Key Insights

The Central and Eastern European (CEE) refrigerated transport market is poised for significant expansion, driven by the burgeoning food and pharmaceutical industries, increased e-commerce adoption, and a growing demand for temperature-sensitive goods. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 8.3%, leading to a projected market size of 113.5 billion by 2025. Key growth catalysts include regional population increases, rising disposable incomes boosting consumption of perishables, and ongoing cold chain infrastructure modernization. The market is segmented by service type (storage, transportation, value-added services), temperature (chilled, frozen), and application (fruits & vegetables, dairy, meat, fish, pharmaceuticals). While specific country data varies, markets like Poland, Czech Republic, and Hungary are expected to see strong growth in dairy and processed foods, while others may prioritize pharmaceuticals. Established players and regional operators indicate a competitive environment with opportunities for diverse logistics providers. Continued investment in efficient cold chain technology and infrastructure supports this growth. However, potential challenges include fluctuating fuel prices, geopolitical instability, and the need for continuous workforce development to meet evolving demands.

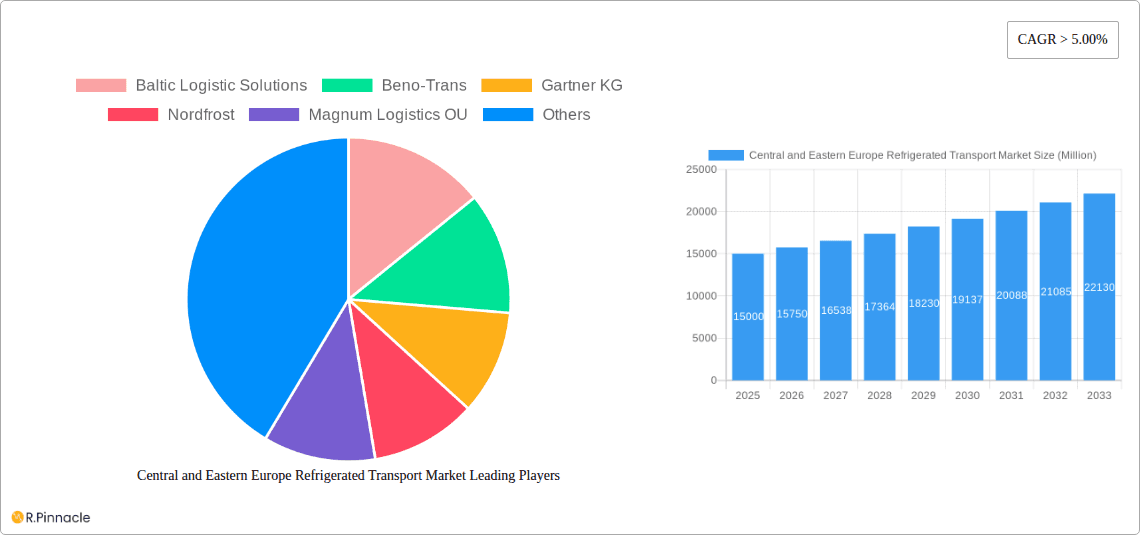

Central and Eastern Europe Refrigerated Transport Market Market Size (In Billion)

The CEE refrigerated transport market's fragmented nature presents both challenges and opportunities. Specialized companies can effectively serve niche segments, while larger enterprises can offer broad, cost-efficient solutions. Strategic navigation requires balancing scale with adaptability to local market conditions. Future growth is anticipated in economically developing areas with improving infrastructure. Integration with Western European markets is also expected to fuel expansion, particularly in cross-border logistics and supply chain efficiency for regional and international clients.

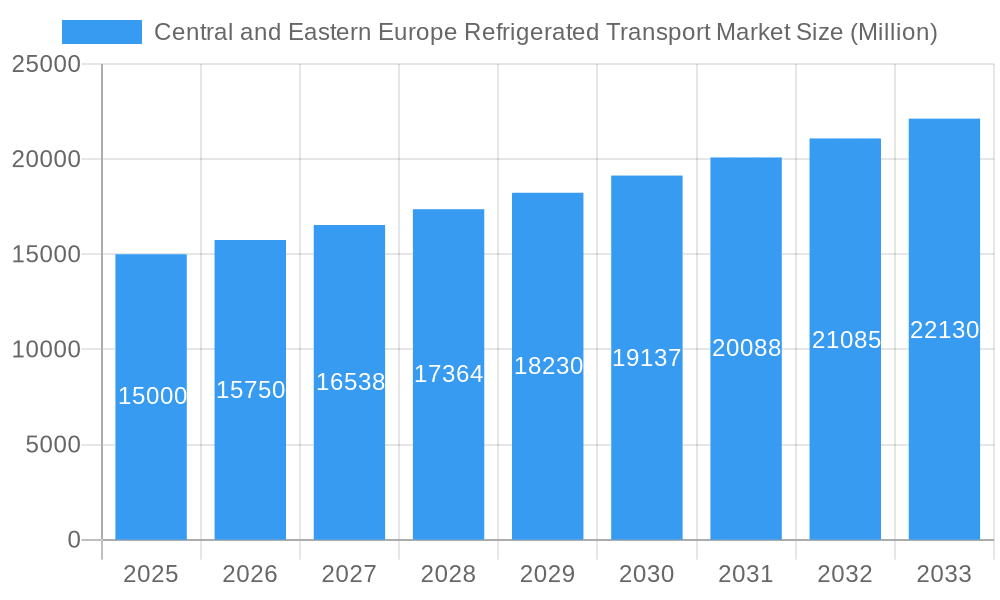

Central and Eastern Europe Refrigerated Transport Market Company Market Share

Central and Eastern Europe Refrigerated Transport Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Central and Eastern European refrigerated transport market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this vital sector. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Central and Eastern Europe Refrigerated Transport Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Central and Eastern European refrigerated transport market. The market exhibits a moderately concentrated structure, with key players such as Baltic Logistic Solutions, Beno-Trans, Gartner KG, Nordfrost, Magnum Logistics OU, PLG Logistics and Warehousing, NewCold, FRIGO Coldstore Logistics, Nagel-Group, and Wilms Frozen Food Service holding significant market share (exact figures vary and require further investigation for precise values). However, the market also features numerous smaller players, creating a dynamic competitive environment.

- Market Concentration: The top 5 players collectively hold an estimated xx% market share in 2025. Further research is needed for precise data.

- Innovation Drivers: Technological advancements in refrigeration technology, automation, and data analytics are driving efficiency and improving cold chain integrity. Sustainability initiatives and the growing demand for traceable and transparent supply chains are also significant drivers.

- Regulatory Framework: EU regulations on food safety and transportation standards significantly influence market operations. Compliance costs and evolving regulations pose both challenges and opportunities for market players.

- Product Substitutes: Limited direct substitutes exist, but improved insulation techniques and alternative transportation methods are gradually impacting the market share of traditional refrigerated transport.

- M&A Activities: The recent acquisition of Kloosterboer Group by Lineage Logistics in June 2021 highlights the ongoing consolidation within the sector. The deal value was undisclosed but is expected to be substantial. Further detailed analysis of M&A activities and deal values is included within the report.

- End-User Demographics: The report thoroughly analyzes end-user demographics, including food producers, distributors, retailers and pharmaceutical companies.

Central and Eastern Europe Refrigerated Transport Market Market Dynamics & Trends

This section delves into the market's growth trajectory, analyzing key factors influencing its expansion. The Central and Eastern European refrigerated transport market is experiencing robust growth, driven by rising disposable incomes, changing dietary habits, increasing demand for fresh and processed food products, and the growth of e-commerce, particularly in the food sector.

The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like GPS tracking and temperature monitoring systems is steadily increasing, further improving efficiency and transparency. Competitive dynamics are shaped by pricing strategies, service differentiation, and investments in technological upgrades. The ongoing expansion of e-commerce and a growing focus on sustainable cold chain logistics will continue to propel market growth in the coming years. A detailed analysis of market trends is provided, including insights into the impact of regional and global economic conditions on market performance.

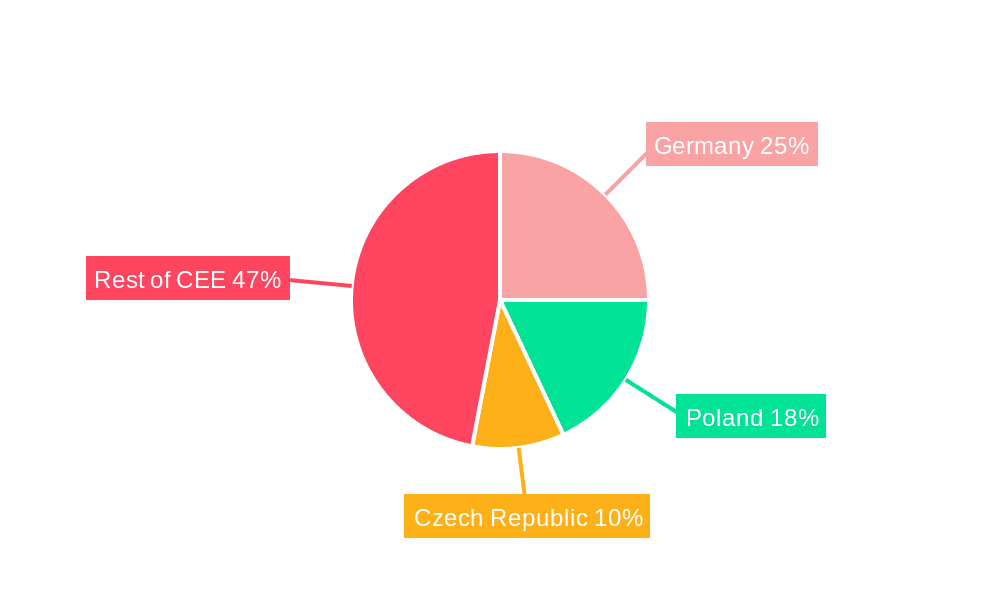

Dominant Regions & Segments in Central and Eastern Europe Refrigerated Transport Market

This section identifies the leading regions and segments within the Central and Eastern European refrigerated transport market. While precise market share data is not yet available for this report, we provide a robust analysis of the different areas of the market.

- By Region: Poland and other high-population countries are expected to dominate the market due to increased food consumption and favorable infrastructure development.

- By Service: Transportation currently holds the largest share, however, value-added services such as blast freezing and inventory management are witnessing the fastest growth, driven by the need for enhanced supply chain efficiency.

- By Temperature: The frozen segment is larger than the chilled segment, reflecting the significant demand for frozen food products.

- By Application: The food and beverage sector (fruits and vegetables, dairy, meat and poultry, processed food) accounts for the majority of the market share due to the high reliance on cold chain logistics for these products. The pharmaceutical sector is a rapidly expanding segment.

Key Drivers (by region and segment):

- Poland: Strong economic growth, robust food processing industry, and well-established logistics infrastructure.

- Other Countries: Expanding retail sector, rising middle class, increased demand for imported food products.

- Storage: Growing need for efficient and secure cold storage facilities to handle increased volumes of perishable goods.

- Transportation: Improved road networks, investments in modern transportation fleets.

- Value-Added Services: Growing demand for supply chain optimization and enhanced food safety.

Central and Eastern Europe Refrigerated Transport Market Product Innovations

The market is witnessing a surge in product innovation, primarily driven by advancements in refrigeration technology, such as improved insulation materials, energy-efficient cooling systems, and smart temperature monitoring devices. These innovations aim to reduce energy consumption, enhance cold chain integrity, and improve traceability. Furthermore, the integration of IoT (Internet of Things) and data analytics is transforming cold chain management, offering real-time visibility and predictive capabilities. This is increasing efficiency and helping to prevent costly losses due to spoilage.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Central and Eastern European refrigerated transport market, broken down by service (storage, transportation, value-added services), temperature (chilled, frozen), and application (fruits and vegetables, dairy products, fish, meat and poultry, processed food, pharmaceutical, bakery and confectionery, other). Each segment is analyzed based on historical performance (2019-2024), current market size (2025), and future growth projections (2025-2033). Competitive dynamics within each segment are also evaluated. Growth projections vary significantly depending on the segment. This detailed analysis of each segment is within the full report.

Key Drivers of Central and Eastern Europe Refrigerated Transport Market Growth

The market’s growth is propelled by several key factors: increasing demand for fresh and processed food, expansion of the retail and e-commerce sectors, growth of the pharmaceutical and healthcare industries, and investments in infrastructure development across the region. Furthermore, rising consumer disposable incomes and evolving dietary preferences towards healthier, convenient food options are contributing to market expansion. Stringent food safety regulations are also driving the adoption of advanced temperature-controlled solutions.

Challenges in the Central and Eastern Europe Refrigerated Transport Market Sector

Significant challenges include maintaining cold chain integrity across vast distances, managing fluctuating fuel costs, ensuring driver availability and training, and meeting stringent regulatory requirements. Furthermore, the lack of consistent infrastructure across certain areas of the region and competition from established international players are some key limitations. These challenges, and their potential impact on market growth, are explored in detail in the full report.

Emerging Opportunities in Central and Eastern Europe Refrigerated Transport Market

This market presents substantial opportunities for companies offering innovative cold chain solutions, sustainable technologies, and advanced logistics services. The growing demand for value-added services such as blast freezing, labeling, and inventory management presents significant potential. Expansion into niche segments such as pharmaceuticals and e-commerce food delivery presents additional growth avenues.

Leading Players in the Central and Eastern Europe Refrigerated Transport Market Market

- Baltic Logistic Solutions

- Beno-Trans

- Gartner KG

- Nordfrost

- Magnum Logistics OU

- PLG Logistics and Warehousing

- NewCold

- FRIGO Coldstore Logistics

- Nagel-Group

- Wilms Frozen Food Service

- List Not Exhaustive

Key Developments in Central and Eastern Europe Refrigerated Transport Market Industry

- March 2021: Danone Sp. z o.o. extends its cooperation with Kuehne+Nagel in Poland, opening a new 11,079 sqm distribution center in Ruda Śląska, equipped for temperature-controlled storage (4-6°C) and co-packing. This highlights the growing importance of strategic partnerships and investment in advanced facilities.

- June 2021: Lineage Logistics acquires Kloosterboer Group, significantly expanding its European presence and market share in temperature-controlled logistics. This merger indicates a trend toward market consolidation and the pursuit of scale economies.

Future Outlook for Central and Eastern Europe Refrigerated Transport Market Market

The Central and Eastern European refrigerated transport market is poised for sustained growth, driven by a confluence of factors, including increasing urbanization, rising consumer demand for fresh and processed foods, and technological advancements in cold chain management. The ongoing expansion of e-commerce and the adoption of innovative solutions, including automation, IoT, and blockchain technology, will create significant opportunities for market players. Strategic investments in infrastructure development and a focus on sustainable practices will further shape the market's future trajectory.

Central and Eastern Europe Refrigerated Transport Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other Applications

Central and Eastern Europe Refrigerated Transport Market Segmentation By Geography

- 1. Poland

- 2. Slovakia

- 3. Czech Republic

- 4. Hungary

- 5. Romania

- 6. Rest of Central and Eastern Europe

Central and Eastern Europe Refrigerated Transport Market Regional Market Share

Geographic Coverage of Central and Eastern Europe Refrigerated Transport Market

Central and Eastern Europe Refrigerated Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.4.2. Slovakia

- 5.4.3. Czech Republic

- 5.4.4. Hungary

- 5.4.5. Romania

- 5.4.6. Rest of Central and Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Poland Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits and Vegetables

- 6.3.2. Dairy Pr

- 6.3.3. Fish, Meat and Poultry

- 6.3.4. Processed Food

- 6.3.5. Pharmaceutical (Including Biopharma)

- 6.3.6. Bakery and Confectionery

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Slovakia Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits and Vegetables

- 7.3.2. Dairy Pr

- 7.3.3. Fish, Meat and Poultry

- 7.3.4. Processed Food

- 7.3.5. Pharmaceutical (Including Biopharma)

- 7.3.6. Bakery and Confectionery

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Czech Republic Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits and Vegetables

- 8.3.2. Dairy Pr

- 8.3.3. Fish, Meat and Poultry

- 8.3.4. Processed Food

- 8.3.5. Pharmaceutical (Including Biopharma)

- 8.3.6. Bakery and Confectionery

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Hungary Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits and Vegetables

- 9.3.2. Dairy Pr

- 9.3.3. Fish, Meat and Poultry

- 9.3.4. Processed Food

- 9.3.5. Pharmaceutical (Including Biopharma)

- 9.3.6. Bakery and Confectionery

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Romania Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Fruits and Vegetables

- 10.3.2. Dairy Pr

- 10.3.3. Fish, Meat and Poultry

- 10.3.4. Processed Food

- 10.3.5. Pharmaceutical (Including Biopharma)

- 10.3.6. Bakery and Confectionery

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Rest of Central and Eastern Europe Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Storage

- 11.1.2. Transportation

- 11.1.3. Value-ad

- 11.2. Market Analysis, Insights and Forecast - by Temperature

- 11.2.1. Chilled

- 11.2.2. Frozen

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Fruits and Vegetables

- 11.3.2. Dairy Pr

- 11.3.3. Fish, Meat and Poultry

- 11.3.4. Processed Food

- 11.3.5. Pharmaceutical (Including Biopharma)

- 11.3.6. Bakery and Confectionery

- 11.3.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baltic Logistic Solutions

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Beno-Trans

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gartner KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nordfrost

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Magnum Logistics OU

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PLG Logistics and Warehousing

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NewCold

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 FRIGO Coldstore Logistics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nagel-Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wilms Frozen Food Service**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Baltic Logistic Solutions

List of Figures

- Figure 1: Central and Eastern Europe Refrigerated Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Central and Eastern Europe Refrigerated Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 3: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 7: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 11: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 15: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 19: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 23: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 27: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe Refrigerated Transport Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Central and Eastern Europe Refrigerated Transport Market?

Key companies in the market include Baltic Logistic Solutions, Beno-Trans, Gartner KG, Nordfrost, Magnum Logistics OU, PLG Logistics and Warehousing, NewCold, FRIGO Coldstore Logistics, Nagel-Group, Wilms Frozen Food Service**List Not Exhaustive.

3. What are the main segments of the Central and Eastern Europe Refrigerated Transport Market?

The market segments include Service, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

March 2021 : Danone Sp. z o.o., part of the global food company Danone, extends its cooperation with Kuehne+Nagel in Poland for another seven years. In conjunction, a new distribution center spanning 11,079 sqm has been opened in Ruda Śląska. The facility is equipped to store goods at a controlled temperature of 4 - 6°C, including co-packing in cold and ambient chambers. While unloading and loading goods, product integrity is ensured by insulated cooling aprons, gates and platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe Refrigerated Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe Refrigerated Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe Refrigerated Transport Market?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe Refrigerated Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence