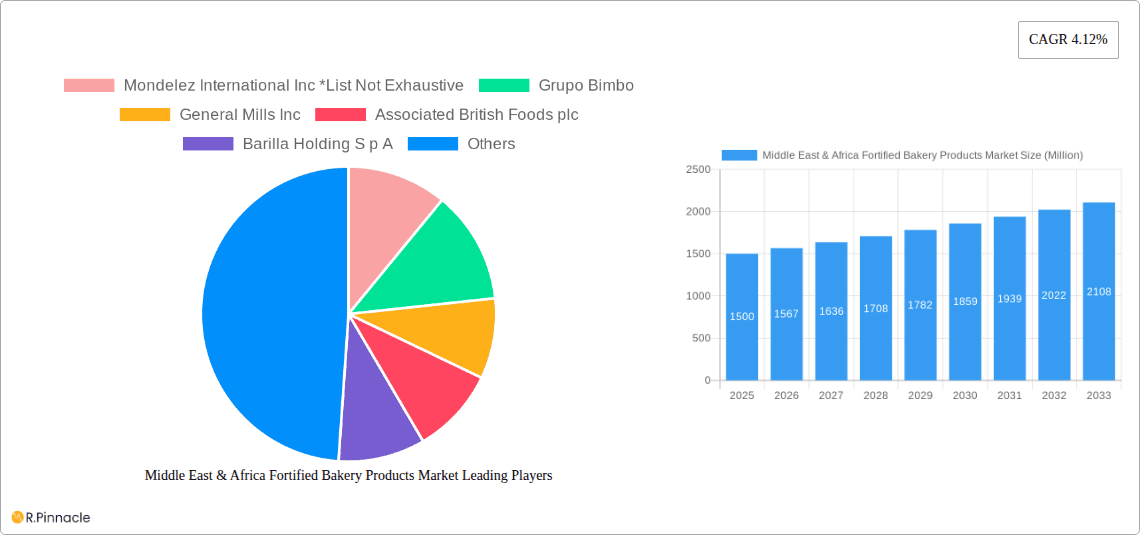

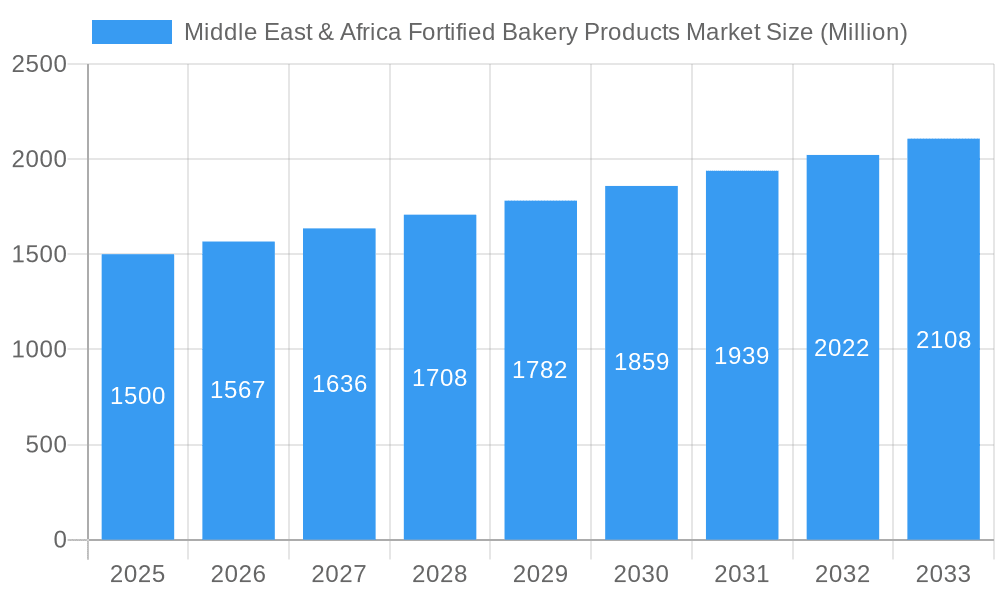

The Middle East & Africa fortified bakery products market is poised for significant expansion, driven by heightened consumer health awareness and the recognized nutritional advantages of fortified foods. The market, valued at 750.82 million in the base year of 2025, is projected to achieve a compound annual growth rate (CAGR) of 2.34% between 2025 and 2033. This growth trajectory is supported by a growing population, increasing disposable incomes across key regions, and the expanding product offerings from both international and regional bakery brands. Demand for convenient and nutritionally enhanced breakfast solutions, including fortified breads, cakes, and morning goods, is a primary growth catalyst. Government-led initiatives promoting nutritional well-being and addressing micronutrient deficiencies in specific populations also contribute to market expansion. Urban centers with higher purchasing power and well-established retail infrastructures, such as supermarkets and hypermarkets, are expected to lead growth, with convenience stores and online retail channels gaining increasing importance. Key challenges include price volatility of raw materials, adherence to diverse regulatory frameworks, and the enduring preference for traditional bakery items in certain cultural segments. Segmentation analysis indicates that cakes and biscuits currently command substantial market shares, while the morning goods category presents a strong growth outlook. Leading market participants, including Mondelez International, Grupo Bimbo, and Nestlé, are strategically prioritizing product innovation, distribution network enhancement, and localization of product offerings to capitalize on this dynamic market.

Middle East & Africa Fortified Bakery Products Market Market Size (In Million)

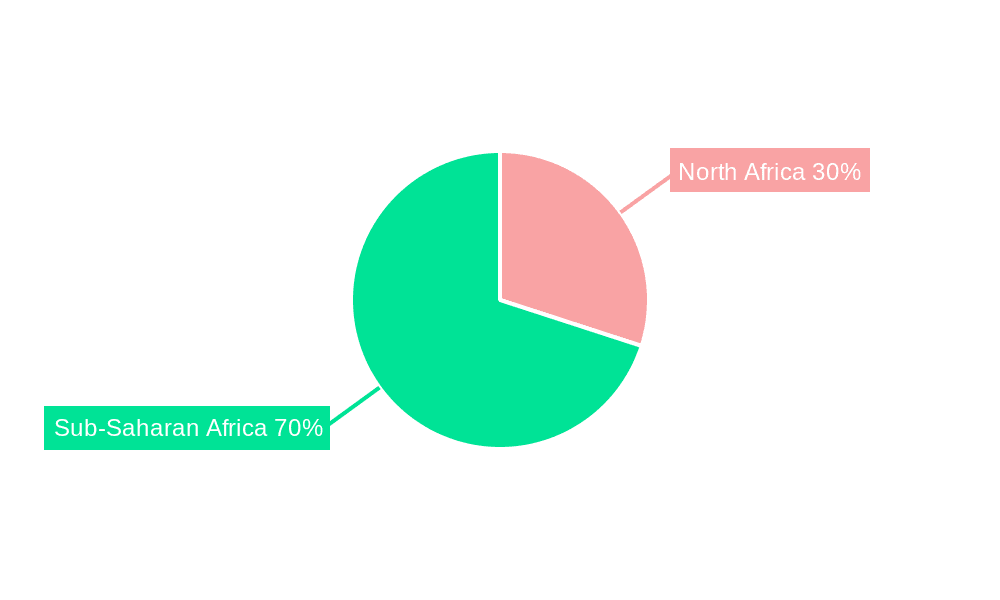

The competitive landscape features a blend of established multinational corporations and agile local enterprises. Multinational players leverage their strong brand equity and extensive distribution capabilities, while local companies benefit from deep insights into regional consumer preferences and cultural specificities. Future market development will be shaped by advancements in food fortification standards, efforts to streamline supply chains, and the continuous adaptation of product portfolios to meet the diverse needs of consumers across various socio-economic strata and geographic locations. Increasing emphasis on sustainable sourcing and environmentally responsible packaging is also becoming a critical factor in shaping market dynamics, responding to growing global environmental consciousness. Divergent growth rates are anticipated across regions, with accelerated expansion expected in economies experiencing rapid development and urbanization.

Middle East & Africa Fortified Bakery Products Market Company Market Share

Middle East & Africa Fortified Bakery Products Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East & Africa fortified bakery products market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, growth drivers, and future opportunities. The market is projected to reach xx Million by 2033, presenting significant growth potential.

Middle East & Africa Fortified Bakery Products Market Structure & Innovation Trends

This section analyzes the market structure, focusing on concentration levels, innovation drivers, regulatory landscapes, substitute products, end-user demographics, and mergers & acquisitions (M&A) activity. We explore the competitive landscape, assessing market share held by key players like Mondelez International Inc, Grupo Bimbo, and General Mills Inc, among others. The report also quantifies M&A activity with deal values and assesses their impact on market dynamics. The analysis includes:

- Market Concentration: Analysis of the market share distribution among major players and the presence of smaller niche players. The Herfindahl-Hirschman Index (HHI) or similar metric will be used to quantify market concentration.

- Innovation Drivers: Examination of factors driving innovation, such as consumer demand for healthier products, technological advancements in food fortification, and changing dietary habits.

- Regulatory Frameworks: Analysis of relevant regulations and standards impacting the production and sale of fortified bakery products across the region. This includes food safety regulations and labeling requirements.

- Product Substitutes: Identification and analysis of substitute products and their potential impact on market growth.

- End-User Demographics: Segmentation of end-users based on factors such as age, income level, and dietary preferences.

- M&A Activities: Detailed analysis of significant M&A deals in the market, including transaction values and their impact on market competition and consolidation. Examples include the Almarai acquisition of Bakemart.

Middle East & Africa Fortified Bakery Products Market Dynamics & Trends

This section delves into the key market dynamics, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics. It presents a detailed analysis of market trends, providing insights into the Compound Annual Growth Rate (CAGR) and market penetration rates across various segments. The report will analyze:

- Market Growth Drivers: Factors such as increasing health awareness, rising disposable incomes, and changing lifestyle patterns driving market growth.

- Technological Disruptions: Impact of new technologies in areas such as food fortification, production efficiency, and distribution.

- Consumer Preferences: Analysis of evolving consumer preferences, including demand for specific product types, ingredients, and health benefits.

- Competitive Dynamics: Assessment of competitive strategies employed by major players, such as product differentiation, pricing strategies, and brand building.

Dominant Regions & Segments in Middle East & Africa Fortified Bakery Products Market

This section identifies the leading regions, countries, and product segments within the market. It provides a granular analysis of the factors driving dominance in each segment, utilizing both bullet points and paragraphs to present a clear picture.

By Product Type:

- Bread: Analysis of market size and growth drivers for fortified bread products, highlighting regional variations and key trends.

- Biscuits: Similar analysis for fortified biscuits, focusing on popular varieties and consumer preferences.

- Cake: Market analysis for fortified cakes, emphasizing variations in taste and consumer demand.

- Morning Goods: Analysis of fortified breakfast goods, such as cereals and pastries.

- Others: Analysis of other fortified bakery products that do not fit into the above categories.

By Distribution Channel:

- Supermarkets/Hypermarkets: Analysis of market share and growth potential through this channel, focusing on factors such as retailer strategies and consumer behavior.

- Convenience Stores: Analysis of the convenience store segment, highlighting its importance and growth potential.

- Specialty Stores: Analysis of specialty stores' contribution, considering their niche focus and target audiences.

- Online Retail Stores: Analysis of e-commerce's role in the market and future expansion possibilities.

- Other Distribution Channels: Analysis of any other relevant distribution channels.

Key Drivers (Examples): Economic growth, urbanization, rising disposable incomes, increasing health consciousness, government initiatives promoting food fortification.

Middle East & Africa Fortified Bakery Products Market Product Innovations

This section briefly summarizes recent product developments, highlighting technological trends and market fit. The discussion will focus on new product launches, innovative fortification methods, and improvements in product quality and shelf life.

Report Scope & Segmentation Analysis

This section details the market segmentation by product type (Cake, Biscuits, Bread, Morning Goods, Others) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Other Distribution Channels). It provides growth projections, market sizes, and an overview of the competitive dynamics within each segment. Each paragraph will cover a specific segment, detailing its characteristics, growth drivers, and challenges.

Key Drivers of Middle East & Africa Fortified Bakery Products Market Growth

This section outlines the key factors driving market growth, including technological advancements (e.g., improved fortification techniques), economic factors (e.g., rising disposable incomes), and regulatory changes (e.g., government initiatives promoting food fortification).

Challenges in the Middle East & Africa Fortified Bakery Products Market Sector

This section addresses the significant challenges hindering market growth, such as regulatory hurdles, supply chain complexities, and intense competition. Quantifiable impacts of these challenges will be provided where possible.

Emerging Opportunities in Middle East & Africa Fortified Bakery Products Market

This section highlights the emerging trends and opportunities, focusing on new markets, technological innovations, and evolving consumer preferences.

Leading Players in the Middle East & Africa Fortified Bakery Products Market Market

- Mondelez International Inc

- Grupo Bimbo

- General Mills Inc

- Associated British Foods plc

- Barilla Holding S p A

- Dunkin' Donuts LLC

- Britannia Industries

- Dawn Food Products Inc

- Nestlé S.A.

- PepsiCo Inc.

Key Developments in Middle East & Africa Fortified Bakery Products Market Industry

- October 2021: Tate & Lyle opens a USD 2 Million technical application center in Dubai to support local bakery producers.

- March 2021: Almarai acquires Bakemart's operations in the UAE and Bahrain.

- July 2020: Puratos Group invests in production facilities in Kenya, Ivory Coast, Ethiopia, and Nigeria.

Future Outlook for Middle East & Africa Fortified Bakery Products Market Market

This section summarizes the growth accelerators and provides a concise outlook on the market's future potential and strategic opportunities. It will address the long-term prospects for growth based on the trends and developments discussed throughout the report.

Middle East & Africa Fortified Bakery Products Market Segmentation

-

1. Product Type

- 1.1. Cake

- 1.2. Biscuits

- 1.3. Bread

- 1.4. Morning Goods

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Rest of Middle East and Africa

Middle East & Africa Fortified Bakery Products Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East & Africa Fortified Bakery Products Market Regional Market Share

Geographic Coverage of Middle East & Africa Fortified Bakery Products Market

Middle East & Africa Fortified Bakery Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Trend of Consuming Healthy Food Among the Health-Conscious Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Fortified Bakery Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cake

- 5.1.2. Biscuits

- 5.1.3. Bread

- 5.1.4. Morning Goods

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East & Africa Fortified Bakery Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cake

- 6.1.2. Biscuits

- 6.1.3. Bread

- 6.1.4. Morning Goods

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East & Africa Fortified Bakery Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cake

- 7.1.2. Biscuits

- 7.1.3. Bread

- 7.1.4. Morning Goods

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa Middle East & Africa Fortified Bakery Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cake

- 8.1.2. Biscuits

- 8.1.3. Bread

- 8.1.4. Morning Goods

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Mondelez International Inc *List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Grupo Bimbo

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Mills Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Associated British Foods plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Barilla Holding S p A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dunkin' Donuts LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Britannia Industries

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dawn Food Products Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nestlé S.A.

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 PepsiCo Inc.

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Mondelez International Inc *List Not Exhaustive

List of Figures

- Figure 1: Middle East & Africa Fortified Bakery Products Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Fortified Bakery Products Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 26: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Middle East & Africa Fortified Bakery Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Middle East & Africa Fortified Bakery Products Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Fortified Bakery Products Market?

The projected CAGR is approximately 2.34%.

2. Which companies are prominent players in the Middle East & Africa Fortified Bakery Products Market?

Key companies in the market include Mondelez International Inc *List Not Exhaustive, Grupo Bimbo, General Mills Inc, Associated British Foods plc, Barilla Holding S p A, Dunkin' Donuts LLC, Britannia Industries, Dawn Food Products Inc, Nestlé S.A., PepsiCo Inc..

3. What are the main segments of the Middle East & Africa Fortified Bakery Products Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 750.82 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Trend of Consuming Healthy Food Among the Health-Conscious Population.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

In October 2021, Tate & Lyle's has opened a USD 2 million technical application centre in Dubai, designed to help local producers in bakery and other segments to develop formulations that addresses the growing consumer demand in the region. The Dubai centre is setup to help the food industry with its expertise in sweetening, mouthfeel and fibre fortification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Fortified Bakery Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Fortified Bakery Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Fortified Bakery Products Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Fortified Bakery Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence