Key Insights

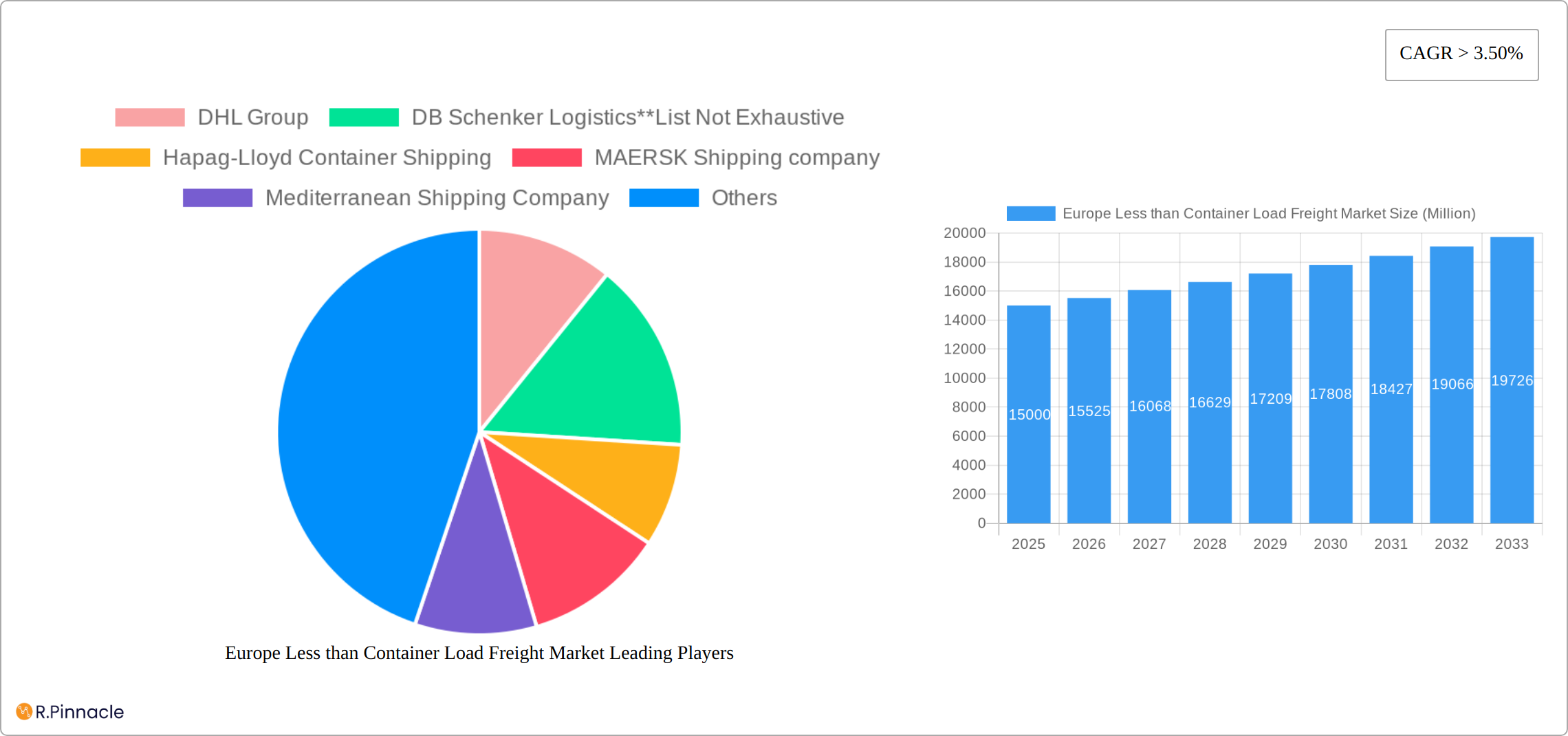

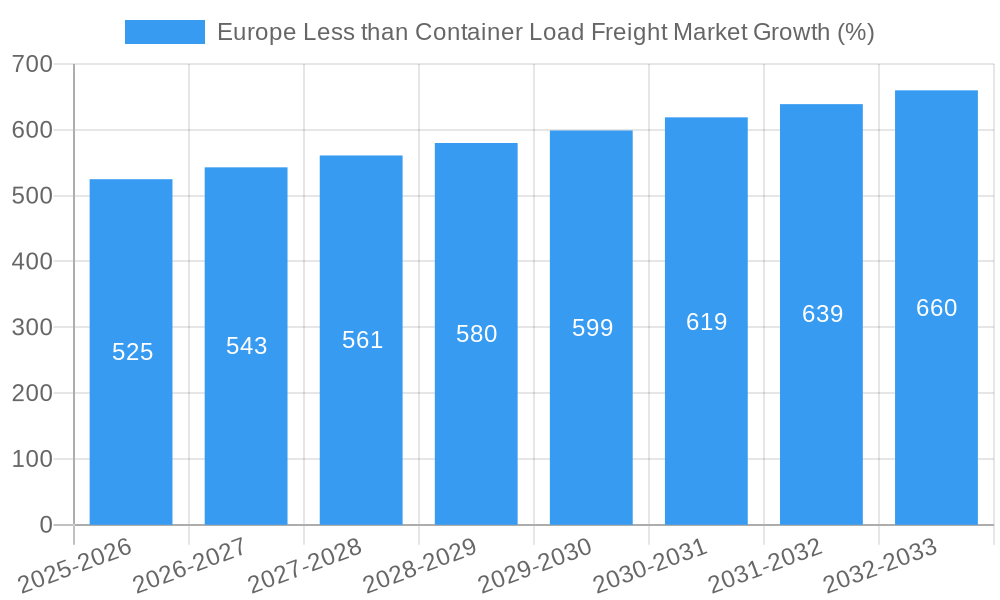

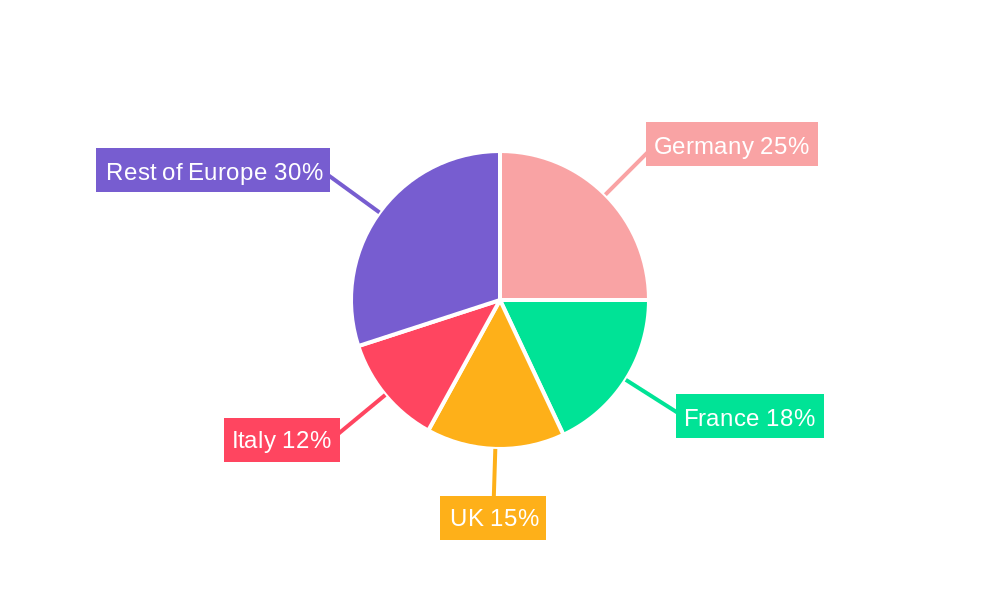

The European Less than Container Load (LCL) freight market is experiencing robust growth, driven by the increasing e-commerce sector, expanding manufacturing and retail activities across the continent, and the resilient demand from the healthcare and pharmaceutical industries. The market's compound annual growth rate (CAGR) exceeding 3.50% indicates a positive trajectory projected through 2033. Key segments within the market, such as domestic and international shipping, continue to see strong demand, particularly from manufacturing and retail end-users, which are significant contributors to overall LCL volume. Germany, France, Italy, and the UK represent the largest national markets within Europe, though growth is expected across all regions, even as the market confronts potential restraints such as fluctuating fuel prices, global supply chain disruptions, and port congestion. This necessitates ongoing adaptation by logistics providers and proactive strategies to mitigate these challenges and maintain efficient operations. The competitive landscape is marked by a mix of large global players like DHL, DB Schenker, and Maersk, alongside regional operators catering to specific market needs. This diverse range ensures a balanced approach to fulfilling the evolving demands of shippers in the European LCL freight market.

The continued expansion of e-commerce and the rise of omnichannel retail models are expected to be significant catalysts for future growth. Furthermore, the increasing globalization of manufacturing and supply chains necessitates efficient and cost-effective LCL solutions. The healthcare and pharmaceutical sectors represent a stable and growing segment, with stringent regulatory requirements and timely delivery vital for this market. To navigate the complexities of this market, companies are focusing on technology adoption, route optimization, and strategic partnerships to enhance efficiency and visibility throughout the supply chain. This includes leveraging advanced technologies such as blockchain for enhanced transparency and track-and-trace capabilities. The projected market size of €XX million in 2025 suggests a substantial opportunity for growth and investment in this dynamic and competitive sector. While precise figures for the total market size are unavailable, based on the provided CAGR of >3.50% and industry analyses, a reasonable estimation of market size and future projections can be extrapolated.

Europe Less than Container Load Freight (LCL) Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Less than Container Load (LCL) Freight Market, offering invaluable insights for industry professionals, investors, and strategic planners. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis to provide actionable intelligence, enabling informed decision-making in this dynamic sector.

Europe Less than Container Load Freight Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European LCL freight market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. We delve into the market share held by key players, including DHL Group, DB Schenker Logistics, Hapag-Lloyd Container Shipping, MAERSK Shipping company, Mediterranean Shipping Company, The CMA CGM Group, Hamburg Sud Logistics company, Dachser Logistics company, ECS European Containers, and GEODIS Freight Forwarding. While the market is relatively consolidated, with the top players holding a significant share (estimated at xx%), smaller niche players also contribute to the overall market dynamism. Innovation is driven by advancements in technology, such as digitalization and automation of processes, leading to increased efficiency and reduced costs. Regulatory frameworks, including those related to environmental sustainability and trade regulations, significantly influence market operations. M&A activity, while not extremely high, plays a role in market consolidation, with deal values estimated to average xx Million annually over the past five years. The increasing focus on supply chain resilience following recent global events is shaping innovative solutions within the LCL segment. End-user demographics, particularly the growing demand from e-commerce and the expanding manufacturing sector, are also shaping market trends.

- Market Concentration: High, with top 10 players holding xx% market share (estimated).

- Innovation Drivers: Digitalization, automation, sustainable logistics solutions.

- M&A Activity: Moderate, with average deal values of xx Million annually (2019-2024).

- Regulatory Framework: Significant impact from environmental and trade regulations.

- Product Substitutes: Limited, primarily alternative transportation modes.

Europe Less than Container Load Freight Market Market Dynamics & Trends

The European Less than Container Load (LCL) freight market is experiencing a dynamic evolution, fueled by a confluence of robust growth drivers. The relentless expansion of e-commerce, coupled with escalating global trade volumes, is a primary catalyst. Furthermore, businesses are increasingly prioritizing efficient and cost-effective logistics solutions, making LCL a preferred choice for smaller shipments. The market is also undergoing significant technological disruption. The widespread adoption of digital platforms is transforming operations, enabling real-time tracking systems that offer unparalleled transparency and enhancing overall supply chain visibility. Artificial intelligence (AI)-powered optimization tools are further streamlining processes, leading to improved operational efficiency and reduced transit times. In line with these advancements, consumer preferences are rapidly shifting towards faster delivery expectations and a greater need for end-to-end visibility throughout the entire supply chain journey. The competitive landscape remains intense, prompting companies to differentiate themselves through the provision of specialized services, strategic investments in cutting-edge technology, and the formation of crucial strategic partnerships. The Compound Annual Growth Rate (CAGR) for the European LCL freight market during the forecast period of 2025-2033 is projected to be robust, reflecting a sustained upward trajectory. The penetration of digital solutions is steadily increasing, with expectations that a significant percentage of the market will be digitized by 2033, revolutionizing how LCL shipments are managed and executed.

Dominant Regions & Segments in Europe Less than Container Load Freight Market

The European LCL freight market is largely dominated by the Western European region, a testament to its strong economic foundations, highly developed transportation infrastructure, and a substantial concentration of manufacturing and retail enterprises. Within this dominant region, Germany, France, and the United Kingdom stand out as key contributors to market activity.

- By Destination: International LCL shipments command a larger market share compared to domestic movements. This trend is primarily driven by the increasing volume and complexity of global trade and the burgeoning cross-border e-commerce landscape.

- By End User: The Manufacturing sector currently holds the most significant market share within the European LCL freight market. This is closely followed by the Retail sector and the Healthcare & Pharmaceuticals industries. This dominance is largely attributable to the substantial volume of goods movement intrinsically linked to the operational needs and supply chain demands of these key industries.

Key Drivers for Segment Dominance:

- Western Europe: The sustained strength of economic activity, coupled with the advanced and efficient transportation infrastructure, creates a conducive environment for LCL freight operations. The high concentration of both manufacturing and retail businesses further amplifies demand.

- International Shipments: The ongoing expansion of global trade networks and the exponential growth of e-commerce are primary drivers for the increased reliance on international LCL shipments.

- Manufacturing Sector: The inherent nature of manufacturing processes often involves the movement of a high volume of raw materials, components, and finished goods, directly fueling the demand for LCL services.

Europe Less than Container Load Freight Market Product Innovations

Recent innovations in the LCL freight market focus on improving efficiency, transparency, and sustainability. This includes the development of advanced tracking and tracing systems, the use of AI-powered route optimization software, and the adoption of eco-friendly transportation methods. These innovations are improving supply chain visibility and reducing transportation costs, enhancing the market competitiveness of LCL services.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Europe LCL freight market across various segments:

By Destination:

- Domestic: This segment focuses on LCL shipments within a single European country. The market size is expected to reach xx Million by 2033.

- International: This segment covers LCL shipments between different European countries or between Europe and other regions. The market size is expected to reach xx Million by 2033.

By End User:

- Manufacturing: This segment covers LCL shipments for the manufacturing industry. The market size is expected to reach xx Million by 2033.

- Retail: This segment covers LCL shipments for the retail industry. The market size is expected to reach xx Million by 2033.

- Healthcare and Pharmaceuticals: This segment is characterized by stringent regulatory requirements. The market size is expected to reach xx Million by 2033.

- Agriculture: This segment is growing due to increased global food demand. The market size is expected to reach xx Million by 2033.

- Other End Users: This includes various other industries using LCL services. The market size is expected to reach xx Million by 2033.

Key Drivers of Europe Less than Container Load Freight Market Growth

The growth of the Europe LCL freight market is fueled by several factors: the expansion of e-commerce, increasing globalization, rising demand for faster and more reliable delivery, technological advancements leading to improved efficiency and transparency, and supportive government policies promoting trade and infrastructure development. Furthermore, the increasing demand for sustainable and environmentally friendly logistics solutions is driving the adoption of green technologies within the sector.

Challenges in the Europe Less than Container Load Freight Market Sector

Despite its promising growth trajectory, the European LCL freight market is not without its complexities and challenges. Fluctuating fuel prices present a persistent hurdle, directly impacting operational costs and profitability. Port congestion, a recurring issue, can lead to significant delays and disrupt supply chain timelines. Furthermore, the implementation and adherence to stringent regulatory frameworks across various European nations add layers of complexity. Broader supply chain disruptions, often stemming from unforeseen events, and ongoing geopolitical instabilities can introduce volatility and unpredictability. Fierce competition within the market also pressures margins, forcing companies to constantly innovate and optimize their offerings. These multifaceted challenges can collectively contribute to increased transportation costs, extended delivery times, and potential disruptions, thereby posing a constraint on the market's overall growth potential.

Emerging Opportunities in Europe Less than Container Load Freight Market

Emerging opportunities exist in the development of specialized LCL services catering to niche industries, leveraging technology to improve supply chain visibility and efficiency, and expanding into new markets with growing demand for LCL freight. Furthermore, the increasing adoption of sustainable logistics practices presents significant growth opportunities.

Leading Players in the Europe Less than Container Load Freight Market Market

- DHL Group

- DB Schenker Logistics

- Hapag-Lloyd Container Shipping

- MAERSK Shipping company

- Mediterranean Shipping Company

- The CMA CGM Group

- Hamburg Sud Logistics company

- Dachser Logistics company

- ECS European Containers

- GEODIS Freight Forwarding

Key Developments in Europe Less than Container Load Freight Market Industry

- Jan 2023: DHL Group announces investment in AI-powered logistics solutions.

- May 2022: DB Schenker expands its LCL network in Eastern Europe.

- Oct 2021: MAERSK launches a new digital platform for LCL shipment tracking. (Further developments will be added in the full report)

Future Outlook for Europe Less than Container Load Freight Market Market

The future outlook for the European LCL freight market is decidedly optimistic, marked by the expectation of sustained and significant growth. This positive trajectory is underpinned by several key factors: the relentless pace of technological innovation continues to unlock new efficiencies and enhance service delivery; the ongoing globalization of economies fosters increased cross-border trade; and the persistent demand for reliable, efficient, and cost-effective logistics solutions for smaller shipments remains a strong market driver. To thrive in this evolving landscape, strategic partnerships will be paramount, enabling companies to expand their reach and capabilities. Significant investments in sustainable logistics practices are not only becoming an ethical imperative but also a competitive differentiator. Furthermore, the proactive adoption of pioneering technologies will be crucial for maintaining a competitive edge and capitalizing on emerging opportunities. The market is anticipated to witness consistent expansion, with substantial potential for further development in rapidly growing emerging markets within Europe and within specialized, high-value niche segments of the LCL freight sector.

Europe Less than Container Load Freight Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End User

- 2.1. Manufacturing

- 2.2. Retail

- 2.3. Healthcare and Pharmaceuticals

- 2.4. Agriculture

- 2.5. Other End Users

Europe Less than Container Load Freight Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Less than Container Load Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. Sales of E-commerce in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing

- 5.2.2. Retail

- 5.2.3. Healthcare and Pharmaceuticals

- 5.2.4. Agriculture

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Germany Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 DHL Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 DB Schenker Logistics**List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hapag-Lloyd Container Shipping

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MAERSK Shipping company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mediterranean Shipping Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The CMA CGM Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hamburg Sud Logistics company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dachser Logistics company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ECS European Containers

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 GEODIS Freight Forwarding

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 DHL Group

List of Figures

- Figure 1: Europe Less than Container Load Freight Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Less than Container Load Freight Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Less than Container Load Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Less than Container Load Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 3: Europe Less than Container Load Freight Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Less than Container Load Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Less than Container Load Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Less than Container Load Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 14: Europe Less than Container Load Freight Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Less than Container Load Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: UK Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Russia Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Less than Container Load Freight Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Europe Less than Container Load Freight Market?

Key companies in the market include DHL Group, DB Schenker Logistics**List Not Exhaustive, Hapag-Lloyd Container Shipping, MAERSK Shipping company, Mediterranean Shipping Company, The CMA CGM Group, Hamburg Sud Logistics company, Dachser Logistics company, ECS European Containers, GEODIS Freight Forwarding.

3. What are the main segments of the Europe Less than Container Load Freight Market?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

Sales of E-commerce in Europe.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Less than Container Load Freight Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Less than Container Load Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Less than Container Load Freight Market?

To stay informed about further developments, trends, and reports in the Europe Less than Container Load Freight Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence