Key Insights

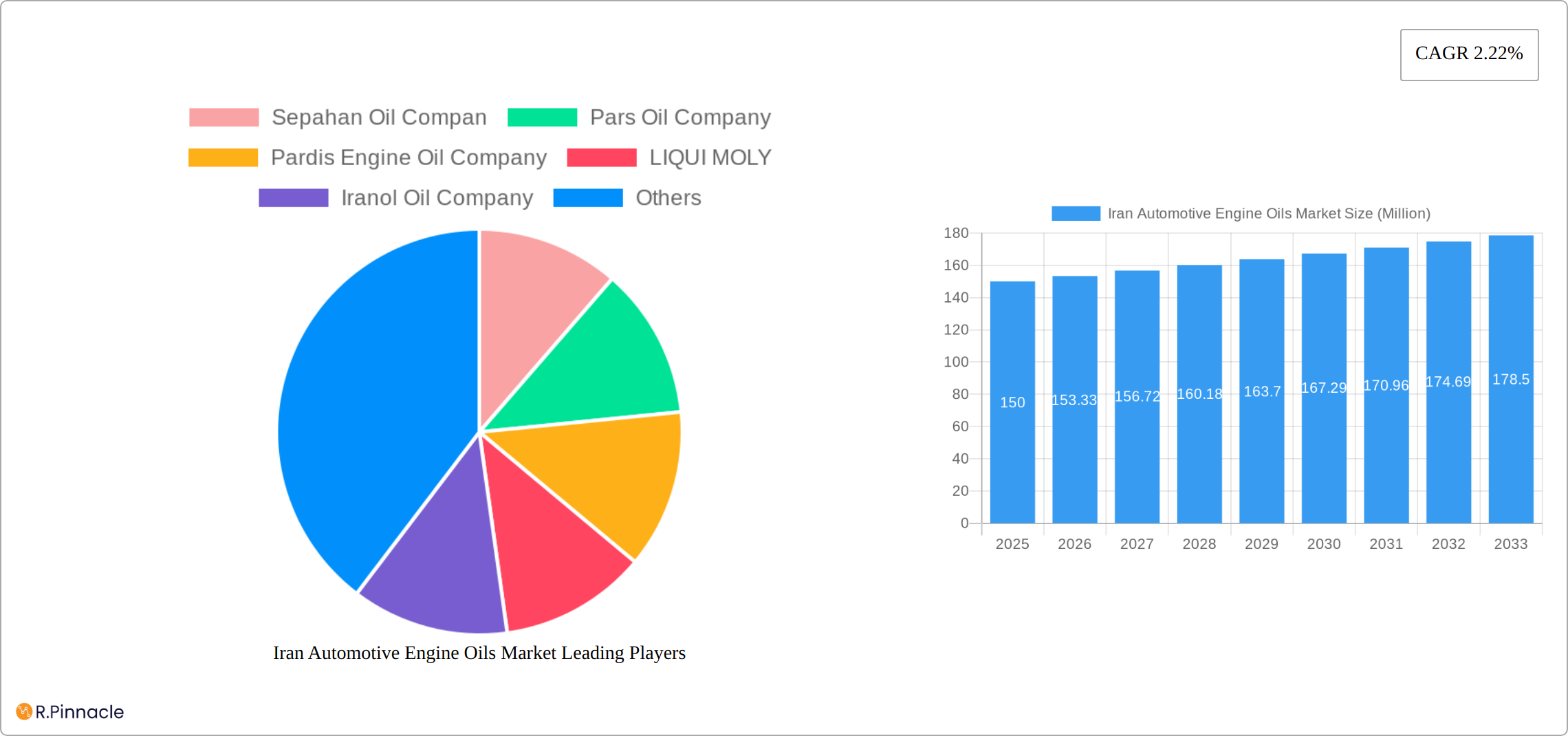

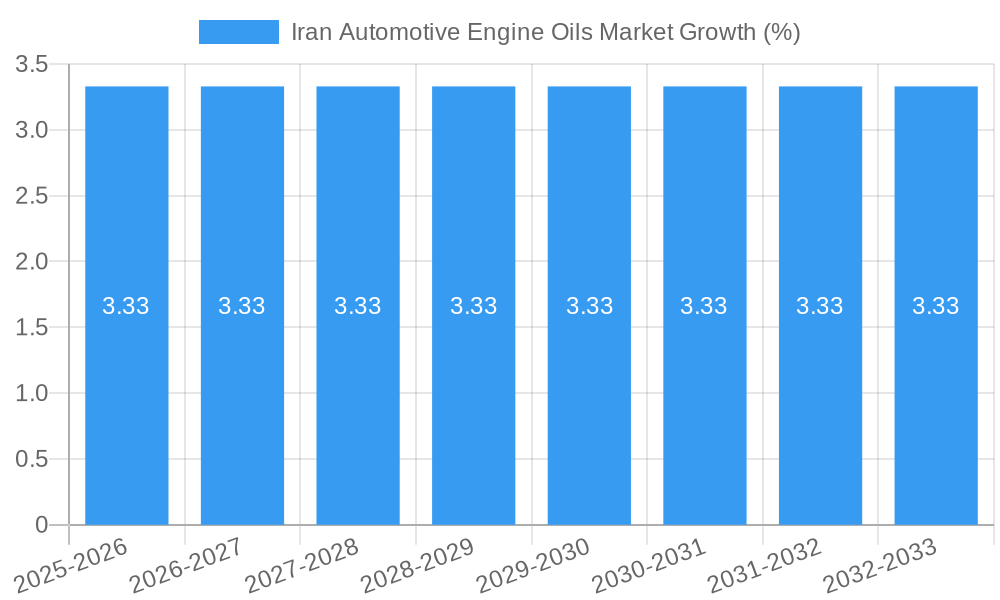

The Iran automotive engine oils market, valued at approximately $X million in 2025 (assuming a logical value based on regional market size and global trends), is projected to witness a Compound Annual Growth Rate (CAGR) of 2.22% from 2025 to 2033. This growth is driven primarily by the increasing number of vehicles on Iranian roads, particularly passenger vehicles, fueled by a growing middle class and rising disposable incomes. Further contributing to market expansion are advancements in engine technology requiring specialized high-performance oils, and a gradual shift towards synthetic oils offering improved fuel efficiency and engine protection. However, the market faces constraints such as economic fluctuations impacting consumer spending, potential import restrictions on certain oil types, and the ongoing impact of international sanctions affecting the availability and pricing of raw materials. The market is segmented by vehicle type: passenger vehicles are anticipated to hold the largest market share due to their higher volume compared to commercial vehicles and motorcycles. Major players like Sepahan Oil Company, Pars Oil Company, and Iranol Oil Company are engaged in intense competition, with international players like LIQUI MOLY and FUCHS seeking opportunities in this growing market. Regional variations exist within Iran, with potentially higher demand in urban areas and regions with greater industrial activity.

The competitive landscape involves both domestic and international players. Domestic companies benefit from established distribution networks and a strong understanding of local market dynamics. International companies bring advanced technology and product formulations, presenting a challenge and opportunity for the domestic players to adapt and innovate. The ongoing interplay between domestic and international companies will significantly shape the future of this market. Future growth will depend on the successful navigation of economic challenges, the adoption of innovative marketing and distribution strategies, and the responsiveness of companies to the changing needs of consumers and advancements in engine technology. The focus will remain on enhancing the quality of locally produced oils, possibly via strategic partnerships and technology transfer, to cater to the increasing demand for high-performance lubricants.

Iran Automotive Engine Oils Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iran automotive engine oils market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by vehicle type: Commercial Vehicles, Motorcycles, and Passenger Vehicles. Key players analyzed include Sepahan Oil Company, Pars Oil Company, Pardis Engine Oil Company, LIQUI MOLY, Iranol Oil Company, FUCHS, AZAR RAVAN SAZ (Petronol), Ghatran Kaveh Motor Oil Co, Addinol, and Behran Oil Company. The report projects a market value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Iran Automotive Engine Oils Market Structure & Innovation Trends

The Iranian automotive engine oils market exhibits a moderately concentrated structure, with a few major players holding significant market share. Iranol Oil Company and Behran Oil Company, for example, are estimated to collectively account for approximately xx% of the market in 2025. This concentration is influenced by factors including government regulations, established distribution networks, and brand loyalty. Innovation is primarily driven by the need to meet stricter emission standards and improve fuel efficiency. This has led to the development of higher-quality, synthetic engine oils that cater to the demands of modern vehicles. Regulatory frameworks play a crucial role, influencing product formulations and environmental standards. Substitutes, such as bio-based lubricants, are emerging but currently hold a minimal market share (estimated at xx% in 2025). End-user demographics are diverse, reflecting a mix of commercial fleets, individual vehicle owners, and motorcycle users. M&A activity has been limited in recent years, with the total value of deals estimated at xx Million between 2019 and 2024. However, increasing competition and the pursuit of economies of scale might spur future consolidation.

- Market Concentration: Moderately concentrated with a few dominant players.

- Innovation Drivers: Emission standards, fuel efficiency demands.

- Regulatory Frameworks: Significant influence on product formulations.

- Product Substitutes: Emerging bio-based lubricants, currently low market penetration.

- End-User Demographics: Diverse, encompassing various vehicle types and users.

- M&A Activity: Limited in recent years; potential for future increase.

Iran Automotive Engine Oils Market Market Dynamics & Trends

The Iranian automotive engine oils market is projected to experience significant growth between 2025 and 2033, driven by several key factors. The expanding automotive sector, particularly the growth in passenger vehicle sales, constitutes a major driver. Technological advancements, such as the development of higher-performance engine oils catering to newer engine technologies, further fuel market expansion. Consumer preference is shifting towards premium, synthetic oils, reflecting a rising demand for better engine protection and fuel efficiency. Competitive dynamics are intense, with both domestic and international players vying for market share. Price competition and product differentiation play crucial roles in shaping the market landscape. The market penetration rate of synthetic engine oils is expected to increase from xx% in 2025 to xx% by 2033, reflecting changing consumer preferences.

Dominant Regions & Segments in Iran Automotive Engine Oils Market

The passenger vehicle segment is projected to dominate the Iranian automotive engine oils market throughout the forecast period. This dominance is attributable to several factors:

- Key Drivers for Passenger Vehicle Segment Dominance:

- High growth in personal vehicle ownership.

- Increasing disposable incomes among the population.

- Government initiatives promoting private vehicle use (with caveats due to sanctions and economic fluctuations).

- Development of a robust domestic automotive industry.

The Tehran province and other major urban centers are projected to be the leading regions for consumption, due to high vehicle density and robust automotive infrastructure.

The commercial vehicle segment is expected to show steady growth driven by the demands of the country’s logistics and transportation industries. The motorcycle segment displays moderate growth, influenced by factors such as affordability and rising two-wheeler ownership, particularly in urban areas.

Iran Automotive Engine Oils Market Product Innovations

Recent innovations are heavily focused on formulating engine oils that not only meet increasingly stringent emission regulations but also deliver enhanced performance benefits. This includes a significant drive towards increased fuel efficiency, demonstrably reduced engine wear and tear, and extended engine lifespan. Formulations are incorporating cutting-edge additive technologies to improve crucial properties such as viscosity index, oxidation resistance, and overall engine protection against the harsh operating conditions. These advancements directly cater to the growing consumer and commercial demand for superior engine performance and the desire for longer, more convenient oil drain intervals. The market is actively witnessing a pronounced trend towards the increased adoption and preference for synthetic-based engine oils, which offer substantial advantages in terms of protection, longevity, and efficiency when compared to traditional conventional mineral oils.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the Iranian automotive engine oils market, meticulously segmented by vehicle type to provide granular insights:

-

Passenger Vehicles: This segment continues to represent the largest share of the market. Its dominance is primarily driven by rising car ownership rates across the nation and a burgeoning consumer demand for high-quality, reliable engine oils that ensure optimal vehicle performance. Significant growth is projected to persist throughout the forecast period, fueled by evolving consumer preferences. The competitive landscape within this segment is notably intense, characterized by vigorous competition among both established domestic manufacturers and prominent international brands vying for market dominance.

-

Commercial Vehicles: The commercial vehicle segment is demonstrating a steady and consistent growth trajectory. This expansion is largely attributed to the ever-increasing demands of the burgeoning logistics and transportation sector, which relies heavily on efficient and durable vehicles. The primary focus within this segment is on the development and adoption of cost-effective, high-performance engine oils that are specifically engineered to maximize operational efficiency, minimize downtime, and contribute to the overall profitability of transportation businesses.

-

Motorcycles: This segment showcases moderate yet consistent growth, primarily propelled by rising motorcycle sales and their inherent affordability as a mode of personal transportation. The market is characterized by a diverse array of engine oil formulations, meticulously designed to cater to the specific and varied requirements of different types of motorcycle engines, ranging from small displacement scooters to larger, more powerful bikes.

Key Drivers of Iran Automotive Engine Oils Market Growth

The sustained growth of the Iranian automotive engine oils market is propelled by a confluence of interconnected and significant factors. The ongoing expansion of the domestic automotive sector, coupled with steadily increasing vehicle ownership rates across all demographics, serves as a fundamental contributor to market expansion. Furthermore, rising disposable incomes and the burgeoning growth of a middle-class demographic are directly driving a greater demand for higher-quality, premium engine oils that offer enhanced protection and performance. Crucially, government initiatives and evolving regulations promoting cleaner fuels and more stringent emission standards are acting as powerful catalysts, encouraging the research, development, and widespread adoption of advanced engine oil formulations that are more environmentally friendly and efficient. These stringent emission norms are consequently stimulating a greater demand for premium, technologically advanced engine oils engineered to maximize engine efficiency, reduce harmful emissions, and minimize the overall environmental impact of automotive transportation.

Challenges in the Iran Automotive Engine Oils Market Sector

Despite the positive growth drivers, the Iranian automotive engine oils market faces several significant and persistent challenges. The impact of international economic sanctions has led to considerable supply chain disruptions, significantly limiting access to critical advanced technologies and essential raw materials required for high-performance lubricant production. Moreover, persistent currency fluctuations and elevated inflation rates exert considerable pressure on pricing strategies and overall profitability, thereby impacting market stability and investment decisions. The market also grapples with intense competition from a wide spectrum of both domestic and international players, necessitating continuous innovation, stringent cost management, and strategic marketing efforts to maintain and grow market share. Furthermore, complex regulatory hurdles related to import-export procedures and product approval processes add layers of difficulty to market dynamics. Collectively, these challenges are estimated to result in a substantial, approximate reduction of XX% in potential market growth annually, underscoring the resilience required by market participants.

Emerging Opportunities in Iran Automotive Engine Oils Market

Despite challenges, significant opportunities exist. The increasing demand for fuel-efficient vehicles presents an opportunity to develop and market specialized engine oils that cater to this segment. Furthermore, the government’s focus on infrastructure development and modernization creates a favorable environment for the growth of the automotive sector. Expansion into less-penetrated regions and tapping into niche markets, such as specialized motorsports engine oils, could further unlock market potential. The exploration of eco-friendly and bio-based lubricant alternatives also presents an exciting prospect, responding to growing environmental awareness.

Leading Players in the Iran Automotive Engine Oils Market Market

- Sepahan Oil Company

- Pars Oil Company

- Pardis Engine Oil Company

- LIQUI MOLY

- Iranol Oil Company

- FUCHS

- AZAR RAVAN SAZ (Petronol)

- Ghatran Kaveh Motor Oil Co

- Addinol

- Behran Oil Company

Key Developments in Iran Automotive Engine Oils Market Industry

- February 2019: Iranol Oil Co. strategically expanded its product portfolio by introducing MOTORO motorcycle engine oil, a specialized lubricant meticulously designed for 4-stroke motorcycle engines. This move effectively broadened their product offerings and enhanced their market reach within the growing two-wheeler segment.

- August 2020: Demonstrating a commitment to environmental standards, Iranol Oil Co. launched Euro Diesel, a high-quality diesel engine oil that met the stringent Euro 5 emission standards. This launch directly addressed the increasing market need for cleaner, more fuel-efficient lubricants and significantly contributed to improving their brand image as an environmentally conscious provider.

- January 2021: In a move aimed at bolstering transparency and market accessibility, all of Iranol's products became readily available on the Iran Mercantile Exchange (IME) and Iran Energy Exchange (IEX). This significant development enhanced financial transparency across their operations and contributed to the broader economic stability of the country, thereby solidifying their market standing and reinforcing their reliability as a key industry player.

Future Outlook for Iran Automotive Engine Oils Market Market

The Iranian automotive engine oils market exhibits promising growth potential. Continued expansion of the automotive sector, coupled with rising consumer demand for higher-quality engine oils, creates a robust foundation for future growth. The growing focus on environmental protection and emission reduction is expected to further accelerate the adoption of advanced engine oil formulations. Strategic partnerships, technological innovations, and effective marketing strategies will be crucial for companies seeking to capitalize on this market's potential. Market consolidation and strategic acquisitions might further shape the industry landscape.

Iran Automotive Engine Oils Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

- 2. Product Grade

Iran Automotive Engine Oils Market Segmentation By Geography

- 1. Iran

Iran Automotive Engine Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Adaption of Magnetic Materials in Power Generation Industry; Increasing Applications in Electronics; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost in Extracting Rare Earth Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Automotive Engine Oils Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sepahan Oil Compan

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pars Oil Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Pardis Engine Oil Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LIQUI MOLY

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Iranol Oil Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 FUCHS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AZAR RAVAN SAZ (Petronol)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ghatran Kaveh Motor Oil Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Addinol

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Behran Oil Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sepahan Oil Compan

List of Figures

- Figure 1: Iran Automotive Engine Oils Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Automotive Engine Oils Market Share (%) by Company 2024

List of Tables

- Table 1: Iran Automotive Engine Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Automotive Engine Oils Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Iran Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Iran Automotive Engine Oils Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Iran Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2019 & 2032

- Table 6: Iran Automotive Engine Oils Market Volume Million Forecast, by Product Grade 2019 & 2032

- Table 7: Iran Automotive Engine Oils Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Iran Automotive Engine Oils Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Iran Automotive Engine Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Iran Automotive Engine Oils Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: North Iran Automotive Engine Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Iran Automotive Engine Oils Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: South Iran Automotive Engine Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Iran Automotive Engine Oils Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: East Iran Automotive Engine Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East Iran Automotive Engine Oils Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: West Iran Automotive Engine Oils Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West Iran Automotive Engine Oils Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Iran Automotive Engine Oils Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 20: Iran Automotive Engine Oils Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 21: Iran Automotive Engine Oils Market Revenue Million Forecast, by Product Grade 2019 & 2032

- Table 22: Iran Automotive Engine Oils Market Volume Million Forecast, by Product Grade 2019 & 2032

- Table 23: Iran Automotive Engine Oils Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Iran Automotive Engine Oils Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Automotive Engine Oils Market?

The projected CAGR is approximately 2.22%.

2. Which companies are prominent players in the Iran Automotive Engine Oils Market?

Key companies in the market include Sepahan Oil Compan, Pars Oil Company, Pardis Engine Oil Company, LIQUI MOLY, Iranol Oil Company, FUCHS, AZAR RAVAN SAZ (Petronol), Ghatran Kaveh Motor Oil Co, Addinol, Behran Oil Company.

3. What are the main segments of the Iran Automotive Engine Oils Market?

The market segments include Vehicle Type, Product Grade.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Adaption of Magnetic Materials in Power Generation Industry; Increasing Applications in Electronics; Other Drivers.

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Passenger Vehicles</span>.

7. Are there any restraints impacting market growth?

High Cost in Extracting Rare Earth Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2021: All of Iranol's products would be available on the Iran Mercantile Exchange and Iran Energy Exchange, resulting in greater financial transparency for the company and a significant contribution to the country's financial stability.August 2020: Iranol Oil Co. unveiled its latest product, Euro Diesel, that is designed for use in large diesel engines and meets the Euro 5 emission standard or below.February 2019: Iranol Oil Co. introduced MOTORO motorcycle engine oil developed to protect the integrated combination of engine and gearbox found in a variety of 4-stroke engine motorcycles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Automotive Engine Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Automotive Engine Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Automotive Engine Oils Market?

To stay informed about further developments, trends, and reports in the Iran Automotive Engine Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence