Key Insights

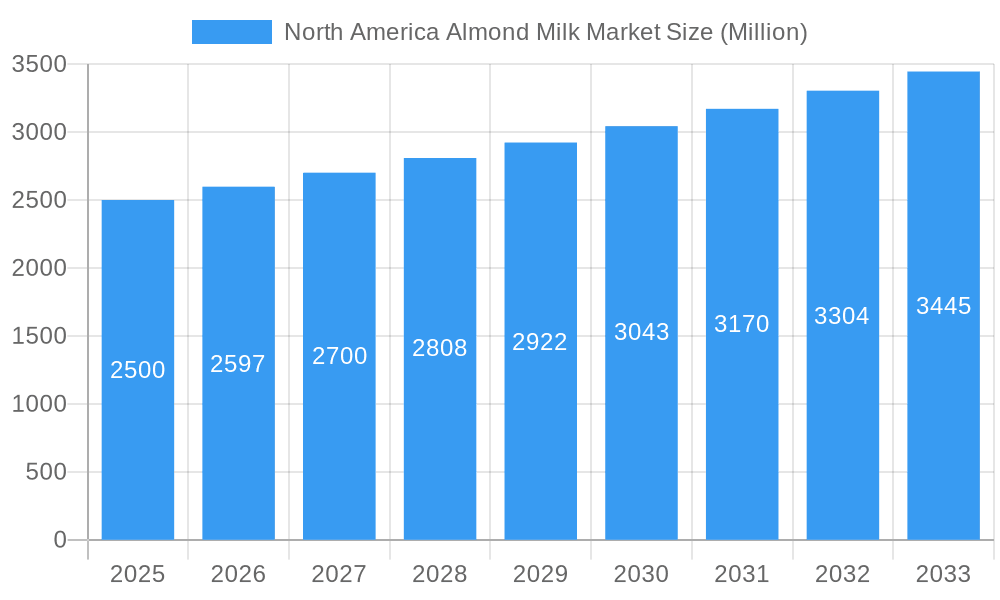

The North American almond milk market, valued at $30.19 billion in 2025 (base year), is projected for robust expansion with a CAGR of 3.74% from 2025 to 2033. This growth is primarily driven by escalating consumer demand for plant-based alternatives, spurred by health consciousness, lactose intolerance, and ethical considerations. The rise of vegan and flexitarian diets further fuels this trend. Product innovation, including new flavors, nutritional fortification, and enhanced textures, also contributes significantly. The "on-trade" distribution channel, encompassing cafes and restaurants, presents substantial growth opportunities due to the increasing integration of almond milk into diverse menu offerings.

North America Almond Milk Market Market Size (In Billion)

Key market restraints include almond price volatility, impacting production costs and consumer pricing. Competition from other plant-based milk alternatives, such as soy, oat, and pea milk, poses a challenge to market share. Manufacturers must prioritize sustainable sourcing to manage price fluctuations and foster continuous innovation to maintain a competitive advantage in the evolving plant-based beverage sector. Market segmentation indicates a strong preference for sweetened almond milk, with unsweetened varieties experiencing significant growth among health-conscious consumers. Leading players like Hiland Dairy Foods, Califia Farms, and Blue Diamond Growers are actively pursuing market dominance through product diversification and strategic marketing. The United States remains the dominant market for almond milk consumption within North America.

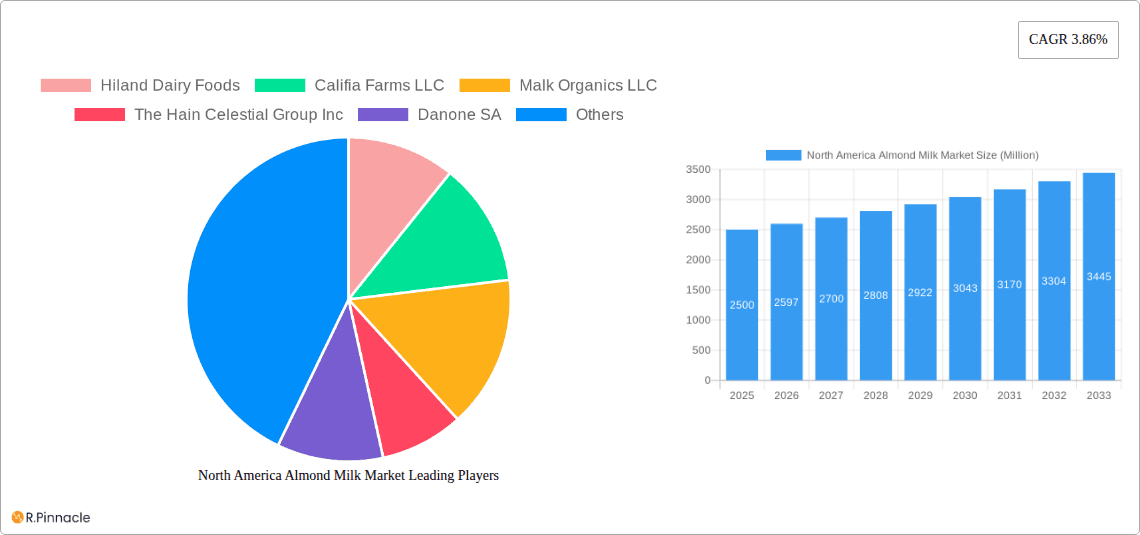

North America Almond Milk Market Company Market Share

North America Almond Milk Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America almond milk market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to understand market dynamics, competitive landscapes, and future growth opportunities. The report leverages extensive data analysis and expert insights to offer actionable strategies for success in this rapidly evolving market.

North America Almond Milk Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American almond milk market, examining market concentration, key innovation drivers, regulatory frameworks, and the impact of product substitutes. The analysis covers the period from 2019 to 2024, providing a historical perspective for forecasting future trends.

Market Concentration: The market exhibits a [xx]% market concentration with the top 5 players—Hiland Dairy Foods, Califia Farms LLC, Malk Organics LLC, The Hain Celestial Group Inc, and Danone SA—holding a combined [xx]% market share in 2024. This concentration is expected to [increase/decrease] slightly by 2033.

Innovation Drivers: Key drivers include the rising demand for plant-based alternatives, increasing health consciousness among consumers, and ongoing product innovation (e.g., new flavors, functional ingredients, and sustainable packaging).

Regulatory Framework: Government regulations regarding labeling, food safety, and sustainability are shaping the industry. These regulations are likely to become more stringent in the coming years, influencing market players’ strategies.

Product Substitutes: Competition from other plant-based milk alternatives (e.g., soy milk, oat milk) is intense and impacts market share. However, almond milk maintains a strong position due to its taste and nutritional profile.

End-User Demographics: The primary consumers are millennials and Gen Z, who exhibit a strong preference for plant-based foods and beverages.

M&A Activities: The almond milk market has witnessed several mergers and acquisitions in recent years. Total M&A deal value from 2019 to 2024 amounted to approximately [xx] Million USD, with significant activity expected to continue into the forecast period.

North America Almond Milk Market Market Dynamics & Trends

This section delves into the key market dynamics driving growth and shaping the future of the North American almond milk market. The analysis incorporates a detailed examination of market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape. The report projects a Compound Annual Growth Rate (CAGR) of [xx]% from 2025 to 2033, with market penetration reaching [xx]% by 2033.

(600 words of detailed analysis on market growth drivers, technological disruptions, consumer preferences, and competitive dynamics would be inserted here. This would include specific data points and trends related to market size, CAGR, consumer behavior, and competitive actions.)

Dominant Regions & Segments in North America Almond Milk Market

This section identifies the leading regions and segments within the North American almond milk market, examining factors driving their dominance.

Dominant Region: [Insert dominant region, e.g., Western US]

- Key Drivers: Strong consumer demand for plant-based products, high disposable income, established distribution networks, and presence of major manufacturers.

(Detailed paragraph explaining the dominance of the selected region would follow here, discussing factors like consumer behavior, economic conditions, and market access).

Dominant Segment (Distribution Channel): [Insert dominant channel, e.g., Off-Trade]

- Key Drivers: Extensive retail presence, convenience, and greater product visibility.

(Detailed paragraph explaining dominance within the Off-Trade channel would follow, addressing factors like consumer purchasing habits, retail strategies, and market access).

Dominant Segment (Product Type): [Insert dominant type, e.g., Unsweetened Almond Milk]

- Key Drivers: Growing health consciousness, preference for less added sugar, and increasing demand from health-conscious consumers.

(Detailed paragraph explaining dominance within the Unsweetened Almond Milk segment would follow, addressing factors such as health trends, consumer preferences, and market positioning).

North America Almond Milk Market Product Innovations

The North American almond milk market is characterized by continuous product innovation, focusing on enhancing taste, texture, and nutritional value. New product launches frequently incorporate novel ingredients (e.g., added proteins, vitamins, and minerals), improved formulations (e.g., creamier textures), and sustainable packaging solutions. These innovations aim to cater to evolving consumer preferences and maintain a competitive edge within the crowded market. Technological advancements in processing and packaging are pivotal to improving efficiency and sustainability.

Report Scope & Segmentation Analysis

This report segments the North American almond milk market based on distribution channel (off-trade and on-trade) and product type (sweetened and unsweetened almond milk). Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed. The off-trade channel is predicted to hold a larger market share than the on-trade channel throughout the forecast period. Similarly, unsweetened almond milk is expected to witness higher growth compared to sweetened almond milk due to increasing health consciousness.

Key Drivers of North America Almond Milk Market Growth

Several key factors contribute to the growth of the North American almond milk market. These include: the rising adoption of vegan and vegetarian lifestyles; growing awareness of the health benefits of almond milk, such as its lower fat and cholesterol content compared to dairy milk; increasing demand for convenient and readily available plant-based milk alternatives; and the development of new and innovative almond milk products to cater to diverse consumer preferences.

Challenges in the North America Almond Milk Market Sector

The North America almond milk market faces certain challenges. These include: increasing competition from other plant-based milk alternatives; fluctuations in almond prices which can impact profitability; stringent regulatory requirements for food labeling and safety; and concerns regarding the environmental impact of almond cultivation. These factors can impact overall market growth and profitability.

Emerging Opportunities in North America Almond Milk Market

Emerging opportunities include: the growing demand for functional almond milk fortified with vitamins, minerals, and probiotics; expansion into new geographic markets; development of novel almond milk-based products (e.g., almond milk yogurt, ice cream); and the increasing focus on sustainability in production and packaging.

Leading Players in the North America Almond Milk Market Market

- Hiland Dairy Foods

- Califia Farms LLC

- Malk Organics LLC

- The Hain Celestial Group Inc

- Danone SA

- Blue Diamond Growers

- Elmhurst Milked LLC

- Campbell Soup Company

- Agrifoods International Cooperative Ltd

- SunOpta Inc

Key Developments in North America Almond Milk Market Industry

- January 2022: Danone North America introduced Silk Extra Creamy Almondmilk.

- April 2022: Califia Farms launched Unsweetened Almond Barista Blend.

- October 2022: SunOpta Inc. completed phase one of a USD 100 Million sterile alternative milk plant.

Future Outlook for North America Almond Milk Market Market

The North American almond milk market is poised for robust growth in the coming years, driven by increasing consumer demand for plant-based alternatives and continuous product innovation. Strategic partnerships, expansion into new markets, and a strong focus on sustainability will be crucial for success in this dynamic sector. The market's future potential is significant, with ample opportunities for both established players and new entrants.

North America Almond Milk Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

-

1.1.1. By Sub Distribution Channels

- 1.1.1.1. Convenience Stores

- 1.1.1.2. Online Retail

- 1.1.1.3. Specialist Retailers

- 1.1.1.4. Supermarkets and Hypermarkets

- 1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

1.1.1. By Sub Distribution Channels

- 1.2. On-Trade

-

1.1. Off-Trade

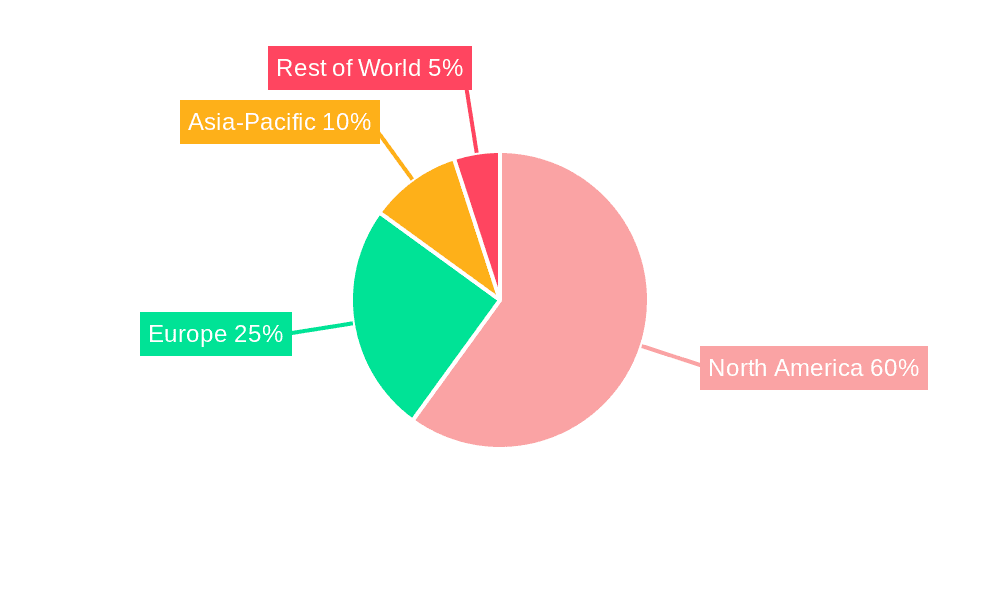

North America Almond Milk Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Almond Milk Market Regional Market Share

Geographic Coverage of North America Almond Milk Market

North America Almond Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry

- 3.3. Market Restrains

- 3.3.1. Competition from Other Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Almond Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. By Sub Distribution Channels

- 5.1.1.1.1. Convenience Stores

- 5.1.1.1.2. Online Retail

- 5.1.1.1.3. Specialist Retailers

- 5.1.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.1.1. By Sub Distribution Channels

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hiland Dairy Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Califia Farms LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Malk Organics LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Hain Celestial Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blue Diamond Growers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elmhurst Milked LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Campbell Soup Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agrifoods International Cooperative Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SunOpta Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hiland Dairy Foods

List of Figures

- Figure 1: North America Almond Milk Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Almond Milk Market Share (%) by Company 2025

List of Tables

- Table 1: North America Almond Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: North America Almond Milk Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Almond Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Almond Milk Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Almond Milk Market?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the North America Almond Milk Market?

Key companies in the market include Hiland Dairy Foods, Califia Farms LLC, Malk Organics LLC, The Hain Celestial Group Inc, Danone SA, Blue Diamond Growers, Elmhurst Milked LLC, Campbell Soup Company, Agrifoods International Cooperative Ltd, SunOpta Inc.

3. What are the main segments of the North America Almond Milk Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Other Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: SunOpta Inc. completed the first phase of a USD 100 million sterile alternative milk plant in Midlothian to manufacture sustainable milk and food products.April 2022: Califia Farms launched the Unsweetened Almond Barista Blend, which contains calcium and vitamin D.January 2022: Danone North America introduced a new addition to its almond milk portfolio named Silk Extra Creamy Almondmilk, featuring a blend of three types of almonds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Almond Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Almond Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Almond Milk Market?

To stay informed about further developments, trends, and reports in the North America Almond Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence