Key Insights

The Brazil engineering polymers market presents a compelling growth opportunity, driven by the nation's expanding industrial sector and increasing demand for lightweight, high-performance materials across diverse applications. The period from 2019 to 2024 witnessed significant growth, establishing a strong foundation for continued expansion. While precise market size figures for 2019-2024 are unavailable, considering the robust growth trajectory of Brazil's manufacturing and automotive sectors, a conservative estimate places the market size at approximately $500 million in 2024. This growth is fueled by factors such as the increasing adoption of engineering polymers in automotive components (lightweighting initiatives), packaging (improved barrier properties and durability), and consumer electronics (enhanced performance and durability). Government initiatives promoting sustainable manufacturing practices further contribute to market expansion, with a growing emphasis on bio-based and recyclable engineering polymers.

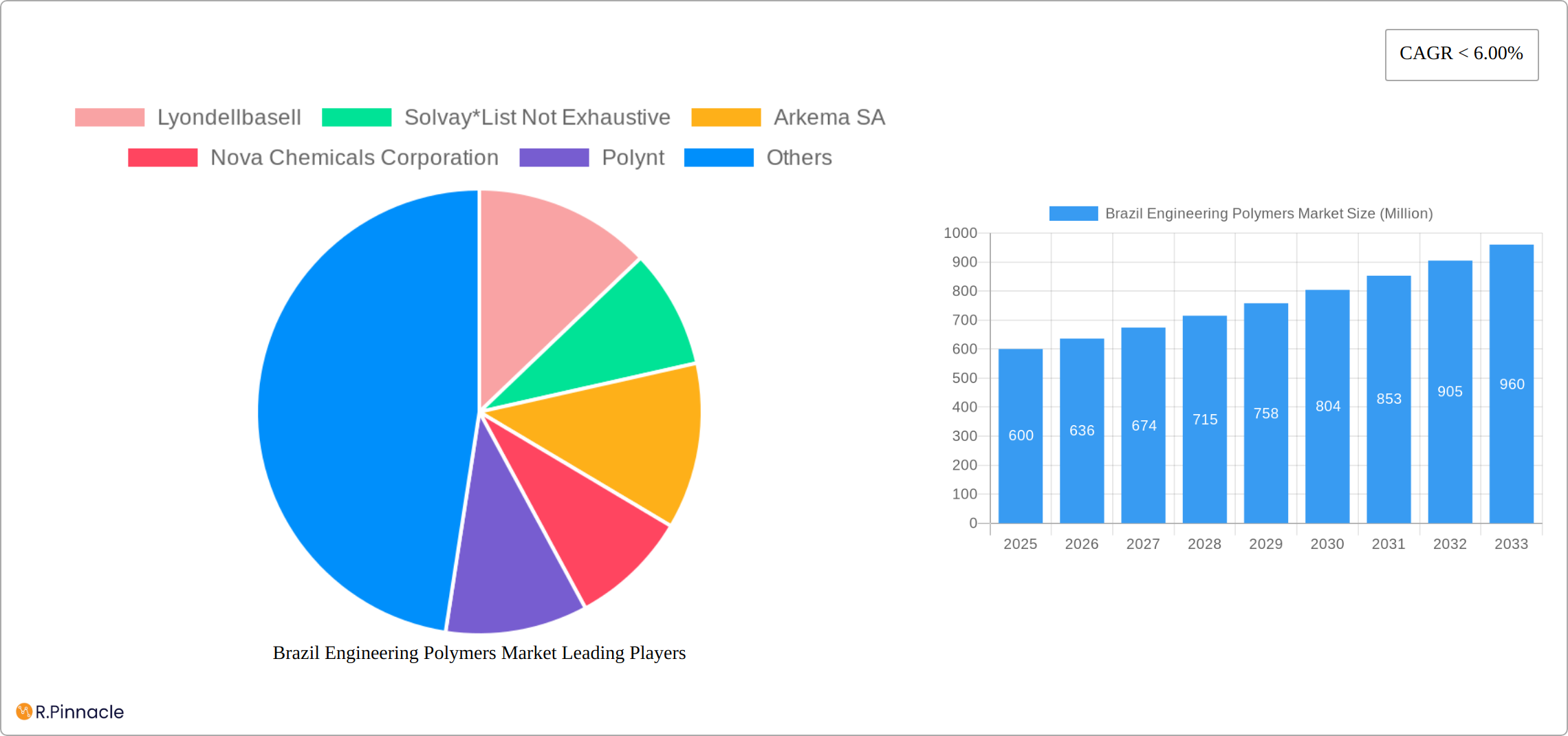

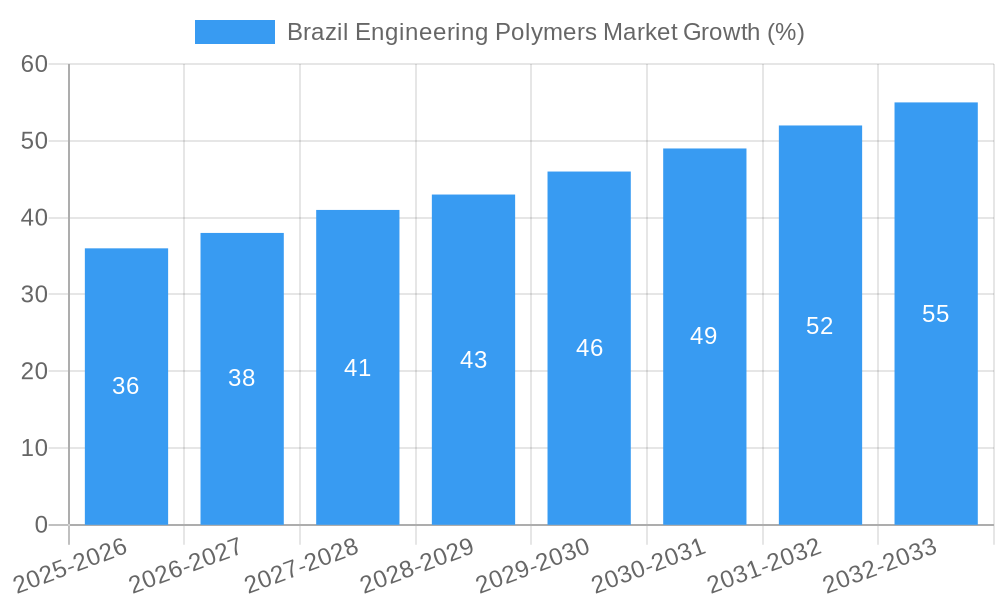

Looking ahead, the forecast period (2025-2033) anticipates continued growth, propelled by consistent industrial investment and infrastructure development. Assuming a moderate Compound Annual Growth Rate (CAGR) of 6% based on global trends and Brazil's economic projections, the market size could reach approximately $900 million by 2033. This growth is expected to be uneven, with certain polymer types experiencing faster adoption rates than others due to specific application advantages and cost-effectiveness. Key challenges include volatility in raw material prices and potential fluctuations in the Brazilian economy, which require careful consideration in market analysis and forecasting. Nevertheless, the long-term outlook for the Brazil engineering polymers market remains optimistic, presenting attractive investment prospects for both domestic and international players.

Brazil Engineering Polymers Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazil engineering polymers market, offering actionable insights for industry professionals and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The study encompasses key segments, leading players, and emerging trends, providing a complete picture of this dynamic market.

Brazil Engineering Polymers Market Structure & Innovation Trends

The Brazilian engineering polymers market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. LyondellBasell, Solvay, Arkema SA, and BASF SE are among the key players, each commanding a substantial portion of the market (exact figures vary across segments and are detailed within the full report). Market share analysis reveals a competitive landscape with ongoing consolidation through mergers and acquisitions (M&A). Recent M&A activity in the sector, valued at approximately XX Million (2022-2024), signifies a trend towards vertical integration and expansion of product portfolios.

- Market Concentration: Moderately concentrated with key players holding significant shares.

- Innovation Drivers: Stringent regulatory compliance, growing demand for high-performance materials, and advancements in polymer chemistry are driving innovation.

- Regulatory Framework: Government regulations concerning material safety and environmental impact significantly influence market trends and technological advancements.

- Product Substitutes: The emergence of bio-based polymers and sustainable alternatives poses a challenge, prompting innovation in material properties and manufacturing processes.

- End-User Demographics: The automotive and electrical & electronics sectors are major consumers of engineering polymers in Brazil, influenced by industrial growth and infrastructure development.

- M&A Activities: A rising number of M&A activities, primarily driven by expansion strategies and technology acquisition, is reshaping the market landscape.

Brazil Engineering Polymers Market Market Dynamics & Trends

The Brazilian engineering polymers market is experiencing robust and dynamic growth, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This upward trajectory is propelled by a confluence of powerful factors. The sustained expansion of Brazil's key industrial sectors, coupled with significant investments in infrastructure development – particularly within the burgeoning construction industry – are primary catalysts. Furthermore, the increasing global and domestic demand for lightweight, durable, and high-performance materials is significantly impacting sectors like automotive and consumer goods, where engineering polymers are indispensable for enhancing fuel efficiency and product longevity.

The market penetration of specific, high-demand polymers such as Polycarbonate (PC) and Polyethylene Terephthalate (PET) is on a steady rise. This is largely attributable to their inherent versatility, exceptional mechanical properties, and cost-effectiveness in a wide array of applications. Concurrently, relentless technological advancements in polymer processing techniques, including additive manufacturing and advanced compounding, alongside the continuous development of specialized materials tailored for niche applications, are actively fueling market expansion and innovation.

The competitive landscape is characterized by intense rivalry among well-established global and local players, as well as the strategic emergence of new market entrants. This dynamic interplay significantly influences pricing strategies, product differentiation, and market access. Importantly, evolving consumer preferences are leaning towards sustainable and recyclable polymer solutions. This burgeoning demand for eco-friendly alternatives is creating substantial opportunities for companies to invest in and develop innovative material solutions that align with global environmental stewardship goals.

Dominant Regions & Segments in Brazil Engineering Polymers Market

The Southeast region of Brazil dominates the engineering polymers market due to its strong industrial base and high concentration of manufacturing activities. Within product types, Polyamides, Polycarbonate (PC), and Polyethylene Terephthalate (PET) represent the largest segments, driven by significant demand from automotive, packaging, and electrical & electronics industries. The Automotive and Transportation application segment is the leading end-use sector, reflecting the country's expanding automotive manufacturing capacity and infrastructure projects.

- Key Drivers (Southeast Region):

- Concentrated industrial activity.

- Robust automotive manufacturing.

- Significant government investment in infrastructure.

- Well-developed transportation network.

- Dominant Product Type: Polyamides, Polycarbonate (PC), and Polyethylene Terephthalate (PET)

- Dominant Application: Automotive and Transportation

Brazil Engineering Polymers Market Product Innovations

The Brazilian engineering polymers market is witnessing a wave of groundbreaking product innovations aimed at meeting increasingly stringent performance requirements and sustainability mandates. Recent advancements include the development of advanced polymer formulations exhibiting significantly enhanced thermal stability, superior chemical resistance against aggressive agents, and vastly improved mechanical strength and toughness. These cutting-edge materials are specifically engineered to cater to the escalating demand for lightweight yet robust components in the automotive industry, reducing vehicle weight for improved fuel efficiency, and to provide exceptionally durable and long-lasting materials for critical infrastructure projects.

A paramount focus of current innovation efforts is the transition towards bio-based and fully recyclable engineering polymers. This strategic shift is driven by the imperative to achieve ambitious sustainability goals, mitigate environmental impact, and address growing consumer and regulatory pressure concerning plastic waste. These novel, eco-conscious products not only offer a reduced environmental footprint but also provide significant competitive advantages by delivering comparable or superior performance characteristics, often at increasingly competitive price points, thereby fostering a circular economy within the polymer industry.

Report Scope & Segmentation Analysis

This report segments the Brazilian engineering polymers market by product type (Fluoropolymers, Polycarbonate (PC), Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), Polyacetal/Polyoxymethylene, Polymethyl Methacrylate (PMMA), Polyphenylene Oxide, Polyphenylene Sulfide (PPS), Styrene Copolymers (ABS & SAN), Liquid Crystal Polymers (LCP), Polyether Ether Ketone (PEEK), Polyimides (PI), Polyamides) and application (Automotive and Transportation, Building and Construction, Consumer Goods, Electrical and Electronics, Industrial and Machinery, Packaging, Medical). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. The report provides detailed market size estimations and forecasts for each segment, considering current market trends and future growth potential.

Key Drivers of Brazil Engineering Polymers Market Growth

The sustained and robust growth of the Brazil engineering polymers market is underpinned by a synergistic interplay of several critical factors. Foremost among these is the **vigorous expansion of key industrial sectors**, with particular emphasis on the automotive manufacturing and construction industries, both of which are significant consumers of engineering polymers. Government-backed initiatives aimed at stimulating and accelerating infrastructure development across the nation, including transportation networks and urban renewal projects, further bolster demand for high-performance construction materials, including specialized polymers.

Moreover, ongoing **technological advancements in polymer materials science and processing technologies** are continuously enabling the development of polymers with enhanced properties and novel functionalities. This facilitates their adoption in more demanding applications. Complementing these industrial and technological drivers is the **rising consumer demand for durable, high-performance, and aesthetically pleasing products** across a broad spectrum of sectors, ranging from electronics and appliances to packaging and sporting goods. This consumer-led demand directly translates into an increased market penetration for advanced engineering polymers that offer superior performance and extended product lifecycles.

Challenges in the Brazil Engineering Polymers Market Sector

Despite the promising growth outlook, the Brazil engineering polymers market is not without its inherent challenges. **Fluctuations in the prices of raw materials**, which are often linked to global commodity markets and currency exchange rates, can significantly impact manufacturing costs and profit margins. Furthermore, the susceptibility of global supply chains to disruptions, whether due to geopolitical events, natural disasters, or logistical bottlenecks, poses a continuous threat to the timely and cost-effective delivery of essential feedstocks and finished products. Stringent and evolving environmental regulations, while crucial for sustainability, can also impose increased compliance costs and necessitate significant investments in cleaner manufacturing processes and waste management systems.

Adding to these complexities, the **increasing availability and adoption of substitute materials** – including advanced composites and traditional materials with improved properties – present a competitive challenge, requiring engineering polymer manufacturers to continually innovate and differentiate their offerings. Finally, the **intense competition among established global and regional players**, coupled with the strategic entry of new market participants, exerts downward pressure on pricing and necessitates a constant focus on operational efficiency and value-added solutions to maintain market share.

Emerging Opportunities in Brazil Engineering Polymers Market

Emerging opportunities lie in the development of sustainable and bio-based polymers, catering to the growing emphasis on environmental sustainability. The demand for lightweight and high-performance materials in the renewable energy sector and increasing adoption of advanced manufacturing technologies present significant growth opportunities.

Leading Players in the Brazil Engineering Polymers Market Market

- LyondellBasell

- Solvay

- Arkema SA

- Nova Chemicals Corporation

- Polynt

- Ashland Inc

- Celanese Corporation

- Rochling Group

- Evonik Industries AG

- 3M

- Chemtura Corporation

- Chevron Phillips Chemical

- LANXESS

- BASF SE

- SABIC

- LG Chem

- DuPont

- Eastman Chemical Company

- Covestro AG

- PolyOne Corporation

Key Developments in Brazil Engineering Polymers Market Industry

- 2023 Q2: BASF SE, a global leader in the chemical industry, announced a strategic expansion with the inauguration of a new production facility dedicated to specialty polymers in Brazil. This investment signifies a commitment to strengthening its regional manufacturing capabilities and meeting the growing local demand for advanced polymer solutions.

- 2022 Q4: The Brazilian engineering polymers market experienced a significant structural shift with a major merger between two prominent regional polymer producers. This consolidation aimed to leverage synergistic efficiencies, expand product portfolios, and enhance market reach, thereby reshaping the competitive landscape and offering new opportunities for collaboration and innovation.

- (For a comprehensive understanding of the market's trajectory, further detailed developments, including specific product launches, strategic partnerships, and investment announcements with precise dates, are meticulously documented within the full market research report.)

Future Outlook for Brazil Engineering Polymers Market Market

The Brazilian engineering polymers market is poised for sustained growth, driven by continuous industrial expansion, infrastructure development, and technological advancements. Strategic partnerships, investments in research and development, and the adoption of sustainable manufacturing practices will be key to capturing future market opportunities. The focus on high-performance, specialized polymers and eco-friendly alternatives will shape the future trajectory of the market.

Brazil Engineering Polymers Market Segmentation

-

1. Product Type

- 1.1. Fluoropolymers

- 1.2. Polycarbonate (PC)

- 1.3. Polyethylene Terephthalate (PET)

- 1.4. Polybutylene Terephthalate (PBT)

- 1.5. Polyacetal/ Polyoxymethylene

- 1.6. Polymethyl Methacrylate (PMMA)

- 1.7. Polyphenylene Oxide

- 1.8. Polyphenylene Sulfide (PPS)

- 1.9. Styrene Copolymers (ABS & SAN)

- 1.10. Liquid Crystal Polymers (LCP)

- 1.11. Polyether Ether Ketone (PEEK)

- 1.12. Polyimides (PI)

- 1.13. Polyamides

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Building and Construction

- 2.3. Consumer Goods

- 2.4. Electrical and Electronics

- 2.5. Industrial and Machinery

- 2.6. Packaging

- 2.7. Medical

Brazil Engineering Polymers Market Segmentation By Geography

- 1. Brazil

Brazil Engineering Polymers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Engineering Plastics Replacing Traditional Materials; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Engineering Polymers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fluoropolymers

- 5.1.2. Polycarbonate (PC)

- 5.1.3. Polyethylene Terephthalate (PET)

- 5.1.4. Polybutylene Terephthalate (PBT)

- 5.1.5. Polyacetal/ Polyoxymethylene

- 5.1.6. Polymethyl Methacrylate (PMMA)

- 5.1.7. Polyphenylene Oxide

- 5.1.8. Polyphenylene Sulfide (PPS)

- 5.1.9. Styrene Copolymers (ABS & SAN)

- 5.1.10. Liquid Crystal Polymers (LCP)

- 5.1.11. Polyether Ether Ketone (PEEK)

- 5.1.12. Polyimides (PI)

- 5.1.13. Polyamides

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Building and Construction

- 5.2.3. Consumer Goods

- 5.2.4. Electrical and Electronics

- 5.2.5. Industrial and Machinery

- 5.2.6. Packaging

- 5.2.7. Medical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lyondellbasell

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solvay*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nova Chemicals Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Polynt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashland Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Celanese Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rochling Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evonik Industries AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3M

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Chemtura Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Chevron Phillips Chemical

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LANXESS

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 BASF SE

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SABIC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 LG Chem

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 DuPont

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eastman Chemical Company

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Covestro AG

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 PolyOne Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Lyondellbasell

List of Figures

- Figure 1: Brazil Engineering Polymers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Engineering Polymers Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Engineering Polymers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Engineering Polymers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Brazil Engineering Polymers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Brazil Engineering Polymers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Engineering Polymers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Engineering Polymers Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Brazil Engineering Polymers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Brazil Engineering Polymers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Engineering Polymers Market?

The projected CAGR is approximately < 6.00%.

2. Which companies are prominent players in the Brazil Engineering Polymers Market?

Key companies in the market include Lyondellbasell, Solvay*List Not Exhaustive, Arkema SA, Nova Chemicals Corporation, Polynt, Ashland Inc, Celanese Corporation, Rochling Group, Evonik Industries AG, 3M, Chemtura Corporation, Chevron Phillips Chemical, LANXESS, BASF SE, SABIC, LG Chem, DuPont, Eastman Chemical Company, Covestro AG, PolyOne Corporation.

3. What are the main segments of the Brazil Engineering Polymers Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Engineering Plastics Replacing Traditional Materials; Other Drivers.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET): The Most Used Engineering Plastic.

7. Are there any restraints impacting market growth?

; Volatility in Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Engineering Polymers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Engineering Polymers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Engineering Polymers Market?

To stay informed about further developments, trends, and reports in the Brazil Engineering Polymers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence