Key Insights

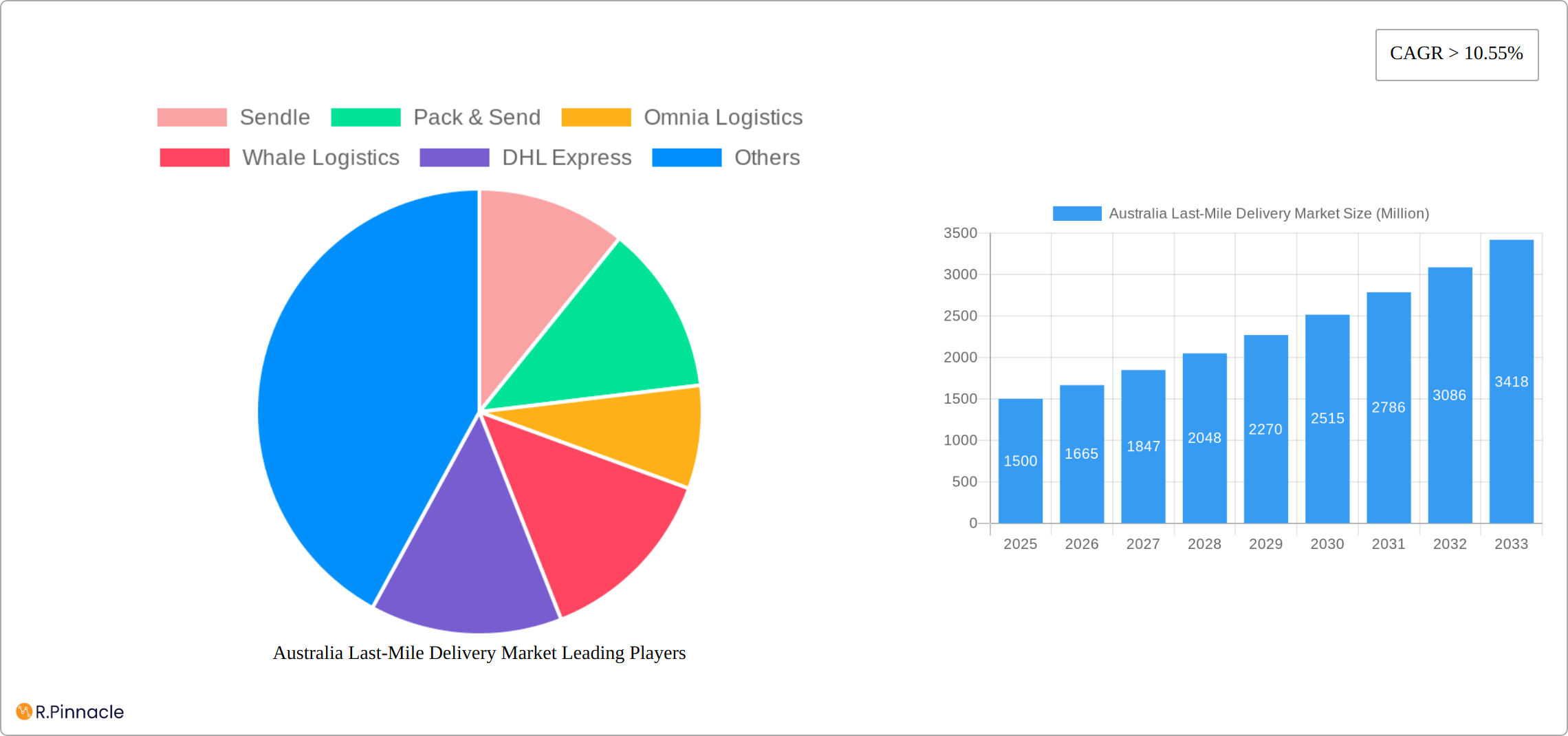

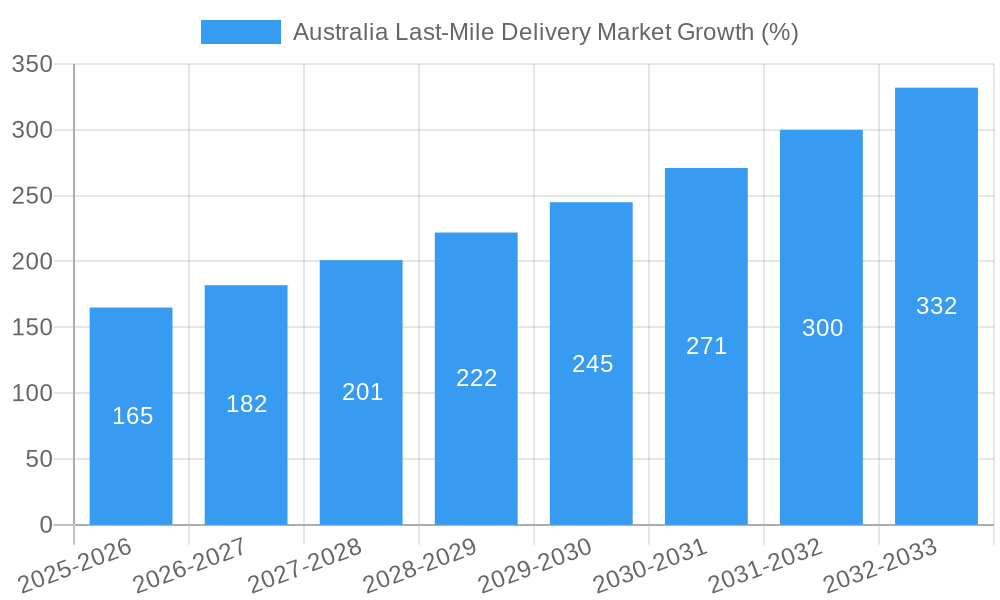

The Australian last-mile delivery market, valued at approximately $XX million in 2025, is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 10.55% from 2025 to 2033. This expansion is fueled by several key drivers. The rise of e-commerce continues to be a primary catalyst, pushing demand for efficient and reliable delivery solutions. Increasing consumer expectations for faster delivery options, such as same-day and express services, are further stimulating market growth. Furthermore, advancements in logistics technology, including route optimization software and delivery management systems, are enhancing operational efficiency and reducing costs for delivery providers. The market is segmented by delivery mode (regular, same-day, express) and business type (B2B, B2C, C2C), reflecting the diverse needs of various customer segments. While the market faces challenges, such as increasing fuel costs and labor shortages, the strong underlying growth of e-commerce and the ongoing investment in technological improvements suggest a positive outlook for the foreseeable future. Competitive intensity is high, with major players like Australia Post, DHL Express, FedEx Express Australia, and numerous smaller, specialized providers vying for market share. This competitive landscape fosters innovation and drives down costs for consumers.

The Australian last-mile delivery market’s projected growth is particularly influenced by the flourishing e-commerce sector. The increasing prevalence of online shopping, driven by factors like convenience and broader product availability, is significantly increasing the volume of parcels needing last-mile delivery. The expansion of urban areas and the growing preference for home deliveries further contribute to the market’s dynamism. Strategic alliances and partnerships between delivery companies and retailers are becoming more common, enhancing supply chain efficiency and customer satisfaction. Moreover, the growing adoption of sustainable practices in logistics, driven by environmental concerns, is influencing market players to adopt eco-friendly delivery methods and vehicles. The projected market value for 2033 can be estimated by applying the CAGR to the 2025 base value, providing a significant increase in overall market size. However, the specific growth rate may fluctuate based on several macroeconomic and industry-specific factors.

Australia Last-Mile Delivery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian last-mile delivery market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth prospects. The Australian last-mile delivery market is experiencing significant transformation, driven by e-commerce growth, technological advancements, and evolving consumer expectations. This report unpacks these trends and provides actionable intelligence for navigating this dynamic landscape.

Australia Last-Mile Delivery Market Market Structure & Innovation Trends

The Australian last-mile delivery market is a dynamic and evolving ecosystem, characterized by a blend of established national postal services, large multinational logistics providers, and agile, specialized couriers. Market concentration is moderately high, with a few key players dominating significant portions of the market, particularly in urban centers. However, a vibrant landscape of smaller, niche operators continually emerges, catering to specific regional needs or specialized delivery requirements. Innovation is the primary catalyst for change, driven by the relentless pursuit of greater efficiency, enhanced customer experience, and reduced operational costs. Technological advancements are at the forefront, enabling new business models and service offerings.

- Market Concentration: While proprietary data makes precise market share figures elusive, it's evident that Australia Post, alongside major international players like DHL and FedEx, holds a substantial share. The remaining market is fragmented among numerous smaller, often regional, operators, fostering intense competition for specific routes and service types.

- Innovation Drivers: The core drivers of innovation are technological advancements and shifting consumer expectations. Key areas include:

- AI and Data Analytics: For sophisticated route optimization, predictive delivery windows, and demand forecasting.

- Automation: Including autonomous delivery vehicles and drones for specific use cases, as well as warehouse automation to speed up dispatch.

- Sustainable Logistics: The growing demand for eco-friendly delivery options is pushing investment in electric vehicle fleets and optimized routing to minimize emissions.

- Customer Experience Technologies: Real-time tracking, flexible delivery options, and seamless communication platforms are becoming standard expectations.

- Regulatory Frameworks: The regulatory environment plays a crucial role, shaping operational possibilities and costs. Key considerations include:

- Licensing and Permitting: Varying requirements for different types of vehicles and delivery operations across states and territories.

- Safety Standards: Regulations pertaining to vehicle roadworthiness and the safety of delivery personnel.

- Data Privacy: Increasingly stringent rules governing the collection and use of customer data for delivery management.

- Environmental Regulations: Initiatives aimed at reducing emissions and promoting sustainable practices.

- Product Substitutes: The rise of e-commerce has spurred the growth of alternative fulfillment models. Prominent substitutes include:

- Click-and-Collect/In-Store Pickup: Offering consumers convenience and immediate access to goods.

- Locker Services: Secure, self-service pickup points that provide flexibility and reduce missed deliveries.

- Local Courier Networks: Hyperlocal delivery services that can offer rapid fulfillment for nearby purchases.

- End-User Demographics: The Australian last-mile delivery market serves a broad spectrum of clients:

- B2C (Business-to-Consumer): The largest and fastest-growing segment, driven by e-commerce.

- B2B (Business-to-Business): Delivering goods between businesses, including supply chain logistics.

- C2C (Consumer-to-Consumer): Facilitating peer-to-peer deliveries, often through online marketplaces.

- M&A Activities: The market has seen strategic consolidation and acquisition as companies aim to scale operations, expand geographical reach, and integrate new technologies. These activities are driven by the desire to capture a larger market share, achieve economies of scale, and gain access to innovative solutions. Deal values, while often undisclosed for competitive reasons, reflect significant investment in the sector.

Australia Last-Mile Delivery Market Market Dynamics & Trends

This section delves into the key market dynamics and trends influencing the Australian last-mile delivery market. The market is characterized by strong growth, driven by several factors.

The CAGR for the period 2025-2033 is projected at xx%, reflecting strong growth fueled by the expanding e-commerce sector, increasing consumer demand for faster delivery options, and continuous technological advancements. Market penetration of same-day and express delivery services is also increasing steadily, reaching an estimated xx% in 2025. Competitive dynamics are intense, with companies vying for market share through price competitiveness, service differentiation, and technological innovation. Consumer preferences are shifting towards faster, more convenient, and trackable delivery options. Technological disruptions, such as the rise of autonomous vehicles and drone delivery, are anticipated to significantly reshape the industry.

Dominant Regions & Segments in Australia Last-Mile Delivery Market

This section identifies the leading regions and segments within the Australian last-mile delivery market. The analysis considers factors like population density, economic activity, and infrastructure development.

By Delivery Mode:

- Regular Delivery: This segment remains the largest, driven by consistent demand for standard delivery services across various industries.

- Same-day Delivery: This segment is experiencing rapid growth fueled by increasing consumer demand for immediate delivery of goods and services. Major metropolitan areas are driving this growth.

- Express Delivery: This segment caters to time-sensitive deliveries and is crucial for industries such as healthcare and logistics.

By Type:

- B2C: This segment dominates the market, reflecting the surge in online shopping and e-commerce activities.

- B2B: This segment experiences steady growth, driven by businesses relying on efficient delivery of goods and materials.

- C2C: This segment shows moderate growth, fueled by peer-to-peer transactions and marketplace platforms.

Dominant Regions: Major metropolitan areas such as Sydney, Melbourne, Brisbane, and Perth are the most dominant regions, owing to high population densities, strong e-commerce activity, and advanced infrastructure. Rural and remote areas pose unique challenges due to logistical complexities and infrastructure limitations.

Australia Last-Mile Delivery Market Product Innovations

Product innovation in the Australian last-mile delivery market is heavily influenced by technological advancements and the imperative to enhance speed, efficiency, and sustainability. Companies are actively investing in and deploying a range of cutting-edge solutions to gain a competitive edge and meet the escalating demands of consumers and businesses. These innovations aim to optimize every stage of the last mile, from dispatch to final delivery.

Key areas of product innovation include:

- Advanced Route Optimization: Leveraging Artificial Intelligence (AI) and machine learning algorithms to dynamically plan the most efficient delivery routes, considering real-time traffic, weather conditions, and delivery priorities. This leads to reduced travel times, lower fuel consumption, and faster deliveries.

- Real-Time Tracking and Visibility: Providing customers and businesses with precise, up-to-the-minute tracking of their shipments. This enhances transparency, reduces customer inquiries, and allows for proactive management of potential delays.

- Sustainable Delivery Solutions: A significant focus is placed on reducing the environmental impact of last-mile operations. This includes the widespread adoption of electric vehicles (EVs), the use of eco-friendly packaging, and optimized route planning to minimize carbon emissions.

- Smart Lockers and Parcel Terminals: The deployment of secure, automated parcel lockers in convenient locations offers customers flexibility in picking up their deliveries at any time, reducing missed delivery attempts and associated costs.

- Automated Delivery Systems: While still in developmental stages for widespread use, autonomous delivery vehicles and drones are being piloted and explored for specific applications, promising future enhancements in speed and cost-effectiveness, particularly in less congested areas or for urgent deliveries.

- Data-Driven Insights: Utilizing data analytics to understand delivery patterns, customer preferences, and operational bottlenecks. This information is crucial for continuous improvement and the development of more tailored service offerings.

These innovations are not merely incremental improvements; they are fundamentally reshaping how goods are delivered, leading to improved operational efficiency, enhanced customer satisfaction, and a more sustainable logistics industry.

Report Scope & Segmentation Analysis

This report offers a comprehensive examination of the Australian last-mile delivery market, providing in-depth analysis across key segmentation dimensions. The objective is to equip stakeholders with a granular understanding of market dynamics, growth trajectories, and competitive landscapes within specific segments.

The market is segmented based on the following criteria:

- Delivery Mode:

- Regular Delivery: Standard delivery services with typical transit times.

- Same-Day Delivery: Expedited services focused on delivering within the same business day.

- Express Delivery: High-priority services designed for rapid fulfillment, often within hours.

- Type:

- B2B (Business-to-Business): Focusing on the movement of goods between commercial entities.

- B2C (Business-to-Consumer): Encompassing deliveries from businesses to individual consumers, largely driven by e-commerce.

- C2C (Consumer-to-Consumer): Facilitating deliveries between individual consumers, often through online marketplaces or peer-to-peer platforms.

For each of these segments, the report provides detailed market size data, presented in millions of Australian dollars, covering historical periods, the base year, and comprehensive forecast periods. Growth projections are meticulously analyzed, acknowledging the diverse factors influencing each segment's expansion. Furthermore, the competitive landscape within each segment is explored, identifying the key players and assessing the intensity of competition. This granular segmentation allows for a nuanced understanding of the opportunities and challenges present across the Australian last-mile delivery ecosystem.

Key Drivers of Australia Last-Mile Delivery Market Growth

Several factors are driving the growth of the Australian last-mile delivery market. The burgeoning e-commerce sector is a primary driver, increasing demand for efficient delivery services. Technological advancements, such as AI-powered route optimization and autonomous vehicles, improve operational efficiency and reduce costs. Government initiatives promoting digitalization and infrastructure development also support market growth. Finally, growing consumer preference for convenient and faster delivery options is strongly impacting the market.

Challenges in the Australia Last-Mile Delivery Market Sector

The Australian last-mile delivery market faces several challenges. Infrastructure limitations, particularly in rural and remote areas, hinder efficient delivery. Rising fuel costs and labor shortages impact operational expenses. Intense competition and regulatory hurdles add to the challenges faced by market players. These factors can affect profitability and lead to increased delivery times.

Emerging Opportunities in Australia Last-Mile Delivery Market

The Australian last-mile delivery market presents exciting opportunities. The growth of e-commerce in regional areas opens up new markets. The increasing adoption of sustainable delivery solutions creates opportunities for environmentally conscious companies. Technological innovations, such as drone delivery and autonomous vehicles, offer potential for improving efficiency and reducing costs. These opportunities represent significant growth potential for market players.

Leading Players in the Australia Last-Mile Delivery Market Market

- Sendle

- Pack & Send

- Omnia Logistics

- Whale Logistics

- DHL Express

- Toll

- Allied Express

- Admiral International

- CBIP Logistics

- Rush Express

- FedEx Express Australia

- StarTrack

- Aramex Australia

- Australia Post

- CouriersPlease

Key Developments in Australia Last-Mile Delivery Market Industry

- 2022 Q3: Australia Post significantly enhanced its operational capabilities with the launch of a new, highly automated sorting facility, leading to substantial improvements in delivery speed and efficiency.

- 2023 Q1: A notable trend emerged as several major logistics providers committed to reducing their carbon footprint by announcing substantial investments in expanding their electric vehicle (EV) fleets for last-mile deliveries.

- 2023 Q4: The market witnessed a significant strategic consolidation with a merger between two prominent regional last-mile delivery companies. This union broadened their operational footprint and service capabilities. (Specific details of the deal remain proprietary).

Future Outlook for Australia Last-Mile Delivery Market Market

The future of the Australian last-mile delivery market looks promising. Continued e-commerce growth, coupled with technological advancements and evolving consumer expectations, will drive market expansion. The increasing focus on sustainability and efficiency will shape future market dynamics. Strategic partnerships and innovative business models will be crucial for success in this competitive landscape. The market is expected to witness a continued shift toward faster, more convenient, and sustainable delivery options.

Australia Last-Mile Delivery Market Segmentation

-

1. Type

- 1.1. B2B

- 1.2. B2C

- 1.3. C2C

-

2. Delivery Mode

- 2.1. Regular Delivery

- 2.2. Same-day Delivery

- 2.3. Express Delivery

Australia Last-Mile Delivery Market Segmentation By Geography

- 1. Australia

Australia Last-Mile Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Developing e-commerce industry fueling the demand for last mile logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Last-Mile Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2B

- 5.1.2. B2C

- 5.1.3. C2C

- 5.2. Market Analysis, Insights and Forecast - by Delivery Mode

- 5.2.1. Regular Delivery

- 5.2.2. Same-day Delivery

- 5.2.3. Express Delivery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sendle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pack & Send

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnia Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Whale Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toll

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allied Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Admiral International**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CBIP Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rush Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FedEx Express Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 StarTrack

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Aramex Australia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Australia Post

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 CouriersPlease

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Sendle

List of Figures

- Figure 1: Australia Last-Mile Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Last-Mile Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Last-Mile Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Last-Mile Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia Last-Mile Delivery Market Revenue Million Forecast, by Delivery Mode 2019 & 2032

- Table 4: Australia Last-Mile Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Last-Mile Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Last-Mile Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia Last-Mile Delivery Market Revenue Million Forecast, by Delivery Mode 2019 & 2032

- Table 8: Australia Last-Mile Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Last-Mile Delivery Market?

The projected CAGR is approximately > 10.55%.

2. Which companies are prominent players in the Australia Last-Mile Delivery Market?

Key companies in the market include Sendle, Pack & Send, Omnia Logistics, Whale Logistics, DHL Express, Toll, Allied Express, Admiral International**List Not Exhaustive, CBIP Logistics, Rush Express, FedEx Express Australia, StarTrack, Aramex Australia, Australia Post, CouriersPlease.

3. What are the main segments of the Australia Last-Mile Delivery Market?

The market segments include Type, Delivery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Developing e-commerce industry fueling the demand for last mile logistics.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Last-Mile Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Last-Mile Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Last-Mile Delivery Market?

To stay informed about further developments, trends, and reports in the Australia Last-Mile Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence