Key Insights

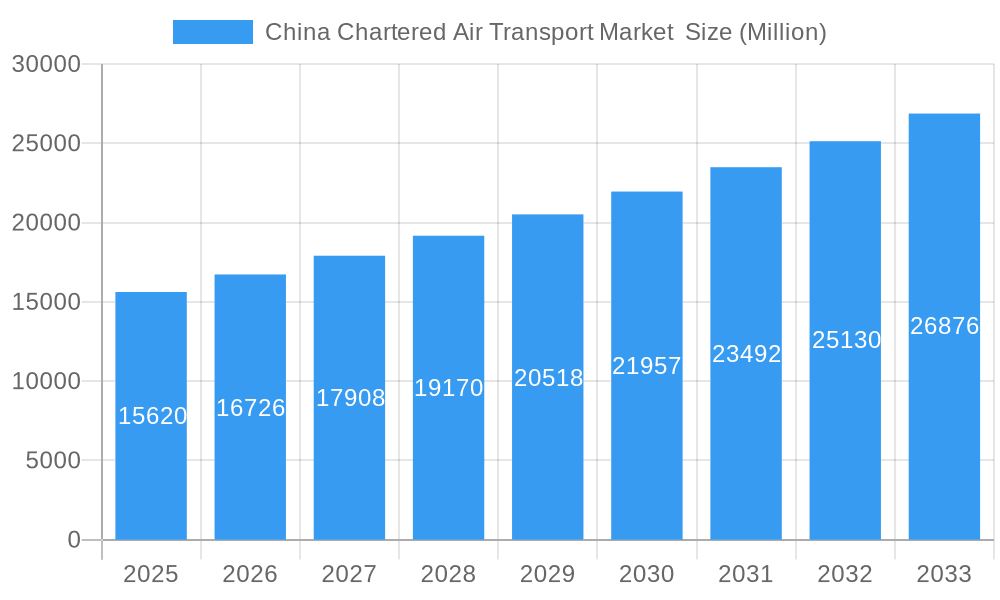

The China chartered air transport market, valued at $15.62 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.07% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector in China is driving demand for time-sensitive deliveries, significantly boosting the time-critical cargo segment. Furthermore, increasing cross-border trade and a growing affluent population demanding faster and more convenient transportation options contribute to market growth. The expanding logistics and supply chain networks within China, coupled with the government's infrastructure investments in aviation, are also creating favorable conditions for market expansion. While regulatory hurdles and potential fuel price fluctuations pose challenges, the overall market outlook remains positive, driven by the consistent increase in both domestic and international business and leisure travel.

China Chartered Air Transport Market Market Size (In Billion)

The market is segmented by cargo type, encompassing time-critical cargo (likely the largest segment due to e-commerce), heavy and oversized cargo, dangerous goods, animal transportation, and other cargo types. Key players like Beijing Airlines, Nanshan Jet Co Ltd, and others are strategically positioning themselves to capitalize on this growth, offering specialized services tailored to the diverse needs of their clientele. Competition is expected to intensify as smaller operators and new entrants seek to gain market share. The regional data currently focuses solely on China, indicating significant untapped potential for expansion into other regions within the Asia-Pacific area or globally as Chinese businesses continue their international reach. Long-term growth projections suggest that the market will significantly surpass its current value by 2033, presenting lucrative investment opportunities for both established players and emerging market entrants.

China Chartered Air Transport Market Company Market Share

China Chartered Air Transport Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China chartered air transport market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages rigorous data analysis and expert perspectives to illuminate current market dynamics and forecast future trends. The market is projected to reach xx Million by 2033.

China Chartered Air Transport Market Market Structure & Innovation Trends

The China chartered air transport market is characterized by a moderately concentrated structure, with a dynamic interplay between established leaders and a multitude of smaller operators. Key players like Beijing Airlines, Nanshan Jet Co Ltd, and Reignwood Star General Aviation command significant market share, but the presence of numerous agile smaller entities fosters a competitive and evolving landscape. Innovation is primarily driven by advancements in aircraft technology, focusing on enhanced efficiency, robust safety features, and sophisticated tracking systems. Concurrently, the escalating demand for specialized cargo solutions, particularly for time-sensitive and high-value goods, is a significant catalyst for innovation in aircraft design and operational methodologies. The regulatory environment, meticulously overseen by the Civil Aviation Administration of China (CAAC), significantly influences safety protocols, operational mandates, and market entry strategies. While air charter offers unparalleled speed and flexibility, it faces competition from other freight modes like rail and sea for less time-critical shipments. The end-user base is remarkably diverse, spanning e-commerce giants, manufacturing enterprises, pharmaceutical distributors, and companies dealing with high-value commodities.

- Market Concentration: The top 5 players collectively hold approximately [Insert Current %]% of the market share as of 2025, underscoring a moderately concentrated market dynamic. The significant contribution of smaller, specialized operators ensures continued market vibrancy and innovation.

- Innovation Drivers: Key drivers of innovation include significant technological advancements in aircraft efficiency, paramount safety enhancements, and the implementation of advanced tracking and monitoring systems. Furthermore, the burgeoning demand for specialized cargo transportation, including temperature-sensitive goods and oversized items, is a powerful impetus for evolving aircraft designs and operational procedures.

- Regulatory Framework: The Civil Aviation Administration of China (CAAC) exerts substantial influence over the market's regulatory landscape. Its role is pivotal in establishing and enforcing safety standards, defining operational regulations, and governing market access for both domestic and international players.

- Product Substitutes: While air charter's speed and flexibility remain unmatched for urgent shipments, potential substitutes for less time-sensitive cargo include rail freight and sea freight, offering cost-effective alternatives for bulk or non-perishable goods.

- End-User Demographics: The market serves a broad spectrum of end-users. This includes businesses heavily involved in e-commerce logistics, manufacturers requiring rapid component delivery or product distribution, pharmaceutical companies needing secure and timely transport of medicines, and industries dealing with the transportation of high-value or sensitive goods.

- M&A Activities: M&A activities in the market have been moderate in recent years. Deal values have averaged around [Insert Current Value] Million USD over the past five years. The majority of these transactions involve the consolidation of smaller entities aiming to bolster their competitive standing and operational capabilities.

China Chartered Air Transport Market Market Dynamics & Trends

This section delves into the market's growth trajectory, exploring key drivers, technological disruptions, consumer preferences, and competitive dynamics. The China chartered air transport market is experiencing robust growth, driven by the rapid expansion of e-commerce, increased demand for time-sensitive goods, and the growing need for specialized cargo handling.

The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration of chartered air transport services within specific industries, particularly e-commerce, is also expected to increase significantly. Technological advancements, such as the implementation of advanced logistics tracking systems and the integration of big data analytics for route optimization, are enhancing operational efficiency and customer satisfaction. Competition is fierce among both established players and new entrants, leading to innovative service offerings and price optimization.

Dominant Regions & Segments in China Chartered Air Transport Market

This section identifies the leading regions and segments within the China chartered air transport market.

Dominant Segment: Time-critical cargo transportation represents the largest segment due to the escalating demand for swift delivery of high-value goods and perishable items.

Key Drivers for Time-Critical Cargo:

- Growing E-commerce: The booming e-commerce sector fuels the demand for rapid delivery of goods.

- High-Value Goods: The transportation of high-value goods necessitates swift and reliable services.

- Pharmaceuticals: The strict temperature and time constraints associated with pharmaceutical transportation drive demand within this segment.

Other Segments: Heavy and oversized cargo, dangerous goods, and animal transportation are also important market segments, each with specific logistical requirements and associated regulations.

The coastal regions of China, including Shanghai, Guangdong, and Zhejiang provinces, are the most dominant due to their high concentration of manufacturing, e-commerce hubs, and international trade activity. The presence of well-developed infrastructure, including numerous airports and efficient transportation networks, further enhances these regions' dominance.

China Chartered Air Transport Market Product Innovations

The market is witnessing the introduction of specialized aircraft configurations optimized for specific cargo types (e.g., temperature-controlled containers for pharmaceuticals, specialized handling for oversized equipment). Technological advancements in flight tracking, real-time monitoring, and predictive maintenance are enhancing operational efficiency and safety. These innovations enhance competitiveness through improved service quality and reduced operational costs, directly influencing customer preference and market share.

Report Scope & Segmentation Analysis

This comprehensive report segments the China chartered air transport market based on critical cargo types: Time-Critical Cargo, Heavy and Oversized Cargo, Dangerous Cargo, Animal Transportation, and Other Cargo Types. Each segment is analyzed for its unique growth trajectory, influenced by specific industry demands and stringent regulatory considerations. For instance, the Time-Critical Cargo segment is projected to experience the highest Compound Annual Growth Rate (CAGR) of [Insert Current %]% throughout the forecast period, largely propelled by the sustained expansion of e-commerce and the increasing volume of high-value goods requiring rapid delivery. The growth of the Heavy and Oversized Cargo segment is intrinsically linked to the performance of the industrial sector, while the Dangerous Goods segment's development is heavily dictated by rigorous regulatory compliance. Animal transportation, though a niche segment, holds significant importance due to the specialized handling and logistical requirements involved.

Key Drivers of China Chartered Air Transport Market Growth

Several factors are driving the expansion of the China chartered air transport market, including:

- E-commerce Boom: The exponential growth of e-commerce is creating a strong demand for faster and more reliable delivery options.

- Economic Growth: China's sustained economic growth is fueling the demand for efficient logistics solutions across various industries.

- Government Initiatives: Government policies promoting improved infrastructure and logistics are facilitating market expansion.

Challenges in the China Chartered Air Transport Market Sector

The market faces challenges such as:

- Regulatory Compliance: Strict regulatory requirements for safety and operational procedures increase operational costs.

- Supply Chain Disruptions: Global supply chain uncertainties can impact the availability of aircraft and other resources.

- Intense Competition: The market is highly competitive, with both established players and new entrants vying for market share.

Emerging Opportunities in China Chartered Air Transport Market

The evolving landscape of the China chartered air transport market presents several compelling emerging opportunities:

- Technological Advancements: The integration of cutting-edge technologies, such as advanced drone delivery systems for last-mile solutions and the exploration of autonomous flight systems for enhanced efficiency and safety, offers significant growth potential.

- Expanding Market Segments: The rapid growth and increasing reliance on air charter services within emerging sectors like pharmaceuticals, advanced manufacturing, and the high-tech industry are creating new and expanding market opportunities.

- Focus on Sustainability: A growing global and domestic emphasis on environmental responsibility is driving increased demand for sustainable logistics solutions. Operators who can offer eco-friendlier flight options and operational practices are poised to gain a competitive advantage.

Leading Players in the China Chartered Air Transport Market Market

- Beijing Airlines

- Nanshan Jet Co Ltd

- Reignwood Star General Aviation

- Amber Aviation

- Deerjet

- ZYB Lily Jet Ltd

- China Southern Airlines General Aviation

- Sino Jet

- Baa Jet Management Ltd

- Donghai Jet Co Ltd

- Jiangsu Jet

Key Developments in China Chartered Air Transport Market Industry

- October 2023: Air Charter Services strategically expanded its Shanghai office. This expansion is designed to enhance service capabilities and better cater to the growing demand from the economically vital Zhejiang and Jiangsu provinces, signaling a focus on regional market penetration.

- July 2023: Jayud launched new air charter services, fortifying its presence in Southeast Asia. This initiative aims to optimize customer logistics solutions and underscores a strategic push towards regional network expansion and enhanced service portfolios.

Future Outlook for China Chartered Air Transport Market Market

The China chartered air transport market is on a robust trajectory for sustained growth. This expansion is underpinned by the continuing boom in e-commerce, the escalating demand for specialized and time-sensitive cargo handling capabilities, and the relentless pace of advancements in aviation technology. Strategic alliances, targeted investments in critical infrastructure, and the proactive adoption of innovative technologies will be instrumental in shaping the market's future trajectory. The market's strong growth momentum is anticipated to persist throughout the forecast period, presenting substantial and promising opportunities for all industry stakeholders.

China Chartered Air Transport Market Segmentation

-

1. type

- 1.1. Time Critical Cargo

- 1.2. Heavy and Oversized Cargo

- 1.3. Dangerous Cargo

- 1.4. Animal Transportation

- 1.5. Other Cargo Types

China Chartered Air Transport Market Segmentation By Geography

- 1. China

China Chartered Air Transport Market Regional Market Share

Geographic Coverage of China Chartered Air Transport Market

China Chartered Air Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for businesses; Increasing disposable income

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges; Infrastructure limitations

- 3.4. Market Trends

- 3.4.1. Booming Chartered Freight Transport Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Chartered Air Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Time Critical Cargo

- 5.1.2. Heavy and Oversized Cargo

- 5.1.3. Dangerous Cargo

- 5.1.4. Animal Transportation

- 5.1.5. Other Cargo Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nanshan Jet Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reignwood Star General Aviation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber Aviation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deerjet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZYB Lily Jet Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Southern Airlines General Aviation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sino Jet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baa Jet Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Donghai Jet Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jiangsu Jet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Beijing Airlines

List of Figures

- Figure 1: China Chartered Air Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Chartered Air Transport Market Share (%) by Company 2025

List of Tables

- Table 1: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 2: China Chartered Air Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 4: China Chartered Air Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Chartered Air Transport Market ?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the China Chartered Air Transport Market ?

Key companies in the market include Beijing Airlines, Nanshan Jet Co Ltd, Reignwood Star General Aviation, Amber Aviation, Deerjet, ZYB Lily Jet Ltd *List Not Exhaustive, China Southern Airlines General Aviation, Sino Jet, Baa Jet Management Ltd, Donghai Jet Co Ltd, Jiangsu Jet.

3. What are the main segments of the China Chartered Air Transport Market ?

The market segments include type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for businesses; Increasing disposable income.

6. What are the notable trends driving market growth?

Booming Chartered Freight Transport Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges; Infrastructure limitations.

8. Can you provide examples of recent developments in the market?

October 2023: Air Charter Services, the aircraft charter broker, has increased its efforts to concentrate on Shanghai and the surrounding provinces, including Zhejiang and Jiangsu, by relocating its office in Shanghai to bigger premises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Chartered Air Transport Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Chartered Air Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Chartered Air Transport Market ?

To stay informed about further developments, trends, and reports in the China Chartered Air Transport Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence